Michael Ciaglo/Getty Images News

Introduction

Late last month, we wrote an article that discussed how bitcoin’s blockchain can be thought of as a base layer on which other things can be built on top of, including bridges/connections to smaller and more experimental cryptocurrency projects, such as Ethereum (ETH-USD) or Solana (SOL-USD), through cross-blockchain integration. We compared this to the Internet itself, which bested other competing protocols, such as Usenet.

I definitely hope centralized exchanges burn in hell as much as possible.

-Vitalik Buterin, creator of Ethereum (7/6/18)

Another example of this is decentralized exchanges. Decentralized exchanges are a type of app that runs on top of one or multiple blockchains, in some cases connecting blockchains together, allowing users to swap their cryptocurrencies without the need for a middleman. It’s decentralized. You don’t need a centralized exchange.

Coinbase Global: The AOL Of Crypto?

Expanding on the ideas from last month’s article, perhaps Coinbase (NASDAQ:COIN) will change its business model, much like AOL did. AOL was early to the internet scene, as Coinbase was to cryptocurrency. The original business model was that people with a computer would pay a fee to dial-up AOL’s web portal, a precursor to today’s websites, in exchange for receiving content and services from AOL.

For a time, AOL was so popular it that was synonymous with the internet, probably because in 1995 it charged people by the hour for using it.

When web browsers came along, anyone could launch a website, that anyone else could visit. It became increasingly difficult for AOL to wall every service into a unified platform, where it could act as a middleman. AOL then made a desperate attempt to capture a ‘share of the internet market’ by acquiring internet browser Netscape. It then made an even more desperate attempt, merging with Time Warner at a $164B valuation.

Not even the largest merger in U.S. history could save AOL from its fate. Broadband competitors, offering faster internet service, plundered AOL’s business faster than it could use profits from offering dial-up internet access to build a business that took advantage of Time Warner’s vast infrastructure and content. The implosion is now legendary.

Elements of this story sound familiar: A pioneer in a new industry builds a very successful business. It’s a platform that gives people access to this technology. New technology, threatens, and then disrupts the business. Arrogant and/or uninformed institutions or institutional investors get smoked. Everyone else benefits.

It’s what we call capitalism.

Coinbase And You

Coinbase operates a cryptocurrency exchange. It was founded in 2012, approximately two years after the first bitcoin transaction famously swapped 10,000 btc for a pizza. By 2014, Coinbase had grown to over one million users and was helping companies such as Overstock and Dell accept bitcoin, and companies such as Stripe and PayPal process bitcoin.

As the ecosystem grew, Coinbase added other cryptocurrencies (other blockchains), such as Ethereum. Coinbase made its debut it the public markets in 2021. At one point was valued at $76B, more than Intercontinental Exchange (ICE), which owns the New York Stock Exchange.

Coinbase is also more profitable than the NYSE. LTM revenue is comparable; the NYSE/ICE generated over $7B in revenue while Coinbase generated almost $8B. Both are low capex businesses. But somehow Coinbase generated $10.7B in cash flow from operations, $4.5B in EBITDA, and $3.6B in net income (according to data provided by S&P).

How is this possible? Coinbase charges its users (over 80 million of them) exorbitant fees on cryptocurrency transactions. Coinbase has $278B in AUM (cleverly marketed as “assets on platform”), yet last year it generated more revenue than the NYSE/ICE. All while the CEO lectures banks about their high fees and bloviates about decentralization in the company’s S-1.

Coinbase is essentially a crypto brokerage house that reverses the decentralization features built into cryptocurrencies. Virtually every wallet for every cryptocurrency comes with a private key and a public key. The public key is an address that can send or receive cryptocurrency to/from any other address as long as it is authorized to do so with the corresponding private key. The “service” that Coinbase provides is that it essentially hides the private key from users so that Coinbase can manage their account on their behalf.

Coinbase is able to get away with this for two reasons:

- Because cryptocurrencies are peer-2-peer at the blockchain level, two parties have to unilaterally agree to a transaction. This is not very practical at scale. Coinbase can act as a market maker, matching buyers and sellers. This is useful but it will soon be antiquated for reasons we will discuss in the next section.

- Cryptocurrency transactions are inherently expensive at present time. So, users don’t really notice, because the fees charged by Coinbase are relatively small (in some cases), compared to the overall cost of the transaction. There are some exceptions as some cryptocurrency projects have developed novel protocols. Most, if not all, cryptocurrencies are being supported by efforts to lower transaction costs.

