The price of Bitcoin fell below the psychological threshold of $30K, scaring investors. It was preceded by the loss of the dollar peg by UST’s stablecoin and the Luna crash.

In this context, more predictions are being made about Bitcoin’s demise and the collapse of the entire cryptocurrency market. But let’s not make an already grim situation worse. At this point, everyone needs to remain cool-headed.

It used to be that price swings for Bitcoin and other cryptocurrencies didn’t discourage HODLers from hanging on to them. Is this changing? It seems so.

The extreme fear on the market is evidently causing small holders to panic and sell off their holdings.

Source: Alternative.me

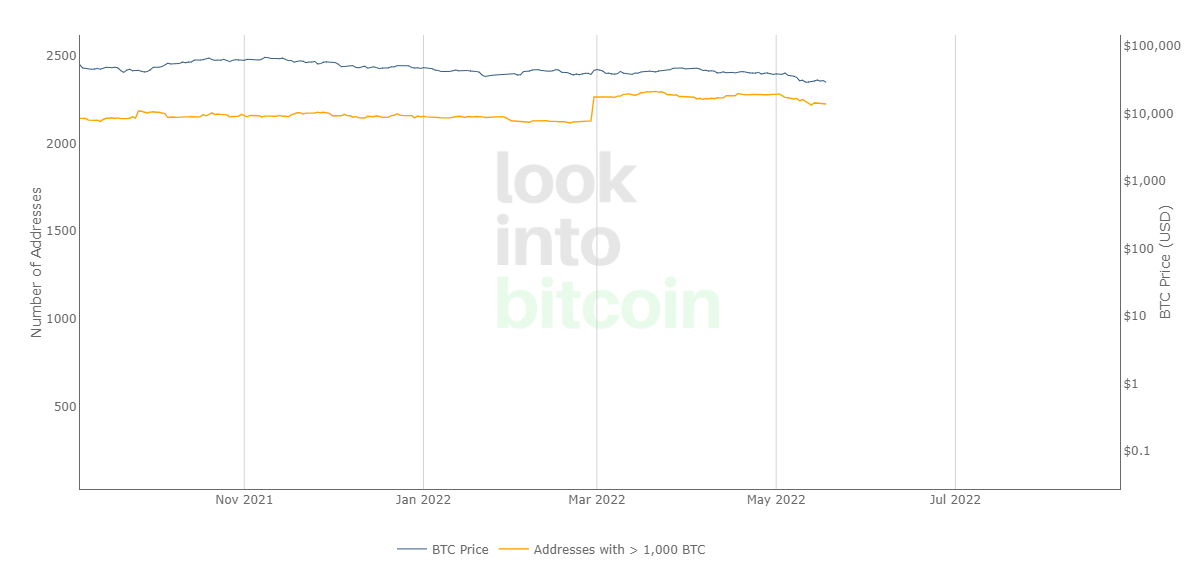

However, whales seem to be quietly buying the dip, with a surge in their activity starting in early February 2022 and steadily staying around that level. The number of wallets holding more than 1,000 BTC reached 2,224 on May 18, 2022.

Source: Lookintobitcoin.com

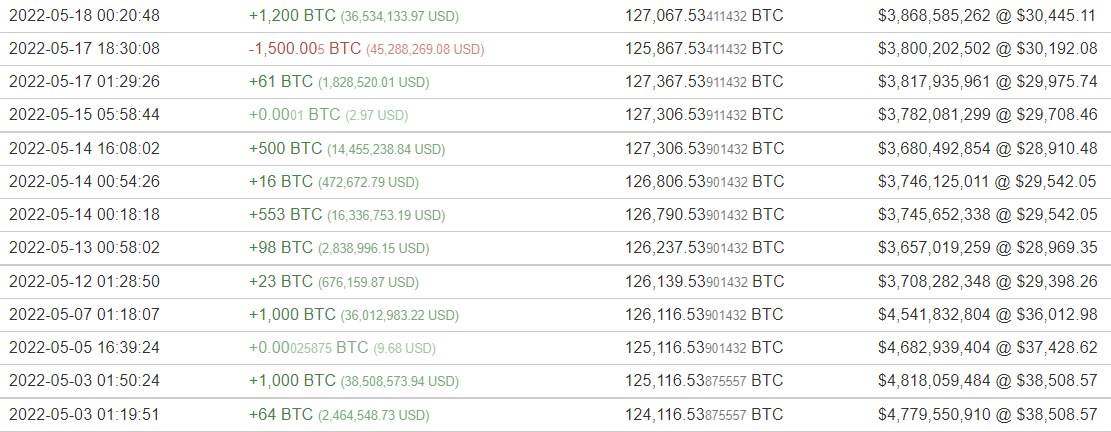

Detailing things a bit more, here’s a screenshot of the activity for the richest Bitcoin address that doesn’t belong to the exchange 1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ that I investigated in my previous articles. It appears to be accumulating the flagship crypto, not getting rid of it. On May 7, 2022 it bought a sizable chunk of 1,000 BTC when it was worth around $36K and then on May 14, it piled up more 553 BTC when the flagship crypto traded at around $30K.

