- Ethereum miner revenue has dropped to $498 million, an alarmingly low level, in June.

- A decline in Ethereum price and the fear of being out of business after the Merge lead to steep decline in miner revenue.

- The Gray Glacier upgrade delayed the difficulty bomb, giving miners another 100 days before the migration to Proof-of-Stake.

The Ethereum Merge, the much anticipated transition from Proof-of-Work to Proof-of-Stake, has negatively impacted miners on the altcoin’s network. Miner revenue was slashed to an alarmingly low level in June. Experts revealed that it is likely miners on the Ethereum network have operated under losses for the last two months.

Also read: One of the most iconic American rappers is bullish on Ethereum despite recent price slump

Gray Glacier upgrade gives miners relief for another 100 days

The Ethereum network underwent a scheduled upgrade at block 15,050,000, to change the parameters of the Difficulty Bomb. The Gray Glacier upgrade went live on June 30 and pushed the Difficulty Bomb back by roughly 100 days.

Tim Beiko, a leading Ethereum developer, tweeted:

Gray Glacier Upgrade Announcement

At block 15,050,000, the Ethereum network will undergo the Gray Glacier fork to push back the difficulty bomb, *hopefully* for the last time ever

If you run a node or validator, make sure to upgrade !https://t.co/wmPqzQSgL7

— Tim Beiko | timbeiko.eth (@TimBeiko) June 16, 2022

The Difficulty Bomb is a mechanism that increases the difficulty level of the puzzles in the Proof-of-Work mining algorithm that results in longer block times and less Ethereum reward for miners. The upgrade affects only the Ethereum mainnet and was not deployed on any testnet.

EIP-5133 was introduced in the Gray Glacier upgrade to delay Ethereum’s Difficulty Bomb to mid-September 2022.

Ethereum miner revenue plummets to alarmingly low levels

Despite the delay in the Difficulty Bomb, miners on the Ethereum network have seen a steep decline in their revenue, month-on-month. While the transition to Proof-of-Stake has been pushed back to September 2022, declining Ethereum prices and lower profitability for miners has sinked revenue to alarmingly low levels.

In the recent crypto bloodbath, Ethereum price dropped at an alarming rate. Ethereum price decline negatively impacts miner profitability.

Ethereum: Total Miner Revenue

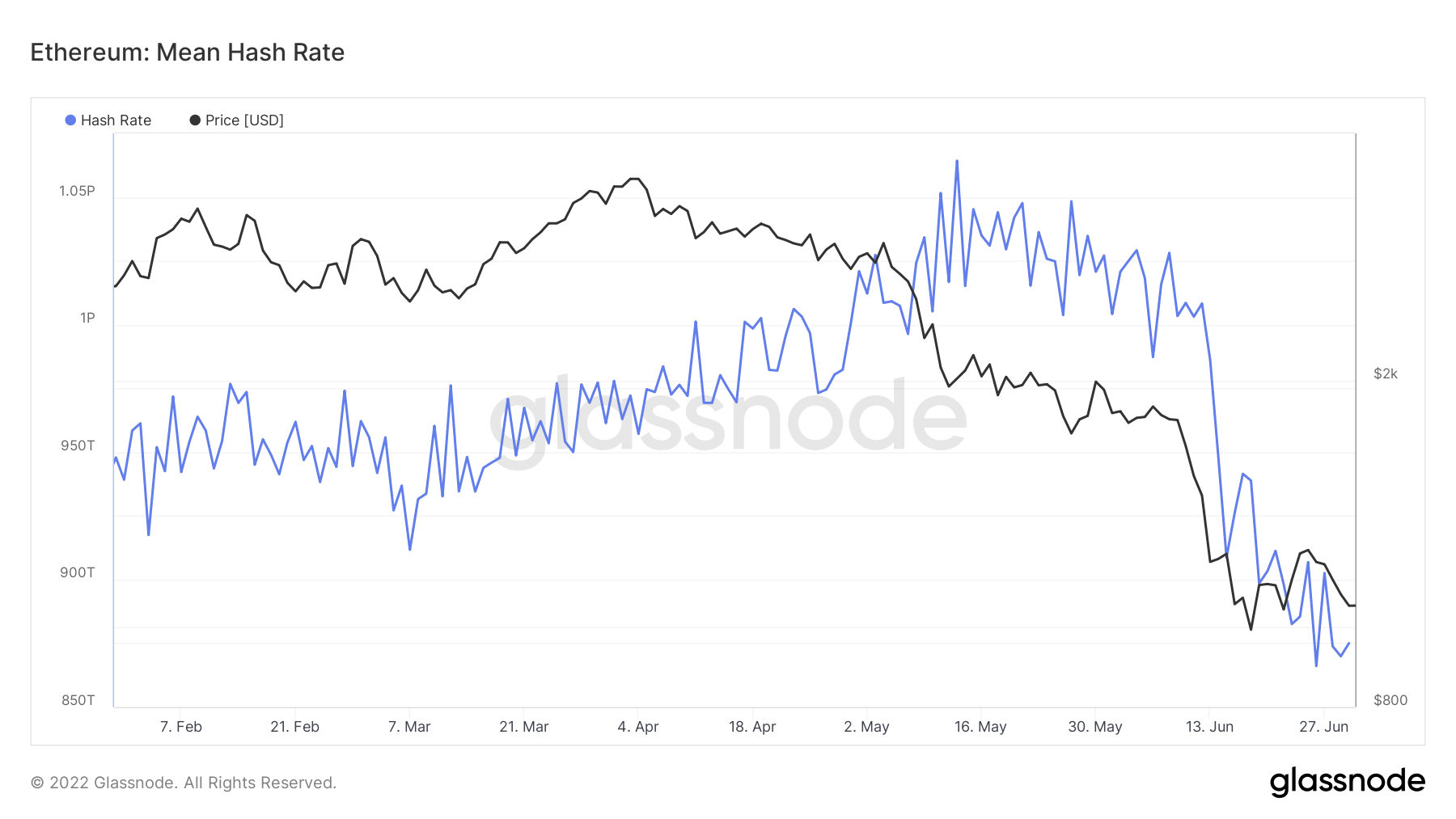

As profitability plummets, miners pull out of the Ethereum network and disconnect, resulting in a lower hash rate.

Ethereum: Mean Hash Rate

Based on data from The Block Research, miners’ revenue on the Ethereum Network shrunk by 45.5% from May to June. Ethereum miners made a mere $528 million in revenue in the month of June 2022. Of this revenue, $498.8 million was from block subsidies, transaction fees from the Ethereum network was significantly lower than in May and April.

Ethereum miners spent $15 billion on graphics cards

Bitpro Consulting disclosed that Ethereum miners have spent as much as $15 billion on gaming graphics cards for mining on the altcoin’s network. These cards cost as much as $2,000 in the retail market, and implies that miners’ objective is to recoup the initial investment through mining revenue.

As Ethereum price declined in the bear market, miners have seen a steep drop in revenues, finding it challenging to recover their operating costs. Interestingly, the shift from Proof-of-Work to Proof-of-Stake has been a looming threat to miners’ operations.

Aydin Kilic, Chief Operating Officer at industrial Ethereum miner Hive, puts the odds of the Merge happening in 2022 between 1 to 10%. Regardless, there is a rise in the number of small miners pooling their resources to continue operations on the Ethereum network. Post the Merge, miners plan to shift focus to Raven, Grin, Dash, Monero and ZCoin.

Though mining in these altcoins is not as profitable as Ethereum, it is a plan for miners to fall back on and recover their cost of operation and initial equipment.

Ethereum Merge end of the road for miners?

Ethereum’s transition to Proof-of-Stake seems like the end of the road for miners on the altcoin’s network. However, it is important to note that the timing of the Merge is key and Ethereum miners have limited time to recoup their losses and exact operating costs out of the altcoin, before pulling the plug.

Ethereum Merge will therefore force the $19 billion mining industry to find new cryptocurrencies to mine. It is likely that mining altcoins with small market capitalization may not be economically viable for Ethereum miners. The total market cap of GPU-mineable coins, excluding Ethereum, is less than 2% of the altcoin’s market capitalization.

Based on a report from Messari, large-scale miners plan to pivot towards a data-center oriented business and focus on high-performance computing. Miners can pool their resources and contribute to Web3 protocols like Render Network and Livepeer. There is a concern of increased selling pressure on Ethereum as miners leave.

Analysts believe Ethereum price could hit previous cycle ATH

Crypto trader and investor @PostyXBT believes Ethereum price could hit its previous cycle all-time high of $1,450 if the altcoin crosses bounces to $1,300 level. The analyst believes Ethereum price is likely to plummet after hitting the previous cycle high until “there is more action from the bulls.”

ETH-USD price chart

Three altcoins to watch this week

Analysts at FXStreet evaluated altcoin price charts and identified three key assets to watch out for gains. For more information and important price levels, checkout this video: