da-kuk/E+ via Getty Images

Coinbase Global, Inc. (NASDAQ:COIN) is a very profitable business with many growth catalysts. The cryptoeconomy Coinbase has helped build is antifragile by design; it is here to stay, and it will grow substantially in the future. Coinbase is likely to be a major beneficiary of the industry’s growth – as the main on and off-ramp, and now officially as the biggest NFT platform.

The market is making a few valuation mistakes which we are happy about because we can acquire shares at a lower price point. COIN is currently trading at a P/E ratio of 8.6, which we find extremely attractive for this fast-growing tech company.

-

The Coinbase Super Bowl ad was ranked #1 on Ad Week, and got 20 million people to use the platform in the 1 minute it aired. The clever marketing strategy worked like a charm, and Coinbase could have just signed up an enormous amount of new users in Q1’22, at a very reasonable cost of user acquisition. This may lead to a jump in Coinbase’s total users and MAU for the first quarter.

-

The market is pegging the revenue of COIN too closely to the price of crypto assets despite the increased revenue diversification of the company. This correlation will decouple over time.

-

The market is not correctly pricing the NFT platform. The NFT platform could add more than $45B to its market capitalization and as of now, it is not accounted for.

-

Coinbase Ventures is undervalued, with 250+ VC investments in pivotal tech and companies in the crypto industry. Coinbase Ventures is a vicarious way to get exposure to early seed-stage VC plays that the regular unaccredited retail investors usually do not get a chance to participate in.

-

New product offerings – NFT, Coinbase Cloud (Infrastructure), Fairx (Derivatives), and Coinbase One (High-Frequency Trading) – will open the doors to new revenue sources.

Macro Backdrop

Move over bull and bear animal spirits, because here come FOMO and FUD – fear of missing out and fear, doubt, and uncertainty, respectively – the new cryptocurrency “human spirits.” FOMO is hitting an all-time high amongst many of the companies in the traditional finance, retail, music, tech, and gaming industries. In 2017, if you would’ve told us that Matt Damon would be the lead in a crypto.com exchange ad, or that Visa, Adidas, and Coca-Cola would be buying and making NFTs on Ethereum (ETH-USD), we would not have believed you. Companies across many industries are scrambling to get up to speed on Web3 because NFTs provide a path for these companies to connect with an increasingly important and growing demographic and we will see a lot more use this year.

A Great Time to Buy Coinbase

When looking to start or add to our portfolio position, FUD and market misconceptions are our friends. If the market got it right every time, there would not be any alpha for us to extract – and if you’re reading this article on Seeking Alpha, we suspect that extracting alpha is exactly what you are here to do.

When the crypto markets are in correction territory, the traditional market thinks that the crypto industry is dead and therefore the Coinbase business will fail. If you don’t believe that the crypto economy is here to stay, then we see how you could fall prey to this narrative and want to sell or stay away from anything crypto-related. We want to encourage you to do the exact opposite when it comes to Coinbase stock during times of FUD or drawdowns in crypto prices.

Times of FUD are the best opportunities to capitalize on an ongoing fallacy that has managed to last for over a decade.

Insanity is doing the same thing over and over and expecting different results. – Albert Einstein

Despite the ubiquity of that Einsteinian quote, for over 13 years now, politicians, economists, news anchors, and many famous investors have incorrectly called the end of Bitcoin and the cryptoeconomy, time after time.

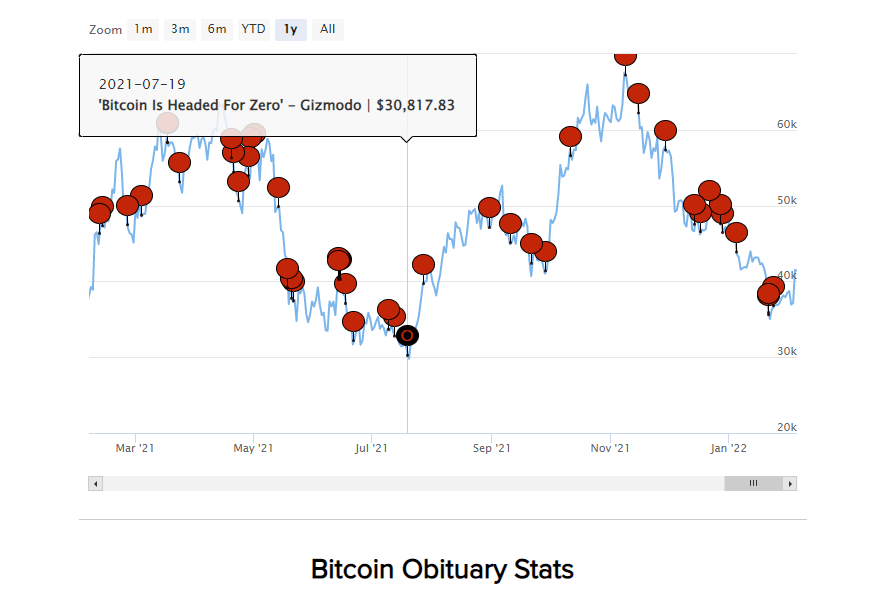

One of my favorite trackers is called “Bitcoin Obituaries,” where at the time of writing there are 444 published Bitcoin obituaries which called the death of Bitcoin and the cryptoeconomy as a whole. Whenever you get emotionally triggered by “news” that suggests crypto is dead, we recommend you head over to the linked website and zoom out to see all the times these “experts” were wrong.

bitcoin obituaries (99bitcoins)

When many tech stocks recently corrected by 50% or more from their all-time highs, we didn’t see any headlines calling the end of the stock market. But with similar prices volatility in crypto you will see another obituary published like clockwork. I just checked and the number is 447. With the assumption that crypto is not dead when crypto asset prices drawdown as they often do in this new and very volatile asset class, we can use the FUD caused by the price correction as an opportunity to acquire depressed COIN shares.

