Key Takeaways

- Bitcoin and Ethereum have dipped by more than 15% over the past four days.

- Bitcoin could dive to $28,060 if it breaches the $32,850 support level.

- Ethereum must hold above $2,500 to avoid a downswing to $1,720 or lower.

Share this article

Bitcoin and Ethereum are still trending downwards while fear surrounding the global macroeconomic environment escalates. Losses could accelerate as both cryptocurrencies appear to breach vital demand zones.

Bitcoin and Ethereum Face Danger

Roughly $110 billion have been wiped out of the cryptocurrency market over the weekend, putting both Bitcoin and Ethereum in a tight spot.

The number one cryptocurrency has taken a 15.5% nosedive over the past four days, dropping from a high of $39,850 to a low of $36,665. The downswing allowed Bitcoin to slice through a crucial area of support. As the selling pressure appears to be accelerating, Bitcoin could be bound for further losses.

From a technical perspective, Bitcoin has sliced through the lower boundary of a parallel channel on its daily chart. Such market behavior anticipates a steep correction as significant as the pattern’s width, which projects a target between $29,620 and $28,060. Still, the Jan. 25 low of $32,850 could serve as a support zone, so only a sustained breach of this level would confirm the pessimistic outlook.

Ethereum has also seen its price drop by more than 15.5% over the past four days, losing over 500 points in market value. The second-largest cryptocurrency by market cap is now holding above the crucial $2,500 support level. A sustained three-day close below this demand area can result in significant losses.

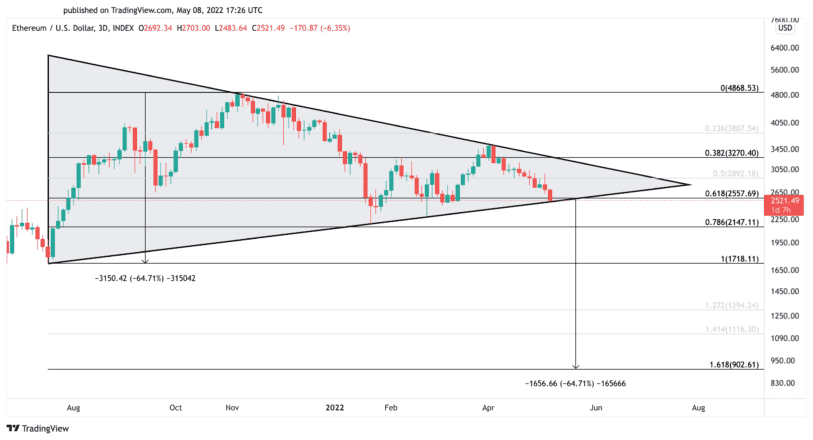

The formation of a symmetrical triangle on Ethereum’s three-day chart suggests that a break of the $2,500 support level could lead to a 64.7% downswing. A breach of the 78.6% Fibonacci retracement level at $2,150 could be the first sign of confirmation for the bearish outlook. Then, Ethereum could hover around $1,720 before a capitulation near the $900 level.

The current technical conditions suggest that Bitcoin and Ethereum are bound for steep corrections. However, given the high volatility in the cryptocurrency market, the bearish thesis could be invalidated. Bitcoin would have to reclaim $38,000 for a chance to make higher highs, while Ethereum would need to slice through the $3,270 resistance level to stage a bullish breakout.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.