Eoneren/E+ via Getty Images

Investment Strategy

Today, investors are asking themselves a lot of questions: how high interest rates will increase in the economy, whether we are facing a recession, if inflation is permanent, or maybe stagflation is waiting for us around the corner. These questions create conditions of absolute uncertainty. Under uncertainty, a market neutral (“EMN”) strategy is a good choice for an investor.

Popular with hedge funds, EMN provides investors with the most effective balance between risk and return. Portfolios based on this strategy have positive dynamics regardless of whether the market is bearish or bullish, which is essential in the current turbulence in the economy.

Fans of risk and good returns may find this strategy boring. Therefore, we chose non-trivial assets for its implementation. In our opinion, Silvergate Capital Corporation (NYSE:SI) and Coinbase Global (NASDAQ:COIN) are a good pair. For both companies, crypto is a crucial driver of growth in financial performance and the reason for the decline in share prices, but the fundamental advantages of the first one can more than compensate for the shortcomings of the second one.

Equity Market Neutral Strategy

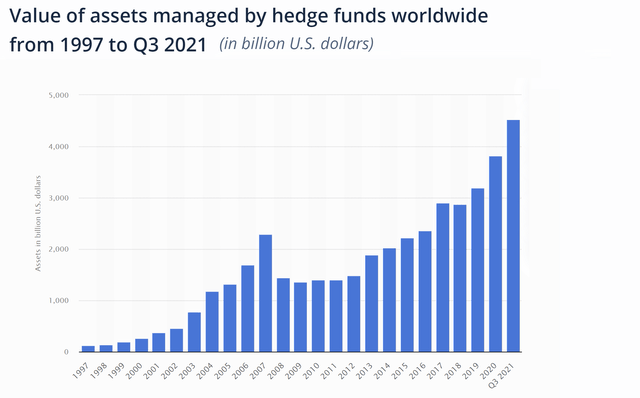

Despite hefty fees and underperforming the S&P 500, the value of assets under the management of hedge funds has steadily risen. If 10 years ago the funds managed $1.5 billion, then in the third quarter of 2021 AUM is $4.5 billion. What is the reason for such indomitable growth?

Statista

It is necessary to understand that risk is an integral part of any investment portfolio. The whole point of a hedge fund is to maximize return per unit of risk taken. This is the main driver of the growing popularity of these financial institutions. To make a portfolio efficient, any asset allocation in a hedge fund should aim to:

- A maximum return;

- A minimum volatility;

- A minimum correlation to the broader market.

If there are strategies providing the extreme values of all three variables in the ideal world, then an asset manager is always forced to find compromises between them in the real world. For example, he may abandon a strategy with the highest return to invest in a strategy with lower expected volatility and correlation to improve overall portfolio performance by risk reduction. A strategy with a higher return may also be chosen, which entails more risk or instability. Hedge fund managers make these kinds of compromises every day.

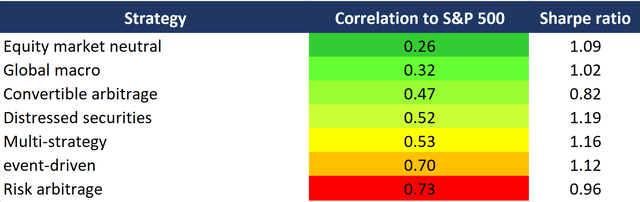

One of the most popular strategies among asset managers is equity market neutral. The reason for the popularity of this strategy lies in the low correlation to the S&P 500 and the high Sharpe ratio. The Sharpe ratio is a measure of the performance of an investment portfolio, which is calculated as the ratio of the average risk premium to the average deviation of the portfolio. The lower the correlation of the chosen strategy to the stock market and the higher its Sharpe ratio, the more effective it is.

Created by the author based on CSFB/Tremont

In other words, EMN is one of the most efficient in terms of return, volatility, and correlation to the market. The strategy involves opening short and long positions of comparable sizes, which ensures zero (or negligible) exposure of the portfolio to the stock market. A hedge fund following this strategy tries to exploit price differences by going long and short in closely related stocks. These stocks may belong to the same sector, industry, and country, or simply have similar characteristics. They must correlate with each other. Portfolios built on this strategy have positive dynamics regardless of whether the market is bearish or bullish, which is essential in the current turbulence in the economy.