‘Number Go Up’

The “Number Go Up” meme succinctly tells a new market entrant the secular trend of the crypto industry is a graph that goes up and to the right. Below is a log chart of BTC where we can see the “Number Go Up.”

BTC Log Chart (coinmarketcap)

Why does the value go up? Could it be that the technology is actually useful and proving value to people, or is it just a scarce asset being priced in an inflating fiat currency that loses value vs any scarce asset over time? It is probably both, the technological value and the unit of account argument, and the two reasons are creating a recursive feedback loop that is just getting started.

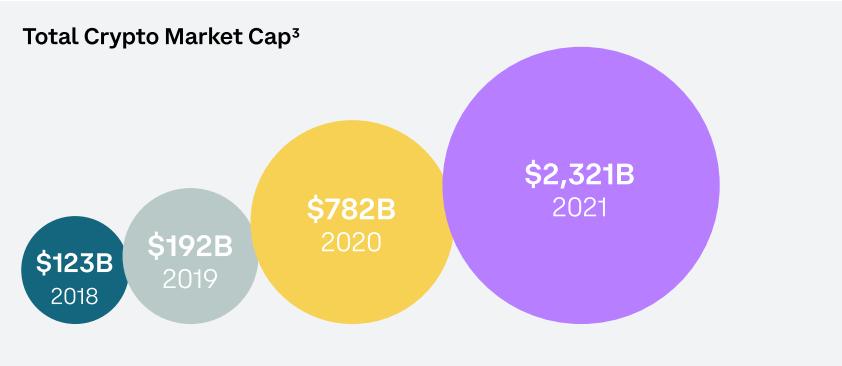

The total crypto market capitalization at the end of Q4’21 was $2.3 trillion, up from approximately $800 billion at the end of 2020 and it hit an all-time-high of $3.1 trillion in November 2021. Bitcoin and Ethereum prices reached new highs that were 247% and 457% higher, respectively than prior peaks of 2017, with Bitcoin itself nearly reaching $1.3 trillion in market capitalization in Q4.

Additionally, the number of U.S. crypto owners continued to climb in 2021 to nearly 1 in 4 U.S. households.

Total Crypto Capitalization (Q421-Shareholder-Letter)

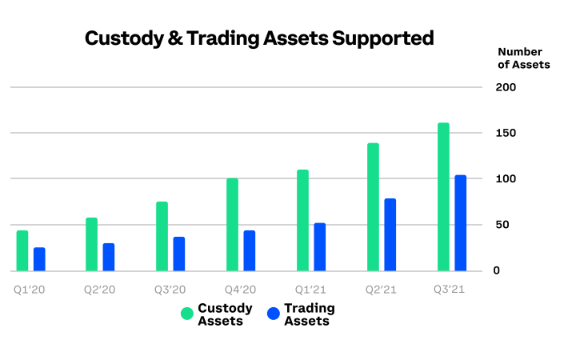

Another number that is going up, is the number of assets supported for trading by Coinbase as well as the number of assets under custody. In Q4’21 Coinbase added support for 14 more custody and 36 trading assets, and ended 2021 with support for a total of 172 assets for custody and 139 assets for trading.

Assets on Coinbase (coinbase shareholder letter)

Each asset Coinbase adds to its offering increases the total revenue. In recent months, Coinbase has aggressively added popular retail coins including Meme coins such as Dogecoin (DOGE-USD) and Shiba Inu (SHIB-USD) that retail investors seem to flock to as their entry point to crypto. Each newly created market adds users attracted by the particular asset and creates transaction revenue that previously didn’t exist. As the number of supported assets goes up, the revenue will also “Number Go Up.”

Volume and Non-Directional Volatility

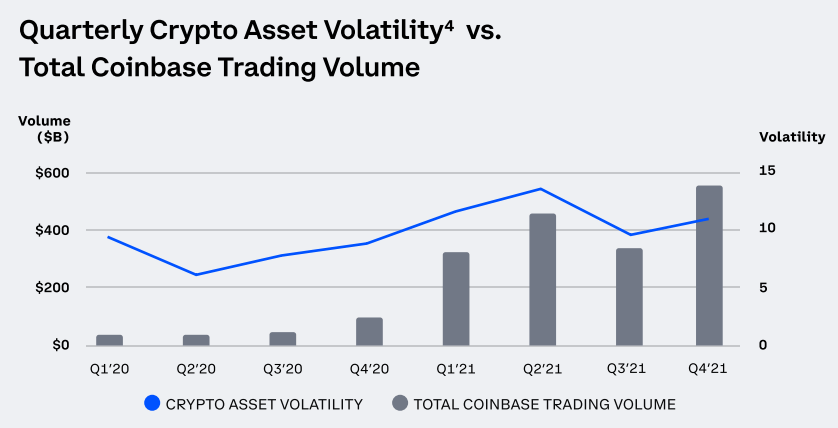

The key drivers of Coinbase revenue are volume and non-directional volatility. This is the most common misconception about the correlation of crypto asset prices and the transaction revenue of Coinbase, which we have noticed in the comment section of our previous COIN article.

