The usually volatile Bitcoin has gotten stuck trading within a narrow range ahead of the Federal Reserve’s annual Jackson Hole gathering later this week.

The world’s largest digital coin by market value rose as much as 2.6% Tuesday to hover around $21,600, though it’s largely been meandering below the $22,000 level since it started to sell off in mid-August. Other cryptocurrencies, including Ether, also rose, with an index of the 100 largest tokens adding roughly 2.3%.

And it’s happening as US stocks try to stage a comeback from Monday, when they had their worst session since mid-June. Traders are bracing for a hawkish tone at the Jackson Hole event after recent comments from Fed officials convinced many investors the central bank will continue to tighten aggressively, even into a slowing economy.

“As August limps toward a weak close, market attention is turning to this week’s Jackson Hole symposium,” wrote Noelle Acheson, head of market insights at Genesis, in a research note. “A key question on traders’ minds is whether the Fed chairman will signal a potential reduction in the pace of hikes, double down on his nominal commitment to lowering inflation, or indeed try to convince the market that the Fed can have its proverbial cake and eat it, too,” she added.

Cryptocurrencies have been trading in tandem with US equities this year as both have been swayed by the Federal Reserve’s interest-rate-hiking path. The 90-day correlation coefficient of Bitcoin and the S&P 500, after weakening slightly in June, now stands around 0.64 once again, among the highest such readings in Bloomberg data going back to 2010.

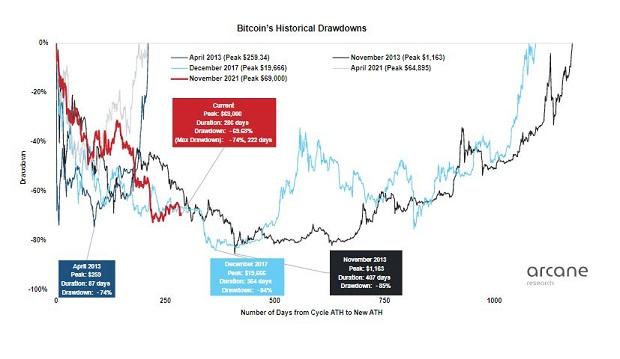

This year’s crypto bear market is tracking ones seen in 2018 and prior years, according to Vetle Lunde an analyst at Arcane Research. This one has lasted for more than 285 days, with Bitcoin down nearly 70% from its November all-time high. The 2018 and 2014 bear markets lasted 12-13 months, with maximum drawdowns of 85%.

“We don’t find a lot of value in speculative assets, particularly cryptocurrencies, where there really isn’t intrinsic value,” said David Spika, president and chief investment officer of GuideStone Capital Management. “It’s all based purely on speculation.”

Bitcoin is hovering near levels that would ensure no “hodler” — or investor who buys and holds even through tough times — has made money on any purchases in almost two years, according to Peter Tchir, head of macro strategy at Academy Securities. “That is a long time to wait to make money (or to sit on large losses). FOMO is a big part of crypto trading, and we are on the precipice of declining to levels where many could decide to take their money and run.”

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor