Ethereum revenue is an essential metric for understanding the health of the second-largest blockchain by market cap. In this article, you’ll find out how we calculate Ethereum revenue, how it changed after a major upgrade called EIP-1559, and what is likely to happen after the transition to Proof of Stake.

Does Ethereum Have Revenue?

The short answer is yes: Ethereum generates revenue, but it’s different from corporate revenue. The decentralized network generates revenue from the fees paid to miners, in the form of new ETH tokens and gas fees. This is why we may also call it “Ethereum miner revenue” or “Ethereum mining revenue,” but that will change soon.

Unlike bitcoin, Ethereum enables users to build new tokens and decentralized applications (dapps) on top of it, using smart contracts. This ensures demand for ETH and gives miners an extra revenue stream derived from gas fees, which are a way to quantify the cost required to conduct a transaction on the network. Miners dictate the price of gas, based on the demand for the network’s computational power needed to process transactions and smart contracts.

It’s worth noting that Ethereum launched with the Proof of Work (PoW) consensus mechanism, being maintained in a decentralized manner by miners who keep the network running. However, due to scaling limitations and environmental impact, Ethereum is currently upgrading to a different consensus algorithm called Proof of Stake (PoS) – see our Investor’s Guide to the Merge.

The London EIP-1559 Upgrade

On August 5, 2021, Ethereum implemented the so-called London upgrade. To avoid confusion, the London hard fork is not directly related to Ethereum’s upgrade to adopt the PoS algorithm. Instead, one of the key parts of that fork was the integration of the Ethereum Improvement Proposal 1559 (EIP-1559), which affects the fee system on the network.

As mentioned, Ethereum users must pay a cost per transaction in the form of gas, measured in ETH. The gas fees make the network more secure, but the original fee system had some flaws.

Prior to EIP-1559, Ethereum relied on a first-price auction mechanism in which users submitted a bid to the miner, indicating the cost they were ready to pay for their transaction to be added in the next block. Thus, miners were incentivized to pick the highest bids, with users being often forced to overpay for transactions, as it was difficult to estimate the fair cost to submit. If users submitted a fee that was too low, they should have expected long delays.

Instead of the first-price auction approach, EIP-1559 introduced a “base fee” for transactions to be added in the next block. Users who want to prioritize their transaction can now pay a “tip” to the miner, called a “priority fee”: a higher tip results in a greater chance of your transaction being added in the next block.

The base fee varies and is adjusted by the protocol based on demand on the network. Like Uber’s surge pricing, the fee increases when Ethereum is at a greater capacity and drops when the network is at a lower capacity.

Thus, EIP-1559 helps users avoid overpaying gas fees while preventing miners from artificially inflating the fee. Eric Conner, a co-author of EIP-1559, told CNBC:

This is great for Ethereum casual users and makes the protocol less intimidating to use.

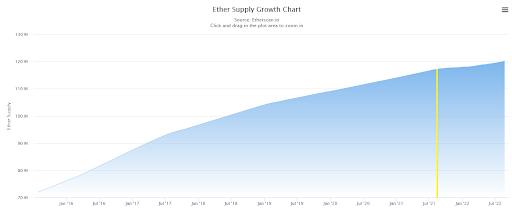

On top of that, the EIP-1559 introduced a deflationary mechanism, as miners receive only the tip, with the base fee being burned, i.e. removed from circulation. This can be regarded as an Ethereum buyback mechanism that reduces the supply of tokens and can potentially make your Ethereum investment more valuable over the long term.

This is the reason why “EIP-1559 is one of the most significant upgrades to Ethereum since the network’s launch,” as per Meltem Demirors, chief strategy officer of CoinShares.

Ethereum Revenue Since the Upgrade

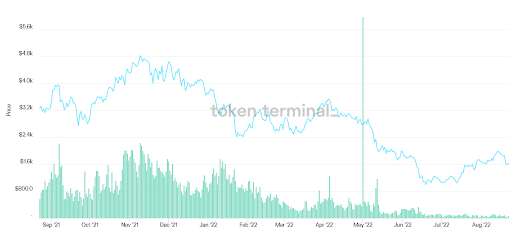

First, the good news: Ethereum revenue soared following the upgrade.

Now the bad news: Ethereum revenue soured in 2023.

The investor takeaway is that Ethereum saw increased revenue for about six months after the EIP-1559 upgrade, with general bearishness following that.

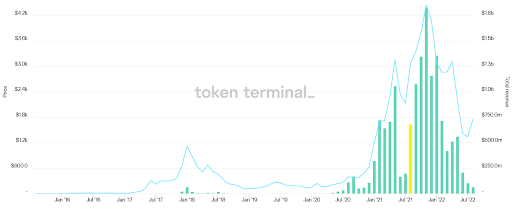

November 2021 remains the best month in terms of generated miner revenue, with users paying over $1.8 billion that month alone.

To be sure, there were many other factors at play besides the Ethereum upgrade: the proliferation of DeFi services, fresh waves of NFT projects, and a swarm of developer activity. The takeaway is that the upgrade did not hinder these developments, but helped them.