The later leads us to an important point, one that is critical to understanding the future of cryptocurrencies. In order for the cryptocurrency industry to grow, transaction costs must decline significantly. The looming risks to Coinbase accentuate the naissance of this industry.

To put it simply, if it cost $3 to send an email or iMessage, you probably wouldn’t send very many of them. If you spent $10 every time you went on YouTube, you probably wouldn’t visit very often. Imagine how things would be if broadband was some sort of esoteric technology that “could’ve been but just never caught on” because it was a threat to AOL’s business model.

And such is the state of affairs in cryptocurrency. For the industry to evolve, the cost of executing transactions, smart contracts, and applications linked to the blockchain must come down dramatically. For Coinbase, these innovations represent existential threats that are rapidly materializing.

Decentralized Exchanges And Wallets

One particularly disruptive innovation is the advent of decentralized exchanges. Much like the cryptocurrencies that underpin them, they are decentralized, ownerless cooperatives that operate autonomously. Some employ “automated market maker” technology that automatically adjust prices based on pre-set mathematical formulas. Users are rewarded for providing liquidity to the trading pool. They’re decentralized version of Coinbase, essentially, complete with automated dividends.

The disruptive potential of decentralized exchanges has not gone unnoticed. Last week we wrote about Core Scientific (CORZ), noting its 3849% EBITDA and 800% revenue growth. But Core Scientific is more than a bitcoin miner, it’s potentially also a future competitor to Coinbase.

Core Scientific acquired RADAR, a developer of decentralized exchange IP. The founder of RADAR is now Chief Technology Officer of Core Scientific.

We intend to utilize RADAR’s business assets and the technical expertise of its principals in enhancing our existing blockchain mining technology and software and in further strengthening our leadership position and value creation potential through the development of decentralized finance (DeFi) products and services.

…

We may also explore adjacent lines of business that leverage our mining expertise and bitcoin assets.

-Core Scientific 10-K

But why would a bitcoin miner be interested in decentralized exchange technology? Because they might be able to support it using their bitcoin holdings. It is one example of how bitcoin, and with it bitcoin mining, may continue to act as the bedrock to the rest of the industry. We have written about this extensively.

This is particularly true if miners are able to self-custody their own holdings, a possibility with increased regulatory support. Individuals are already able to self-custody their own wallets/keys, as that is what cryptocurrency was designed to do. It’s a key feature.

Another example is Metamask. Metamask allows users to transact with decentralized apps and manage their wallets right from their browser. In November 2021, Metamask reported over 21M users.

Due to the cost of operating smart contracts, transacting on decentralized exchanges is currently expensive. They can also be tricky to use, things like Metamask are still experimental.

Yet costs are declining rapidly. As a compliment to decentralized exchange technology, consider Bitcoin Lightning Network. Lightning Network is a “layer-2 protocol” that runs on lightweight nodes that use little power. The result is bitcoin transactions that average a fraction a cent. Less than using a credit card.

Bitcoin Lightning Network is so disruptive that it allowed El Salvador to make bitcoin legal tender and roll it out nationwide. Ultimately, these Lightning Network channels settle on the bitcoin blockchain with bitcoin mining. Using layer-2 technology, El Salvador is able to take advantage of bitcoin’s stability while at the same time keeping transaction costs minimal.

At last week’s bitcoin conference in Miami, MicroStrategy CEO Michael Saylor intonated a thinly veiled criticism of Coinbase, calling out exchanges that don’t support Bitcoin Lightning Network and complimenting ones that do. Across from him was Cathie Wood, the fifth largest shareholder of Coinbase, who laughed nervously.

I think they’ve thrown down the gauntlet.

-Michael Saylor (4/7/2022)

Lastly, the nuance of the Federal Reserve’s CBDC discussion paper does not bode well for Coinbase either. The report suggested a system that would create USD accounts custodied directly at the Federal Reserve. There would then be some sort of API (a software connection) that would allow private sector “digital wallet” apps to build on top of this. It’s not a stretch to suggest that this digital wallet API could interact with smart contracts, including decentralized exchanges.

What will the world look like years from now? Will people use the centralized Coinbase app to access Tether USD coin? Or will there be accounts/smart contracts on the blockchain that interact with a digital US dollar through decentralized apps and exchanges?

If it’s centralized, what would be the point?

The Coinbase Counteroffensive

So, Core Scientific and its peers are investing billions of dollars in bitcoin mining infrastructure that might strengthen innovation across the industry through cross-chain integration and layer-2 protocols/apps; Coinbase claims that it is “building the infrastructure to power the cryptoeconomy“. But other than sucking $7.4B in fees out of the market, what else is it doing? Does it have a plan to compete?

