Most cryptocurrency enthusiasts and anyone who follows the financial markets are aware that crypto exchanges make a lot of money. However, many people don’t know how these exchanges make money. This article looks at Coinbase Global Inc. (NASDAQ: COIN) and its revenue sources, spending habits, future prospects and balance sheet.

How Coinbase (COIN) Makes Money

Coinbase generates revenue in a variety of ways, the most obvious being through transaction fees. Coinbase also earns money from maker-taker fees on Coinbase Pro, interchange fees, interest on cash and personal loans and the sale of software tools.

Coinbase has a tiered fee structure depending on the transaction amount.

Flat fees

- Transaction amount less than $10: the fee is $0.99

- Transaction amount more than $10 but less than or equal to $25: the fee is $1.49

- Transaction amount more than $25 but less than or equal to $50: the fee is $1.99

- Transaction amount more than $50 but less than or equal to $200: the fee is $2.99

Variable fee

- Transaction amount more than $200: the fee is 1.49% (bank account, Coinbase card), 3.99% (debit card).

Maker-taker fees Coinbase Pro

Coinbase Pro fees are lower than Coinbase fees. If you want to save on transaction fees, use Coinbase Pro.

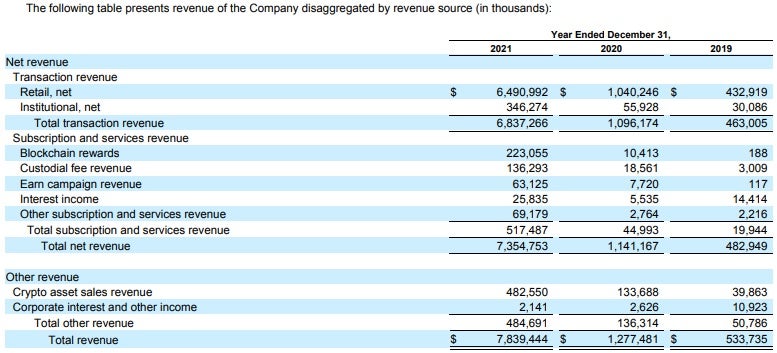

Coinbase’s total transaction revenue includes fees paid by retail and institutional investors. Coinbase reported over $6.8 billion in transaction revenue for year-end 2021, up from just over $1 billion in 2020.

Subscription and Services Revenue

Blockchain rewards, custodial fees, its Earn campaign program, interest income and other subscription and service fees contribute to Coinbase’s revenue. In 2021, Coinbase reported total revenue of $517.4 million for these services, an increase from just under $45 million in 2020.

Other Revenue

The final source of revenue is from the sale of crypto assets, corporate interest and other income. Coinbase reported over $484.6 million in revenue from these sources in 2021, up from just over $136.3 million in 2020.

Coinbase reported over $7.8 billion in revenue for 2021 when all revenue sources were added together, which represents a significant increase over the previous year’s figure of nearly $1.3 billion. The majority of Coinbase’s revenue is still generated by retail investor transactions. However, if Coinbase can continue to grow its institutional investor base while increasing subscription and service revenue, that gap may close.

Is Coinbase (COIN) Worth Investing In?

According to the annual report for 2021, investing in Coinbase seems like it could be a smart choice based on its revenue increase over the last three years. However, past performance does not guarantee that the revenue stream will continue to grow.

It’s great to have a rapidly expanding revenue stream, but you also need to consider the big picture. Important factors to consider are the company’s future plans and its position in relation to its competitors.

Pros

- Strong year-over-year revenue increases

- Over 89 million verified users

- Available in over 100 countries

- Over $278 billion worth of assets on the platform

- In existence since 2012

- Multiple income streams

- Cryptocurrencies still in the early adoption phase

- Easy-to-use trading platform

- Advanced trading platform on Coinbase Pro

- Growing institutional investor base

- NFTs could open up new revenue streams

- 54% profit margin

- Over $7 billion in cash and equivalents

Cons

- Unknown regulatory environment

- Risk of an exchange hack

- Risk of a long-term crypto bear market

- Possibility of a Black Swan event

Coinbase Global, Inc. Overview by FinViz

Looking at the list of pros and cons, the pros dominate. However, some of the cons pose serious risks. A major consideration is your investment time horizon. With the possibility of a prolonged bear market, patience is warranted. Slowly building a position over an extended period would be the safest strategy. Currently, COIN is down around 50% from the November high and only about 16% above its all-time low.

Should You Use Coinbase (COIN)?

