Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Over the past couple of years, the decentralized finance (DeFi) sector has absolutely exploded, leaving many earlier investors very happy. While finding the best DeFi cryptos can be a difficult task, it doesn’t have to be.

Throughout this guide, we’ll be reviewing 12 of the best DeFi coins to buy, explaining whether or not DeFi cryptocurrencies make for good investments, and taking an in-depth look at perhaps the top exchange to buy the best DeFi coins in 2022. Let’s get started.

12 Best DeFi Coins to Invest in 2022

We’ve included a brief summary of the best DeFi cryptos to invest in right now, with more detailed reviews of each project located slightly further down the page.

- Tamadoge – Overall Best DeFi Coin to Invest in

- Battle Infinity – Powerful DeFi Ecosystem with P2E Elements

- Chainlink – Leading Provider of Oracle Solutions

- XRP – Project Aiming to Decentralize Currency Conversion

- Tezos – Easily Upgradable Ethereum Competitor

- Avalanche – Low-Cost Layer-1 Blockchain

- Maker – DAO Behind Leading Stablecoin

- Loopring – Advanced Ethereum Layer-2 Scaling Solution

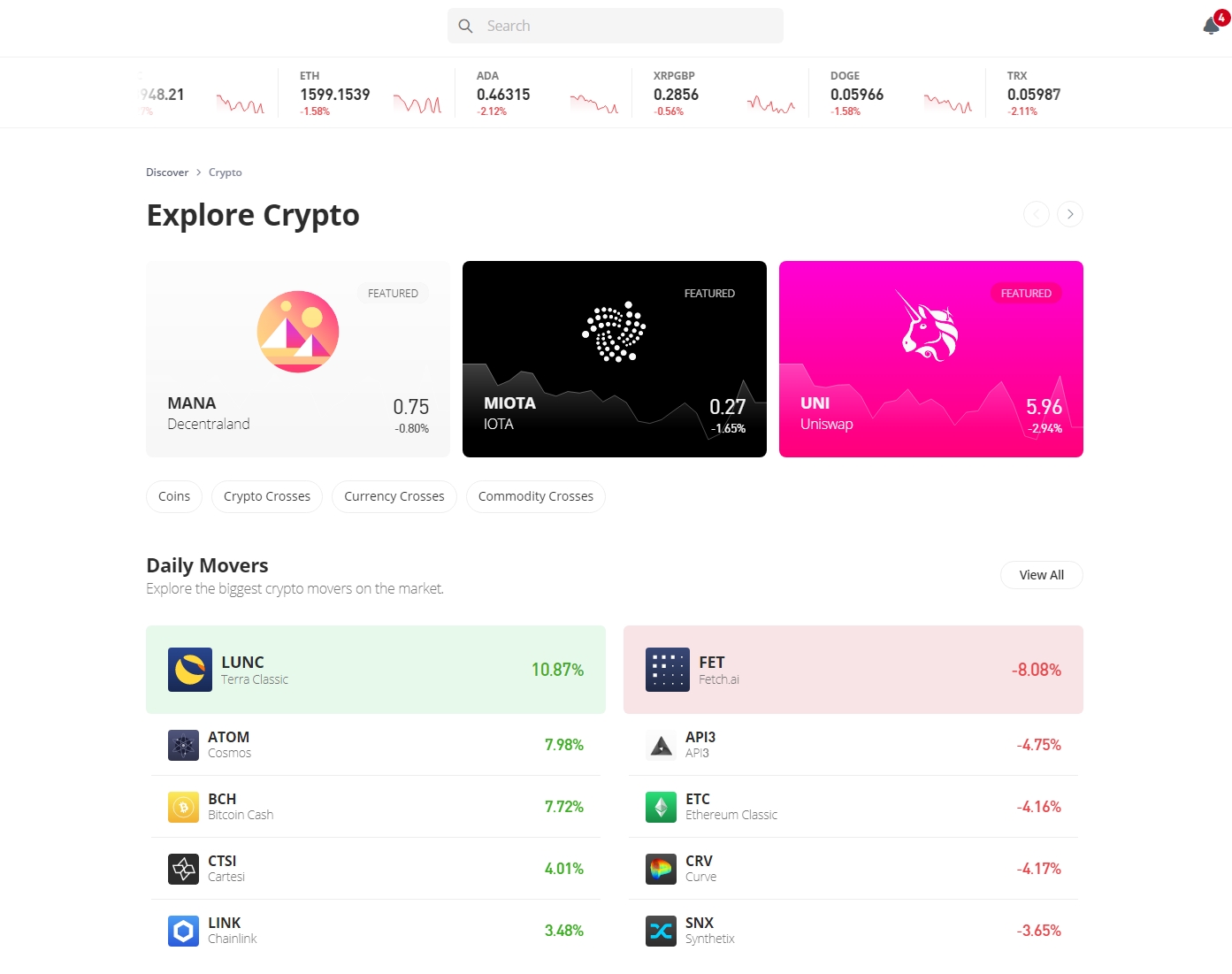

- Uniswap – Decentralized Exchange and DeFi Platform

- Compound – Popular Lending and Borrowing Platform

- Terra Classic – Legacy DeFi Project Pumping Significantly

- PancakeSwap – Well-Known DeFi Exchange and Staking Pool Provider

Analyzing the Best DeFi Tokens & Projects

We’ve included a broad range of the best DeFi investments in order to provide budding investors with ample choice. Each of the projects we’re taking a look at shows plenty of promise and boast strong fundamentals to support their inclusion on our list.

1. Tamadoge – Overall Best DeFi Coin to Invest in

Tamadoge (TAMA) is a new meme coin taking aspects from play-to-earn (P2E) gaming in order to create a unique and engaging experience like no other.

The project has recently sold out its presale far ahead of schedule, raising a staggering $19 million. With an already confirmed LBank listing and another tier-1 exchange expected to be announced on September 23rd, it’s one of the best altcoins on the market and perhaps the best DeFi crypto to buy right now.

The project centers around a Metaverse world in which players can collect, train, and battle NFT-based Tamadoge pets. Users can upgrade a pet using items from the in-game store, in doing so, they can earn Dogepoints, boosting their leaderboard ranking, and providing them with a larger share of the monthly rewards pool.

