AlexSecret/iStock via Getty Images

It has been 15 months since I last covered Basic Attention Token (BAT-USD) for Seeking Alpha. Like most altcoins, the price of BAT has done very poorly since that article was published. However, unlike many of the altcoins in the cryptocurrency space, Basic Attention Token has continued to be linked to real economic activity despite the declining prices. BAT is a key component in a fast growing ecosystem that provides real utility in a blockchain-based model. In this article, I’ll briefly revisit the utility of BAT, update some of the key metrics in the ecosystem, and compare recent price performance to creator coin peers.

Brave Ecosystem

The Brave ecosystem is designed to reward both publishers and web users to a larger degree than what is currently experienced in the “web 2” model. The backbone of the ecosystem is Brave’s web browser that has built-in privacy and ad-blocking features. Users of the browser can opt into Brave’s ad-serving model and earn BAT token in exchange for willingly receiving advertising. Users who receive the BAT token for viewing ads can choose to either take the BAT token for themselves or designate its distribution to the online publishers that they enjoy reading or watching.

The BAT token is made possible with the proceeds from in-browser campaigns that are ordered through Brave’s ad platform. For a deeper analysis of why that model is beneficial for content consumers, publishers, and the advertisers who are subsidizing all of the activity, take a look at my previous coverage titled BAT: Building a More Free and Fair Internet.

Ecosystem Growth

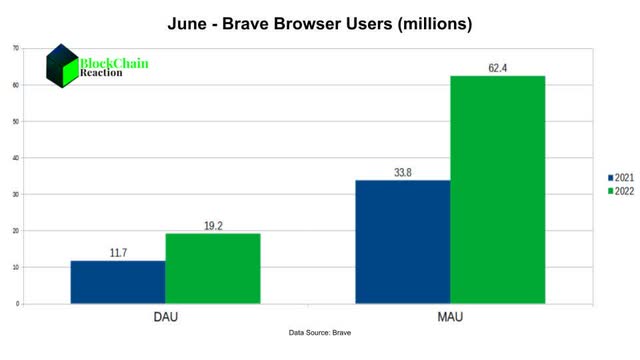

The growth of the Brave ecosystem has been very strong in the last year. When I wrote about the token last April, there were roughly 29 million monthly active users of the browser. According to Brave, there are now over 62 million monthly active users and 19.2 million daily active users.

The year over year increases in Brave browser usage have been impressive. Monthly Active Users of the browser are up 85%. The Daily Active Users are up 64%.

Advertisers Are Using Brave

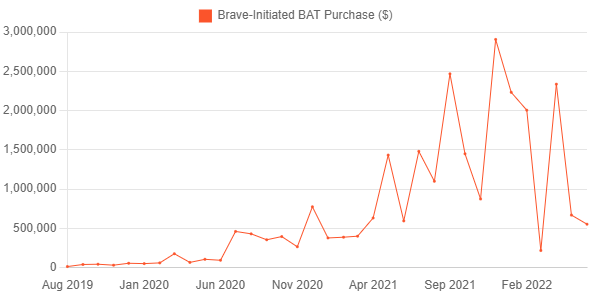

Advertisers seem to be taking notice of Brave’s browser user increases as BAT purchased for ad viewing rewards has been steadily climbing when measured in dollars.

BAT purchases for ads (Brave)

For the first quarter of 2021, Brave spent $1.15 million on BAT token for Brave rewards purposes. In Q1 2022, that figure rocketed up to $4.3 million. A year over year increase of 273%. While that buying slowed a bit in Q2 Brave spent just under $3.6 million in BAT rewards in second quarter 2022 – a year over year increase of 34%. Beyond just the growth in the user base, ad buyers likely look to Brave because the marketing done through Brave’s ad platform works better than other options.

Brave Ad Effectiveness (Brave)

According to Brave’s media kit, campaigns run through the ad platform have experienced a 64% lift in awareness and a 17% lift in purchase intent. Additionally, the user base is a strong fit for ad partners who wish to reach a traditionally coveted demographic as 65% of the browser’s users are between the ages of 25 and 49. The kit boasts an 8% click through rate – well ahead of market peers like Facebook (META) display and Google (GOOG) search. Brave claims to have worked with over 400 ad partners spanning over 3,600 campaigns.

