Looking to buy Yearn.Finance (YFI)? Below we dive into the ins and outs of Yearn.Finance. We explore what this crypto offers investors and what its price is likely to do.

If you’re new to cryptocurrency trading, read on to find out how to buy YFI safely and with low fees in 2022.

How to Buy Yearn.Finance – Quick Steps

Thinking about buying cryptocurrency in 2022? Here’s how to buy Yearn.Finance safely and with low fees in less than five minutes:

Step 1: Open an account with eToro – This global broker is set up with beginners in mind. Sign up with a few personal details and verify your account with some ID.

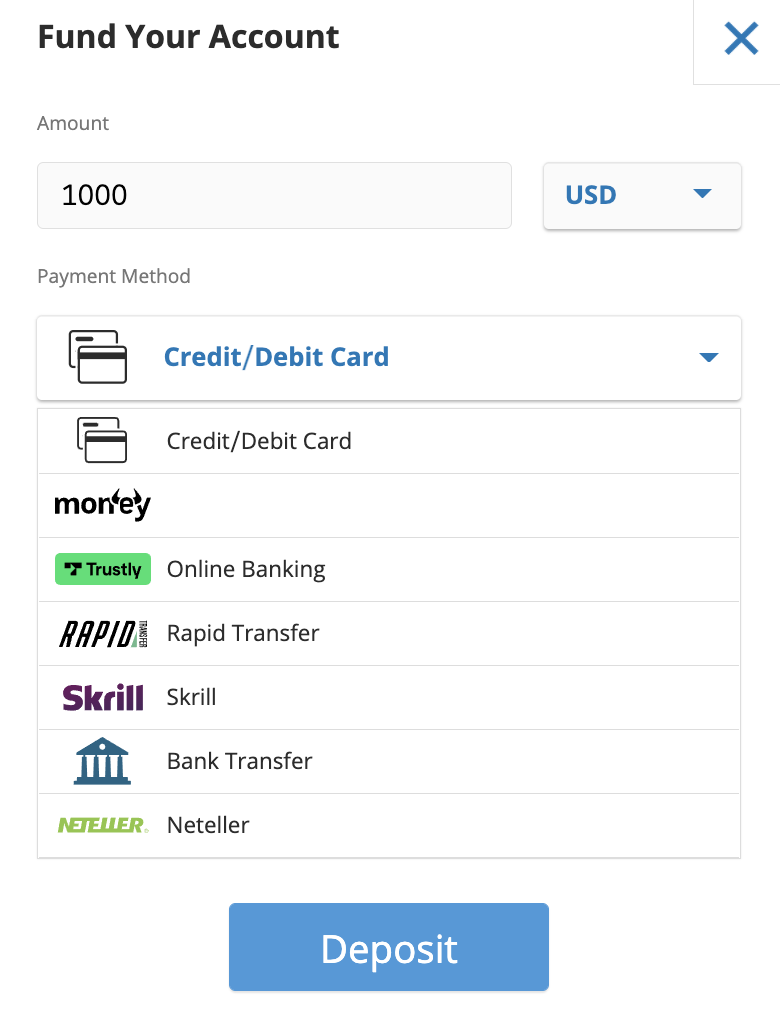

- ? Step 2: Deposit – eToro accepts 15 currencies (including GBP, EUR and USD) via bank transfer, credit/debit card and a range of e-wallets. No deposit fee applies.

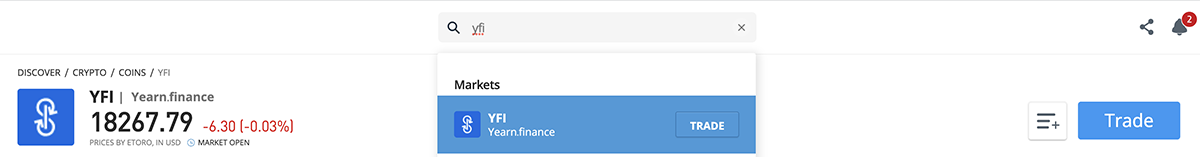

- ? Step 3: Search for Yearn.Finance coin – One of eToro’s many easy-to-use functions is Search. Simply enter ‘YFI’ in the top eToro toolbar to track down your crypto. Check out eToro’s 55+ other crypto too, as well as stocks, ETFs and commodities.

