Khanchit Khirisutchalual

Thesis Summary

Inflation has taken its toll on the stock market and led many investors to seek refuge in inflation hedges. Bitcoin (BTC-USD) has been touted by many as an inflation hedge, given its scarcity, but its performance appears to be much more closely tied to stocks than commodities like gold.

For various reasons, Bitcoin is a must-own, but it will not act as an inflation hedge right now, especially with a rising dollar.

Furthermore, I propose that there is an even better hedge against inflation in the realm of cryptocurrencies, and that is Ethereum (ETH-USD)

The Bitcoin Inflation Hedge Debate

Bitcoin has been made to mimic gold in many ways. The supply is increased by “mining”, a slow process that gets harder over time. Like gold, the supply of Bitcoin is finite, although arguably there are still chances of discovering more hold, while 21 million Bitcoin is all that will ever exist.

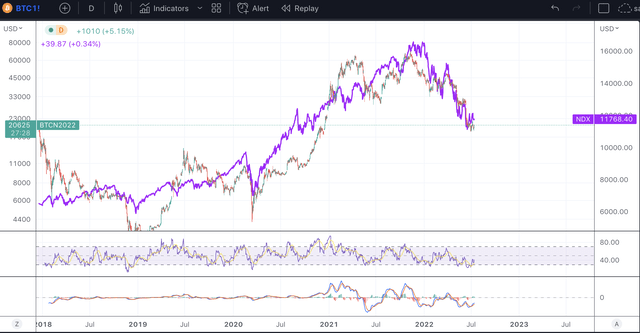

With that in mind, people often believe that Bitcoin should act as an inflation hedge since gold is perceived as an inflation hedge. However, Bitcoin has been trading much more in sync with the Nasdaq 100 (NDX) and “risk-on” assets.

We can see that the performance of BTC and the NDX has been closely linked, especially following the 2020 covid crash. Bitcoin performed best under the covid-induced deflation.

So what’s going on? Is Bitcoin like gold or like stocks?

Before we answer this, we must look at another key variable. The dollar index (DXY)

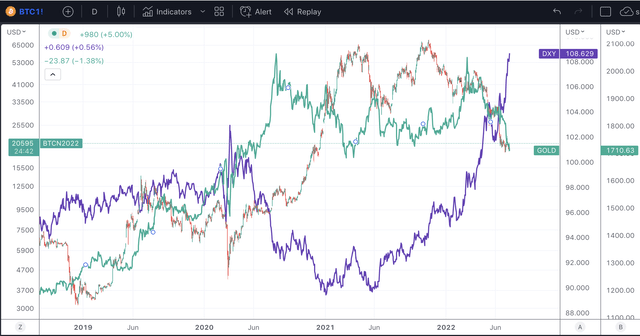

BTC, GOLD and DXY (TradingView)

In the chart above, we can see the performance of gold, the dollar and Bitcoin. We can see some correlation, but also periods where this breaks.

The strongest (inverse) correlation is the one we see between BTC and the dollar. Bitcoin peaked just as the dollar bottomed and has been downtrend as the DXY rallied from 90 to over 108.

Gold, on the other hand, rallied strongly with Bitcoin after the covid crash but has since traded sideways. Arguably. It performed okay during 2021 at the same time as the dollar was rising. However, gold has been falling since March as the dollar uptrend has accelerated.

Many people seem to be neglecting here that we are witnessing both price inflation and a very strong dollar, which doesn’t make much sense on the surface. Higher inflation is the result of excess cash vs the goods in the economy, which is symptomatic of a “weakening currency”.

However, we are seeing inflation and a higher dollar. Why? There are a couple of reasons. Firstly, the dollar is considered a haven. Secondly, the Federal Reserve is increasing rates faster than other countries and is experiencing lower inflation than, for example, Europe. Thirdly, we could see this as proof that inflation today is being driven more by shortages of supply shocks rather than straight-up monetary inflation. Or at least a combination of both.

So, while Bitcoin is a “scarce resource”, it is also a currency, and like almost all other currencies, it has been losing ground against the dollar. In a scenario where a weakening currency induces inflation, Bitcoin could be a hedge against inflation, but this is not the case today.

Ethereum Could Be The Better Store of Value

With the above in mind, I’d like to point out that, amongst the realm of cryptocurrencies, there is a superior alternative to Bitcoin in terms of inflation hedging, and that is Ethereum.

As you probably know by now, Ethereum is the world’s second-largest cryptocurrency, and it currently operates on a Proof-of-Work (PoW) consensus mechanism. But this will change following “the Merge”, which will turn Ethereum into a Proof-of-Stake (PoS)coin.

Under PoS, coins are no longer mined but are obtained/created by staking, which involves locking up existing Ethereum. I mention this because this change will make ETH more deflationary. This is because rewards under PoS are a fraction of rewards in PoW. About 5-10x less, according to Tim Beiko, the man responsible for coordinating the work of Ethereum’s core developers.

When Ethereum transitions to PoS, less ETH will be created with every block. On top of that, Ethereum recently introduced a burn mechanism under EIP-1559, which was part of the London Hard Fork. Following this update, block sizes were increased, and part of the rewards sent to miners are now being burned.

Ultimately, this means that ETH should be a deflationary currency. According to estimates from Ultrasound Money, Ethereum should deflate at a rate of 2% annually following the merge.

So, if you are looking for a scarce asset to protect you from inflation, look no further than Ethereum. Not only that, but ETH has a concrete utility within its blockchain. ETH is needed to pay for gas fees to execute smart contracts.

If Bitcoin is digital gold, Ethereum is digital oil, and we know that the latter has performed much better during this period of inflation.

Takeaway

Cryptocurrencies will not serve as inflation hedges with a strengthening dollar. The scenario in which they become an inflation hedge is when the dollar falls out of favour, something I believe will happen, but not at this point. This is not to say Bitcoin and Ethereum won’t perform well moving forward, only to say that inflation is not the reason. Of the two, Ethereum arguably has more utility, and its supply will dwindle every year, making it perhaps an even better store of value.