Coinbase and Bitbuy are two of the world’s most popular cryptocurrency exchanges, with a combined user base of almost 99 million traders. But when it comes to Bitbuy vs Coinbase, which is best for Canadians?

While Coinbase owns most of the US cryptocurrency market, Bitbuy has become an excellent alternative for Canadians, with over 400,000 Canadian traders using the platform.

Bitbuy was launched in 2016, 4 years after Coinbase, and is exclusive to Canadian traders. It has proven to be a big success throughout Canada, promising low fees, easy payment methods, and third-party auditors to maintain high levels of security.

In this article, we will compare Bitbuy and Coinbase, outlining the key differences between both options, including Bitbuy vs Coinbase fees, payouts, security, unique features, and more, to help you decide which option is right for you.

|

||

|

Reviews |

||

|

Site Type |

World’s Most Used Crypto Exchange |

Canadian Crypto Exchange |

|

Beginner Friendly |

||

|

Mobile App |

||

|

Buy/Deposit Methods |

Credit Card, Debit Card, Bank Transfer |

Wire Transfer or Interac e-Transfer |

|

Sell/Withdrawal Methods |

PayPal, Bank Transfer, Cryptocurrency |

Interac e-Transfer, Electronic Bank Transfer, Bank Wire Transfer |

|

Available Cryptocurrencies |

Bitcoin, Ethereum, Litecoin, and over 150 other options |

Bitcoin, Bitcoin Cash, EOS, Ethereum, Litecoin, Ripple’s XRP, and 11 other options |

|

Company Launch |

2012 |

2016 |

|

Location |

San Francisco, CA, USA |

Toronto, Canada |

|

Community Trust |

Great |

Great |

|

Security |

Great |

Good |

|

Customer Support |

Good |

Good |

|

Verification Required |

Yes |

Yes |

|

Fees |

Medium |

Low |

|

Site |

Company Bios: How Do They Compare in 2022?

Coinbase is the world’s largest cryptocurrency exchange, with over 98 million registered users. In 2021 the company was valued at $65 billion, an increase of $37 billion from 2020.

However, it’s not all sunshine and rainbows.

Coinbase took a big hit in 2022, announcing a net loss of $430 million in Q1 and a decrease in trading volume from $547 billion to $309 billion. Consequently, it had to fire 18% of its staff.

Bitbuy, in comparison, is significantly smaller, with a user base of only 400,000+ Canadians and a trading volume of $4.6 billion since being founded. Talk about David vs Goliath!

Despite market fluctuations, Bitbuy experienced some growth in 2022. On January 4th, 2022, Bitbuy was acquired by WonderFi for CA$206M. Following the purchase, Bitbuy saw a 29% increase in Ethereum volume traded in January versus December and added $34 million in value to the platform after adding seven new cryptocurrencies.

Despite these wins, WonderFi announced a loss of $14 million at the end of Q1, 2022. Nonetheless, Bitbuy is showing signs of growth in a turbulent crypto market.

As of June 2022, Coinbase investors can earn up to 5.75% of their crypto, whilst Canadians that hold Bitcoin, Ethereum, and Bitcoin Cash can earn up to 10% annualized interest through Bitbuy.

Bitbuy Vs Coinbase Fees

In the US, Coinbase fees are relatively low, with a 1.50% fee for any transaction and a minimum fee of $0.55. However, Coinbase fees are expensive for Canadians, with a 0.5% fee on all buy and sell transactions in addition to a 3.99% fee. This fee will depend on the transaction size and works at 3.99% or a flat rate used for smaller transactions. For example, if a Canadian user places a buy order for $10, they’ll pay a $0.99 CAD fee – that’s 10% of their order!

To trade with lower fees, Canadians can use Coinbase Pro for transactions. However, Coinbase Pro doesn’t let Canadians make fiat transactions. All transactions are crypto to crypto, and fees start at 0.5%, decreasing as a user’s trading volume increases. Although this rate is reasonable, Coinbase Pro can be a little complex for new crypto investors.

Bitbuy has two different trading interfaces with their fees. The first is the traditional cryptocurrency exchange, where fees range from 0.5% to 3.5% of the total transaction.

Interac e-Transfers are charged a 1.5% fee for all transactions, which is considerably lower than Coinbase’s fee for Canadians.

Bitbuy also has an advanced trading platform where users are charged a 0.2% fee on express trades, a 0.10% fee as a trade maker (a user who provides two-sided markets), and a 0.2% fee as a trade taker (a user who trades on prices set by a maker.) Users who want faster transactions are charged a 0.75% buy fee and 0.5% sell fee.