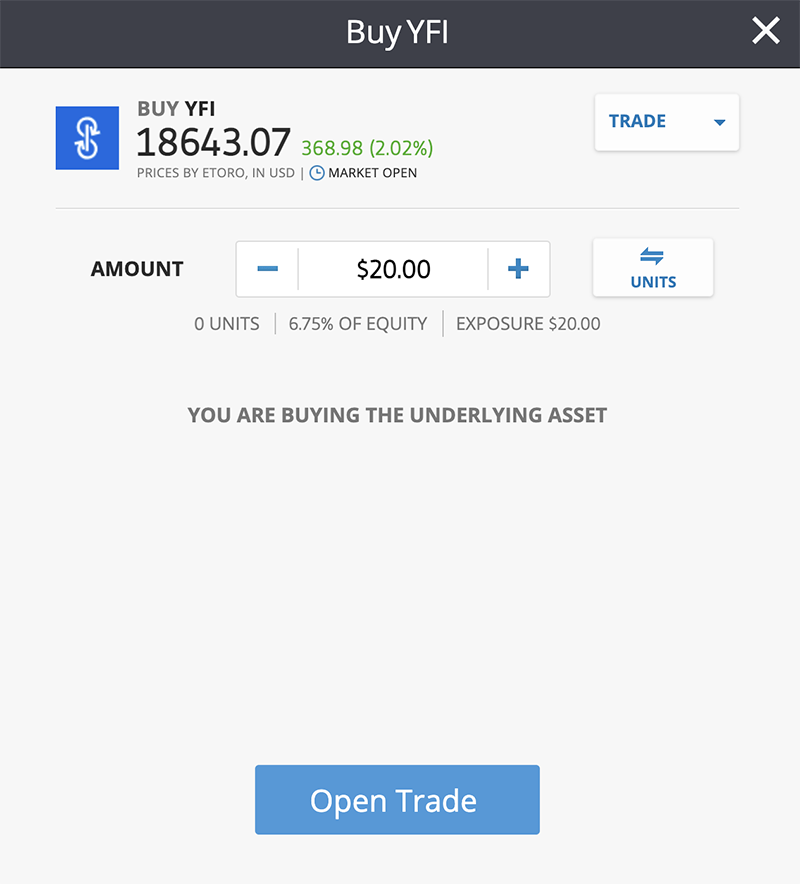

- ? Step 4: Buy – Use your account balance to buy YFI in seconds. eToro will hold your crypto until you want to sell.

Where to Buy Yearn.Finance

Below we tackle the question of where to buy Yearn.Finance with a review of leading broker eToro and three top crypto exchanges:

1. eToro – Best Broker to Buy Yearn.Finance with Tight Spreads

Since its launch in 2006, eToro has attracted over 23m users. The global broker, accessible from over 120 countries, has spent many years ensuring that its interface is easy to use as possible. This makes it perfect for beginners. You can access eToro via a desktop/laptop or via its own free smartphone app — which was the most downloaded trading app in 2021.

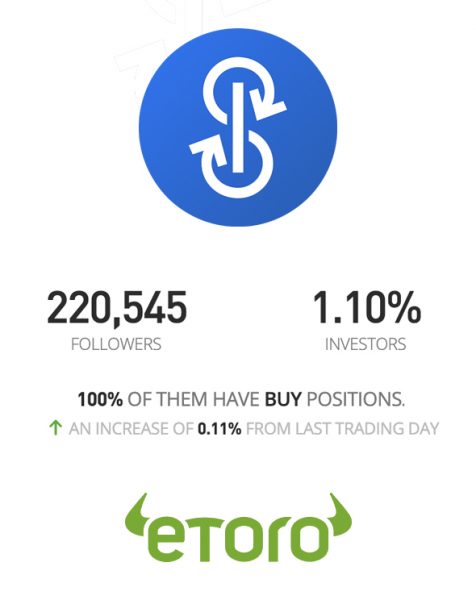

It is a great time to sign up with eToro because the broker has, in March 2022, changed its fee structure. 49 out of 55 of its cryptos are now cheaper to trade than before, including YFI. This fee reduction applies to all its crypto range, including meme coins and metaverse coins. Instead of levying a hefty bid-ask spread (the difference between buying and selling price) and 0% commission, eToro now charges a 1% fee on crypto transactions twinned with a much lighter spread. The new spread on Yearn.Finance, for example, has reduced from 2.9% to just 0.15%. Yearn.Finance has 220k followers on eToro.