The correlation between BTC and COIN is very strong and close to 1. We believe that this correlation will decouple over time as Coinbase revenue streams diversify and as the market realizes what we are about to explain.

Yes, the prices and revenue are connected, but not in a way most people assume, which is why the market sells Coinbase stock whenever crypto asset prices correct despite the volume often being elevated above average during those periods. Coinbase makes money on the total trading volume, and not on the price of any single asset that is traded on their platform.

Volatility & Volume (coinbase)

Yes, when the BTC price goes up, it creates volatility and thereby volume, so it is assumed to be the same thing. But, the volume is also manifested with volatility in the downward direction.

We want to encourage our readers not to assume that lower crypto asset prices immediately imply a lower volume of transactions. Often negative price impacts result in traders panic selling or trading more frequently to capitalize on the volatility regardless of the direction.

There’s one caveat: This framework fails during prolonged correction cycles, which do lead to less volatility and thereby less volume, unlike prolonged cycles of exuberance. We highlight this as a key short-term risk for Coinbase value, and believe it is currently overblown. Currently, the market is reacting as if the crypto industry is going to die any day now, when in fact it is growing at triple-digit percentages per year, like the adoption growth rates of the internet.

A second country, The Central African Republic, following in El Salvador’s footsteps, has just adopted bitcoin as legal tender. We believe these are just the first among many to come and that Coinbase is positioning itself perfectly to be the main beneficiary of this global phenomenon.

What happened in 2021

Overall, 2021 was a great year for Coinbase, showing tremendous growth across the board. We are incredibly happy with the trajectory of the company and the stats below, and do not see any major roadblock to continued growth.

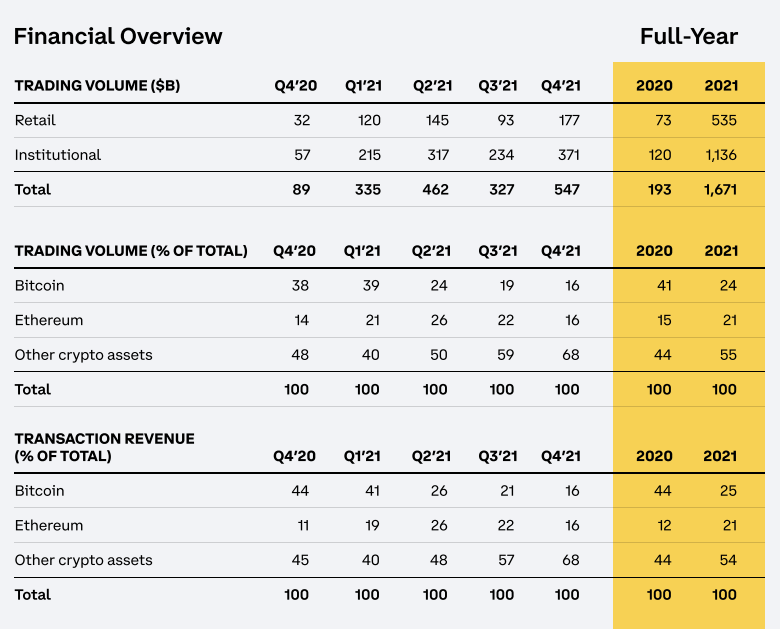

- In 2021, Coinbase grew its market share of Trading Volume by more than 8.5x compared to 2020.

- Revenue diversification generated over $500 million in subscription and services revenues, $200 million in the fourth quarter alone with a traction uptick in products including staking, earn, and custody.

- At the end of Q4 2021, Coinbase had 3.6 million users who were earning yield on their crypto assets using the company’s staking services. Coinbase takes ~15% from the generated staking rewards as a service fee.

- The company grew its Institutional customer base by over 50%, including doubling the number of custody customers.

- In 2021, Coinbase generated $3.6 billion in net income, up 11x compared to 2020. “Probably nothing!”

Q4’21 results vs. our estimates; our Q1’22 estimate will be even more accurate

Net revenue in Q4 was $2.5 billion, of which $2.3 billion was Transaction revenue and $213 million was Subscription and services revenue. On a full-year basis, COIN generated net revenue of $7.4 billion in 2021.

Here’s our Q4 report card:

Transaction volume

- Our estimate: ~$537B

- Actual: $547B

Subscription and service revenue

- Our estimate: $200M

- Actual: $213M

Revenue estimate

- Our estimate: $2.3-2.5B

- Actual: 2.5B

Net revenue estimate

- Our estimate: $7.4B

- Actual: $7.4B

EPS (our only big miss)

- Our estimate: $7.14

- Actual: $3.9

We were off by $3.5 in our EPS. Kind of a big delta there, and we will do better for Q1’22!

Why was our EPS so off, while all the other estimates were so accurate?

In order to give our readers confidence in our future estimates for Q1’22 and beyond, we felt it was necessary to explain our mistake in EPS calculations in the Q4 forecast.