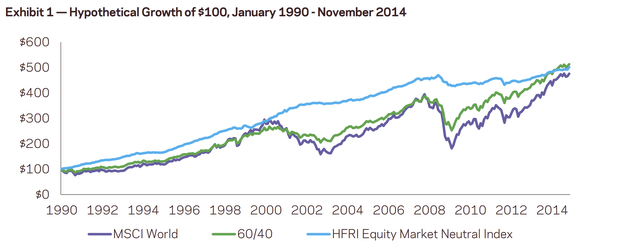

Our conclusions are confirmed if we compare the hypothetical growth of a hundred dollars invested in MCSI World, a classic investment fund using a 60/40 strategy, and hedge funds included in the HFRI Equity Market Neutral Index.

aqr.com

At first glance, the formation of a neutral position of two companies from the crypto industry contradicts the idea of minimizing risks. However, there are several reasons why we have focused on crypto.

- The crypto companies are highly correlated with each other since the key determinant of the market value of their shares is the price of Bitcoin (BTC-USD).

- Until recently, the crypto industry attracted capital from all over the world. As a result, a large number of value-burning companies have entered the market. But there are value-creating firms for which crypto is the new growth driver.

- The blaze of glory that surrounded crypto companies during the bull market led to the fact that all of them, regardless of fundamental indicators, traded at cosmic multiples. Today, the market looks with equal skepticism both at profitable growing businesses and deeply unprofitable firms.

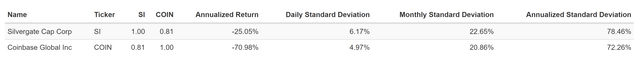

The classic antipodes in the non-classical market for us are Silvergate Capital Corporation and Coinbase Global. For both companies, crypto is a key driver of growth in financial performance and the reason for the decline in share prices. The asset correlation level is high – 0.81.

portfoliovisualizer.com

The annualized standard deviation of SI is 80.96%, while COIN is 75.52%.

Silvergate Capital Is A Buy

In the previous article, we were neutral on Silvergate as the company traded at a premium.

Silvergate Capital is the parent company of Silvergate Bank, founded in 1988. As a member of the Fed, the bank specializes in commercial banking and commercial lending. However, apart from traditional banking, the company’s offerings for crypto investors are unique, providing a key growth driver for the company.

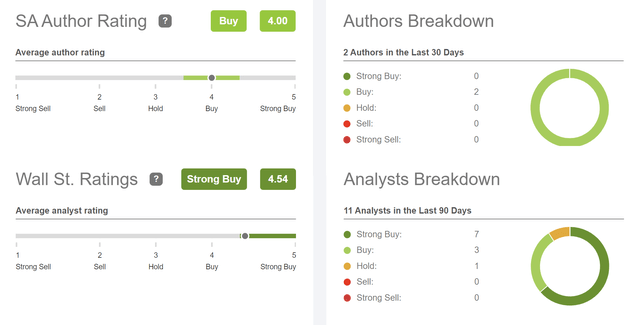

The company has high ratings according to the authors of Seeking Alpha and according to Wall Street analysts.

Seeking Alpha

Silvergate Exchange Network

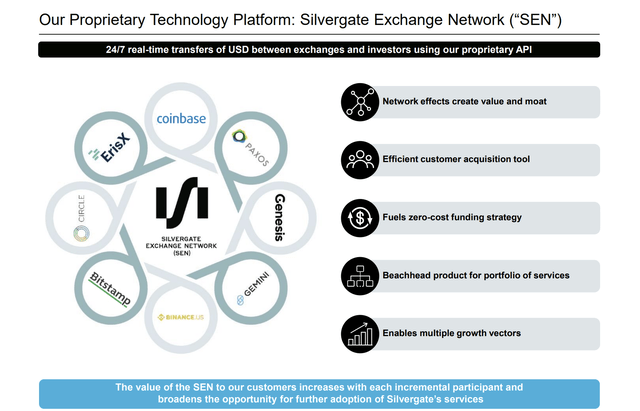

Through the Silvergate Exchange Network (“SEN”) the company provides a wide range of services and infrastructure solutions for institutional investors in digital assets and cryptocurrency exchanges. SEN is a network of investors and exchanges providing members with the ability to transact between digital currency deposits. Silvergate charges transaction processing fees and also earns interest income from crypto-backed loans (SEN Leverage).

