cemagraphics/E+ via Getty Images

Produced in collaboration with Avi Gilburt and Ryan Wilday

For those who have followed the work of myself and Ryan Wilday, you know that while Bitcoin has yet to reach our expected targets for rally patterns off of both the 2018 and 2020 lows, we still see the price action as constructive. Price has been in a larger holding pattern, denoted as a flat correction off the April 2021 highs, and the larger degree support for this perspective continues to hold. Though micro setups have developed to take BTC back to $24k, price has evaded a deeper drop. BTC has not been able to push below $30k for any significant period of time before attracting an excess of buyers who push price back up. In short, expectations for higher targets described in my various articles entitled with some iteration of “Moonpath,” still appear to be very much on track.

The guidance that we provide in Crypto Waves tends to center around Bitcoin as the core holding among digital assets and we tend to strike a position of caution around both over-allocating into alt-coins and holding alt-coins as longer- term investment. Nevertheless we do track selected alt-coins for the purposes of high quality trade setups (not long-term investments) and view them as having a prospect of offering some shorter-term outperformance (relative to 100% Bitcoin holdings) for selected coins during specific periods.

This mini-series of articles focuses on three well known higher market cap altcoins that demonstrate higher probability of outperformance and expectation of new all time highs in the next bullish cycle. These are Binance Coin (BNB-USD), Polygon (MATIC-USD), and Aave Liquidity Protocol (AAVE-USD).

Part I focuses on Binance Coin.

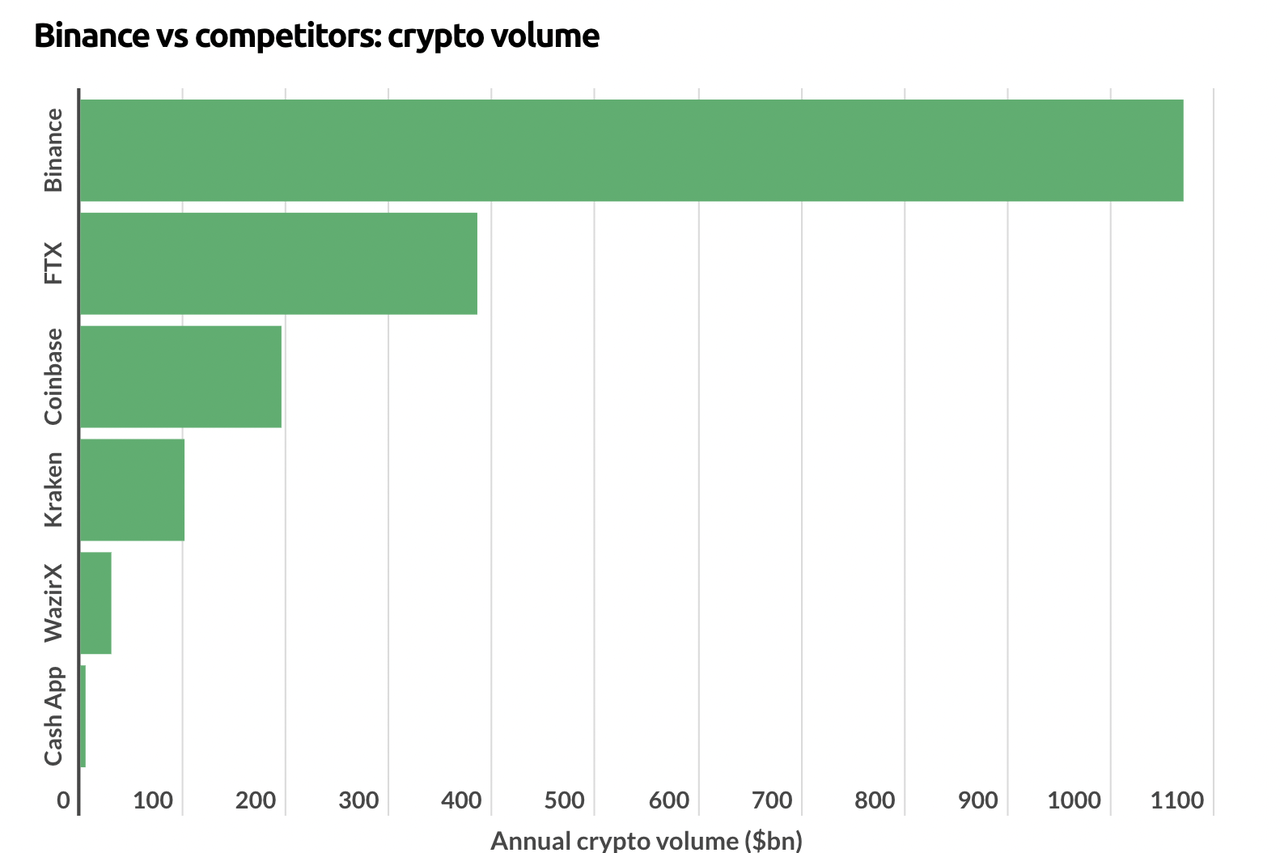

Binance Coin (BNB) was created as a utility token that would offer to its holder discounted trading fees on the Binance Exchange, the world’s largest cryptocurrency exchange (see comparison table below).