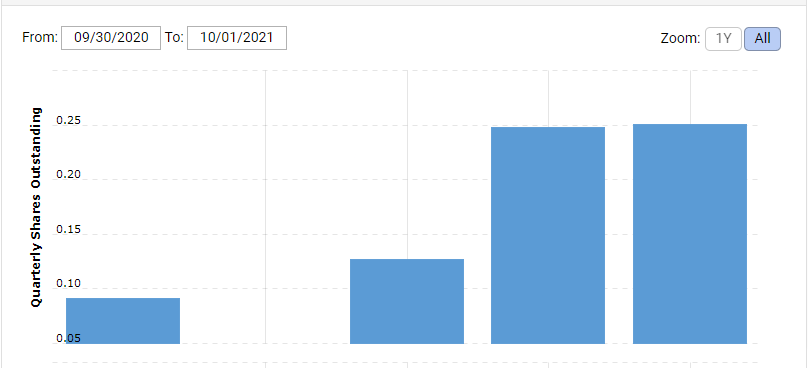

We concluded that our error came from the change in outstanding shares from 127M in Q2 to 252M in Q4, as we can see in the chart below. We used Q2’21 results as our estimation template given that it was the closest in revenue that we were projecting. We failed to account for this change in shares outstanding in our calculations and therefore our estimate was an order of magnitude off.

When adjusting for this error, $7.14 /2 becomes a much more respectable estimate of $3.57 with a much smaller delta from the actual.

outstanding shares chart (macrotrends)

Q1’22 Forecast for May 10, 2022

According to our estimates, COIN is on a path to reach $1.59B in revenue for Q1’22.

- $1.258B in transaction revenue

- $336M in subscriptions and services

We estimate a $1.88 EPS, which is $0.66 or 54% higher than the consensus $1.22 EPS, despite having a similar revenue forecast (current consensus call of $1.67B).

Fear and Greed

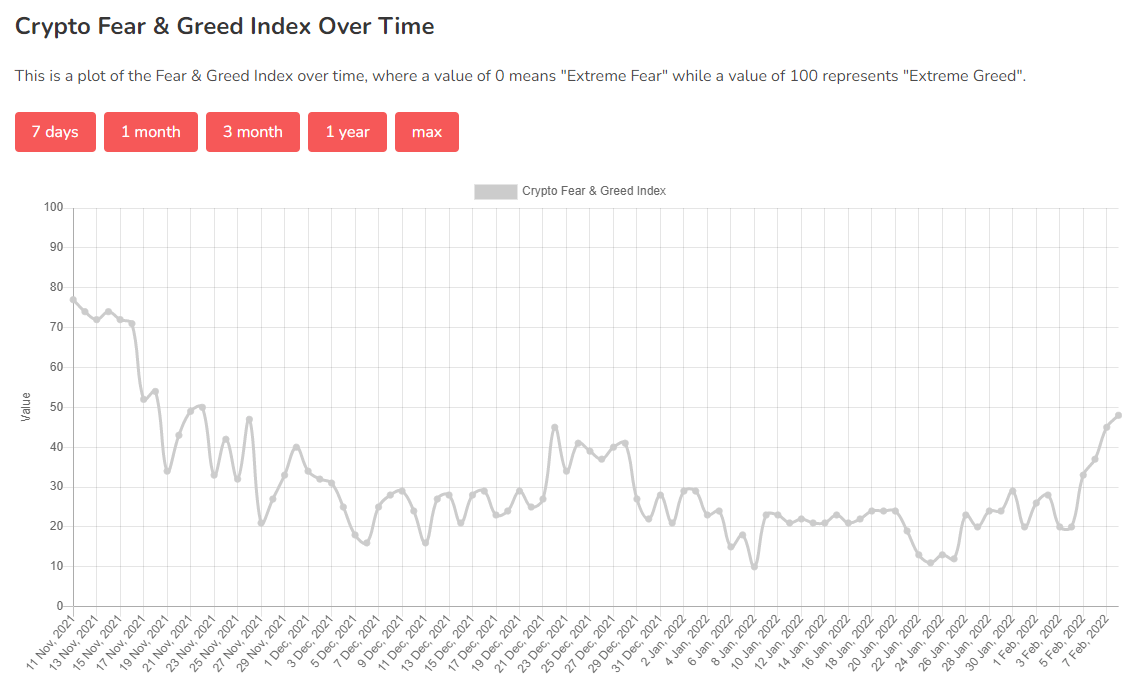

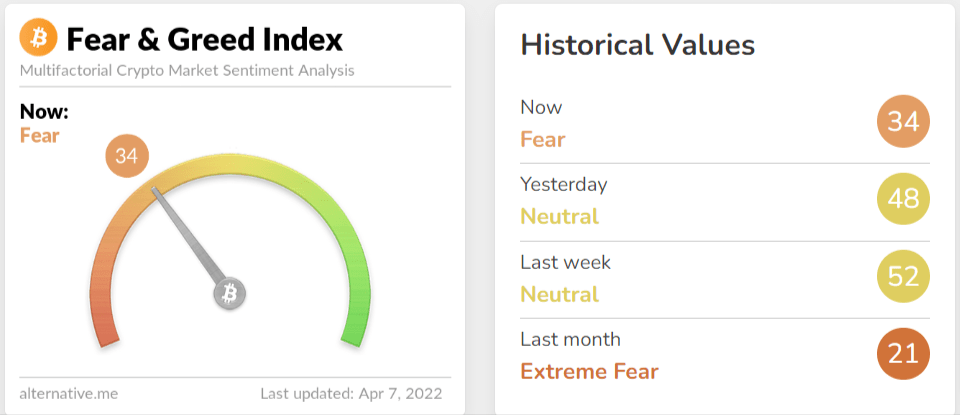

As we can see in the fear and greed index chart below, crypto has been in a fear zone since late November 2021.