Unlike many crypto exchanges, broker eToro is heavily-regulated. In the UK, it is the stringent FCA which oversees eToro operations. In Australia, ASIC; Cyprus, CySEC; in the US, the SEC and FinCEN. Regulation will not stop your trades losing money if crypto prices go the wrong way. But regulation does guarantee that you are dealing with a reputable business that is doing business by the book.

You can buy as little as $10 of Yearn.Finance with eToro. So it is not as if you have to risk much to dip your toe into crypto waters. But where eToro really stands out is in the area of social trading. With its free CopyTrader and Smart Portfolio tools, eToro ensures that the beginner to crypto is never alone when it comes to making tough trading decisions.

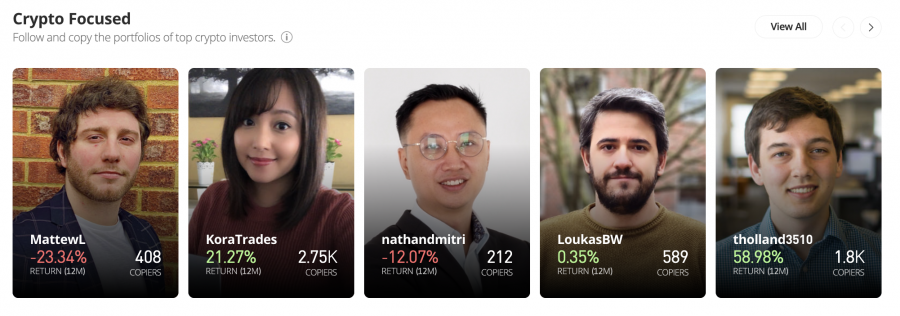

Copy trading is an idea that goes back twenty years. But, apart from general broker AvaTrade, eToro is the only broker to offer a 100% in-house social trading system. You can pick from over 600 crypto traders and copy their trades with your own money. The CopyTrader software handles everything automatically. You decide how much to invest, and how long to hang around. Best of all, you get to review traders to copy with a wealth of stats, including their risk rating and 12-month performance.

Smart Portfolios are another way that eToro makes things easier for beginners. Smart Portfolios are smart because they are designed by experts to offer different crypto investment strategies in one go. As an eToro investor, you can buy into these positions free-of-charge. Usually a minimum investment applies of $1,000.

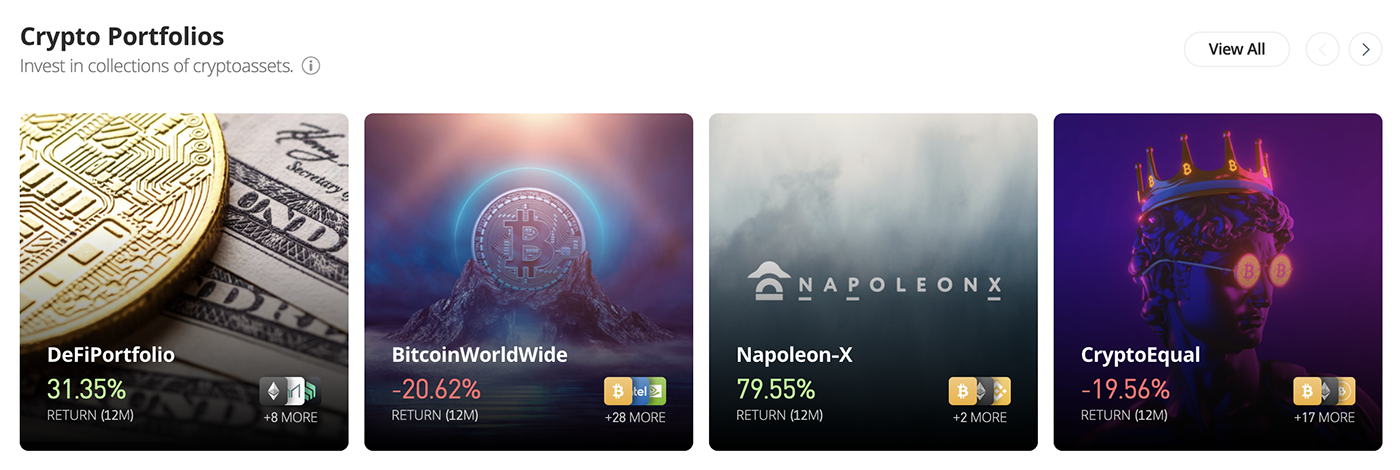

You may solely be interested in buying Yearn.Finance. But check out eToro’s DeFi Portfolio. It has achieved a return of over 30% in the last 12 months. The DeFi Portfolio allows you to spread your risk amongst several key DeFi coins including Yearn.Finance (YFI), Ethereum (ETH), Polygon (MATIC), and Algorand (ALGO). Worth looking into!

