MicroStockHub/E+ via Getty Images

Bitcoin (BTC-USD) has often been hyped as an inflation hedge or as an alternative investing class, an opportunity to diversify a portfolio. However, evidence continues to mount, especially in the recent market downturn, that crypto holds a high correlation with stocks (SP500).

This connection is evidenced by the fact that both bitcoin and equities grinded higher in the easy money era of 2020-2021, and now both are facing cyclical downturns as financial conditions tighten and liquidity dries up.

“The correlation between bitcoin and equity indices has remained high and will continue to do so unless bitcoin becomes widely used as a medium of payment – which looks unlikely to happen soon,” Morgan Stanley analyst Sheena Shah wrote in a note May 10.

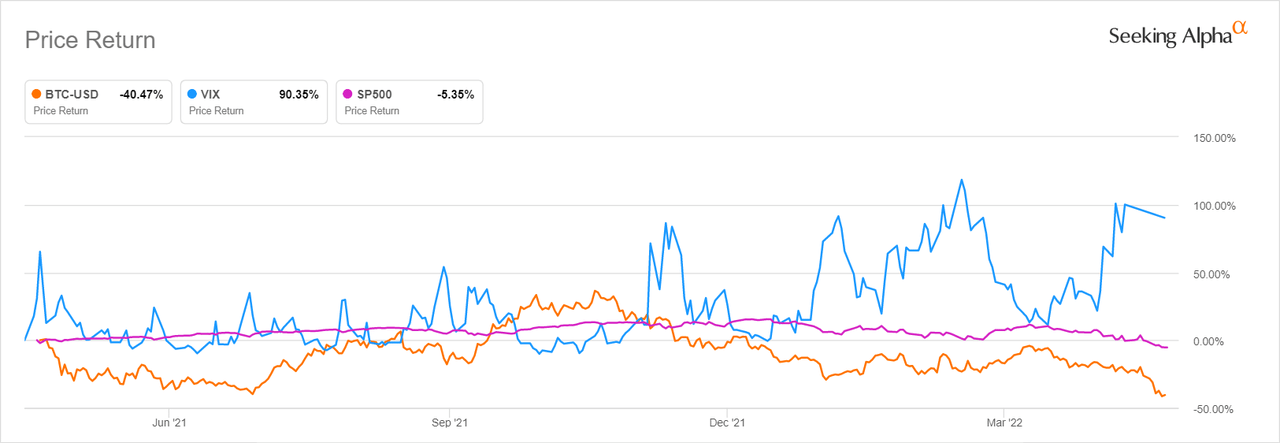

For some context, the rolling 120-day correlation between the S&P 500 index (SP500) and bitcoin (BTC-USD) was recently standing at 0.60, the highest reading since the series began in 2011, Charles Schwab Chief Investment Strategist Liz Ann Sonders wrote in a Twitter post May 10. In other words, bitcoin’s price action resembles that of stocks and therefore risk assets. Take a look at the chart below to further grasp how bitcoin has fared Y/Y with the S&P 500 as well as S&P volatility, which is inversely correlated with the major stock index.

For a macro perspective, as central banks across the globe pivot to tighter monetary policy (some more aggressive than others) in an effort to dull widespread inflationary pressures, global money supply growth continues to decelerate from its peak in Feb. 2021, Shah noted, adding that bitcoin’s (BTC-USD) market cap growth topped a month later in March 2021, implying that global liquidity and bitcoin could share a connection.

Note that in 2020, speculative assets like bitcoin soared in price in the wake of extraordinary accommodative monetary/fiscal policy and surging money supply. Stifel recently predicted for bitcoin to reach as low as $15K as shrinking M2 money supply growth, a broad measure of money in circulation, “should sharply weaken Bitcoin.”

Looking at the BTC-stocks correlation from a different lens, retail investors used to be the dominant cryptocurrency trader around four years ago, but now “the largest proportion of daily crypto trading volumes is from crypto institutions, much of which comes from them trading with each other,” Shah explained.

This dynamic has contributed to bitcoin’s (BTC-USD) strong bond with equities since those institutions are sensitive to the availability of capital and therefore interest rates, she added.

Commentary: “We’ve definitely seen [bitcoin] trade more in line with stocks and more in line with the Nasdaq and tech stocks, in particular, over the last few quarter,” Coinbase (COIN) CFO Alesia Haas told CNBC’s Squawk Box in an interview May 12. “Lots of institutional money has come into crypto, and with the broader volatility that we’re seeing, we’ve seen strong correlations,” she added.

Take a look at SA contributor’s The Digital Trend’s bullish take on bitcoin.

Earlier this past week, (May 12) Bill Miller said he hasn’t sold any bitcoin.