With Tamadoge already making waves in the industry and the price of TAMA set to explode once the 5% burn mechanism on revenue generated from the in-game store kicks in, there’s no telling how much TAMA could soar.

Check out the project today and join the Tamadoge Telegram group to stay updated with any new developments or listing announcements.

2. Battle Infinity – Powerful DeFi Ecosystem with P2E Elements

Battle Infinity (IBAT) comprises a diverse DeFi ecosystem that boasts a myriad of exciting features designed to benefit crypto enthusiasts of all shapes and sizes.

Similar to Tamadoge, Battle Infinity made a big splash when it entered the crypto market. Going from selling out its presale 65-days ahead of schedule to offering early investors 4x returns following its PancakeSwap listing, the IBAT token has gone from strength to strength and shows no signs of slowing down.

The IBAT ecosystem consists of a decentralized exchange (DEX), a staking platform (set to launch September 24th), a fantasy sports league, an NFT marketplace, a collection of tokenized P2E games, and even a Metaverse arena in which players can advertise and interact with each other.

With such a diverse feature set, Battle Infinity seems primed to explode as the core functionality of the platform begins to roll out. With that in mind, it could be worth grabbing some of the best DeFi tokens before prices are forced higher due to increased demand. Join the Battle Infinity Telegram to stay updated with any new developments

3. Chainlink – Leading Provider of Oracle Solutions

Chainlink (LINK) is a DeFi cryptocurrency dedicated to bringing off-chain data sources onto the blockchain to be used by other web3 projects, massively expanding the use cases of new crypto projects.

With Chainlink being one of the first projects to offer such a service, it has been picked up by key players and become the go-to platform for a number of the best DeFi crypto projects including Aave, Hedera, and Compound.

As Chainlink’s services are in such high demand, it’s of little surprise that LINK has remained one of the strongest assets on the market, even during the recent crypto downturn.

With many investors touting LINK as one of the best long-term crypto projects available, and the asset showing huge amounts of strength whenever the market enjoys a slight run-up, we’ll be watching closely to see how it performs once the next bull run begins.

