Optimism is designed to scale Ethereum. The scaling solution processes transactions outside the Ethereum mainchain and then bundles them back onto it.

As a result, the project can significantly reduce ETH transaction costs. For example, a token swap via Uniswap on Optimism currently costs just $0.529. On the main Ethereum network, users have to pay $25.39 for the same transaction.

And now Optimism is launching what could be the biggest token airdrop the crypto space has seen so far.

Ethereum, scaled.

Optimism is a low-cost and lightning-fast Ethereum L2 blockchain.

Ethereum has a scaling problem. Since the beginning of the year, this has become quite apparent.

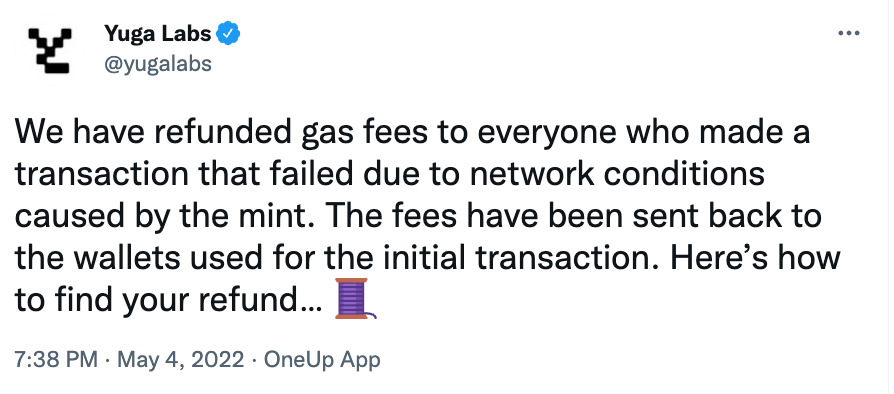

Only recently, the Yuga Labs “Otherdeeds” mint on the Ethereum blockchain has set a new record for any NFT launch in terms of fees. Due to the lack of scalability, the gas fees skyrocketed due to the number of simultaneous transactions. This was the reason behind the sudden increase in gas prices on the network, leading to the so-called “gas wars” as buyers tried to outbid each other for a chance to mint.

Yuga Labs then had to apologize in order to calm down network users who had been heavily affected by the fee spike. Yuga Labs has refunded $265,000 worth of ETH for failed transactions in its sale.

Following the many technical difficulties of the launch, Yuga announced potentially moving its metaverse from Ethereum to its own chain, though details on that development have not been clarified yet.

The reason for this scaling problem can be found in the so-called blockchain trilemma. According to this, a blockchain must make compromises in terms of security, scalability, and decentralization. In very simplified terms, developers have to decide which of the two of these three properties they want to optimize for. For example, if one wants to ensure a certain level of security, it must be understood that, in this case, scalability is inversely proportional to decentralization. Comparable to Bitcoin, the Ethereum blockchain was optimized for security and decentralization, while scalability was sacrificed.

As the number of transactions increases, the Ethereum network becomes increasingly busy — if users still want to use the Ethereum blockchain, they are forced to pay excessively high transaction fees. Optimized scaling of the Ethereum blockchain and the associated lower transaction fees would lead to increased user-friendliness and the development of new use cases.

Competing blockchains such as Solana, Avalanche, Polkadot, and the like, which tend to call themselves Ethereum killers, often optimize with a view to scaling the blockchain and accept an increased level of centrality for this.

Fantom FTM: Does Fantom solve the Blockchain Trilemma? Faster, decentralized and still secure

In most cases, the minimum hardware requirements for operating nodes are set so high that only a few players can participate in the network. In return, the network is significantly faster but centralized. Contrary to the philosophy of a blockchain and Web 3.0.

Kadena is quite a new Ethereum competitor. Read more here

If Ethereum wants to keep up with the growing competition, innovations are needed. According to Vitalik Buterin (co-founder of Ethereum), the key to Ethereum’s scaling problem can be found in rollups.

Approaches: Rollups

Rollups are a scaling solution where transactions are bundled and compressed off-chain before being verified on the consensus layer. This ultimately allows multiple transactions to be “aggregated” to a single on-chain transaction. The result of verifying multiple transactions simultaneously is increased efficiency; in parallel, the number of possible transactions that can be executed increases, resulting in increased scalability.

