The co-founders of leading blockchain analytics firm Glassnode are revealing that institutional investors are loading up on Bitcoin as BTC trades below the $30,000 level.

In Glassnode’s latest newsletter, Jan Happel and Yann Allemann say that weekly crypto inflows show that institutional investors are gobbling up Bitcoin as it continues to flash signs of weakness.

“What is interesting to observe is that the demand for Bitcoin exposure in traditional markets strengthened. Following Bitcoin’s $69 million inflow noted in [May 30th] the capital flows nearly doubled last week as institutional investors bought into weakness at a discount.”

While the Glassnode co-founders say that Bitcoin is witnessing weaker demand from long-term holders on top of selling pressure from short-term holders, they highlight that BTC is faring better than altcoins given the current market sentiment.

“Bitcoin outperformed altcoins as investors seek safety within the crypto space in a fear-induced market.”

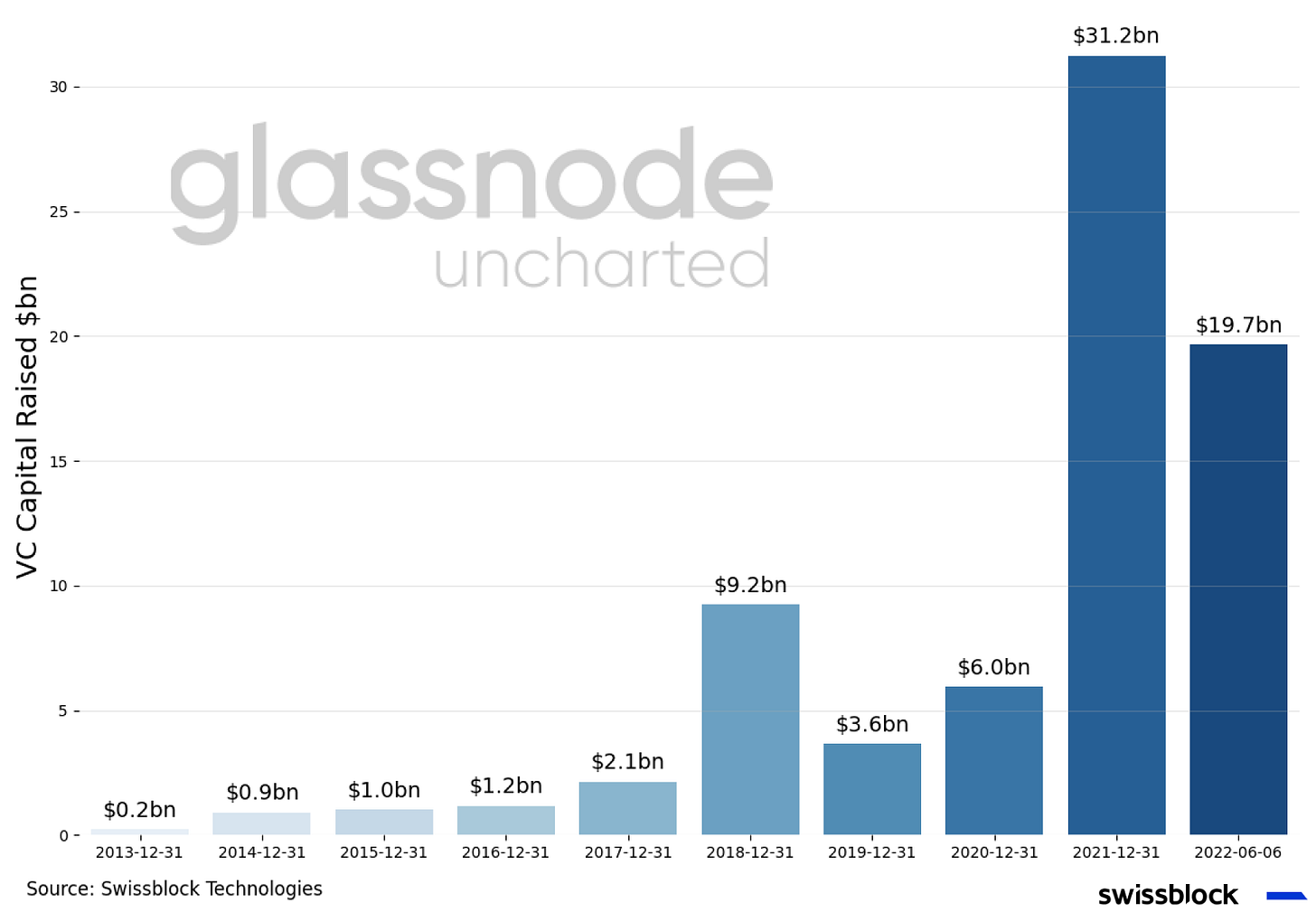

The Glassnode executives also say that venture capitalists (VCs) continue to pour money into the crypto space despite a gloomy macroeconomic backdrop.

“A similar appetite was noted in the VC market, as the year-to-date capital raised is at 63% of 2020 ($19.7 billion vs. $31.2 billion). This continued acceleration in VC interest reinforces the narrative of Bitcoin and crypto as an alternative risk-on investment class during a time of debilitating economic growth, which is impacting the expensively valued earnings of the Nasdaq and S&P 500.

Keep in mind: even when Bitcoin’s price behaves like a tech stock’s price, Bitcoin’s underlying structure of an incorruptible, limited asset that is open to every individual is a fundamental diversifier for any portfolio and institutional investors seem increasingly aware of this.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/DCornelius