Leon Neal/Getty Images News

Investment Thesis

Coinbase Global, Inc. (COIN) reported decent FQ4 results, as it outperformed consensus estimates on both its revenue and profitability. However, its FY22 guidance reinforced our perspective that crypto volatility meant that Coinbase’s estimates are challenging to model. In a previous article (Hold rating), we also shared that modeling COIN stock’s valuation will be challenging.

The company dropped a bombshell on investors that its investments and crypto volatility could turn FY22 into an unprofitable year. Investors could be looking at adjusted EBITDA losses of up to $500M if its monthly transacting users (MTUs) came in at the low end of its guidance range.

We emphasized previously that Coinbase stock is not suitable for long-term investment due to the design of its business model. We maintain our conviction that Coinbase stock’s valuation is predicated on significant future optionalities that consist of high execution risk. But, we also said that COIN stock can still be traded on a short-term basis.

Given the recent sell-off in COIN stock, we think the time has come to revise our rating on COIN stock from Hold to Buy for speculative investors. We discuss this further below.

How Was Coinbase’s Earnings Report?

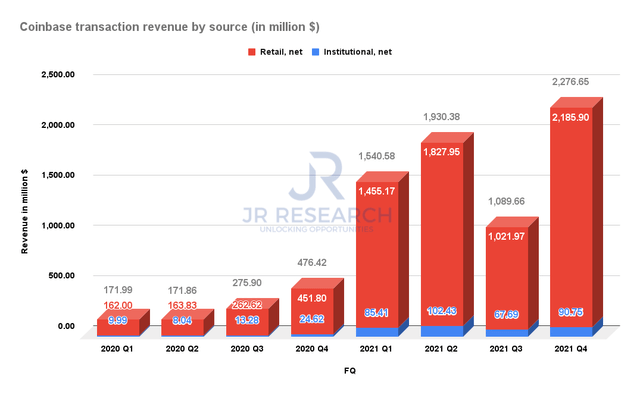

Coinbase transaction revenue by source (Company filings)

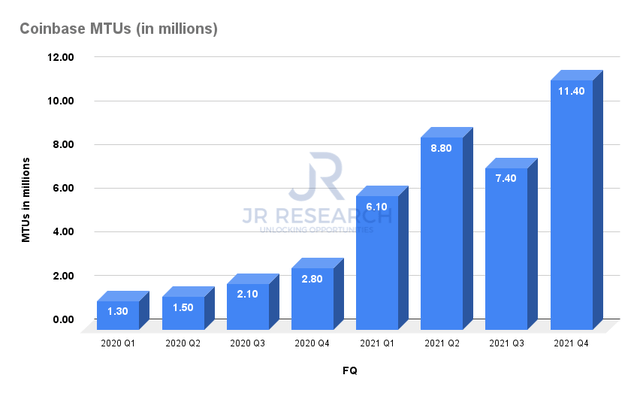

Coinbase MTUs (Company filings)

Readers can glean from the above charts and observe a robust FQ4 report by Coinbase. It reported revenue of $2.49B, of which $2.28B was attributed to transaction revenue. It also posted MTUs of 11.4M, which easily surpassed consensus estimates of 9.8M. Therefore, it was a resounding beat by Coinbase. However, the company pointed out that FY22 could be a challenging year. Notably, Coinbase noted that its MTU could vary significantly between 5M-15M. Therefore, it would adversely impact the accuracy of its revenue and profitability estimates. As highlighted earlier, the company could report adjusted EBITDA losses of up to $500M if its MTUs came in at the low end of its guidance.

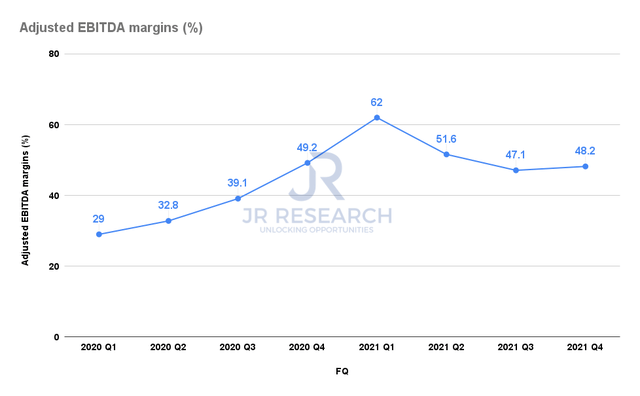

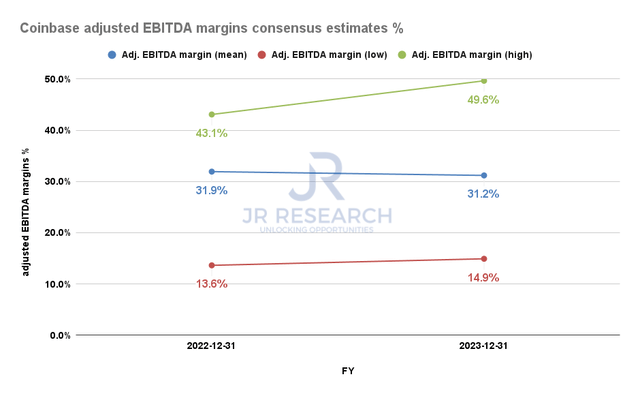

Coinbase adjusted EBITDA margins % (Company filings)

The guidance by management was a massive blow to Coinbase’s profitable business model. But, we were not surprised. We emphasized that it’s very challenging to model Coinbase’s business model given its huge reliance on retail transaction revenue, which accounted for 96% of Coinbase’s transaction revenue in FQ4. We think the company’s guidance for its MTUs for FY22 highlighted the inherent weakness of its business model. Therefore, it has diluted the “historical significance” of its adjusted EBITDA profitability trend, as seen above.