Pros

- Buy and sell Yearn.Finance with a straightforward and transparent fee of just 1%.

- Smart Portfolios and CopyTrader

- Free eToro Money crypto wallet and smartphone app

- Balance your crypto investment with stocks and 250+ ETFs available

- 23m registered users

- Regulated by the FCA, ASIC, CySEC and the SEC

- 55+ cryptocurrencies available

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Reputable Crypto Exchange with Beginner-Friendly Mobile App

Whereas eToro is a regulated broker, Crypto.com is one of the world’s 460+ crypto exchanges. It is based in Singapore and is ranked by data experts CoinMarketCap as the 16th-biggest exchange. You may have seen the TV ads for Crypto.com fronted by film star Matt Damon.

Crypto.com divides its service between a full-on trading exchange and a far simpler smartphone app suitable for beginners.

If you want to trade crypto for crypto, you can use the exchange and trade with just 0.4% fees. Here you can access advanced trading options, as well as apply to trade ‘on margin’ (this means borrowing to trade, so beginners: forget it!) You will need to buy some Tether, USD Coin, Bitcoin or Crypto.com’s native crypto CRO to get started on the exchange.

With Crypto.com’s crypto smartphone app, on the other hand, you can immediately buy up to 250 different crypto with credit card or fiat currency.

The Crypto.com app offers three key benefits in the area of finance. Firstly, you can access lucrative crypto staking options. This allows you lend your crypto out to earn rewards of up to 14.5% APY (annual percentile yield). Secondly, you can get a Crypto.com credit card which allows you to spend your crypto like fiat currency as well as earn rewards on spending. Thirdly, you can put down some crypto and borrow more crypto off the back of it.

Crypto.com offers impressive security credentials. It keeps 100% of client crypto in ‘cold’ storage (which means offline, away from hackers). And a $750m insurance fund is on hand to reimburse any client in the unlikely event of a hack.

Although Crypto.com does not offer the powerful social trading tools or high regulation of eToro, its offering is helpfully very much aimed at the beginner. Check out Crypto.com for easy-to-access crypto financing and a good range of crypto.

Pros

- Low maker/taker fees on exchange

- Great range of crypto financing options

- 100% of client crypto held in cold storage

- Trade over 170 crypto

- Instantly buy crypto with credit/debit card

Cons

- Cannot use fiat currency on main exchange

- Card fees are relatively high after 1 month fee-free period

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Popular Cryptocurrency Exchange with Huge Asset Portfolio

Like Crypto.com, Coinbase is a major crypto exchange. Based in San Francisco, Coinbase does over $1bn worth of crypto business every day and boasts 73m verified users. It was the first crypto exchange to go public on the stock markets with a 2021 IPO on the NASDAQ (you can trade Coinbase stock on eToro under the ticker COIN).

Coinbase shares a few key features with Crypto.com: you can buy crypto instantly with credit card, you can stake crypto for rewards, and you can set up a credit card to spend your crypto in the real-world. An excellent range of 170+ of crypto is offered, including of course Yearn.Finance.

Getting going with crypto purchase with Coinbase is as easy as it with eToro. You get verified with some ID, fund your account and get buying. Coinbase will then hold your crypto for you until you want to sell, or you can transfer it to your free Coinbase wallet. Like eToro, Coinbase is set up with beginners in mind: although it cannot match eToro for its powerful social trading options, Coinbase offers free crypto to complete learning modules as well as the definitive list of all crypto available in the sector. With both eToro and Coinbase, you really can learn a lot.

The major downside with Coinbase is the dual fee structure. This mixes flat fees and commissions, and has come in for a lot of stick over the years. Coinbase says its fees are under review. A definite upside of Coinbase, on the other hand, is its free smartphone app which is particularly-well reviewed. On the App Store, 1.6m users give it an average rating of 4.7/5. On Google Play, 664k users give it an average score of 4.2/5.