Coinbase is one of the Internet’s largest cryptocurrency trading platforms. From Bitcoin to Litecoin or Basic Attention Token to Chainlink, Coinbase makes it exceptionally simple to buy and sell major cryptocurrency pairs.

You can even earn cryptocurrency rewards through Coinbase’s unique Coinbase Earn feature. More advanced traders will love the Coinbase Pro platform, which offers more order types and enhanced functionality.

Though Coinbase doesn’t offer the most affordable pricing or the lowest fees, its simple platform is easy enough for complete beginners to master in as little as a single trade.

Best For

- New cryptocurrency traders

- Cryptocurrency traders interested in major pairs

- Cryptocurrency traders interested in a simple platform

- Simple platform is easy to operate

- Comprehensive mobile app mirrors desktop functionality

- Coinbase Earn feature rewards you with crypto for learning about available coins

- Higher fees than competitors

For traders and investors with less experience trading, Coinbase’s standard trading platform is user friendly. Keep in mind, though, that in addition to higher fees, Coinbase also includes a spread in the price when using the standard trading platform.

Coinbase Pro also has an advanced trading platform that gives you access to the order book with real-time data. With the addition of the advanced trading platform and an excellent selection of crypto, Coinbase is great for new users and experienced traders alike.

Coinbase has dependable security features plus crime insurance in case of a hack. However, security risks accompany the use of crypto exchanges. It is best to transfer large amounts of crypto into a cold storage hardware wallet.

As a publicly-traded company, Coinbase makes sure its safety and security standards are as secure or more secure than industry standards. Coinbase users can feel confident linking their bank account and completing financial transactions.

What Does Coinbase (COIN) Spend Money On?

The 2021 annual report shows that Coinbase spent almost $1.3 billion on transaction expenses. It spent another $1.3 billion on technology and development. Sales and marketing for 2021 cost nearly $664 million. General and administrative costs totaled almost $910 million. Other operating expenses for 2021 totaled over $630 million.

How Is Coinbase (COIN) Funded?

In 2013, Coinbase participated in the Y-combinator incubator program. Venture capitalist (VC) Garry Tan became one of Coinbase’s first investors when his VCl firm, Initialized Capital, wired Armstrong $200,000.

Coinbase held a Series A round of funding in 2013 that raised $5 million selling shares at $0.20 each. Fred Wilson’s VC firm Union Square Ventures was a significant investor in that round. Other notable early investors included Andreessen Horowitz and Ribbit Capital. Coinbase held four more funding rounds, with the share price increasing dramatically with each subsequent round. The table below shows the details of each round.

Source: CNBC

On April 14, 2021, Coinbase went public via a direct listing on the Nasdaq exchange. Shares of COIN opened at $381 and hit a high of $429.54 before pulling back and closing at $328.28. That closing price gave Coinbase a valuation of $85.8 billion. Because Coinbase was already profitable, it chose to go public by direct listing instead of an initial public offering (IPO). The direct listing meant that no new shares were issued or sold. It also meant no lock-up, allowing employees and existing shareholders to sell shares immediately.

Coinbase (COIN) Outlook for 2022 and Beyond

So how is Coinbase doing right now, and how is it positioned for the future? Coinbase reported over $7 billion in cash and cash equivalents in its 2021 annual report, which would serve it well through an extended bear market. It also provides it with the ability to make an acquisition if the opportunity arises.

The rest of the balance sheet looks strong as well, with a current ratio of 1.61 that exceeds Apple Inc.’s (NASDAQ: AAPL) at 1.54. Financially Coinbase appears to be in good shape. However, that doesn’t necessarily mean that it is all clear sailing. Coinbase will still need to work to keep expanding its institutional investor base as well as bring in new retail investors.

The outlook for Coinbase in 2022 is still a bit cloudy. Coinbase is tied closely to the overall crypto market, which remains in a bear market. For now, the price of Bitcoin has stabilized around the $40,000 level, but the risk of further downside remains.

Coinbase is making the right moves to set itself up for continued growth in the future. Coinbase plans to launch Coinbase NFT, its own non-fungible token (NFT) marketplace, soon. It has also recently teamed up with Mastercard Inc. (NYSE: MA) to facilitate the purchase and sale of NFTs.

Coinbase CEO Brian Armstrong announced a strategy late last year that will guide the company over the next 5+ years. The growth strategy is based on three pillars — crypto as an investment, crypto as a new financial system and crypto as an app platform. These moves and others that Coinbase has been making should set it up well for the next several years.