Payouts

Payouts from Coinbase to a US bank account take between 1-5 business days, depending on the payout method. Once a user chooses to cash out, a delivery date will be shown on a trade Confirmation page before submitting your order. Users can double-check this date on the History page.

Here’s the average payout time for payment methods in the US:

Faster Payment: 1-3 business days

SEPA Transfer: 1-3 business days

PayPal: 1 business day

Instant Card: Cashouts Instant

To make sure US users always have access to their funds, the minimum payout is around $0.10, though this will fluctuate based on exchange rates.

For Canadian customers, cashing out isn’t easy. As of June 2022, Canadians will need access to a US bank account to withdraw funds as Canadian banks aren’t currently supported.

Bitbuy, on the other hand, makes it significantly easier for Canadians to withdraw money with two payout methods.

Interac e-Transfer, which requires a minimum payout of $50.00 and is completed within 24 hours, and bank wire which requires a minimum payout of $20,000.00 and takes 2-3 business days.

Bitbuy vs Coinbase Currency Support

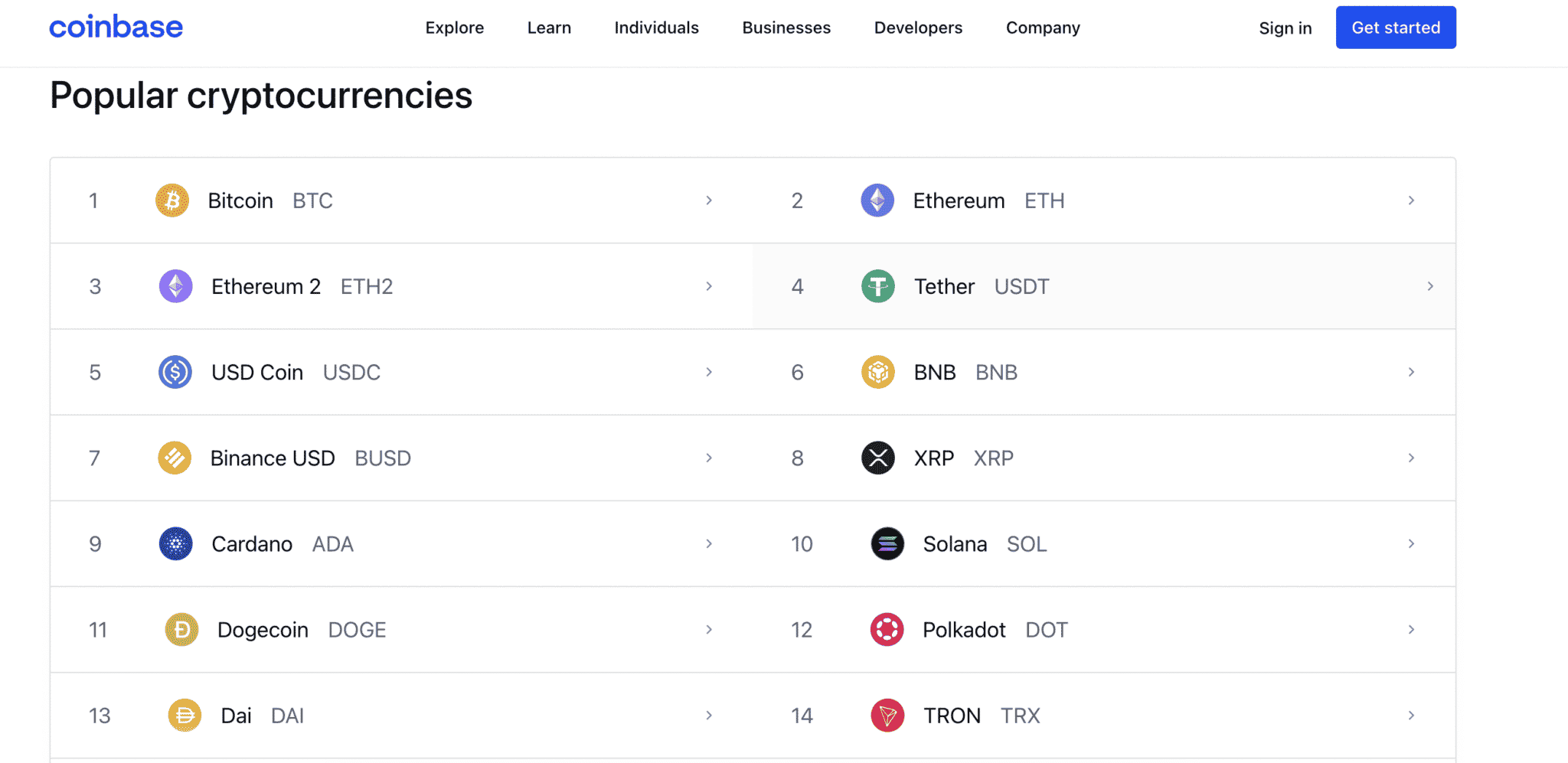

When it comes to cryptocurrency support, Coinbase has a considerable advantage over BitBuy. Coinbase provides traders with over 150 different cryptocurrencies to invest in, while BitBuy has only 17.

However, Bitbuy has an advantage over Coinbase regarding fiat currency. The native fiat on the site is Canadian dollars, and the platform is integrated with the Interac e-Transfer system, which makes it significantly easier to use for Canadians. Coinbase, on the other hand, isn’t compatible with any Canadian banks.

Bitbuy vs Coinbase Security

Regarding security, Coinbase is one of the industry’s best options. The exchange has never experienced any serious threats and uses Coinbase Custody, an independent, NYDFS-regulated company, to meet all regulatory requirements.

Coinbase also provides investors with insurance on their crypto holdings when stored on the platform. This insurance covers up to $1,000,000 of crypto losses should a user’s account be hacked.

Bitbuy also has an impressive record when it comes to security. Although it was founded four years after Coinbase, Bitbuy has never been hacked and operates as a registered Money Services Business with FINTRAC.

In addition, Bitbuy keeps 99% of its user’s funds in cold storage, meaning the funds aren’t accessible through the internet for hackers to steal. To ensure the highest standards are continuously met, Bitbuy regularly passes third-part cold storage and proof-of-reserve tests.