Fear and Greed index (alternative)

The index is oscillating between fear and neutral zone, as we can see in the gauge below.

Last month it was even in the extreme fear zone, which explains the negative crypto asset sentiment as well as negative price impact on COIN shares.

fear-and-greed-index (alternative)

We believe that the index will flip to greed or extreme greed in Q2-Q3 and add substantial amounts of volume to Coinbase as retail and institutional investors’ sentiments change.

Catalysts for the sentiment change are:

- Coinbase NFT

- Ethereum PoS protocol upgrade

- Litecoin MWEB and Taproot upgrade

- BTC hitting new all-time-high as institutions deploy capital

Any one of these events can contribute to a drastic sentiment change and renewed interest in crypto from which COIN will be a beneficiary via increased activity and trading.

Coinbase Super Bowl Ad

This year’s Super Bowl was dubbed the “Crypto Bowl” given the number of ads from crypto companies. There were two crypto ads that stood out during this year’s Super Bowl.

FTX exchange had a well-produced spot starring Larry David. The ad showed David not “getting” technology during different time periods and being a naysayer. He didn’t like the wheel, indoor toilets, coffee, U.S. democracy, Edison’s light bulb, and finally crypto. The ad had a feel of the movie “Cloud Atlas,” with David being the constant character across time.

In the end, the ad encouraged the audience to “not be like Larry,” with a nice dose of FOMO: “Don’t miss out: The next big thing is here, even if Larry can’t see it.” Undoubtedly, there were many crypto naysayers who had to take a long, hard look in the mirror and see their inner Larry David reflection.

But, the most talked-about ad was none other than Coinbase’s QR code. The crypto exchange aired its first Super Bowl ad, and it definitely got people talking and scanning. The 60-second ad featured a QR code changing colors and bouncing across the screen, like the infamous DVD logo.

And that’s it, that was the entire ad. Coinbase’s marketing team did not expect the interest to be so high. For a short period of time the landing page to sign up for an account or opt-in for the lottery got an error message because their servers were not ready for the number of people that scanned the QR code.

The QR code directed Super Bowl viewers to a page on Coinbase’s website that offered $15 in free BTC for signing up. Those who already had an account could opt-in to the platform’s $3 million bitcoin giveaway.

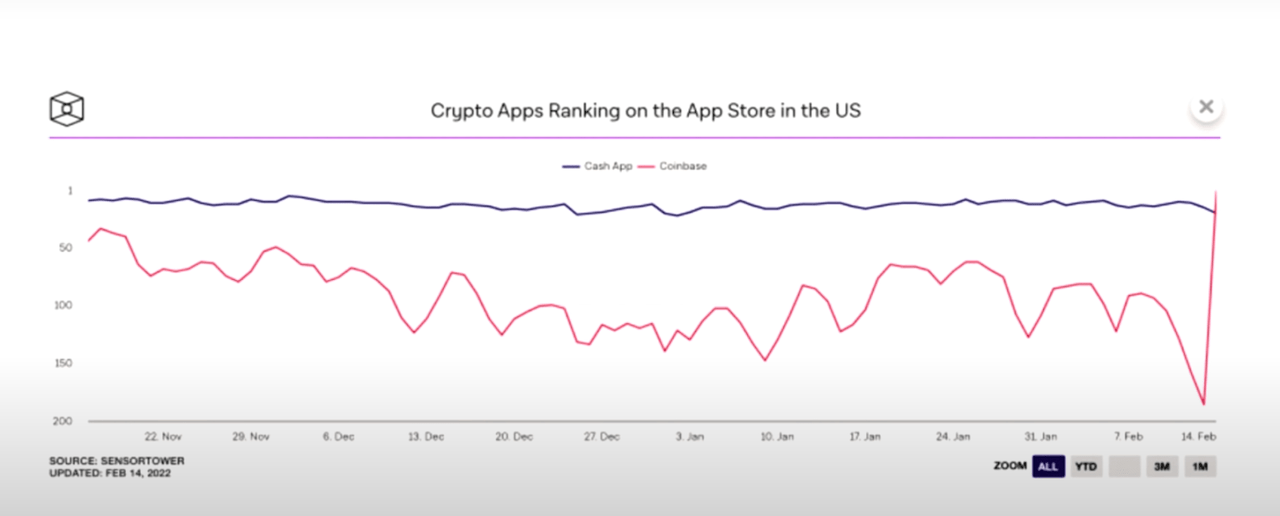

App store ranking (sensortower)

The $14 million ad was a remarkable success. In the chart above, we can see how quickly the Coinbase app went from No. 167 to No. 2 in the app store.

Chief Product Officer at Coinbase Surojit, tweeted that 20+ million people went to the landing page in the one minute the ad was live. “Ad Week,” one of the largest advertising-trade publications, ranked the Coinbase ad as No. 1, and we certainly agree with their pick.