Supply and Performance

It would be one thing if increased adoption of the Brave browser was happening in a token environment where BAT had a low circulating supply, thus risking dilution through inflation. That is currently not the case for BAT as the circulating supply of tokens is 100%. This is different from other “creator coins” like Chiliz (CHZ-USD), The Sandbox (SAND-USD) or ApeCoin (APE-USD).

| Market Cap Rank | Project | Token | Circulating Supply |

|---|---|---|---|

| 36 | ApeCoin | APE | 30% |

| 37 | The Sandbox | SAND | 42% |

| 65 | Chiliz | CHZ | 68% |

| 74 | Basic Attention Token | BAT | 100% |

Source: CoinMarketCap, 7/5/22

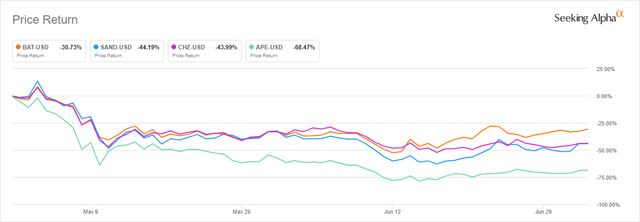

While the crypto market broadly struggles, each of these coins has moved down mostly in tandem as they’re viewed as “altcoins” rather than as legitimately impactful tokens. From May through mid-June, declines in close proximity was very much the case.

I covered this relationship for my BlockChain Reaction subscribers in early-June. In that article, I wrote the following:

While I certainly think it’s fair to say the broad market crypto market has a lot of worthless junk, I think the fact that good tokens like BAT move with other assets that may not have a utility presents an opportunity to accumulate a position. At some point, the risk dilution in these tokens will matter. And that will likely be to BAT’s benefit.

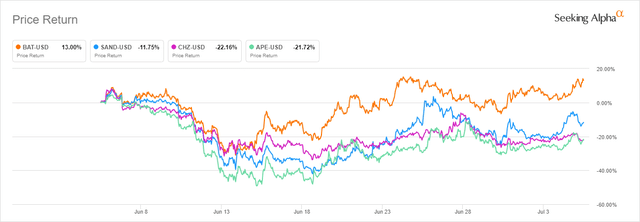

Since that article, BAT has been the strongest of the four highlighted creator coins and it is the only one with a positive performance over the last month.

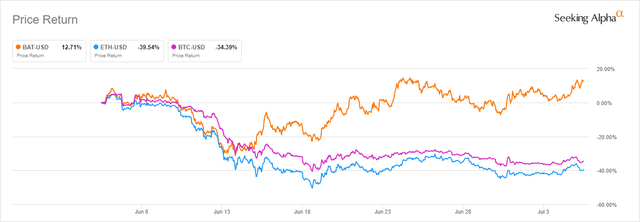

BAT’s outperformance over the last month hasn’t been limited to just creator coins, Basic Attention Token has performed better than both Bitcoin (BTC-USD) and Ethereum (ETH-USD) over the last month.

Other Potential Catalysts

In addition to the core web browser, the team at Brave is also continuing buildout of its browser-based wallet that is positioned to compete with wallet plugins like Metamask; a popular wallet application for Ethereum and layer 2 chains like Polygon (MATIC-USD). So far, Brave’s browser wallet has Ethereum and Solana (SOL-USD) integration. The company recently announced a partnership with NEAR Foundation that will enable Brave wallet compatibility with Aurora (AURA-USD) chain. This integration would allow BAT token to be bridged from Ethereum to NEAR (NEAR-USD).

Risks

There are quite a few risks to consider when investing in any cryptocurrency. How the crypto industry is regulated continues to be an unknown at this time. But however, that shakes out it is sure to have an impact on the entire landscape, BAT included. BAT token carries risk as Brave browser users who claim their BAT rewards could opt to trade out of the currency for something else; this conceivably puts selling pressure on the BAT price. Finally, BAT could suffer if there is sustained economic uncertainty as the model is dependent on advertising dollars and marketing budgets are generally cut during recessions. I believe recession fears from marketers is already being seen expressed by the slowing rate of BAT purchase growth in Q2.

Summary

I’m long BAT token. I think it’s one of the best positioned real utility tokens in the entire cryptocurrency market and I believe it will survive the crypto winter that investors currently find themselves in. Because of that belief, BAT is one of my core holdings in my long-term crypto investment portfolio.