With the broader market in its recovery mode, whale activity has been picking up pace lately. With the cumulative market cap comfortably seated above $1.1 trillion, Altcoins like Dogecoin has become a compelling pick, relative to Bitcoin and Ethereum.

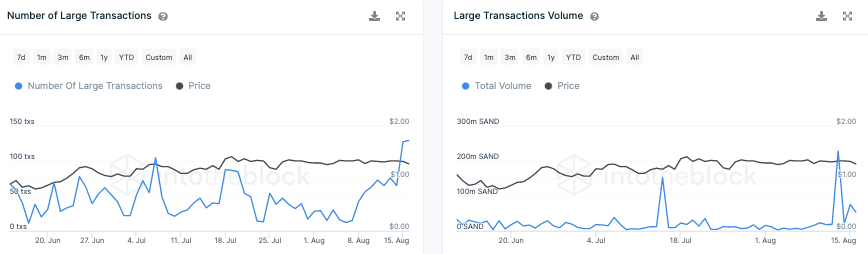

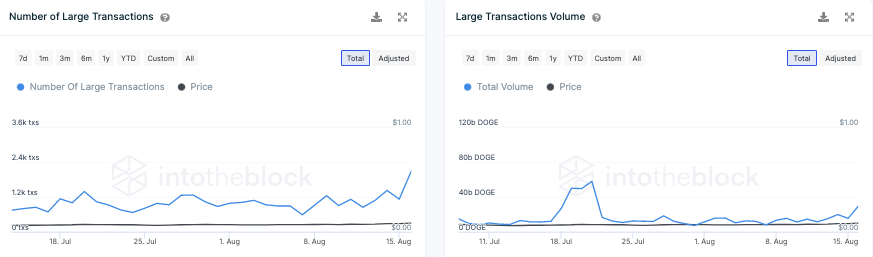

The latest data from Santiment revealed that whale activity on altcoin networks has been picking up steam “in a hurry” this week. As illustrated below, the frequency of $100k+ worth of transactions has spiked for Dogecoin, Chiliz, and Sandbox.

Correspondingly, the price of the first two assets has inclined by 28.3%, and 45.17% over the past 7-days, indicating that the whales are rather buying than selling. Sandbox, on the other hand, has noted a mere 2.8% incline in the same period, indicating that bullish whales have not really been able to assert their dominance.

One of the main reasons why SAND has not been able to climb up on the price charts is, perhaps, because the large transaction volume deflated as quickly as it inflated, despite the count still remaining high.

On the other hand, the other two Altcoins—Dogecoin and Chiliz—have been able to keep the volume inclined alongside the transaction count. And that’s why their price upticks have been more significant than that of Sandbox.

Ripple effects

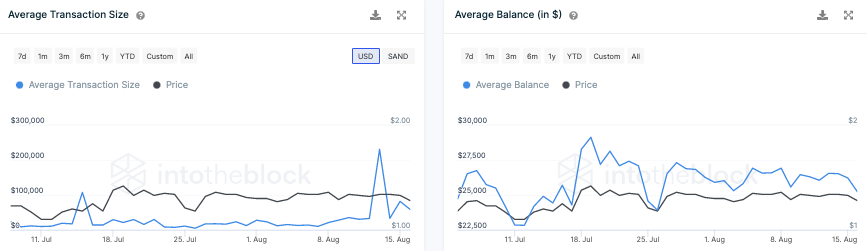

Owing to the under-nourished volume associated with large transactions, SAND has not been able to reap any other by-product. Its averages—both, transaction count and balance—continue to point downward. For Dogecoin and Chiliz, on the other hand, the said numbers stand quite refined, indicating that HODLers are now engaging in larger transactions than usual, and as a result, the size of their HODLings have also risen.

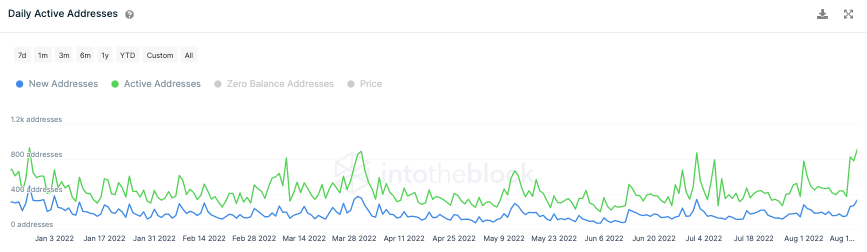

Furthermore, DOGE and CHZ have registered an improvement in their respective network activities. Per ITB’s data, Chiliz’s active addresses have spiked up by 122% over the past week, and as illustrated below, they currently stand at their highest level this year. In fact, new addresses joining the network have also inclined by 119% in the same frame.

For Dogecoin the numbers stood at 73%, and 52%, while for Sandbox, they reflected negative values of 2.8% and 19.2%.

In the past, whenever improvements on these fronts have been noted, asset prices have ripened. So, historically, Dogecoin, and Chiliz may register brief pumps over the short term. Given the lack of momentum in the Sandbox ecosystem, it looks like this asset will find it challenging to fetch significant returns.