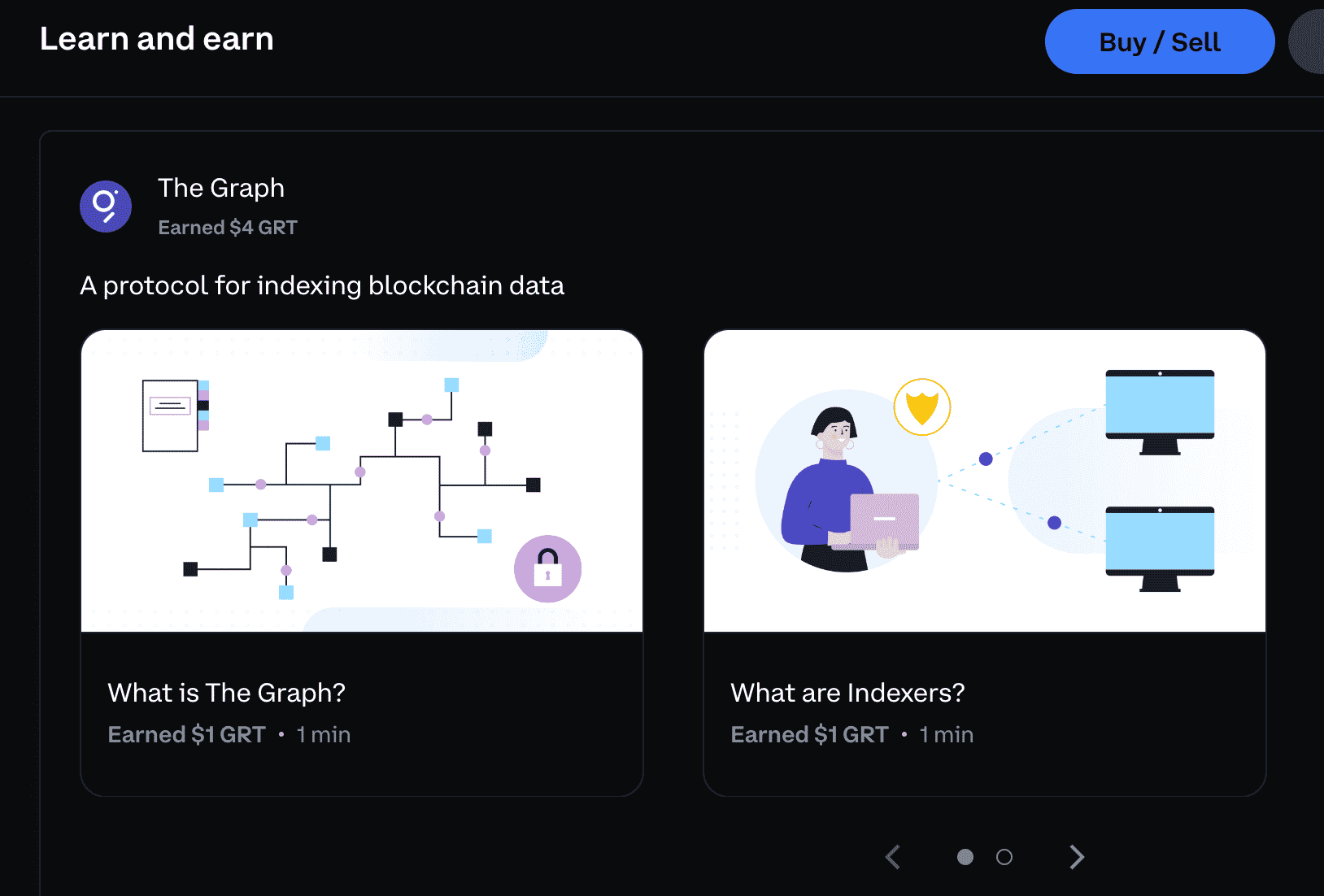

Unique Features

Coinbase introduces cryptocurrency education to users and incentivizes them to learn with cryptocurrency rewards. To earn these rewards, users need to watch a short video (usually 1-3 minutes long) teaching them about cryptocurrency. Once finished, they’ll need to complete a short multiple-choice question and will earn crypto as a reward. These rewards range from $1-3 per video, with new videos being released every few months.

Another unique feature of Coinbase is its Wallet app for iOS and Android devices. According to the Google Play store, the app has received a 4.3-star rating, 1 million downloads, and over 24,000 reviews. The Coinbase Wallets themselves allow users to store and trade crypto, collect NFTs, participate in airdrops and initial coin offerings (ICOs), and browse decentralized apps (DApps).

Instead of looking for innovative features, Bitbuy has focused on mastering the basics. The platform is extremely user-friendly, making it easy for beginners to get started even if they have no prior crypto experience. An Express Trade feature is available for all 17 cryptocurrencies, allowing users to buy and sell cryptocurrency in seconds.

For more experienced traders, Bitbuy also has a Pro Trade market. This market showcases more advanced crypto charts through a TradingView and provides access to limit and market orders.

Although not a feature that users can directly use, Bitbuy stores 99% of its cryptocurrency offline after partnering with BitGo Trust Company. BitGo Trust Company is the world’s first qualified custodian built to store digital assets. These assets are covered by an insurance policy covering all Bitbuy users’ assets.

Despite neither option having standout features such as the Pancakeswap lottery, both have solid foundations and plenty of features for new cryptocurrency investors to enjoy.

Mobile And Desktop Trading

For mobile trading, Coinbase provides its users with one of the best crypto exchange apps available. Available on both iOS and Android, the app lets users trade cryptocurrency, earn yield, and provides the latest crypto market updates.

Bitbuy also provides mobile investors with a great app to use. The app gives users access to all 17 cryptocurrencies available through desktop trading, and users can view how each cryptocurrency is performing through detailed charts.

For desktop trading, Coinbase is often praised as the best option for new traders. The interface is clean and easy to follow, with clear options to buy/sell and send/receive cryptocurrency at the top of the page. Users can view their assets through the Assets tab or trade over 150 cryptocurrencies through the Trade tab, where all currencies and their current performances are listed.

Much like Coinbase, Bitbuy is also easy to use for new investors. Although it doesn’t have as many trading options as Coinbase, it covers all the essential cryptocurrencies such as Bitcoin, Ethereum, Dogecoin, and Uniswap.

Bitbuy vs Coinbase Customer Support

Coinbase has a range of customer support services to meet the needs of its users. Before contacting any support team directly, users can access the Coinbase Help Center for fast solutions from a list of common FAQs.