Pros

- Beginner-friendly

- Definitive database of all crypto on the market

- Free Coinbase crypto wallet

- Range of 167+ crypto to trade

- Free crypto wallet app

- Free crypto incentives

Cons

- Confusing fee structure

- High card fees: 3.99%

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Giant Exchange to Invest in Yearn.Finance

Binance is the world’s biggest crypto exchange. It does $12bn worth of crypto business every day. As a result of this volume, Binance can offer super-low trading fees of 0.1% as well as a giant range of 400+ crypto.

How to buy Yearn.Finance? Binance gives you so many purchase options it can be quite overwhelming. As with eToro, you can deposit fiat currency into your account using bank transfer or credit card and the purchase YFI. Or you can trade YFI for other crypto. Or you can use P2P Trading to do deals direct with other traders. If you are newcomer to crypto, be sure to set your desktop Binance interface to ‘classic’ and use Binance Lite on the smartphone app to keep things simple.

Like Crypto.com, Binance offers a fantastic range of crypto financing options. These centre around their one-stop investment solution Binance Earn, which features staking and liquidity options across a massive range of crypto. Simply browse through your options, find a deal that you can manage, lock in some crypto – and wait for the financial interest to come in.

Binance is catching up when it comes to regulation. Nowadays the exchange offers full KYC procedures (Know Your Customer), which protects against fraudulent individuals getting involved. Some users complain that the computerised verification system is difficult to use; but certainly we managed to get registered. Teething problems with KYC is, unfortunately, a sector-wide problem. But at least exchanges are doing their best to keep everybody’s money safe. Like Crypto.com, Binance has its own insurance fund to reimburse any investor who gets hacked.

If you want to strike out and see what the crypto world has to offer, Binance is an ambitious destination. We would recommend, though, that beginners take advantage of eToro’s recent fee decrease and learn the ropes in a regulated buying space first.

Pros

- Low trading fees (0.1% commission)

- 400+ crypto to choose from, including YFI

- Numerous ways to buy crypto

- Binance ‘SAFU’ insurance fund

- Free Binance Trust crypto wallet

- 24/7 phone support

- Crypto futures trading

Cons

- Unregulated by financial authorities

- Many options can be overwhelming for crypto newbies

Cryptoassets are a highly volatile unregulated investment product.

What is Yearn.Finance ?

Yearn.Finance (YFI) is a top DeFi crypto. YFI is the governance token for the Yearn platform. You can use YFI to get involved in how the Yearn platform is run, or simply buy Yearn.Finance coin as an investment.

With Yearn, anybody can deposit crypto and choose to trade it for other crypto or use it to earn rewards through staking in liquidity pools. Yearn acts as a gateway for a range of crypto financing products provided by big names like Aave, Balancer and Curve.

Yearn.Finance was launched in 2020 by a single developer Andre Cronje. YFI is the 95th-biggest crypto (according to CoinMarketCap) with a market capitalisation of $670m. Approximately $80m YFI changes hands every day.

Is Yearn.Finance a Good Investment?

Buy the Dip

It is always difficult to predict when an asset price is bottoming out. But what is certain is that, at just under $20,000, YFI has not been this cheap since November 2020. At this price it then quadrupled in value over the next six months. The crypto market as a whole is so governed by irrational investor sentiment that it is entirely possible that this could happen again. But, of course, the YFI price could do the opposite and drift further.

Be sure to minimise your crypto risk by a) investing only 1% of your total portfolio in crypto and b) spreading your crypto investment around different crypto sectors and coins. One risk management strategy you might check out is to receive crypto signals from expert companies, with guidance on individual crypto trades.

Get in on DeFi

The Total Value Locked (TVL) into the DeFi sector has increased by a staggering 80 times over the last two years. As a gateway to a range of DeFi products, Yearn.Finance is well-positioned to benefit from ongoing support for the DeFi sector.

Diversify your DeFi Investment

Yearn.Finance has a LOT of competition. That’s just the way the DeFi sector is. Now that it has been established that crypto financing offers far better returns than the traditional banks can offer, numerous companies are setting up. That’s why investing in a spread of DeFi companies makes sense; check out eToro’s DeFi Smart Portfolio, for example.