It was simple and innovative at the same time while achieving the desired outcome. Because of this amazing Super Bowl touchdown by Coinbase, we expect an above-average increase in user growth as well as monthly active users (MAU) for Q1’22. Additional registered users and MAU directly contribute to revenue as well as the valuation of the company which we will further expand on in the next section.

Coinbase NFT Platform Is Now Live

Coinbase stands to become the main gateway to the whole NFT industry. Coinbase NFT is a new product where users can mint, collect, discover and showcase their NFTs, all in one place. The “showcase” part is a feed-based social element that is unique to Coinbase and potentially a very important differentiator. In the current Beta we can see the ability to comment and like the listed NFTs.

As of day one, April 20, exploring the Coinbase NFT platform, the user experience has been amazing. Other NFT platforms, including the biggest ones, seem to build it as they go, whereas Coinbase feels like a high-tech snappy UX, with images and videos that load instantly. NFTs are an exciting new opportunity for creators in various mediums to share their work, and for users to engage directly with the creators and the social element will help facilitate that interaction.

Coinbase’s NFT platform has a lot of potential revenue that will be realized in transaction fees, but for a limited time, Coinbase will be waiving all fees on the NFT platform. The NFT platform will lead to the acceleration of user growth and MAUs, especially if the social element proves interesting to the users.

Creating, buying, or selling an NFT costs fees on the blockchain that facilitates the transactions. The crypto asset that will benefit most from the new NFT platform will be Ethereum (ETH-USD) as it is the only blockchain currently supported by Coinbase NFT. Increased ETH adoption can also nudge the overall crypto sentiment which can positively impact Coinbase’s share price.

We expect that the Coinbase NFTs will also cause a spike in trading volume on Coinbase’s trading platforms because one often needs to purchase crypto in order to buy or mint an NFT, even if Coinbase obfuscates that fact in the background for simplicity via credit card rails, someone will be paying with ETH to mint and transfer ownership of NFTs. This flywheel will add substantial revenue to the company’s bottom line in the long run, especially once Coinbase starts charging fees. For now, the company is happy to offer the platform for free to grow users and adoption.

As of September 2021, there were 73M+ users on the Coinbase platforms and the growing number was 89M+ at the end of Q4. Coinbase users have been growing at an impressive clip, from 23M in 2018 to 89M+ today. That is 16M or a 22% increase in the last quarter. If that pace continued in Q1 and with the help of the Super Bowl ad spike we are looking at ~ 108M verified users in the next earnings announcement on May 10.

Calculations for Value of Coinbase NFT

To calculate relative values of the Coinbase NFT platform we will compare it to the most well-known leader in the space: OpenSea. When it closed a $300 million Series C round, OpenSea had about 1 million users. The series C raise valued the startup at $13.3 billion valuation.

Coinbase had 3.5 million users on the NFT waitlist in February, and at least 86 million other registered Coinbase users that could easily dip their toes in the NFT platform the company has just launched. Using the valuation OpenSea received, we divided it by the number of users, and calculated $13.3B/1M user which equals $13,300 per user. We rounded this number down to $13K value per OpenSea NFT platform user.

Using the ~ $13K per user value OpenSea received during the recent Series C round, we multiplied it by the Coinbase NFT user waitlist count of 3.5M. From this we extrapolated that ($13K per user) x (3.5M waitlist users) = $45.5B!

Currently, Coinbase holds a market value of ~$29B, which implies that the NFT platform the company just launched could more than double the valuation of COIN, if OpenSea valuation methodology was applied.

On April 11, 2022, Coinbase tweeted that “Something is Coming” with smaller pink font underneath that said “probably nothing,” which is a crypto-Twitter remark that sarcastically points out just how big something really is.

With Coinbase NFT usage starting at nearly 4 million at launch (post-Beta), we can likely see the numbers will quickly grow to double digits over the course of a few quarters given the total number of registered users on Coinbase. If adoption grows to 10 million+, we can see an even greater multiple materializing for the total valuation of the company.

After the growth hacking “no fees” is phased out, even a single-digit percentage fee will add substantially to the total revenue of Coinbase. If Coinbase can match NFT trading volume ($4B) of OpenSea, and charge only a 1% fee, it could bring in $140M (adjusted for 3.5 X more users than OpenSea) in additional revenue each month. This could add up to as much as $1.6B extra revenue over a year, just to start.

There will be users attracted to Coinbase solely for the NFTs and some portion of them will stay for the other products. The moat Coinbase is building is unmatched in the industry, and the NFT product just gobbled up a large portion of the NFT market share, with a promising revenue stream to come.

Coinbase Ventures

As part of its growth strategy, Coinbase is reinvesting its profits in three key areas:

- 70% of the reinvestment fund goes in their core

- 20% into ctrategic

- 10% into venture bets, a.k.a. moon hots

2021 was a record year for Coinbase Ventures, with just under 150 deals. This averages out to a new deal every 2.5 days. Coinbase now has 250+ portfolio companies including OpenSea (NFT competitor), TaxBit, BlockFi, Uniswap (the largest decentralized crypto exchange), Coinswitch Kuber, Messari, and more.