First and foremost, Coinbase is developing its own private wallet software, Coinbase Wallet. Coinbase Wallet allows users to access their own keys, join DAOs, and even access decentralized exchanges. It’s an admittedly nice gesture, as it’s not clear to what extent this could be realistically monetized, especially when there are free competitors (Metamask). Perhaps this is similar to AOL’s ‘dial-up to us, we’ll be your portal to everything else on the internet’ phase.

Coinbase is also looking to create a “crypto app store“. There is some use-case to this, as Coinbase could collect economic rents because people might trust this centralized source as a way to ensure that the apps they download are trustworthy. Yet it begs the question of why developers, whom have already created so many decentralized solutions, would not also be able to solve that problem. Are people really going to get their decentralized apps from a centralized app store? And if it’s not centralized how exactly does Coinbase control it in a way that allows Coinbase to charge people for using it?

AOL also tried this, creating a marketplace where companies could offer products and services. Companies preferred offering their products and services through their own websites, rather than relying on AOL.

Meet the new boss, same as the old boss. (Brian Armstrong)

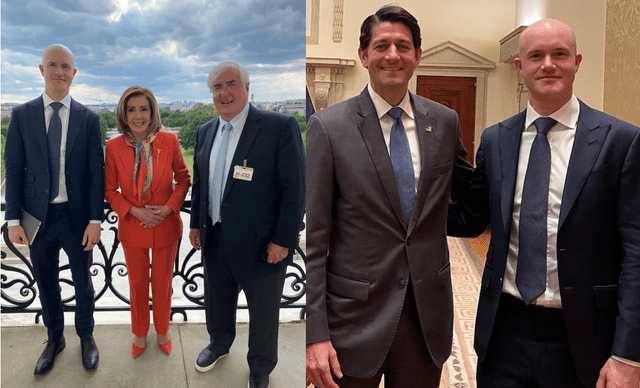

Coinbase is also doing things the old fashioned way, with lobbying! Coinbase CEO Brian Armstrong’s proximity to politicians is at an altitude that makes you wonder if Coinbase is hoping the rules are written in its favor. Perhaps it shouldn’t come as a surprise that developers actually building this stuff want the company to burn in hell.

Conclusion: Can They Keep Getting Away With It?

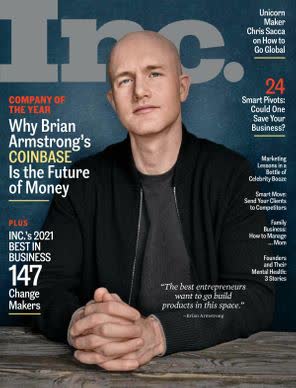

Coinbase CEO Brian Armstrong on the cover of Inc. magazine. (Inc. Magazine)

If you were duped into thinking that Coinbase is the “future of money” (according to Inc. Magazine) and CEO Brain Armstrong is the songbird of the digital generation, don’t blame yourself. The same people telling you five years ago that bitcoin was ‘a fraud‘ are the same ones telling you Coinbase is a buy, offering it banking services, and managing its IPO (technically a DPO).

And for all the coverage of Coinbase by major investment banks, they seem to ignore bitcoin mining entirely; The operators of actual cryptocurrency infrastructure. Core Scientific (CORZ), to harp once more on this example, had 800% revenue growth last year. The CEO was formerly the vice chairman of a $472B private equity firm. Not a single major investment bank covers it.

Odd, isn’t it?

The developers building and creating this industry, both small and large, seldom get the recognition they deserve. Yet the pundits assist the complex of crypto exchanges and VC-backed tokens in the hyping up of the latest projects.

So yeah… …I think some of the other platforms in the in the wider crypto space have tokens. And so, they’re more focused on advertising the token. And so, they tend to be very heavy on marketing.

Bitcoin doesn’t have a marketing department. It just has lots of different individuals that own it, and essentially nobody really marketing it to the world, right? It’s just marketed by organic adoption so it tends to be kind of low-key messaging, I guess. Right?

And the people building on it are more interested in building lasting value because they don’t have a token that they’re trying to like rush to market or sell or something.

-Adam Back, Blockstream CEO & Bitcoin pioneer

They rarely reflect on the fact that the innovators, disruptors, and “bitcoin killers” of five years ago have mostly disappeared. Litecoin (LTC-USD), XRP (XRP-USD), Dash (DASH-USD), and ZCash (ZEC-USD) all had their distinct advantages, but long-term these advantages were by and large found to be nil compared to the vast scale and steady pace of bitcoin.

History often rhymes.