Assess your Risk Appetite

All crypto investment is risky. That is because crypto is a new sector. Nobody is sure whether it will take over the world, or become an offshoot to TradFi (Traditional Finance). But risk is the price we investors pay for a chance at reward. Compared with other crypto, Yearn.Finance has a medium-to-high risk profile. As a DeFi coin that is based on real business, Yearn.Finance is nowhere near as risky an investment as an obscure meme coin that offers no business value. But, as noted above, YFI’s underlying business Yearn faces stiff competition. Certainly YFI is more risky than the giants of the sector Ethereum (ETC) and Bitcoin (BTC) — but the potential gains it offers are higher.

Back the Underdog with Real Bite

A standout feature of Yearn.Finance is that it got off the ground without any funding and without a team; just one developer, Andre Cronje, is responsible for the Yearn platform. For YFI to now be the 95th-biggest crypto is quite an achievement, and suggests that the business model for the Yearn platform is sound.

Yearn.Finance Price

During the last two weeks or so, the YFI price has dropped by roughly 7 percent. In the previous 24 hour period, the Yearn.finance price has risen by about 2.5 percent. The price has increased by 0.63 percent in the last hour. The current price per YFI is floating around the $18,800 mark. Yearn.finance is now trading at 79.89 percent of its 2021 all-time high of $93,435.53.

According to CoinMarketCap, Yearn.finance is ranked 96th with a market capitalization of $688,296,916.23 and a circulating supply of 36,638 YFI crypto coins. If you’re wondering how to earn YFI tokens you can do this by providing liquidity, with token holders also gaining voting rights.

In terms of Yearn.finance’s YTD price performance it has been riding a bearish wave falling from its January highs of $40,000 to its current price of $18,886.40. This represents a drop of -52.784%.

Yearn.Finance Price Prediction

The price of Yearn.Finance depends, like all crypto, on investor sentiment concerning crypto as a whole. Most crypto, including YFI, tend to move in the direction that market-leader Bitcoin takes, and this depends largely on how investors feel about the future of crypto as a whole. Crypto is held by institutions as a hedge against inflation, and global inflation is rocketing — but fears of a recession have created something of a ‘crypto winter’ since the New Year. As a result, we expect the Yearn.Finance price to drift in the short-term.

However, an outstanding feature of YFI price performance is its durability since hitting its all-time-high of $80,000 last summer. Review the price chart above and notice how the price has refused to collapse and rather stay within the band of $20,000 to $40,000. YFI could well hit a price of $40,000 by 2023.

Ways of Buying Yearn.Finance

Buy Yearn.Finance with PayPal

With Coinbase, you can buy Yearn.Finance with PayPal (depending on which country you live in). With Binance, you can use PayPal for P2P trading; you might be able to pick up some YFI this way, depending on what deals are on offer. With Crypto.com, you can use PayPal to top up your Crypto.com Visa card. Nowadays crypto broker eToro offers the eToro Money crypto wallet as an alternative to PayPal that makes for a seamless digital asset ecosystem all in one place.

Buy Yearn.Finance with credit card or debit card

Where to buy Yearn.finance with a credit card? Be smart and think outside the box: one of the cheapest ways to invest in Yearn.Finance with a credit card is not with instant credit card purchase, but by charging your eToro account with credit card (no deposit fee) and then buying YFI with your deposited funds. You can use the best crypto exchanges such as Crypto.com, Coinbase and Binance to buy YFI direct with credit card, but credit card fees are charged.

Best Yearn.Finance Wallet

If you are pondering how to invest in Yearn.Finance, allow us to clear up a key point: you do not need to own a crypto wallet to buy YFI or to sell it. Top brokers and exchanges allow you to buy crypto and will then hold it for you until you are ready to sell.