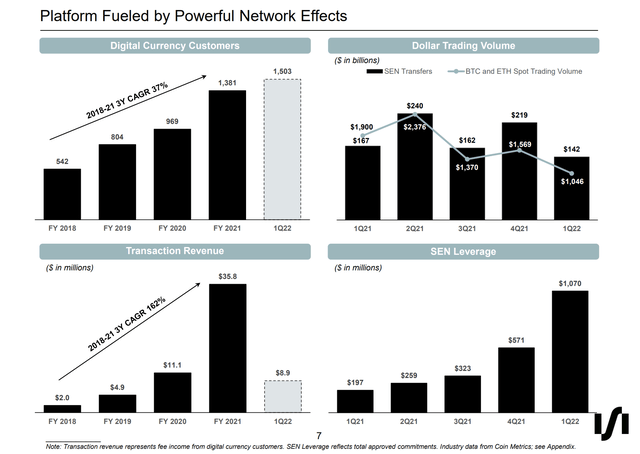

SEN is a key growth driver for Silvergate. And although the volume of transactions decreased in the last reporting period due to the fall of major cryptocurrencies, the number of customers continues to grow. It is worth noting that the more participants come to SEN, the more attractive the network becomes for other industry players.

Company’s Presentation

While other industry players are focused on a certain segment of users and offer a certain set of services, Silvergate is a kind of broker for brokers. By connecting the largest participants in the digital asset market, SI is growing along with the market as a whole.

Company’s Presentation

The Diem acquisition is also an important driver for SEN growth. Silvergate may become the only stablecoin issuer under the control of the Federal Reserve, which is especially true after the resounding collapse of the UST.

Traditional banking

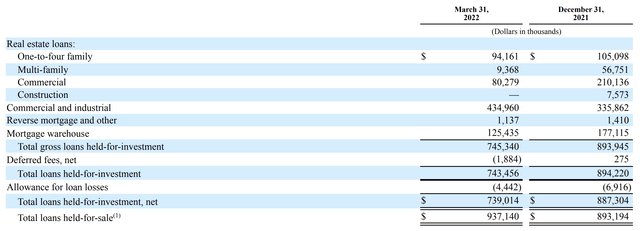

While SI’s key driver of growth is its Silvergate Exchange Network, the company has a solid foundation in its traditional banking business. According to the latest 10-Q filing, real estate loans and mortgage warehouse obligations account for 41.5% of total loans held-for-investment.

10-Q filing

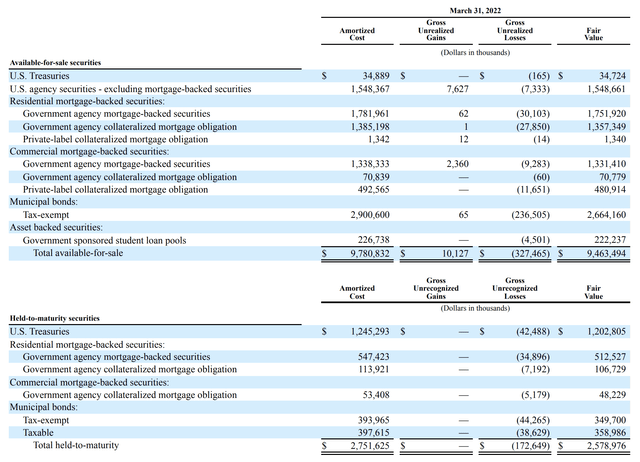

Most of Silvergate’s assets are securities – $12.2 bn or 77.3% of the company’s total assets. At the same time, 55% of securities consists of mortgage-backed securities and collateralized mortgage obligation, which have a floating interest rate.

10-Q filing

The presence of the traditional banking business is an important advantage of the company over other fintech since the growth of interest rates in the economy will lead to an increase in income in this segment. In other words, the growth in interest income from securities is an important driver of Silvergate, which few people pay attention to.