Binance Revenue and Usage Statistics

Source: Binance Revenue and Usage Statistics (2022)

It was launched in 2017 and has grown into (as of this writing) the fifth-largest crypto by market cap. Along those lines, BNB has maintained a consistent uptrend, making higher lows and higher highs. This is somewhat unique among altcoins, most of which have failed to exceed their high-water marks following any lasting bear market in crypto.

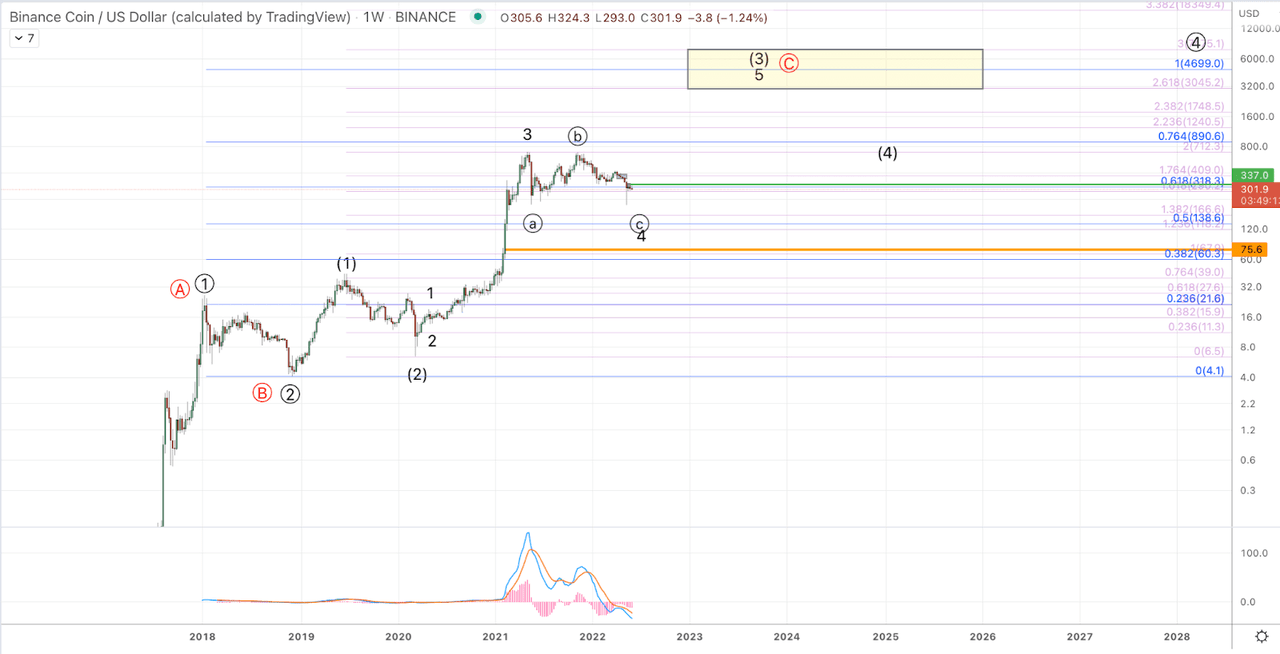

Jason Appel (Crypto Waves)