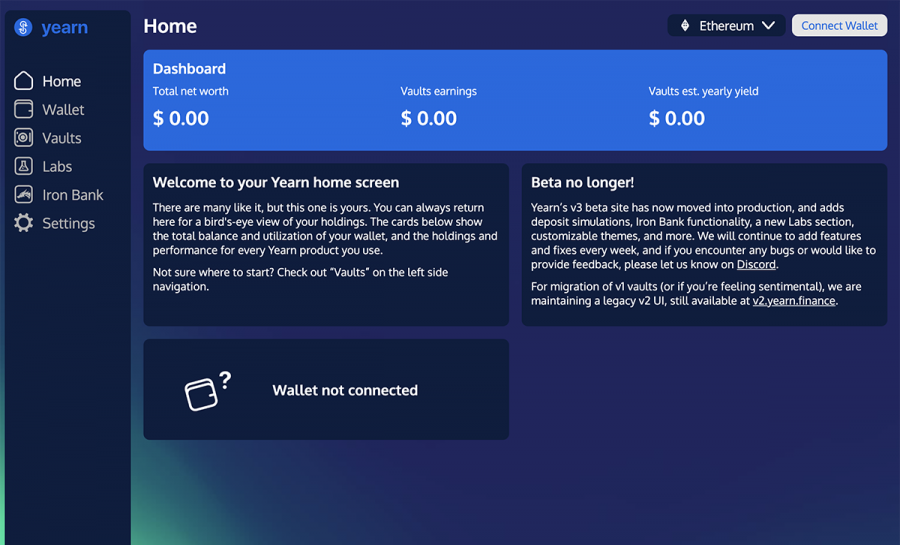

Crypto wallets are needed when you want to send crypto around the internet, or to plug into DApps (Decentralised Applications). You need a crypto wallet, for example, to plug into the Yearn platform, and browse through the crypto lending and financing options available.

We recommend the eToro Money crypto wallet. It acts as a vault where you can keep all your digital assets in one place as well as a fiat currency balance. You can send and exchange crypto, as well as stake certain crypto direct with eToro. The best thing about eToro’s wallet is that is regulated (by the Gibraltar Financial Services Commission); this is a rare attribute indeed in the world of crypto wallets.

How to Buy Yearn.Finance – Tutorial

1. Choose a Broker or Exchange

How to buy YFI? It all begins with choosing between a broker like eToro or an exchange like Crypto.com, Coinbase or Binance. We have used regulated broker eToro for our tutorial guide to buying Yearn.Finance. Where to buy YFI crypto is a decision you will have to make yourself; but eToro certainly offers one of the easiest ways to get started.

2. Sign up with eToro

Head to eToro.com. Fill in a few personal details or sign up quicker with your Facebook or Google account.

3. Verify your ID with eToro

Supply scans of proof of ID and proof of address. Use a valid scan of your passport for quickest verification.

You will receive a notification email from eToro as soon as you are verified. Now you are ready to get buying.

4. Deposit Funds with eToro

Log into your eToro account. Press the blue ‘Deposit Funds’ button at the bottom left of your interface. You can then deposit any of 15 fiat currencies using a variety of methods: credit/debit card, bank transfer or e-wallet. For frictionless transfer, move fiat currency from your free eToro Money crypto wallet. No deposit fee is charged by eToro, but a currency conversion does apply if you are depositing any currency other than USD.

5. Buy Yearn.Finance with eToro in Seconds

First, find Yearn.Finance’s homepage on eToro. Type ‘YFI’ into the top toolbar:

Click on the logo to access the YFI homepage and review stats, opinions and powerful charting options. When you are ready to finalise a trade, press the blue ‘Trade’ button.

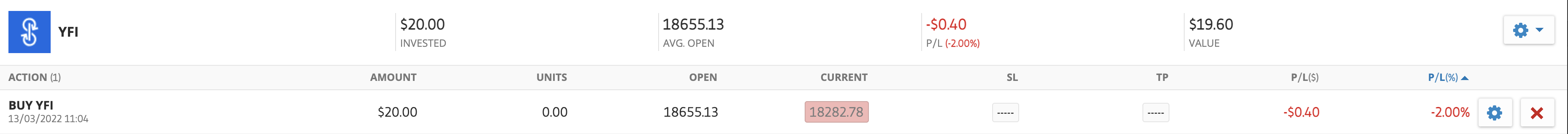

Simply enter how much you want to spend on YFI and press ‘Open Trade’ to finalise your order. You will receive onscreen notification of your purchase. You can then review your purchase in your portfolio. Note that eToro levies its 1% fee on purchase and 1% fee on sale at the start of your order; so do not be alarmed to see that you are immediately in the red.

Cryptoassets are a highly volatile unregulated investment product.