Suddenly, Ethereum can scale from what used to be 15 transactions per second (tps) to 3000+ tps — without compromising on security.

There are two types of rollups:

- Optimistic Rollups. Implemented at Arbitrum, Optimism

- ZK Rollups. Used By ZKSync, StarkNet, Polygon Hermez

In short:

Optimistic rollups assume that the bundles of transactions are valid and are published accordingly. Within a certain period of time, other participants then have the opportunity to prove that the data is incorrect by means of “fraud proof”. In this case, the data is rolled back. The participant receives a reward. The longer this “challenge period” is chosen, the greater the likelihood of preventing the publication of incorrect data on Ethereum’s Layer1. In direct trade-off to this, is that it takes longer for the transaction to become final on Layer1. In reality, this leads to the consequence that it takes up to seven days to withdraw one’s funds. Remedies in this regard can be provided by intermediaries who, for a fee, payout the user’s funds immediately on Layer1 and take on this waiting time and the risk of an incorrect transaction.

ZK rollups, on the other hand, are based upon a pessimistic view of the world. Unlike fraud proofs, validity proofs are generated with each bundle and presented with the Layer1 data to prove that all data is correct. This cryptographic proof (called ZK-SNARK) can be easily verified on-chain for correctness, regardless of the size of the data bundle or how much computational power was required for the transactions it contains. The transaction is written directly to the Layer 1 blockchain. Problem: loss of efficiency.

How To Buy $ETH?

For newcomers, I’d personally recommend crypto.com* as an easy-to-use trading platform with a user-friendly interface and step-by-step instructions. Crypto.com*offers a whole ecosystem with a credit card (including crypto-cashback), staking, and many more features. Read more here.

For anyone seeking a more advanced platform with lower fees, give BitForex* a try!

Optimism is a well-known layer 2 on Ethereum blockchain and uses “optimistic rollups”. Layer 1, in this case, Ethereum, does not need to process each operation, making ultra-high scalability possible without having to worry about gas fees. Optimism is open-source, permissionless, and decentralized. Optimism was introduced in June 2019, and a testnet was released in October 2019. It wasn’t until January 2021 that an alpha mainnet launched, and it took until October 2021 for Optimism to launch a version of the Alpha mainnet that was compatible with the Ethereum Virtual Machine. An open mainnet launched in December 2021.

How Does It Work

Optimism is basically a big append-only list of transactions. All of its rolled-up blocks are stored on an Ethereum smart contract called the Canonical Transaction Chain. Then, the moment there is a certain amount, they are packaged and sent in bulk to layer 1.

Unless a user submits their transaction directly to the Canonical Transaction Chain, new blocks are produced by something called a sequencer.

Alternatively, users can skip the sequencer entirely and submit their transactions directly to the

CanonicalTransactionChainvia an Ethereum transaction. This is typically more expensive because the fixed cost of submitting this transaction is paid entirely by the user and is not amortized over many different transactions. However, this alternative submission method has the advantage of being resistant to censorship by the sequencer. Even if the sequencer is actively censoring a user, the user can always continue to use Optimism and recover any funds through this mechanism. — optimism.io

This sequencer takes care of the following:

- Providing instant transaction confirmations and state updates.

- Compose and process Layer 2 (hence Optimism) blocks. These blocks are the ‘rollups’ — batches of Ethereum transactions. The sequencer compresses this data even further to reduce the size of the transaction (and thus save money).

- Send transactions to layer 1 (Ethereum).

The sequencer immediately accepts or rejects transactions. When a user sends their transaction to the sequencer, the sequencer checks that the transaction is valid (i.e. pays a sufficient fee) and then adds the transaction to its local state as a pending block. These pending blocks are periodically submitted in large batches to Ethereum for finalization. This batching process significantly reduces overall transaction fees by spreading fixed costs over all of the transactions within a given batch. The sequencer also applies some basic compression techniques to minimize the amount of data published to Ethereum.

Optimism’s layer 2 software is designed to work with Ethereum’s code as much as possible. It uses, for instance, the same virtual machine as Ethereum, and charges for gas in the same way (with at a lower price, thanks to its optimistic rollup solution).

As mentioned, the downside is the challenging period. There must be sufficient time to detect any possible corruption or problems in the transactions that occurred on the L2, so that they can be corrected.

