Images we create and what actually happens are always beautiful when we have imagination./iStock Editorial via Getty Images

Hype and reality are rarely the same. Warren Buffett famously talked about how in the short-term the market votes, and in the long-term markets weigh, and his comments couldn’t truer than they are today.

No single investment idea has gotten more hype over the last five years than cryptocurrencies. Bitcoin (BTC-USD) is by far the largest current cryptocurrency, although there are also a number of other digital currencies such as Ethereum (ETH-USD) and Tether (USDT-USD).

Coinbase (NASDAQ:COIN) is the largest U.S. based cryptocurrency trading platform in the US as measured by trading volume, the company was founded in 2012.

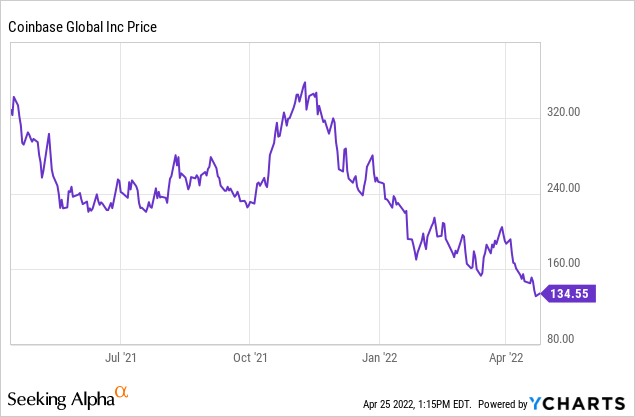

Coinbase has been very volatile since the company’s IPO in April of last year, when the stock began trading at nearly $381 a share after soaring from the opening $250 reference price on the Nasdaq. The stock then sold-off hard as Bitcoin and other cryptocurrencies began to fall significantly in December of last year. Shares now trade at nearly $125 a share. Coinbase has a market cap of just $30 billion today, after the company went public with a market capitalization of nearly $100 billion just over a year ago.

The main problem Coinbase has is starting to have is that the company’s business model is built almost exclusively on charging retail traders and investors transaction fees for buying and selling crypto currencies.

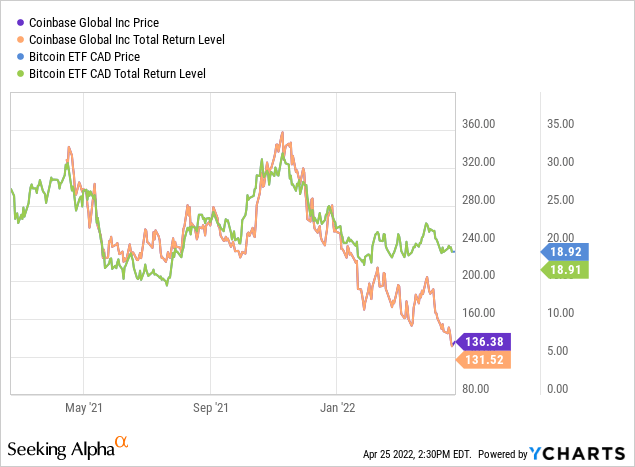

Since going public Coinbase’s stock has correlated heavily with the price of Bitcoin, but the 2 asset classes have diverged recently.

Bitcoin and Coinbase haven’t been trading as closely in tandem since early this year, but the 2 assets are still correlated since trading volumes are obviously higher when Bitcoin and other major crypto currencies are performing better.

Coinbase’s charges larger institutional traders very marginal commissions of around .1%, while retail traders are charged commissions of nearly 1.4%. Retail traders and investors are also charged fees on everything from ACH deposits, PayPal (PYPL) transactions, and credit card deposits. The company gets nearly 85% of revenues from fees charged to retail traders.

Coinbase had revenues of $1.3 billion in 2020, and the company reported revenues of $7.3 billion in 2021. The company generated $3.6 billion in net income in 2021 on net margins of 46%. Coinbase’s balance sheet is fine with $7.1 billion in cash and just $3.4 billion in mostly low yield long-term debt, and the company was able to increase their assets under management from $35 billion in 2020, to $90 billion in 2022.

A Picture of Bitcoin (Getty Images)

Coinbase’s isn’t going likely to see a year as successful as 2021 anytime soon, and the company knows that. Management has guided to lower trade volumes in 2022, and with bitcoin and other crypto currencies performing much poorer this year than 2021, the retail transaction volumes this company depends on could easily plummet.

The fee schedule that Coinbase charges retail investors is also not likely sustainable over the long-term for several reasons. Until recently traders could exchange many cryptocurrencies such as bitcoin free of charge through exchanges such as Circle. This changed when Coinbase began to buy competitors and form agreements with companies such as Circle to merge and monetize trading platforms. When Coinbase originally formed there were very few major exchanges to buy and sell Bitcoin and other digital currencies.Today there are far more market places for institutions and individuals who want to buy and sell crypto currencies. Binance (BNB-USD), Kraken (KRAK-USD), Paxful, etoro, and Gemini, are all exchanges where people can today buy and sell cryptocurrencies.

Even though Coinbase is the largest crypto currency exchange in the US, there are many exchanges in the US offering retail buyers and sellers a similar trading experience. Coinbase offers more liquidity to traders and investors because of the size of the market place, but for most retail buyers of Bitcoin and other crypto currencies, the experience on different trading platforms essentially the same. Traders and investors have already gotten accustomed to not being charged significant commissions for trading assets such as stocks, and Coinbase’s 46% net margins show that the company’s transactional fees are not correlated to actual costs. As the crypto market place grows new competitors are also increasingly likely to enter this space and charge lower fees and commissions. This crypto marketplace has very few barriers to entry right now, so new startups in this space are likely as well.

The other issue Coinbase should face moving forward are the multiple ways increased regulations will likely impact this industry. Because crypto currencies are not heavily regulated right now, most major banks and financial institutions don’t offer customers the ability to buy and sell these assets. This is likely to change. Biden has already recently signed an executive order to further study crypto currencies, and the current administration has also proposed reducing the reporting threshold for crypto currency trading to $600 and increasing IRS oversight. The democrats also proposed a Build Back Better bill that Biden and most of the Democratic party, which would have supported much heavier regulation of Crypto currencies.

Crypto currencies are likely to be more regulated moving forward, and this increased scrutiny should impact exchanges such as Coinbase in several ways. First, tougher regulations and reporting requirements will likely lower demand for Bitcoin and other crypto currencies. Second, as the crypto currency industry becomes more regulated, more established banks and other financial institutions are likely to enter this space.

A Picture of the Coinbase logo (rawdev.com.ng)

Given this headline risk, Coinbase’s stock does not look cheap. The stock trades at 65x forward EBIT, 12x forward cash flow, 4.6x book value, and 3.6x sales. Coinbase also trades at 32x forward earnings not just adjusted for general accounting procedures. Analysts also continue to lower expectations for growth as Bitcoin and many other cryptocurrencies continue to fall, resulting in lower trade volumes.

Crypto currencies were heavily hyped when Coinbase went public last year, and the rally in Bitcoin and many other crypto currencies throughout much of 2021 led to a huge rally in this stock. Today the picture looks much different. Not only has Bitcoin has sold-off hard, but Coinbase is facing the prospect of increased competition and heavier regulation. As good of a year as 2021 was for Coinbase, this year should be much more difficult. Retail traders and investors tend to be more sensitive to price moves than large institutional traders, and Bitcoin has been very volatile this year. Crypto currencies are likely here to stay, but Coinbase’s business model of building a business on retail trading volumes is not likely sustainable over the long-term.