A widely followed crypto analyst is predicting an abrupt rally for a trio of digital assets fueled by short sellers.

Crypto strategist Michaël van de Poppe shares to his 628,000 Twitter followers a tweet by financial researcher Jason Goepfert.

According to Goepfert, retail traders have spent $18 billion on put options and accumulated $46 billion worth of short positions on index futures – both record setting.

Van de Poppe says that the record-setting amount of short positions in the traditional markets is actually a bullish signal.

“Short squeeze incoming.”

A short squeeze happens when traders who borrow units of an asset at a certain price in hopes of selling lower to pocket the difference (short) are forced to buy back as the trade moves against their bias.

With Van de Poppe predicting a rally in the traditional markets, the crypto analyst is expecting Bitcoin (BTC) to follow suit.

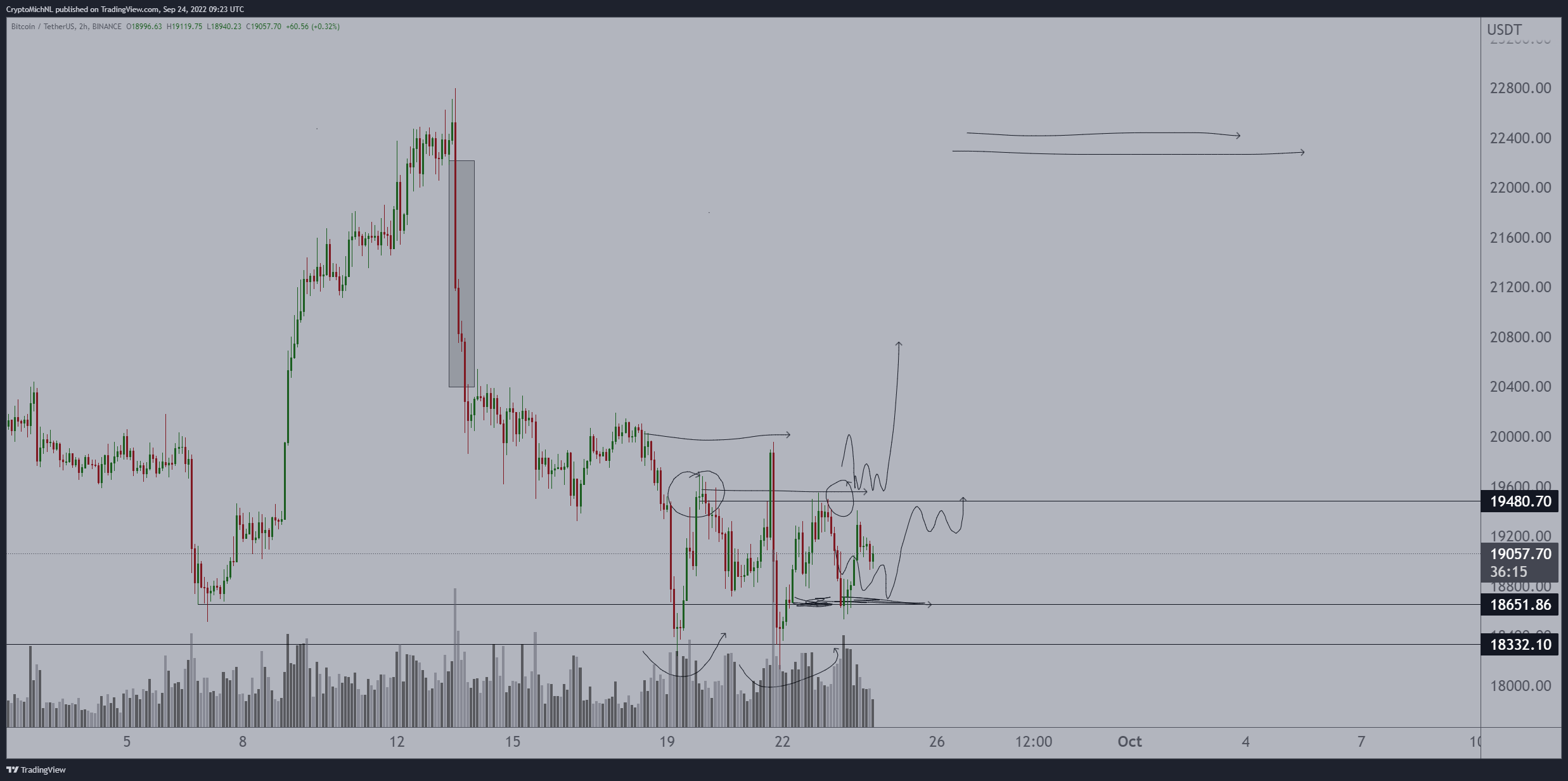

“Bitcoin held the crucial area around $18,500 and is now looking to break out of this range.

Another test of $19,500 (probably Monday) and we’ll be good to go.

Crucial barrier to hold: $18,500.”

At time of writing, Bitcoin is changing hands for $18,887.

Next up is Ethereum (ETH), which Van de Poppe says is managing to hold support at $1,200.

“Ethereum still on support, which was previously the resistance area.

Interesting though. It should be holding here and test $1,425-$1,450 area.”

At time of writing, Ethereum is valued at $1,305.

The crypto analyst is also keeping a close watch on decentralized oracle network Chainlink (LINK). According to Van de Poppe, LINK might be due for a short-term pullback before igniting the next leg up.

“Two levels I’d be watching on LINK (and I think we’ll be going towards $12-$15 soon).

Resistance around $8 to be tested would be a scalp short.

Swing longs around $7.”

At time of writing, LINK is trading at $7.77, up over 2% on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Alexxxey/Obsidian Fantasy Studio