Source: Bitinfocharts.com

It is important to view technical analysis along with fundamental analysis, as technical analysis alone cannot be relied on. But here’s what it says:

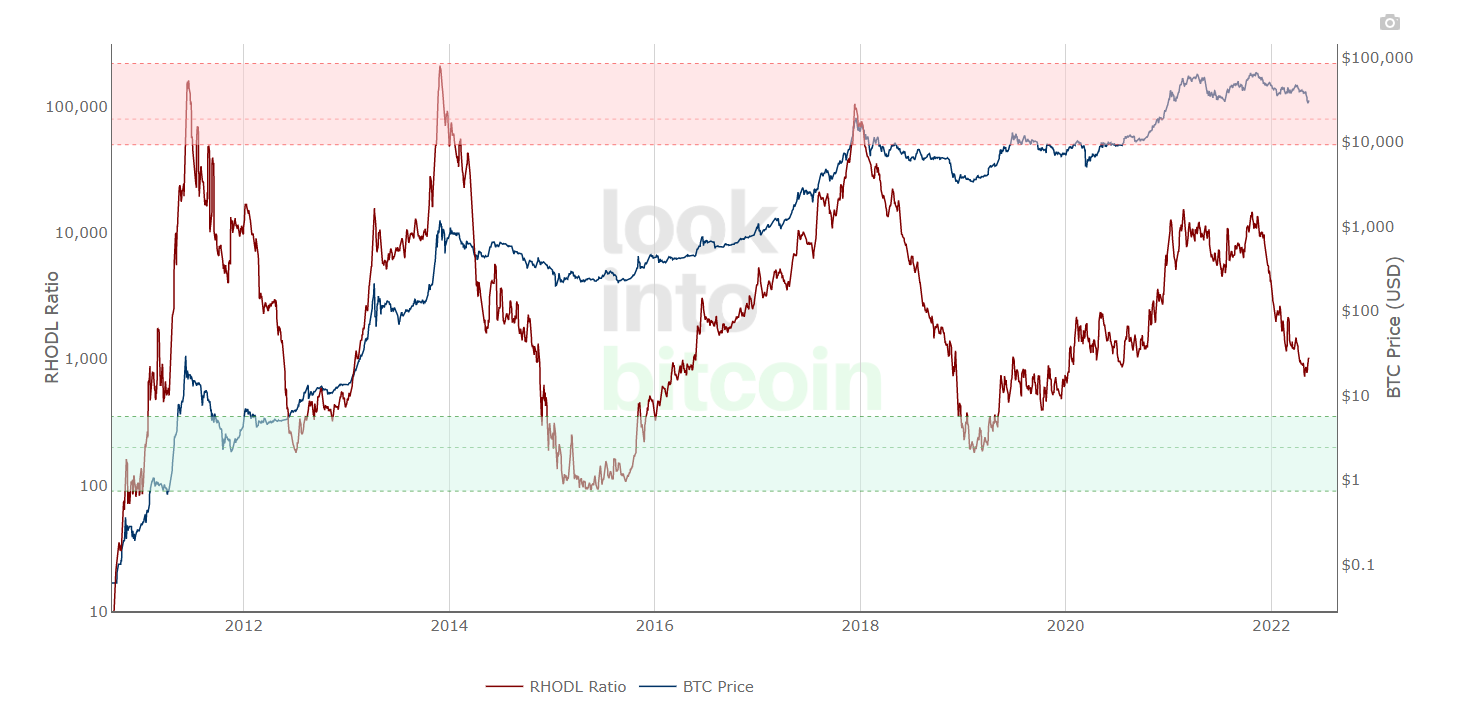

Below is the Realized HODL Ratio chart which analyzes the ratio between RHODL bands of 1 week versus RHODL bands of 1-2 years and can identify with high accuracy each price high of Bitcoin’s previous macro cycles.

The RHODL Ratio has the ability to predict Bitcoin’s pullback when the line enters the upper red band, and it can also predict its rally after spending time within the lower green band. As it stands, the line is heading towards the lower green band, meaning that the price of BTC may start to rally after spending some time there as it has historically done throughout its entire existence.

Source: Lookintobitcoin.com

The current economic climate is very different from the past, with the global economy on the verge of collapse. Bitcoin is still considered a risky asset, weighted by the same factors as stocks. As long as it has both a huge technology potential and a store of value, it has a strong chance of decoupling itself from traditional assets. Basically, it’s not the same as traditional assets; the public just needs to change their perception of it. I do believe this will happen and we will soon see Bitcoin’s incredible growth.