How to Sell Yearn.Finance

eToro will always buy your crypto back from you. So you don’t need to worry about finding a buyer. To sell, locate YFI in your portfolio:

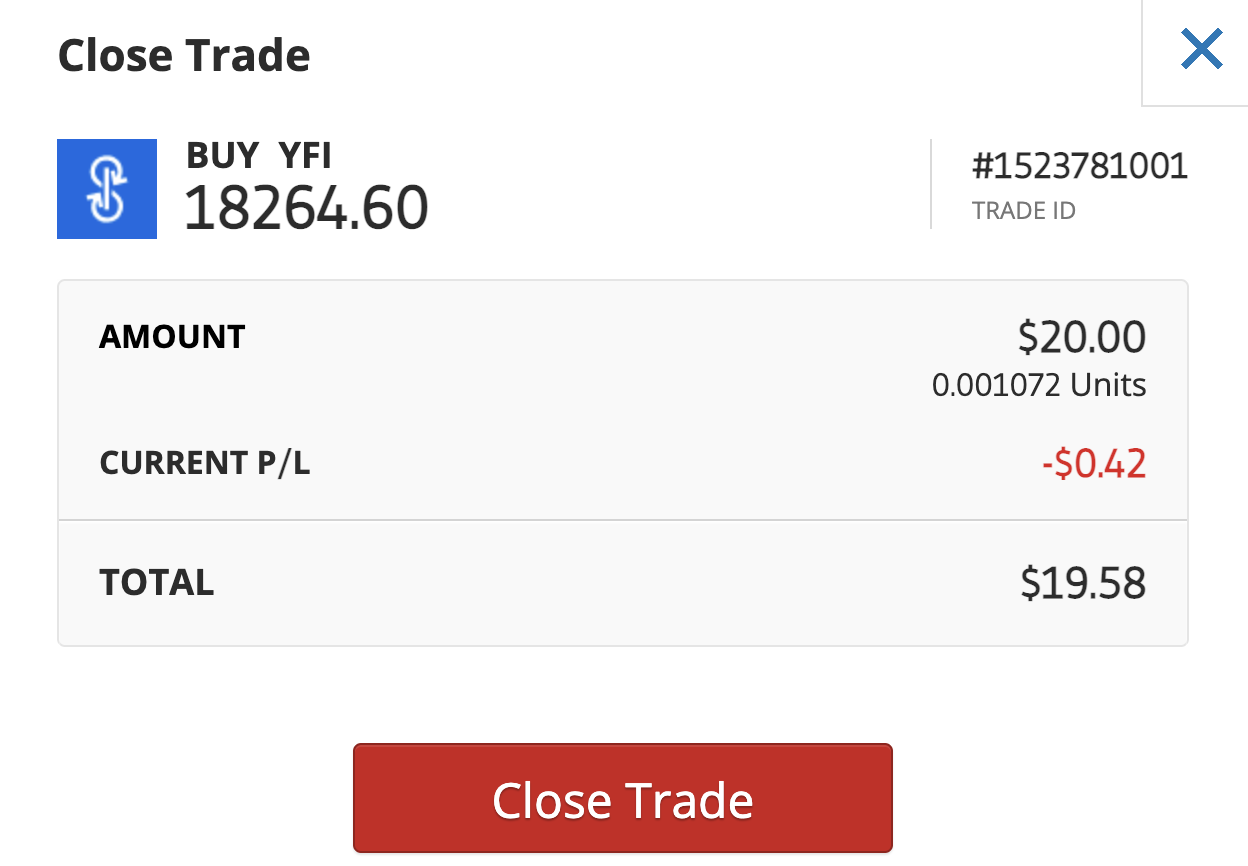

Click on the blue cog icon to the right to access details of your trade:

Press the red cross icon to the right to begin closing out of your trade:

Press the red ‘Close Trade’ button to exit your Yearn.Finance position. Your eToro balance will immediately be credited with the proceeds.

Conclusion

We have looked at how to buy YFI (go online!), where to buy Yearn.Finance (with a top broker or exchange) and even when to buy Yearn.Finance (when the price is low). But should you buy YFI? As a DeFi coin, YFI certainly offers investors the reassurance that its price is not purely based on sentiment, but grounded in real-world business.

If you are a crypto newcomer, we can recommend the three exchanges we have covered because they all go out of their way to help the beginner. But there’s no topping broker eToro when it comes to two key areas: regulation and social trading. Regulated crypto trading is such a bonus, because it means you are definitely dealing with a decent company. And social trading means you never have to face the ins and outs of the crypto world alone. With a range of freebies on offer too, eToro is our standout recommendation for best overall place to invest in Yearn.Finance.

Cryptoassets are a highly volatile unregulated investment product.

Frequently Asked Questions on Yearn Finance

Can you buy Yearn Finance on Coinbase?

Where can you buy Yearn Finance?

Is YFI a good investment?

Is Yearn.Finance going up?

Is Yearn.Finance undervalued?

Can you buy YFI?