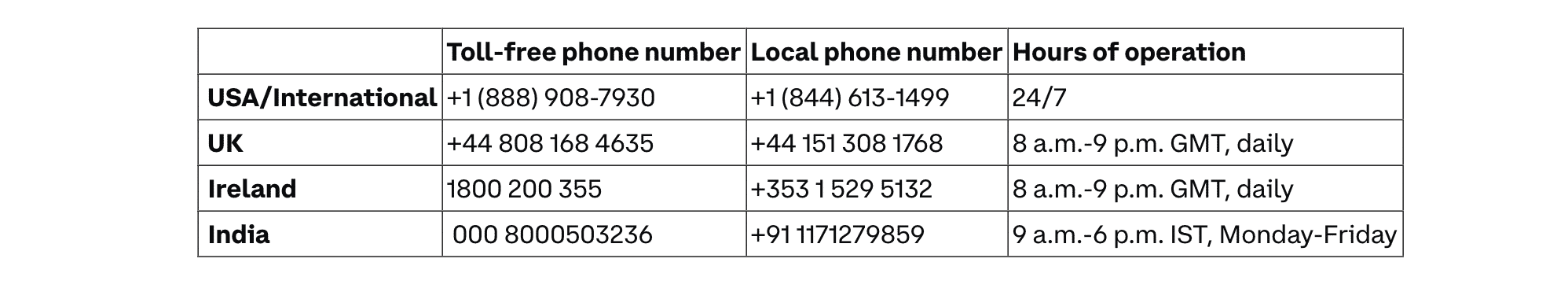

If you can’t find what you need at the Help Center, Coinbase provides users with mobile support to chat directly with a customer support assistant. Here are the different lines:

Alternatively, live messaging is available through the Coinbase web browser and is open 24/7, 365 days a year. It can be accessed through the Message Us button in the right-hand corner of any support page. The chat will start with a virtual assistant, but users will be passed onto a live support agent if necessary.

The final support option is through email and can be found here. When sending an email, make sure you use the same email you signed up to Coinbase with.

Twitter is used by Coinbase to provide generic updates; however, account support is not available on the platform.

Bitbuy doesn’t quite have the same level of support that Coinbase offers.

As of June 2022, Bitbuy doesn’t offer telephone support.

To contact the team, investors need to email Bitbuy directly at [email protected] or by submitting a request through their website.

Users can also contact the Bitbuy support team through Twitter and Reddit, however, the team can’t provide account advice on social media due to security reasons.

Alternative Trading Options

So you’ve done your research and decided that Bitbuy and Coinbase aren’t for you… what are your options? Luckily, there are plenty of alternatives to choose from. Here are a few of our favorites for US and Canadian traders.

Binance

Binance is the world’s largest centralized cryptocurrency exchange with a daily trading volume of $10,639,965,754. The exchange provides users with over 80 cryptocurrencies, including altcoins and new additions to the market. Several support services are also on the site for those looking to learn more about cryptocurrency. You can find out more about Binance through our guide.

CoinSmart

CoinSmart was founded in 2018 and was the first Canadian exchange to be regulated by the Financial Transactions and Report Analysis Centre of Canada (FINTRAC). It has around 152,000 users and a customer satisfaction rating of over 99%. Through its GetSmart Hub, users can learn the fundamentals of cryptocurrency, from the basics to more complex investing strategies.

NDAX

NDAX is a Canadian crypto exchange first launched in 2018. The platform is integrated into the Canadian banking system, allowing for quick transfers from Canadian banks, credit unions, and other financial institutions. The project is at the forefront of crypto security, with over 95% of crypto assets being held in Ledger Vault, a cold storage solution that promises higher levels of governance, security, and transparency for user’s crypto assets.

Bitbuy vs Coinbase: Which Is Best For Canadians?

Both Coinbase and Binance provide US and Canadian investors with a solid foundation to build a crypto portfolio. But which is best for Canadians?

When it comes to transactions, Bitbuy has a huge advantage over Coinbase for Canadian investors. Fees are lower for both smaller and larger transactions, and payouts can be sent directly to a Canadian bank from Bitbuy, with Canadians needing an alternative for Coinbase withdrawals.

Both platforms provide users with industry-leading security and are fully regulated, making either a great option from a security perspective.

In terms of unique features, neither option has anything that particularly stands out. Instead, both options provide users with a solid foundation for investing. However, if you want to invest in some alternative cryptocurrencies, then Coinbase is the better option, with over 150 cryptocurrencies compared to Bitbuy’s 17.

When you compare Bitbuy to Coinbase in terms of customer support, Coinbase is also slightly better overall. Although both options offer email support, Bitbuy doesn’t provide any telephone support, which lets it down a little.

Overall, both exchanges provide users with a range of benefits, though from our perspective, Bitbuy is the better option for Canadian users due to its compatibility with Canadian bank accounts. With Coinbase being tailored to a US audience, it somewhat limits what Canadian investors can do with their money.

Should Coinbase integrate Canadian bank accounts in the future, it’s possible that it could quickly become a favorite amongst Canadian crypto investors.