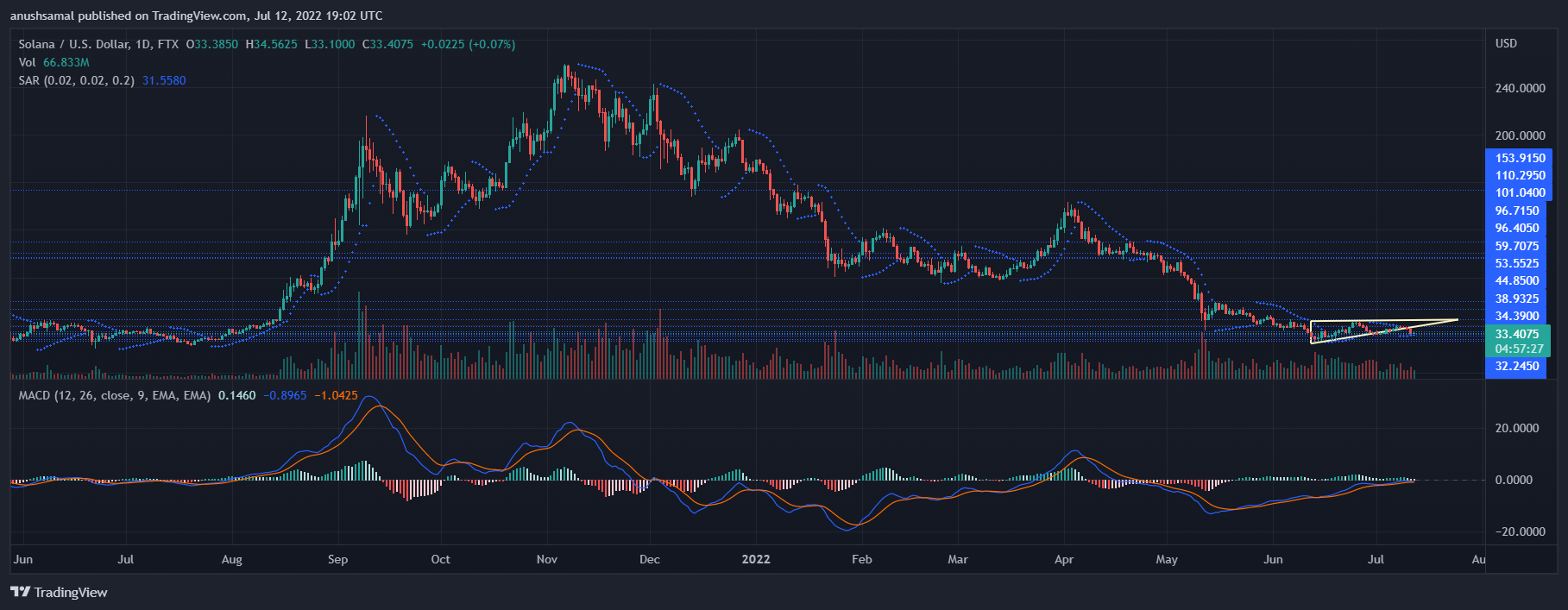

Solana was on a downtrend as the bulls have lost steam after SOL fell below the support line of $38. Over the last 24 hours the coin depreciated 4% and in the last week, the coin fell by 8%. Price of Solana was pushed to $33, however, at press time the coin was trading slightly above the support line.

Bitcoin too struggled below the $20,000 mark and the altcoins walked the same price path. Broader market weakness continues to contribute towards the altcoins bearish pressure. One the daily chart, Solana had formed an ascending triangle but it managed to break below the same.

If the coin continues on the same path then it could move below the $30 price mark. The current vital support level for the altcoin stood at $33. Buying pressure declined on the daily chart as SOL met with a sell off. The global cryptocurrency market cap today is $924 Billion with a 3.1% negative change in the last 24 hours.

Solana Price Analysis: One Day Chart

SOL was trading at $33.40 at the time of writing. It moved precariously close to the critical price floor of $33. A fall in price below the $33 price mark will first drag SOL to $30 and then to $27.

Due to increased bearish strength, SOL broke below the ascending triangle (yellow).

Continued downward movement can cause another 18% fall on SOL’s chart. If Solana manages to move above the $34 price level and topple the $38 price mark, the bearish thesis stood a chance to be invalidated.

The immediate resistance was at $34 and then at $38. Trading volume of Solana dropped slightly but the bar was green which indicated that buyers still attempted to stand their ground on the chart.

Technical Analysis

SOL’s buying strength has remained delicate with the coin witnessing regular sell-offs in the market. For the most of May, June and July, Solana has witnessed high selling pressure.

In accordance with the same, the Relative Strength Index was below the half-line which meant that sellers dominated the market.

Price of SOL was seen below the 20-SMA, a reading that indicated sellers were responsible in driving the price momentum in the market.

Suggested Reading | Solana Glints With 14% 3-Day Rally – Will SOL Keep On Beaming?

SOL’s chart displayed mixed technical signs. The Moving Average Convergence Divergence depicts the price momentum and possible trend reversals. MACD underwent a bullish crossover and pictured green signal bars.

The green signal bars are connected to buy signal on the chart. This could be a positive sign for the coin as there might be an upcoming change in the price direction over the next trading sessions.

Parabolic SAR determines the price direction, the dotted lines below the price candlesticks were indication of an anticipated change in the current price action.

For the coin to move upwards, strength from the broader market remains vital.

Related Reading | Glassnode: Bitcoin LTHs Who Bought During 2017-2020 Aren’t Selling Yet

Featured image from BusinessToday.in, charts from TradingView.com