The cryptocurrency industry isn’t just about buying and selling coins and tokens. You can do myriad other things with your crypto, and thousands of crypto enthusiasts want to take their passion a step further by building decentralized projects. This is where the Zilliqa blockchain can be of service.

But what exactly is the Zilliqa blockchain, what does it offer, and why is it becoming one of Ethereum’s big competitors?

What Is Zilliqa?

Launched in 2017 by university researchers Amrit Kumar and Xinshu Dong, Zilliqa can be used for many reasons by investors and developers alike. Like Ethereum, this blockchain facilitates smart contract technology to reduce transaction times and lower fees. Zilliqa uses Scilla, a smart contract language, to make this possible.

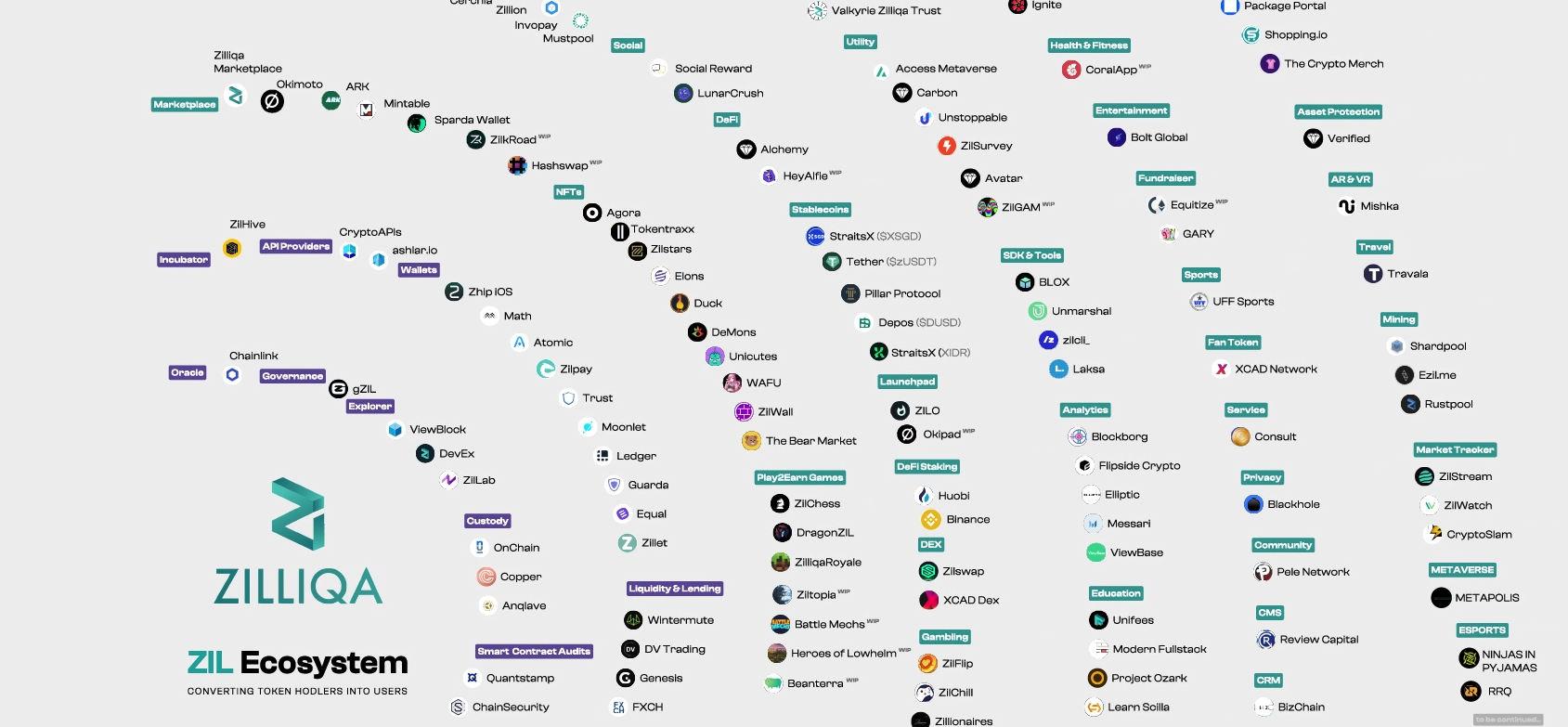

In terms of DApp building, Zilliqa is a great option. Developers can enjoy increased scalability and faster transactions using Zilliqa (which we’ll discuss shortly) while also being part of a fast-growing ecosystem with a lot of potential.

