In May 2022, cryptocurrency exchange giant Coinbase made an SEC disclosure that created turmoil in the crypto space. It warned that customer assets could be subject to proceedings if the company went bankrupt, raising questions about the risks of investing on the platform.

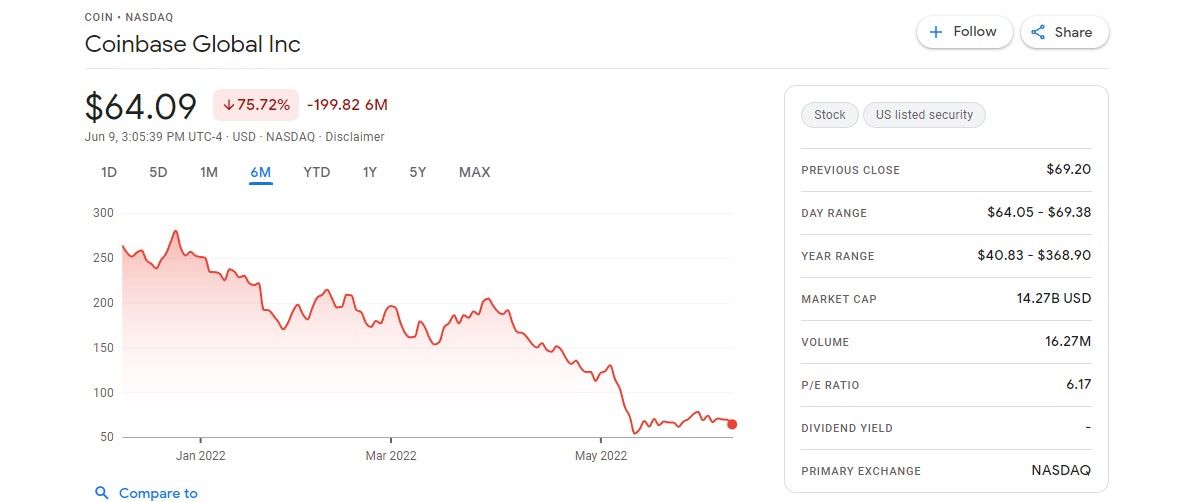

With Coinbase shares plummeting by more than 27% after the filing, the company has since released a statement to clarify its position. But, the big question is whether Coinbase is going bankrupt, and what happens to your crypto if it does?

Is Coinbase Going Bankrupt?

The recent statement made by Coinbase [PDF] was part of a quarterly report filing, but the company did not say that it is getting close to insolvency. Instead, they were detailing a new risk factor per a new SEC requirement called SAB 121, specifically aimed at companies holding crypto-assets for customers.

Rescinding Job Offers

The situation gets a little more complicated when you consider Coinbase’s recruitment issues and rescinded job offers in the weeks following the quarterly report. In addition, the company has decided to slow down recruitment to focus on improving other aspects of its operations.

Based on the evidence currently available, it would be pure speculation to say that Coinbase may go bankrupt. The company’s CEO has denied that Coinbase is at risk, and other cryptocurrency exchanges will have to add similar risk factors to their own reports. Unfortunately, though, trust is a significant factor in the crypto sector, and Coinbase’s falling stock value is a good indication that people don’t trust the exchange.

What Happens if Coinbase Goes Bankrupt?

There is little precedent for a cryptocurrency exchange going bankrupt, making it difficult to say exactly how a situation like this would play out. However, as of March 2022, Coinbase was the custodian of $256 billion in customer assets and money, so a lot is on the line if it goes bankrupt.

Those investing in cryptocurrencies don’t have the same insurance or protection as those putting money in the bank. If an exchange like Coinbase goes bankrupt, the customer assets it holds may be subject to bankruptcy proceedings.

But what exactly does this mean for those who have crypto-assets with an exchange?

If Coinbase filed for bankruptcy, all of the company’s assets as well as the customer assets it holds would first be divided up to cover money owed to creditors. This means that if Coinbase’s debt exceeds the value of the company’s own assets, money would be taken from the customer pool to cover the difference. Only once this is done will customers be able to make a claim to get their money back.

Keeping Your Cryptocurrency Investment Safe

Whether you think exchanges like Coinbase will go bankrupt or not, it always makes sense to do everything you can to keep your investment safe. The only money at risk in a bankruptcy situation is that which is stored in custodial wallets owned by an exchange.

Exchanges use custodial wallets to store cryptocurrencies on behalf of their customers, making trades faster but also taking power away from users. Avoiding a custodial wallet is the best way to keep your cryptocurrencies safe.

Non-Custodial Cryptocurrency Wallets

This is where non-custodial wallets come in. No matter which exchange you buy your cryptocurrencies from, you always have the right to move your money into a wallet under your control. New wallets can be made with ease with all major cryptocurrencies, from Bitcoin to Ether and beyond; you just need to take the step to move your money.

What Happens to Your Crypto if Coinbase Goes Bankrupt?

Coinbase doesn’t appear to be on the verge of bankruptcy, but it’s always worth securing your investments. You can avoid this sort of loss entirely by storing your currencies in your own wallets, making it worth learning about this side of crypto investment before you get started.