4. XRP – Project Aiming to Decentralize Currency Conversion

XRP has been a favorite asset of crypto investors since its release as a fast settlement, low-fee, sustainable cryptocurrency alternative to Bitcoin. The asset has created by David Schwartz and Jeb McCaleb who then went on to launch Ripple Labs in order to create use cases for XRP.

As we touched on, the primary attraction to XRP is its extreme efficiency. Transactions can be settled in just seconds and cost only a fraction of a cent, making it one of the fastest and cheapest networks on the market. Furthermore, the recent release of the XRP Ledger (XRPL) in 2021 has expanded the project’s use case by allowing other projects to be created on the network.

The primary use of XRP is as a transactional cryptocurrency. It has already partnered with leading international currency transfer services like Swift and MoneyGram, leading many investors to consider the asset as one of the 10 best penny crypto projects currently available.

5. Tezos – Easily Upgradable Ethereum Competitor

Tezos (XTC) is a DeFi DeFi coin that is akin to a more efficient, easily upgradable Ethereum. The project was conceptualized in 2014 but it wasn’t until far later in 2018 that the Tezos mainnet was officially released.

The project allows developers to build applications using the Tezos network through smart contracts. The project is consistently regarded as being a great alternative to Ethereum as the Tezos network can be easily upgraded with zero downtime, meaning the team can always ensure that the network boasts the latest technology.

With the recent Ethereum merge, the need for on-the-fly upgradable blockchains has become more apparent than ever before. With Tezos offering this functionality in an incredibly efficient package, many crypto fanatics regard it as being one of the best cryptos to buy in 2022.

6. Avalanche – Low-Cost Layer-1 Blockchain

Similar to Tezos, Avalanche (AVAX) is a new cryptocurrency and a highly-efficient layer-1 blockchain. The project exploded in 2021 at the height of the ‘Ethereum killer’ narrative, promoting a huge amount of P2E games and web3 projects to make the switch to the Avalanche network.

While the hype surrounding the project has subsided over recent months, its technology remains powerful. One of the main reasons why Avalanche was able to pick up traction so quickly was its massively impressive throughput.

Rather than treating every kind of transaction as one, Avalanche settles transactions on three different chains. The C-Chain is used to settle transactions that originate from the best DeFi coins and web3 projects, X-Chain is used for sending and receiving AVA, and P-Chain is for network validators.

While AVAX has fallen a long way from its 2021 highs, the DeFi DeFi coin seems to have found a bottom at around $20. While investor confidence has likely been shaken a bit following its dramatic fall, once the next bull run kicks off we could see impressive returns from AVAX.

7. Maker – DAO Behind Leading Stablecoin

Maker (MKR) is a governance token that investors can use to make decisions in the Maker decentralized autonomous organization (DAO), that controls the popular stablecoin DAI. With the DAI stablecoin rapidly gaining market share falling the fall of algorithmic dollar-pegged stablecoin UST, MKR could be the best DeFi crypto to buy this year.

As, by design, stablecoins don’t have any room for growth (unless something goes seriously awry), the MKR token is used to provide value to investors and fans of the project. As anyone holding MKR can vote on the development of DAI, and the price of MKR is linked to DAI’s success, this system should, in theory, ensure that only the best decisions are made regarding the future of the stablecoin.

Out of all the best DeFi projects to invest in, Maker fits perfectly in the industry. With the need for a trusty stablecoin more apparent than ever, we could see big things from this DeFi cryptocurrency in the coming months.

8. Loopring – Advanced Ethereum Layer-2 Scaling Solution

While there was a large demand for Ethereum alternatives, the focus has now shifted to Layer-2 scaling solutions like Loopring (LRC). These projects utilize the Ethereum network but commonly settle transactions in a different way. This means that Layer-2 solutions benefit from Ethereum’s security but aren’t held back but its lackluster throughput.

In order to achieve higher throughput than its parent network, Loopring bundles multiple transactions together off-chain, before settling them together on-chain at a later date. This allows the project to validate transactions far more efficiently than Ethereum, reducing fees and network congestion.

With its partnership with GameStop, Loopring has been brought into the limelight. While it’s yet to enjoy a meaningful move to the upside, there’s plenty of hype surrounding the project meaning it could end up being one of the best DeFi projects to invest in ahead of the market’s recovery.