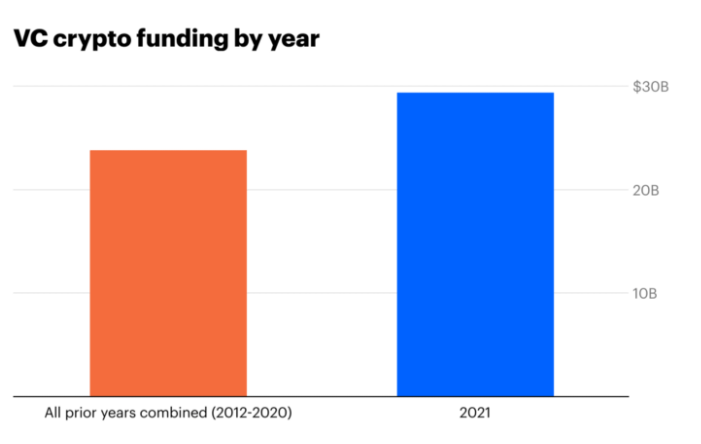

Investments in early-stage crypto companies are growing at a neck-breaking pace as we can see the total of all the prior years compared to 2021 in the chart below.

blog.coinbase

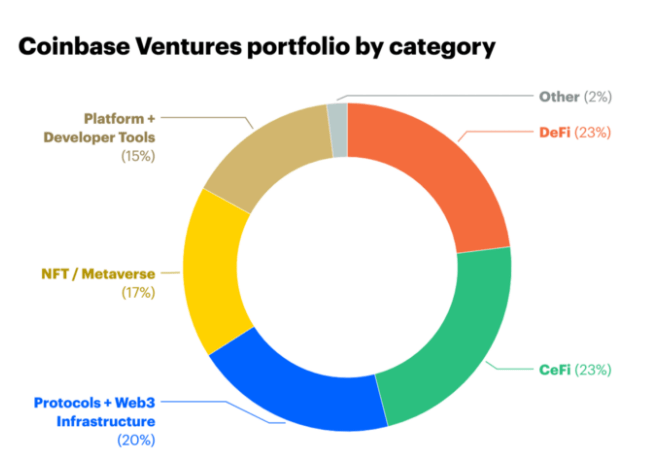

On a cumulative basis, more than 90% of the capital Coinbase Ventures has deployed since its inception was deployed last year, echoing the trend in the above chart. Coinbase Venture’s portfolio now consists of over 250 companies, and broadly breaks down across the following verticals. Probably nothing!

blog.coinbase

To accelerate the growth of the cryptoeconomy globally, Coinbase Ventures plans to double down on regional investments, adding to their portfolio of platforms such as CoinSwitch Kuber and CoinDCX in India, Rain in the Middle East, and Bitso in Latin America. According to a report by Brazilian daily Estado, Coinbase is set to acquire a company called 2TM, which is the parent company of Mercado Bitcoin, the largest crypto exchange in Latin America, in what is likely to be the biggest acquisition in the company’s history unless it acquires Turkey’s largest exchange BtcTurk for $3.2 billion first.

#WAGMI

As evident by its OpenSea investment, Coinbase invests in companies that are potentially competitive, because it’s in everyone’s interest to see the ecosystem innovate and grow. Coinbase also gives out donations and grants to industry builders with no strings attached, as long as what they are building somehow benefits the crypto industry. This year, Coinbase allocated $5M through “Coinbase Giving” philanthropic division, to expand the grant program for builders.

The company’s positive-sum culture and the long-term perspective of the space are what the crypto community calls #WAGMI – “We are all gonna make it.” And that’s what Surojit added at the end of his Super Bowl ad Tweet. A rising tide lifts all boats, and non-zero-sum thinking benefits everyone involved. The #WAGMI approach is the best collective move, this young industry still needs to HODL, and Coinbase is leading by example.

New products and revenue sources

With the recent acquisition of FairX, Coinbase is getting into a position to offer crypto derivatives, which could dwarf the spot market trading volume and open the doors to a whole new revenue stream. Coinbase is also testing a new subscription service called “Coinbase One,” which offers users zero-commission trading for a flat monthly fee. This zero-commission option might be key to winning over high-frequency traders.

Coinbase Cloud plans to become the “Amazon Web Services” of cryptocurrencies. AWS is the infrastructure layer of much of the internet we use today and it brings in ~$18B in revenue to Amazon (AMZN). If successful, Coinbase will also be providing picks and shovels for Web3 with its Cloud offering.

Coinbase Prime is an institutional-grade execution engine, advanced trading platform, and secure custody solution used by industry-leading corporations like Tesla (TSLA) and MicroStrategy (MSTR), hedge funds, wealth managers, asset managers, family offices, university endowments, and other multi-strategy allocators. The institutional horde needs services and Coinbase is the most trusted go-to provider.

Institutional Horde Is Coming for the Yield

The institutional investment horde is at the gates with massive war chests of capital waiting to be deployed in the new Decentralized Finance (DeFi) Web3 world, where yields and opportunities are exceptionally attractive. Because investors are demanding exposure to digital investment strategies, institutions need more sophisticated tools, like Coinbase Prime.

Coinbase Prime is a result of investments made years ago, like many strategic, core, and venture investments that is only now starting to add to the revenue stream. As we can see from the Q4’21 table below, the institutional volume makes up a significant percentage of the total trading volume already, and the number is trending north at a healthy clip.

Q421-Shareholder-Letter

BlackRock (BLK), the world’s largest asset manager which manages over $10 trillion in assets will start offering Bitcoin trading to its clients. BlackRock’s over 1,500 institutional clients include corporate and public pensions, endowments and foundations, and sovereign wealth funds.