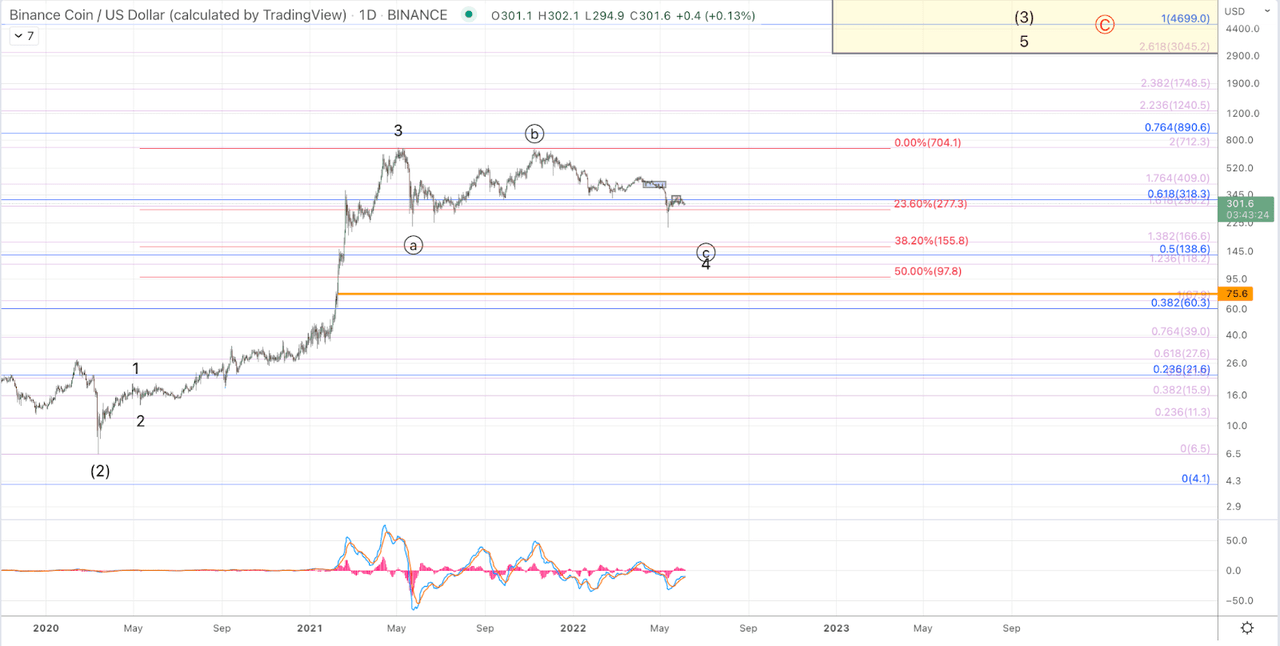

From an Elliott Wave perspective: BNB coin counts best as a larger degree impulse off its inception lows. The chart exhibits a series of 5 wave rallies, followed by corrective 3 wave retraces, also known as a series of 1-2s in Elliott Wave terminology. The breakout in February of 2021 marked the start of what’s typically found to be the strongest most directional portion of a trend, known as “the heart of the third wave.” In this case, Minor 3 of Intermediate (3) of Primary (circle) 3. Since the May 2021 high, price has pulled back substantially in percentage terms, but note on the chart, the high consolidation, ie, BNB has retraced a very small portion of the wave 3 advance and price is range-bound near the upper end of the whole wave 3. This high consolidation is quite supportive of this action being labeled as a 4th wave, which portends further extension far into new all-time highs upon resumption of the trend in the next crypto bull market. In Elliott Wave, we note that within an impulsive pattern, wave 4s typically retrace between 23.6% and 38.2% of the preceding 3rd wave. In this case, the lower end of that range occurs around $155. As such, those with a longer-term view on BNB should not be shaken by a further dip into that region. What would become problematic would be a sustained break below the 50% retracement of wave 3, roughly $95. Otherwise, the chart portends a very bullish outcome to the current pullback which has now lasted over one year.

Expectations are for wave 5 of (3) next. The blue Fibonacci lines derived from the larger degree Primary 1-2 show the 1.0 (logarithmic scale) extension of the Primary wave 1 (projected upward from the Primary wave 2 low) at $4,699. This level is the standard target for wave (3) of Primary 3. Additionally, though it’s roughly 15x from current price, it does fall within range of a typical extension in wave 5 of (3) based on the advance achieved in waves 1-3. As such, $4,699 would be the standard target. From a technical standpoint, the only concern about this target – so long as price maintains necessary support – is that the wave (1) was quite small, failing to reach the .382 extension at $60 to which the wave (3) reaching the 1.0 is based. Additionally, the wave (2) drop into the 2020 low was quite deep. All of this necessitates a massive wave (3) for price to achieve the target for (3) portended by the larger Primary 1-2, and to be sure, BNB has not disappointed.

From a valuation perspective, a 15x appreciation in the coin price does not likely entail a 15x increase in market cap. Keep in mind that BNB performs a quarterly coin burn so while price may rally 15x (or more) that does not entail a commensurate gain in the market cap.

In summary, so long as the price of BNB is able to maintain without any prolonged break below $95, expectations are for a bullish conclusion to the consolidation from the May 2021 high, and while $4,699-plus is the ideal target, the minimum target expected is $3,000.

Jason Appel (Crypto Waves)