SI Stock Valuation

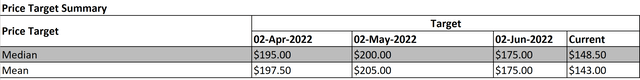

The minimum price target from investment banks set by Morgan Stanley is $88 per share (65.91% upside potential). In turn, Bank of America estimates Silvergate at $200 (277.07% upside potential). According to the Wall Street consensus, the company’s fair market value is $143.0, which implies 169.61% upside potential.

Refinitiv

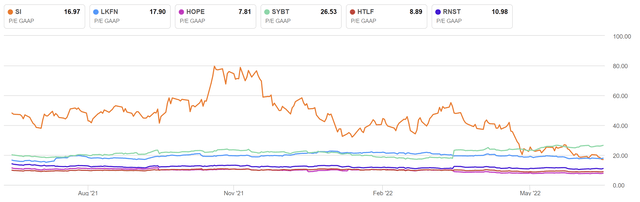

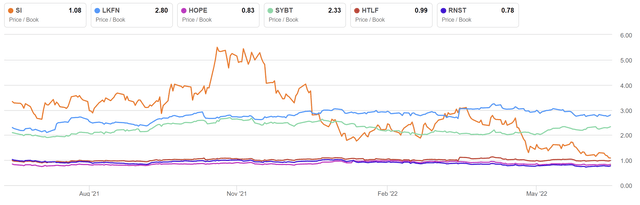

Despite the high growth rate and potential of SEN, Silvergate is trading at the level of traditional banks by a comparable valuation.

Seeking Alpha

Seeking Alpha

Thesis Risks

- Silvergate Capital is a pioneer in the infrastructure market for digital asset investors. As the market grows, competition will intensify. Already, the largest Wall Street banks are creating teams dedicated to cryptocurrencies.

- Regulatory risk is one of the main ones for financial institutions serving investors in digital assets. The Basel Committee on Banking Supervision has proposed limiting crypto assets to just 1% of a lender’s capital. Further tightening of regulation could significantly impact the financial performance of companies like Silvergate Capital.

Coinbase Is A Sell

Coinbase is one of the largest cryptocurrency exchange platforms in the world. The company offers retail crypto investors the ability to buy and sell digital assets, as well as provides large institutions with access to a marketplace with a pool of liquidity for transactions with crypto assets.

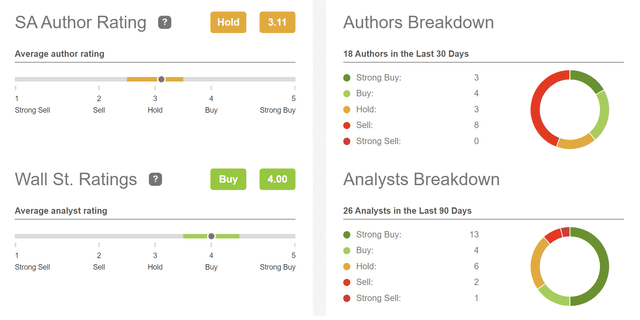

The authors of Seeking Alpha have a mixed view of COIN stock, with eight contributors recommending a sell. Although Wall Street’s position is more positive, three out of 26 analysts rated the stock as a sell or a strong sell.

Seeking Alpha

Tougher Competition

As a pioneer in the fee-free trading market, Robinhood (HOOD) has forced the biggest brokerages to adapt. As a result, even discount brokers have a free trading mode. Cryptocurrency platforms are going through a similar stage.

High intermediary commissions have always been a feature of digital asset trading, but the associated costs were more than offset by the huge profitability that buyers of cryptocurrencies received. Decreased risk appetite and the fall of bitcoin have spurred competition between platforms. At the end of May, FTX US launched zero-commission stock trading, which does not affect crypto trading fees but indicates the desire of players to expand the range of services for clients, which means that competition is getting tougher. At the end of June, Binance offered zero fees for four bitcoin trading pairs, including BTC/USD, BTC/USDT, BTC/USDC, and BTC/BUSD.

In response to the new Binance fees, Coinbase has taken on staff optimization. The company announced a layoff of 1,100 employees or 18% of its workforce. The day after Coinbase’s announcement, Binance’s CEO Changpeng Zhao announced 2,000 positions for hire.

