fstop123/E+ via Getty Images

Thesis Summary

Ethereum (ETH-USD) is still the world’s second-largest cryptocurrency, but it is quickly losing ground to other cryptocurrencies. In this article, I look at two metrics which support this thesis and discuss which are the most relevant competitors to Ethereum in today’s environment.

Institutions are fleeing ETH

I previously discussed the problems with ETH in this article. Some of these issues, the cryptocurrency is looking to fix with the move to PoS, but there are still limitations to Ethereum, and institutional investors are moving out of ETH in favour of other layer 1 solutions.

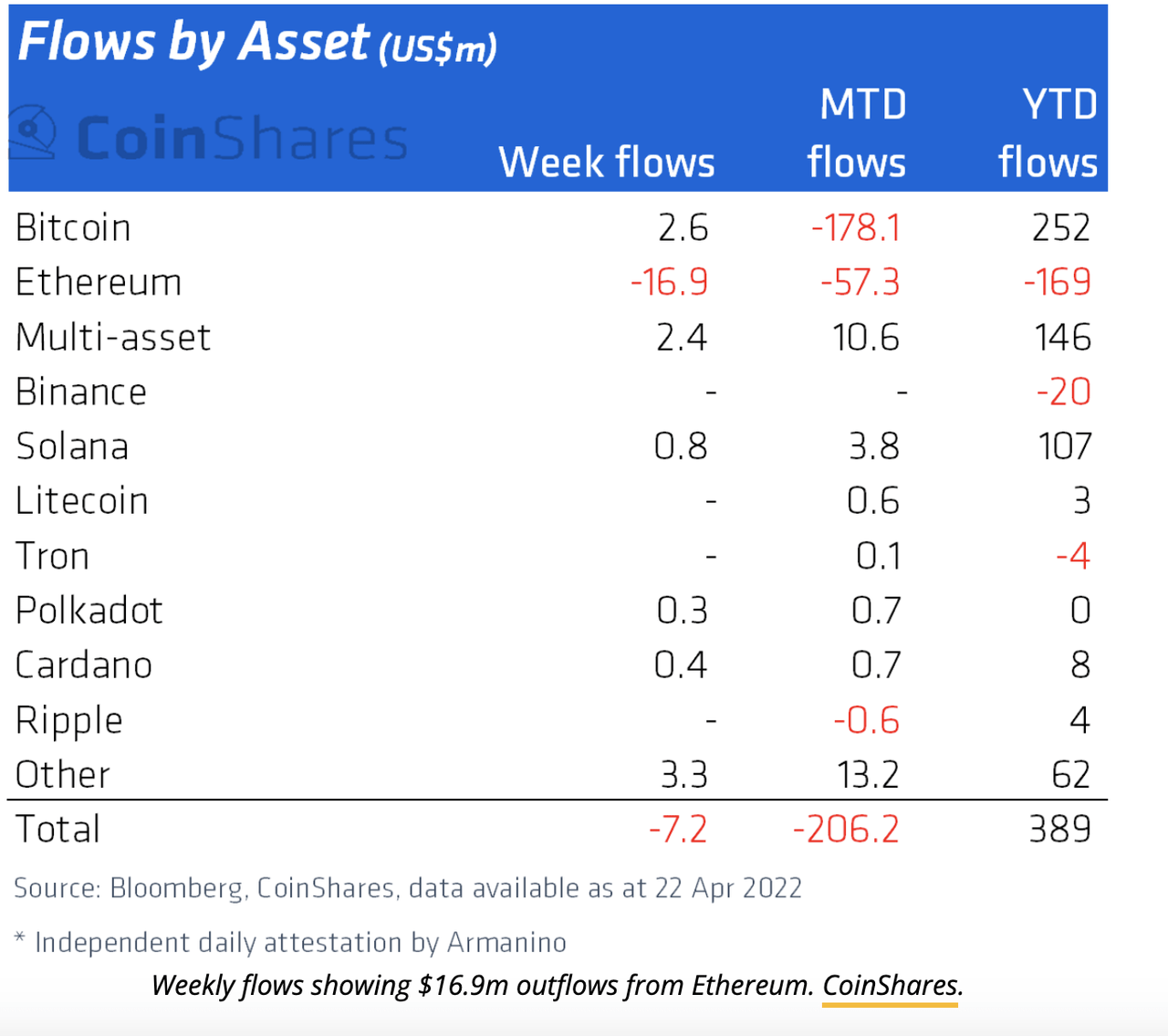

Crypto Flows (CoinShares)

In the table above, we have the weekly, monthly and YTD flows/outflows for various coins. The data is from the 22nd of April.

As we can see, money has been flowing out of Ethereum at a fast pace. In the last week alone, $16.9 million flowed out of ETH and ETH products. This trend has been going on for the past few months, with about 10 times that amount flowing out from ETH since the beginning of the year.