9. Uniswap – Decentralized Exchange and DeFi Platform

Created by former Ethereum developer Hayden Adams, Uniswap (UNI) is packed with pedigree. It is a decentralized exchange (DEX) that hosts some of the best DeFi projects to invest in right now. During the DeFi explosion, the platform enjoyed widespread notoriety and quickly become one of the most used DEXs on the planet.

UNI was created as a governance token, allowing fans of the project to help forge its future. With Uniswap (alongside PancakeSwap) remaining one of the largest decentralized trading protocols on the market, clearly, this model worked.

Although Uniswap can no longer be considered a low-cap crypto with its multi-billion dollar market cap, the project remains a favorite of DeFi-centric investors worldwide. While the smaller DeFi projects that live on Uniswap have been hit hard by a downtrend, it’s likely that Uniswap will enjoy huge amounts of volume after these projects begin to draw attention once again.

10. Compound – Popular Lending and Borrowing Platform

Compound (COMP) is a popular lending platform and one of the best DeFi crypto projects to invest in today. The COMP token is used for governance, allowing holders to vote on decisions that affect the platform.

Compound runs a host of different pools, allowing investors to earn interest on their crypto holdings with ease. The platform allows users to securely use their cryptocurrency as collateral in order to receive a fiat loan, helping to prevent complications with capital gains. Additionally, users can earn interest on their assets by lending them to others while the Compound platform ensures safety.

With Compound being one of the most popular platforms for the lending and borrowing of crypto assets, and the sector rapidly rising in popularity, it’s entirely possible that COMP could be one of the best DeFi cryptos to watch this year.

11. Terra Classic – Legacy DeFi Project Pumping Significantly

Born from the collapse of the Terra Luna, Terra Classic (LUNC) was created following the release of the new LUNA token. While the project was originally created as a lending and yield farming platform, similar to Compound, the collapse of Terra’s UST stablecoin left the original token near-worthless.

While the LUNC token was birthed from harsh times and more decisions, it has since grown rapidly in popularity. Since LUNC was released, it has surprisingly been performing rather well. Over the past month, the token has appreciated by an impressive 183% and since its June release has climbed by a staggering 376%, making it one of the best-performing assets in recent months.

While the project’s merit as a secure platform to store tokens and earn a yield has been decimated, it remains valid as one of the best DeFi investments on the market right now.

12. PancakeSwap – Well-Known DeFi Exchange and Staking Pool Provider

PancakeSwap (CAKE) operates in a similar fashion to Uniswap. It uses an automated market maker algorithm to provide a way for investors to buy the best DeFi cryptos in a decentralized manner. It’s one of the best-known DEXs on the market and many crypto speculators anticipate that it could explode once investors pile back into the DeFi space.

While the main reason for PancakeSwap’s popularity is its numerous benefits as a DEX, it also provides a way for investors to earn interest on their assets by providing liquidity. Users are able to lock their assets in a pool in exchange for LP tokens which can then be used to farm CAKE or exchanged for the locked tokens and a portion of the trading fees generated from the user’s liquidity.

PancakeSwap has been regarded as one of the best DeFi coins for years and that’s unlikely to change in the future. The platform works well and has thus far withstood the test time cementing its place amongst the top DeFi cryptocurrencies.

What are DeFi Coins?

DeFi is short for decentralized finance. This refers to any sort of financial application that does away with a central authority and instead allows users to act for themselves. For example, on the PancakeSwap platform users provide liquidity in order to earn interest, with the platform then using an algorithm to match a buyer and liquidity provider.

With cryptocurrency having a heavy focus on both finance and decentralization, there are a huge number of projects that could be considered DeFi coins. We’ve already discussed 12 of the best DeFi crypto projects to watch but a few other notable examples include Aave, The Graph, and Fantom.

To summarize, any cryptocurrency that has a focus on finance or decentralization can be considered a DeFi coin. As decentralization requires that there is no central body controlling an application, it’s common for DeFi coins to be largely autonomous, hence the inclusion of a large number of DAO-based projects on our list.

Are DeFi Coins a Good Investment?

With decentralized finance growing in popularity massively over the past couple of years, the best DeFi cryptos can make for solid investments. However, as with any sector, there will be projects that fail to perform as expected.