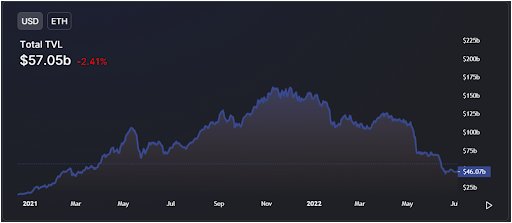

Case in point: November 2021 was also the most active month for DeFi on Ethereum, with Total Value Locked exceeding the $160 billion mark. Despite the decline in TVL since then, Ethereum is still the most dominant chain in DeFi.

Elsewhere, NFT marketplace volumes surged by almost 2,500%, from $509.36 million to $12.93 billion. In the first quarter of 2022, volume figures exceeded the $200 billion mark, as NFTs made headlines.

A final investor takeaway: the inflation rate of Ethereum has gradually tapered off since the London upgrade, due to the burning mechanism introduced by EIP-1559.

You can clearly see inflation slowing after EIP-1559, which is good news for Ethereum investors. (The less ETH issued, the more of the pie you hold.) The forthcoming Ethereum upgrade may slow inflation further; Ethereum may even become deflationary.

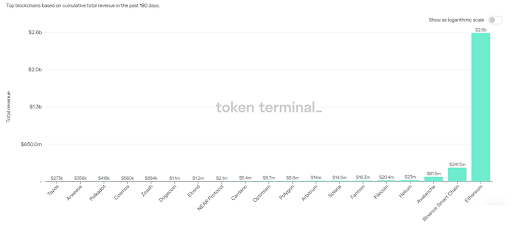

Ethereum Revenue vs. Other Blockchains

Ethereum is the second-largest cryptocurrency by market cap. Its blockchain network is used by thousands of projects related to dapps, DeFi protocols, Layer-2 solutions, and NFTs. Thus, the Ethereum network enjoys the highest demand compared to other chains.

Other major blockchains including Solana, Binance Chain, Cardano, Avalanche, and Algorand employ different versions of the PoS algorithm, and don’t have miner fees. However, they also have a revenue metric that reflects network activity. None of the top PoS blockchains even come close to Ethereum in overall revenue.

How Will The Merge Affect Ethereum Revenue?

The Ethereum Merge is the most critical phase of the gradual upgrade to PoS. Scheduled for September 2022, it represents the much-anticipated move from PoW to PoS.

Last year, Ethereum introduced the Beacon Chain as an initial phase of the upgrade. The Beacon Chain is a PoS network that enables users to stake ETH and become block validators. However, the Beacon Chain has operated as a secondary network in parallel with the PoW-based mainnet.

The Merge will combine the Beacon Chain and the mainnet, ending Ethereum mining for good. After the completion of the Merge event, stakers will step in to validate blocks instead of miners.

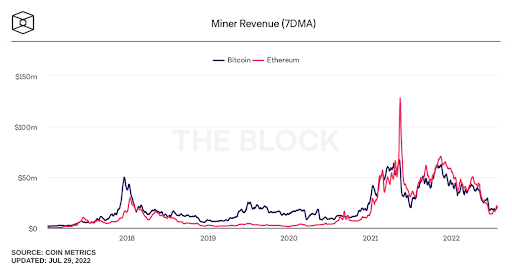

The significant decline in mining revenue already reflects the approach of The Merge, as miners won’t be able to monetize their efforts anymore. The transition to PoS is forcing Ethereum’s $19 billion mining industry to look for other PoW cryptocurrencies.

At that point, Ethereum’s revenue metric will reflect the transaction fees paid to stakers instead of miners. Speaking of fees, they will probably not come down, according to a DeFi researcher.

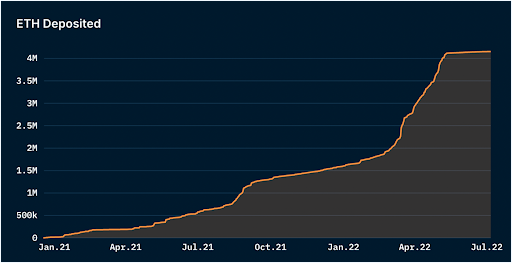

On a side note, the amount of staked ETH in the Beacon Chain continues to increase.

Investor Takeaways

Ethereum revenue is a key metric because it reflects the activity on the network. Investors can think of it like revenue taken in by the Ethereum “company.”

Since Ethereum plays such an essential role in the crypto industry, Ethereum revenue indirectly reflects the health of DeFi, NFTs, and the broader Web3 industry.

For investors, Ethereum revenue is a more important number than Ethereum market cap. Market cap is more a function of investor sentiment; revenue is a function of actual usage.

The Merge will change the way Ethereum revenue is accounted, from fees paid to miners to fees paid to stakers.

Finally, Ethereum revenue soared after the EIP-1559 upgrade, and that could be a very good sign for investors in The Merge.

Subscribe to Bitcoin Market Journal to get more exclusive insights on Ethereum (find out before the market does).