The Zilliqa blockchain has always had a focus on scalability. However, as the popularity of the crypto industry grows, blockchains are becoming clogged with an overwhelming number of transactions. This is an issue seen by the most valuable crypto out there, Bitcoin, and developers across the market are now looking for ways to tackle this problem.

This is why Zilliqa uses a technique known as sharding. So, what exactly does this entail?

Zilliqa’s Blockchain Shards

The sharding process involves splitting one blockchain into multiple, with each chain having its own purpose and unique storage of data.

The main reason sharding is used is to combat the scalability issues plaguing the crypto industry. By spreading network traffic across multiple chains, it’s much easier to avoid a backlog of un-validated transactions, which lowers transaction times. We won’t be doing a deep dive into sharding today, but you can read about how sharding works in another of our pieces.

What you should note about Zilliqa’s sharded network is that it offers significantly lower transaction times than most other popular blockchains out there, which is certainly seen as a plus by many crypto enthusiasts.

However, some individuals speculate that using sharding poses a security risk. If each blockchain shard is unique and operates somewhat independently, there is a chance of one blockchain being more easily infiltrated or corrupted. The compromised blockchain could then be used to take over the other blockchain shards within the network. But this has not yet happened to the Zilliqa ecosystem.

Zilliqa’s Native Coin

Like the blockchain itself, Zilliqa’s native coin is also called Zilliqa, or ZIL. We’ll refer to this crypto as ZIL in this piece to differentiate it from the blockchain itself. Within the Zilliqa network, ZIL can be used to pay transaction fees, giving it its own purpose beyond store-of-value. Like any other crypto, Zilliqa can also be bought and sold on decentralized exchanges like Coinbase and Binance.

In March 2022, ZIL’s price began to grow in anticipation of the blockchain’s upcoming “Metapolis” project. As you may have guessed, this relates to the metaverse, a virtual world that has excited many internet users. Metapolis will function as a space where users can build virtual worlds, and the announcement of this new venture resulted in a big price boost for ZIL.

However, ZIL still doesn’t have a particularly high value at the moment. It still sits at under a dollar in price, but this isn’t to say that it’s an unpopular coin. With a 24-hour trading volume of almost a billion dollars, it’s safe to say that ZIL has secured itself a comfortable spot in the crypto market for the time being.

Staking on Zilliqa

The Zilliqa blockchain isn’t just great for building DApps. If you’re a crypto owner, you can use Zilliqa for staking to make a passive profit on the funds you already have.

The fact that Zilliqa offers staking may sound a little confusing, as the blockchain itself uses a proof of work protocol known as the Practical Byzantine Fault Tolerance mechanism. This mechanism involves using both primary and secondary nodes and allows a consensus to be reached even when malicious nodes are present.

Usually, you’ll find staking on blockchains that use the proof of stake protocol, but Zilliqa’s protocol isn’t the same as that used on Bitcoin or Dogecoin, meaning it can still offer staking.

ZIL can be staked on various staking platforms, including KuCoin, Atomic Wallet, Everstake, and Zilliqa itself. If you use Zilliqa to stake ZIL, you can currently earn a reward of more than 14%, which is pretty generous. As you may have guessed, Zilliqa itself offers the highest staking reward compared to other available platforms.

You can also choose between six wallets for ZIL staking, including Guarda Wallet, Atomic Wallet, and Ledger.

NFTs on Zilliqa

Zilliqa has its own art marketplace, the Zilliqa Marketplace, allowing artists to sell their work. You may think that this marketplace would only be suitable for NFTs, but Zilliqa actually facilitates the sale of physical artworks alongside virtual ones. So, if you create paintings or sculptures, you may be able to make a profit by selling them on Zilliqa’s marketplace.

The Zilliqa marketplace also allows NFT artists to connect with their fans by creating their own unique shop within the marketplace and even allows artists to pair physical and virtual artworks together.

Zilliqa also allows users to mint their own NFTs, meaning an artist can mint and sell their artwork within the same network! In order to pay for the minting process, you’ll need some ZIL to hand, so you must buy the amount of ZIL required for the minting fee beforehand. At the time of writing, ZilSwap is host to the most ZIL-based NFTs.

Zilliqa’s Diverse and Ever-Changing Ecosystem Has a Bright Future

The Zilliqa network offers crypto owners and developers a chance to expand their portfolios and create projects without the added frustration of high fees or long transaction periods. Without the dark cloud of scalability limitations hanging over the Zilliqa ecosystem, there’s no telling how far it can go within the crypto industry.

Who knows, we may even see Zilliqa surpass Ethereum at some point in the future!

Read Next

About The Author