Multitude of Use Cases

As we briefly touched on, DeFi coins can comprise a huge variety of sectors and use cases. With such diversity, the future of DeFi holds near-endless possibilities. With what’s possible in cryptocurrency constantly changing, DeFi projects are set to evolve as blockchain technology improves, making the best DeFi investments great for getting exposure to a future-first market.

Future of Finance

Decentralized finance has already disrupted the traditional finance sector in a big way and with cryptocurrency adoption steadily rising, this is unlikely to change in the foreseeable future. While it’s impossible to know for sure how things will progress as the DeFi market matures, few sectors can compete with DeFi when it comes to future potential.

Adheres to the Crypto Ethos

At the core of the cryptocurrency ethos is decentralization, the belief that no one individual or organization should have total control. With this concept being important to many die-hard crypto investors, projects that respect this, tend to generate more buzz from key players in the industry.

Early Mover Advantage

While finance in the traditional sense has been around for centuries, the DeFi revolution is only just starting. The cryptocurrency market as a whole has existed for just over 10 years and DeFi far fewer. As such, the sector has seldom had time to mature. With this in mind, investing in DeFi can provide users early access to what could eventually become the new financial system.

Where to Buy DeFi Coins

In order to assist investors looking to purchase DeFi coins, we’ve reviewed one of the top regulated platforms on which they can be acquired.

eToro – Best Platform to Buy DeFi Coins

eToro was launched back in 2007 and has since grown in popularity massively, serving millions of users all around the globe. Being one of the world’s leading brokers, eToro supports a plethora of DeFi coins as well as other cryptocurrencies and even stocks.

eToro supports over 50 of the most popular crypto assets and allows users to buy and trade them with just a 1% commission. As such, crypto investors are able to get far more value for their money when compared with other large exchanges which often charge anywhere between 2-3% on purchases.

In addition to its low fees, the platform’s security is also phenomenal. eToro encrypts all sensitive data before it leaves the user’s device, ensuring that it’s of no use to nefarious individuals attempting to intercept traffic. Furthermore, the platform uses cold storage for the vast majority of client funds. Therefore, even if eToro was compromised, clients wouldn’t be left out of pocket.

For investors that are just getting started and want to learn strategy or simply get used to trading, eToro has the perfect tool. The broker offers a social trading platform that allows users to automatically mirror the trades of other users. Those wishing to copy trade can view the performance of the users they’re able to copy, helping to ensure transparency.

For investors looking to buy the best DeFi project, eToro is a great choice. It’s an extremely capable exchange that offers a plethora of the best DeFi coins as well as plenty of other financial instruments.

Cryptoassets are highly volatile and unregulated. No consumer protection. Tax on profits may apply.

Conclusion

Decentralized finance is one of the hottest sectors in cryptocurrency right now. Throughout this article, we’ve taken a look at 12 of the best DeFi cryptos currently available, discussed the merit of DeFi as an investment, and reviewed the top DeFi exchange. However, while creating this guide we noticed that a particular project offered massive room for growth.

Tamadoge has already proven to be hugely popular with investors and as the TAMA token is soon to be listed on numerous tier-1 exchanges, it could be the best DeFi project on the market right now. Check out Tamadoge today to learn more.

FAQs

What crypto coins are DeFi?

DeFi simply means decentralized finance. As such a huge number of crypto coins fall under the category. However, a few notable examples include Tamadoge and Battle Infinity.

What is the best DeFi Coin to invest in?

Each of the projects we’ve reviewed has plenty of room for upwards growth. With that said, however, Tamadoge has just concluded its presale, and with exchange listings and exciting features expected to roll out over the coming weeks, it takes the crown as the best DeFi crypto.

Are DeFi Coins worth it?

While it’s important to understand that every project is different, the best DeFi coins have historically yielded excellent results for early investors. So, while it’s crucial to perform ample due diligence, DeFi coins can make for solid investments.

What are the best DeFi projects?

The best DeFi project will vary greatly based on a particular investor’s goals. Most DeFi projects specialize in different areas so it’s important to consider what one is looking for prior to investing. However, both Tamadoge and Battle Infinity seem primed to explode as features roll out.