Leon Neal/Getty Images News

Cryptocurrency exchange Coinbase Global (NASDAQ:COIN) shares are sliding nearly 7% in midday trading Tuesday, as bitcoin (BTC-USD) edges down to $45.9K per token, though slightly higher overall.

COIN’s selling pressure comes as Mizuho analyst Dan Dolev lowered his price target on COIN to $190 per share from $220, implying less than 1% downside from Monday’s close, according to a note written to clients. As COIN is set to launch its non-fungible token marketplace this year, “we question the strategic rationale of chasing NFTs… especially as the NFT hype seems to wane,” he said, adding that the company in 2022 could face $500M in adjusted EBITDA losses if it “performs at the low end of the user guidance range.”

A slew of Coinbase’s rivals are also trading in the red, including Robinhood Markets (HOOD -5.7%), Voyager Digital (OTCQX:VYGVF -3.4%), Net Savings Link (OTCPK:NSAV -3.1%) and SoFi Technologies (SOFI -4.1%).

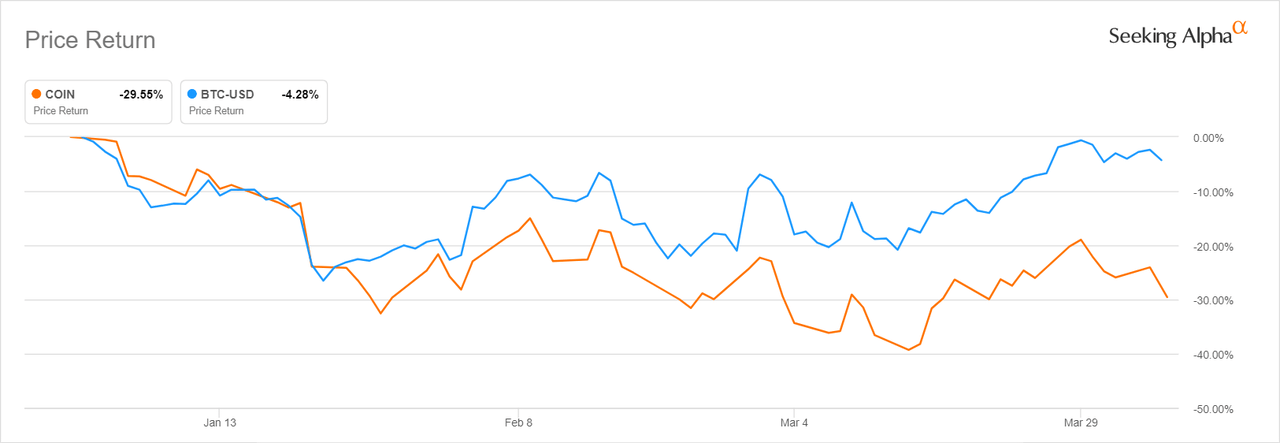

While COIN stock has been positively correlated with BTC for much of the past year, BTC started to outpace COIN in mid-March, though both are down more than 20% Y/Y, according to the chart below. Still, COIN is off nearly 30% YTD, while BTC is down just 4.2%.