This delay is quite long but similar to other Optimistic Rollup approaches: one week.

More specifically, Optimism’s strengths are:

- Reduced gas fees resulting from the transaction batching operated by the sequencer.

- Speed

- Scalability and sustainability

- Security, guaranteed by the fact of having Ethereum to manage the consensus.

Like Arbitrum, Optimism doesn’t have a native cryptocurrency to pay for gas fees. It uses ETH — just like Arbitrum. Read more:

Arbitrum: This Ethereum Scaling Solution Receives Support From Cuban And Reddit

How to use Optimism

To use Optimism, you’ll have to deposit your ETH or ERC-20 tokens to the Optimism token bridge. This allows you to transact on Ethereum through Optimism. You can convert your tokens back to the Ethereum mainnet once finished.

In order to deposit your tokens, you’ll have to deposit them through the Optimism Gateway. You can connect to the Gateway through a Web3 wallet.

Once you’ve deposited funds on Optimism, you can use them within supported decentralized applications. Uniswap, for instance, allows you to trade Optimism to save on fees. All you have to do is select Optimism from the menu of networks; then, you can trade as normal.

Optimism announced on April 26 that it plans to issue its own governance token under the ticker OP. The aim of the airdrop is to reward early adopters and drive the decentralization of the Ethereum scaling solution, according to the Optimism team on Twitter. OP tokens are not yet tradable. However, Airdrop-eligible users can already check to see how many OP Tokens they will receive once Optimism releases the tokens for trading. Furthermore, the Optimism team has published a list showing all the criteria for qualifying for the airdrop. Specifically, the team announced that users who either use Optimism or actively participate in the development of decentralized applications could get future airdrops.

Passive Income With DeFi: 70% Returns and 30$ Signup Bonus

The platform Cake DeFi provides an easy and user-friendly way to generate passive cash flow on your crypto portfolio. This is done in three different ways, called lending, staking, and liquidity mining. All you have to do is to sign up for the platform, top-up money via credit card or transfer cryptocurrencies and put your assets to work. Read more.

You receive a 30$ signup bonus upon your first top-up with the following referral code:

Another way to earn passive income with crypto is Curve in combination with Crypto.com Cashback. Take a look at: This Is How You Can Add Every Card To Google/Apple Pay

Optimism Layer 2 solutions are meant to ease the burden of the Ethereum network. There are two main features to make crypto adopters excited. Optimism allows almost instantaneous transactions. Transactions on the Ethereum blockchain are nearly ten times less expensive.

Regarding Ethereum scalable solutions, the Polygon crypto network is also worth discussing.

Polygon is also a Layer 2 scaling solution. Polygon is a multi-chain platform that combines the best aspects of Ethereum and other blockchains. Polygon addresses several issues associated with the Ethereum blockchain, including high gas fees and slow transaction speeds. However, polygon also has its disadvantages — and not all DeFi applications rely on the scaling solution. For example, it is criticized that Polygon is too centralized and insecure. For this reason, among other things, projects like Optimism and Arbitrum are working on completely different approaches to scale Ethereum.

Will Ethereum 2.0 Kill Polygon (MATIC)?

This makes Optimism one of the most promising Ethereum scaling solutions as well as the third largest ETH Layer 2 network, after Arbitrum and dYdx (DYDX), according to L2beat.com.

Optimism’s rollup chain now has nearly $500 million on it, being the third largest ETH Layer 2 network, after Arbitrum and dYdx (DYDX), according to L2beat.com.

Still, Optimism has historically been more centralized than Ethereum.

However, Optimism took a big step toward decentralization in April 2022, launching a DAO, called the Optimism Collective, to fund public goods and govern the protocol. As mentioned, Optimism also began airdropping newly created OP tokens to Optimism users and others who could help push the DAO. The network’s consistent development, along with the increased adoption of ETH, will likely make Optimism one of the notable crypto-projects of the future.

Enjoying the content? If you’d like to support me as a writer, please make sure to become a Medium Member. It’s just $5 a month and you get unlimited access to Medium. Sign Up here

With much love,

The article includes the personal opinion of the author. It should not be considered Financial or Legal Advice. All data and numbers have been sourced the 2022–05–27. Changes may apply.