Morgan Stanley (MS) Wealth Management also introduced a 20-page primer on the cryptocurrency ETH, to its clients. The report highlights Ethereum’s growth and attractions as it is the main blockchain that is used for decentralized applications (dApps), DeFi, and NFTs. To reiterate, Coinbase NFT Platform is exclusively built for Ethereum blockchain support as of now.

BlackRock and Mogan Stanley are some of the biggest and most well-known asset managers in the world and they are just dipping their toes in the crypto pool. Once they are comfortable in the water, they will allocate a greater percentage of capital to crypto.

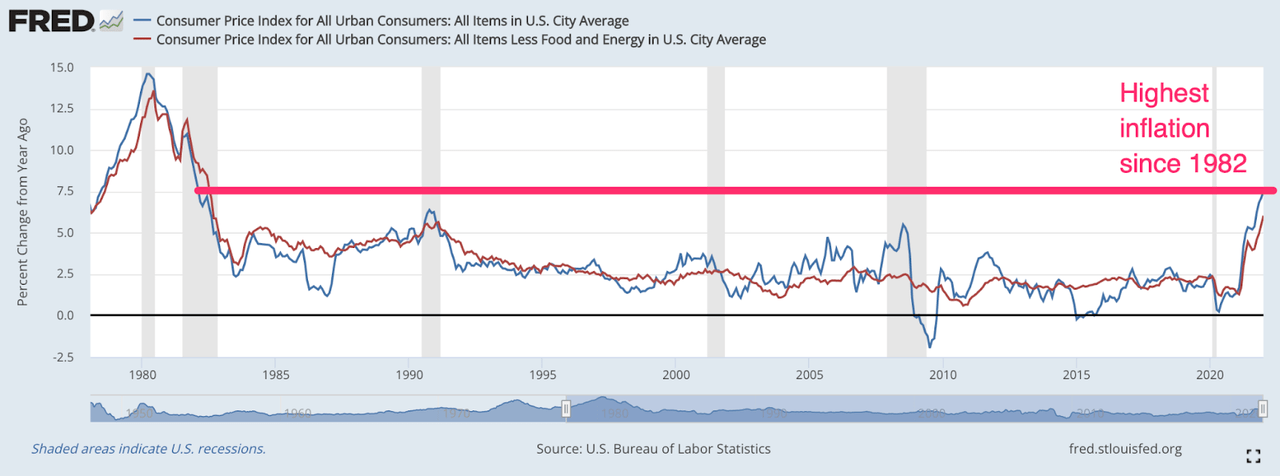

We will likely see the industry grow by orders of magnitude as more institutions realize they can get a “risk-free” yield of ~8-20% on a stablecoin (risk-free DeFi yield of ~10% – isn’t 100% free of risk; there is always smart contract risk, but insurance products are now available to account compensate for this risk). That kind of a risk-free return beats the current 8.5% inflation print, and more of their clients will demand better results and exposure to the asset class.

Inflation (fred.stlouisfed.org/series/CPIAUCSL)

Over time, institutions that are open-minded and curious enough to learn without dismissing this entire industry as a scam or a Ponzi scheme will clearly stand out with superior portfolio returns. Underperforming investors will inevitably convert to investing in crypto just to keep up or go out of business.

TradFi (traditional finance) should be careful not to fall behind in crypto as the auto industry did with the electric vehicle (EV) revolution. Traditional car manufacturers turned their noses at Tesla as the company was pushing in the logical evolution of the car industry. Now, those same traditional combustion engine manufacturers are technologically 3-5 years behind Tesla – the world’s most valuable car company valued at ~$1T.

Coincidentally, Tesla also just happens to have BTC on their balance sheet, which we do not find surprising.

Risks

As we saw with our Q4 results, despite a missive beat, the soft Q1’22 guidance and the negative crypto-asset sentiment were more impactful than the amazing results. So we caution again as we did in our previous article that guidance is a big risk.

A prolonged bear market would also be bad for Coinbase share price. In terms of macro risks, there’s the most recent crypto price correction of ~50% along with traditional markets as a reaction to the increase in interest rates, inflation, and the war in Ukraine. This could get worse as the Fed further increases tightening, but crypto is also a hedge against inflation and a risk-on asset at the same time. As such, the outcome is uncertain, and an asset decoupling is on the table.

Continued multiple compression in tech/SaaS could throw this crypto baby out with the bathwater, despite being a very profitable and fast-growing company. So far, this baby has been tossed out with the bathwater, and we will see on May 10 if the market fishes this baby out.

Smart Contracts are the backbone of the decentralized finance ecosystem and could have a bug in the code that results in massive lost funds. The Ethereum consensus protocol change from proof-of-work to proof of stake, which is scheduled to go live sometime this year, might not go smoothly and the consequences could be grave and negatively impact Coinbase.

However, if a smooth ETH merge does occur, institutions that have been on the sidelines are likely to buy and stake ETH for an expected 10% yield. That would make it a de facto risk-free DeFi rate.

Final words

We think Coinbase is an exceptionally strong buy at the current valuation, and between $114 and $140 a share at a P/E ratio of 8.6 while growing at 100% per year. We think the company has a long runway of growth ahead with many catalysts from past investments, and we would not be surprised if the value doubled from the NFT product alone.