While there were enough customers for everyone during a time of rapid growth, the deteriorating market environment and tougher competition raise doubts about Coinbase’s long-term prospects.

High Short Interest

According to Refinitiv, Coinbase’s short shares are 31.4 million out of 222 million outstanding shares. Thus, the short interest is 14.16%.

Refinitiv

This short interest is high enough to attract new sellers, but still provides a solid margin for growth.

COIN Stock Valuation

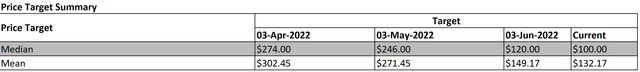

Coinbase’s valuation range is significantly wider than Silvergate’s. The minimum price target set by Goldman Sachs is $45 per share (8.24% downside potential). In turn, BTIG Research values Coinbase at $290 (491.35% upside potential). According to the Wall Street consensus, the company’s fair market value is $132.17, which implies a 169.52% upside potential. Notable that all analysts have recently significantly cut their ratings on COIN.

Refinitiv

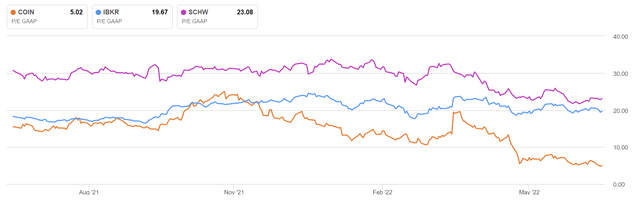

Coinbase’s business model is closer to brokerage firms than exchanges. COIN is trading at a significant discount to blue chips such as Interactive Brokers (IBKR) and The Charles Schwab Corporation (SCHW) on a P/E multiple. The discount is due to the expected decrease in operating results due to the fall of cryptocurrencies.

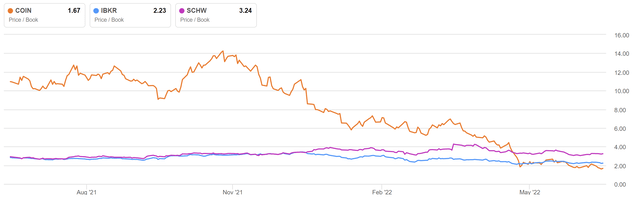

On a P/B multiple, the companies trade at comparable levels.

Seeking Alpha

Seeking Alpha

Thesis Risks

- A comparable valuation shows that the downside drivers are already largely priced in. There is a possibility that we are being too pessimistic about Coinbase.

- Unexpected positive news can lead to panic exits of bearish positions and a short squeeze due to accumulated short interest. We think the likelihood of this risk materializing is low, as the current short interest is insignificant for contraction and is more likely to be a driver for a further decline in shares.

Allocation

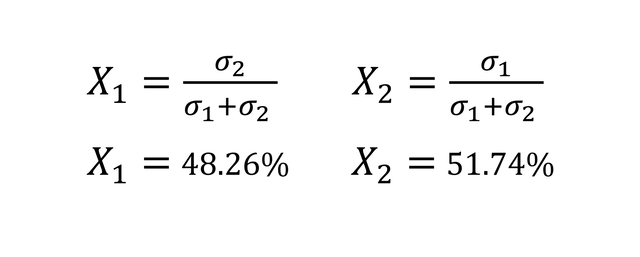

As noted earlier, the annualized standard deviation of SI is 80.96%, while that of COIN is 75.52%. The EMN proportions of a portfolio consisting of two assets are determined by the formulas:

Created by the author

Thus, assets should be distributed in the following proportion: a long position on SI should take 48.26% of the total portfolio value, and a short position on COIN should take 51.74%, respectively.

Conclusion

The equity market neutral strategy is one of the most effective in terms of the ratio of profitability, volatility, and correlation to the market. The EMN provides the least correlation to the S&P 500 and the highest Sharpe ratio, which is why hedge funds love it so much.

Focusing on growth companies, we have selected non-trivial assets for EMN implementation, which should appeal to risk-takers and yield seekers. In our view, long Silvergate Capital Corporation and short Coinbase Global in the right proportion could be a good deal for growth investors in the face of market uncertainty.