What is COIN Stock’s Forecast?

Furthermore, the company also highlighted that it’s investing in building up its capabilities in its NFT marketplace and its international expansion efforts. We welcome these opportunities to help Coinbase diversify its significant transaction-based revenue. However, they are also fraught with tremendous execution risks. Moreover, these are nascent opportunities where Coinbase is not the market leader and they are highly competitive. Nevertheless, Coinbase believes that the TAM is significant enough for many leading players to co-exist. Coinbase emphasized (edited):

So clearly there’s a significant and growing amount of volume across NFT marketplaces today, but the industry is still so nascent that we see a lot of opportunity for innovation. We definitely don’t believe that this is a zero-sum game. We’re huge fans of OpenSea and in fact we’ve been investors in their platform as members of Coinbase ventures. It’s not really about beating OpenSea. I think this is a new market. There are going to be a lot of winners. Oftentimes if you put out a product and another product looks similar in the early days, they tend to diverge over time and find their own niches after at some point. So I think just generally, we’re really bullish on NFTs. (Coinbase’s FQ4’21 earnings call)

Therefore, we think that if you invest in Coinbase for the long haul, you need to have an extremely high conviction over management’s ability to execute well moving forward. Unfortunately, while management is confident of its long-term potential, management has also not offered any guidance over its potential value to its business.

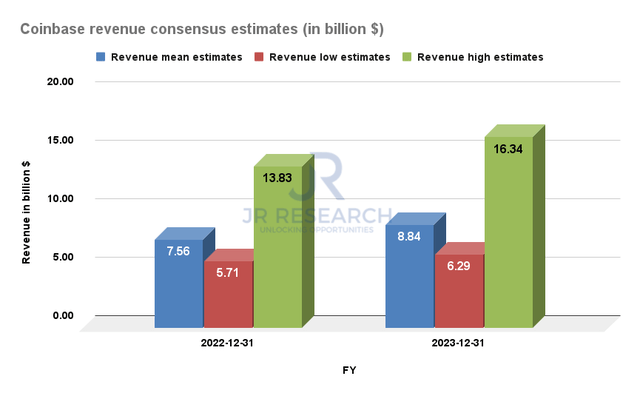

Coinbase revenue consensus estimates (S&P Capital IQ)

Coinbase adjusted EBITDA margins estimates % (S&P Capital IQ)

Furthermore, we can also glean from the above charts the significant variance in the consensus estimates. We highlighted previously that even the Street couldn’t be close enough in modeling Coinbase’s revenue and profitability. It has undoubtedly been exacerbated by the inherent volatility prevalent in its business model. Nonetheless, even the average EBITDA margins estimates have also been revised downwards to reflect the weaker than expected guidance from Coinbase. The mean estimates for FY22 suggest an adjusted EBITDA margin of 31.9%, against FY21’s 52.2%. However, the low estimates suggest an adjusted EBITDA margin of just 13.6%. Therefore, we think it’s challenging to model Coinbase’s numbers for FY22 given its highly variable guidance and business model volatility.

Is COIN Stock A Buy, Sell, Or Hold?

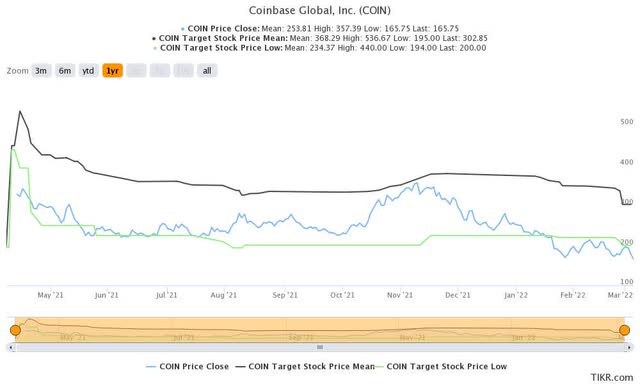

COIN stock consensus price targets Vs. stock performance (TIKR)

We can glean from the above chart and observe clearly that the average price targets (PTs) have been highly inaccurate since its listing. It demonstrated the significant difficulty in modeling what COIN stock should be worth. But, we noted that COIN stock has been trading below its most conservative PTs since the start of 2022. Moreover, we think COIN stock also seems to be oversold and could be poised for a short-term rebound. Therefore, we believe it offers a short-term buying opportunity for speculative investors. But, we do not encourage investors to hold COIN stock for the long term unless you have a very high conviction of its execution.

Consequently, we revise our rating on COIN stock from Hold to Buy for speculative investors only. Our price target for the short-term opportunity is $200, with an implied upside of 24%.