Meanwhile, data from CoinShares shows that investors loaded up on $3.5 million worth of Avalanche (AVAX-USD), Solana (SOL-USD), and Terra (LUNA-USD) and Algorand (ALGO-USD). Notably, Bitcoin also performed well in the last week, with $2.6 million, as investors seek safety in the crypto space.

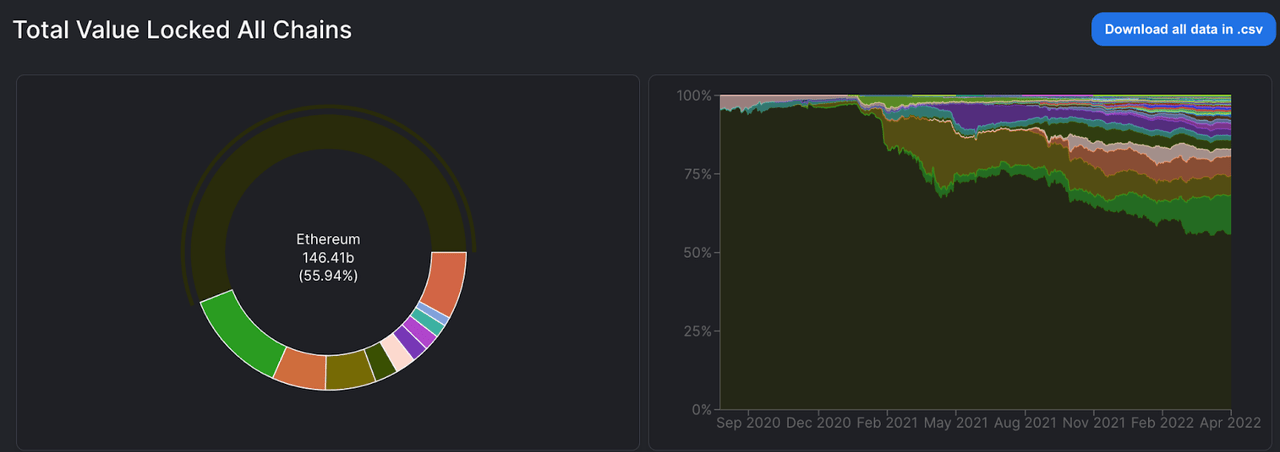

ETH’s demise can also be seen if we look at the evolution of TVL over the last year:

TVL (DeFi Llama)

This time last year, ETH accounted for 72.6% of the Total Value Locked. Now, this is only 55%. Furthermore, we can see an acceleration in ETH’s loss of market share over the last 6 months.

Investors are turning away from ETH, and more activity is now taking place in other blockchains. But who are ETH’s main competitors?

Where’s the money going?

As mentioned above, the coins receiving the most funds include Avalanche, Solana, Luna, and Algorand. Each of these coins has its specific characteristics, but what they do have in common is that they are all layer 1 solutions. In other words, they are all base blockchains upon which smart contracts and dApps can be built.

Solana

This is a blockchain I have talked about extensively before. It uses a consensus mechanism called Proof-of-History, and can allegedly carry out 50,000 tps. However, in its quest for higher efficiency, Solana has had to sacrifice decentralization. Most of the supply is held by early investors, and there are only a few hundred validators, some of which are subsidized by the Solana foundation.

Avalanche

AVAX describes itself as the “fastest smart contracts platform in the blockchain industry”, as measured by time-to-finality. Avalanche achieves finality in under 2 seconds. Unlike Solana, though, Avalanche is more secure and decentralized thanks to the thousands of validators in its network.

LUNA

Terra could also be defined as an L1 blockchain, though in this case, it is underpinned by a series of algorithmic stablecoins. This makes it an ideal place to build DeFi applications, decentralized exchanges and the like. LUNA’s UST has now become the 12th largest token by market cap in crypto.

ALGO

Finally, we have Algorand. This crypto also presents itself as a faster, lower cost and less polluting alternative to Ethereum. Algorand uses a “Pure” Proof-of-Stake consensus. Pure means that validators don’t have to stake/bond their ALGO to participate in the process. ALGO can currently process around 1,300 TPS

How to play this moving forward

There is no single Ethereum killer, as Ether’s demise will come at the hands of numerous blockchains. Ethereum paved the way, but it is undeniable that there are better alternatives out there.

What does this mean for crypto investors moving forward? First off, we have to consider that we are entering Altseason, which means that these lesser-known coins will appreciate substantially in the coming months. While I think Ether’s price will also go up in this market, returns will be much higher in the other altcoins.

But how do we know which altcoin will come out on top and provide the best returns? The only real way to know this is to keep regular track of developments in the crypto space and see how each blockchain ecosystem grows.

Also, to diversify risk, I recommend owning at least a few altcoins with strong fundamentals. All the above, for example, are good candidates in terms of L1 blockchains. However, there are also a lot of interesting coins in different areas of crypto. Layer 2 solutions, metaverse coins, utility coins and even meme coins.

Ultimately, the best thing to do is to build a well-rounded portfolio of altcoins. In this way, we can have a portfolio that has a high return potential, but less volatility and downside risk.