ismagilov/iStock via Getty Images

The so-called asset class that has boomed in the last year is non-fungible tokens (NFTs), which have grown from $74 million in total sales at the beginning of 2021 to over $41 billion today. Everyone is getting on the NFT bandwagon, which has even seeped into pop culture. Saturday Night Live has parodied them. Jimmy Fallon, Paris Hilton, and Justin Bieber each bought one or more. Snoop Dog is one. There is now an NFT museum in Seattle. Many companies have created them: Mattel (MAT) has Hot Wheels and Barbie NFTs, Taco Bell (YUM) has taco NFTs, and McDonald’s (MCD) has McRib NFTs.

NFTs are specialized cryptocurrency tokens. Each is unique and attached to it is a record of ownership of a digital asset. A digital asset can be almost anything, but usually a picture, video, or music file; occasionally it is not digital, but a physical asset, such as a tennis shoe. A cryptocurrency’s blockchain has the structure of NFTs built into it. A blockchain is the computer code behind a cryptocurrency and its ledger records the ownership of an NFT and its digital asset. Ethereum is the most common blockchain used for NFTs because it was the initial one to have the structure for NFTs built into it. The blockchain does not attach the digital asset to the token, it only records the ownership of the asset, and usually a weblink to the asset. The creator or seller of a digital asset can store the asset anywhere. (For more details on NFTs, see the article “What is an NFT?”)

NFT traders buy, sell, and create (called minting) on NFT marketplaces. There are more than 150 different NFT marketplaces today, structured as auction sites like eBay’s (EBAY). The largest is OpenSea, which historically has had a market share of over 90% and has total transaction value as of today of over $21 billion. A very recent entry into NFT marketplaces, LooksRare, has captured a sizable piece of OpenSea’s market share, but it is yet to be seen if they can maintain that position. Other smaller marketplaces include Rarible, SuperRare, and Foundation.

Clearly, certain aspects of NFTs have become trendy. But are they any good from an investment perspective? My concern is that many participants in this market position NFTs as interesting investment propositions, even though there is no evidence to indicate this. I know of only one study that has looked at the performance of trading in NFTs, which concluded that only a minority of speculative NFT traders earn positive returns. On top of this, the structure of NFTs and NFT marketplaces are inherently unsecure and open to fraud.

In this article I will first discuss the market for NFTs, how NFTs are priced in the market, and then examine their investment potential. Next, I will discuss issues and risks inherent in NFT investing, followed by a discussion of whether the returns outweigh the risks to make NFT investing viable. I conclude with a section on if and how you can get exposure to NFTs via public investments.

Traders Have Concentrated NFT Speculation in a Few NFT Collections

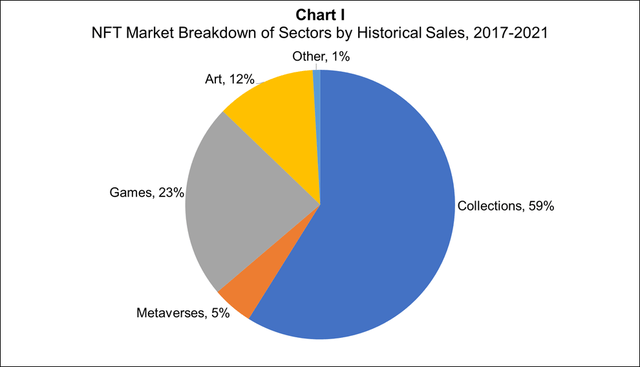

Analysts typically split the NFT market into four main sectors: collections, metaverses, games, and art. Data sites bucket individual NFTs into these sectors based on their details, such as how it was created, whether there are other NFTs similar to it, how and where it can be used, and so on. Many think of NFTs as art, but this is only one side of the NFT marketplace, and one of the smaller ones. The NFT world is truly diverse with numerous distinct types. By breaking the market into sectors, we get a better understanding of this diversity and how the NFT universe is evolving and where it might go.

A collection is a set of NFTs all produced by the same creators, and the NFTs are somehow similar to each other, while being different enough to make them interesting. The creators usually generate each of the collection’s NFTs in an analogous manner, such as by randomized artificial intelligence or based on a pattern. As seen in Chart I below, most of the trading in NFTs, by total historical sales value, is in digital assets from collections, which have a 59% market share. We see this reflected in the number of collections available in the NFT ecosystem today: over 3,200, up from around 200 just a year ago.

nonfungible.com

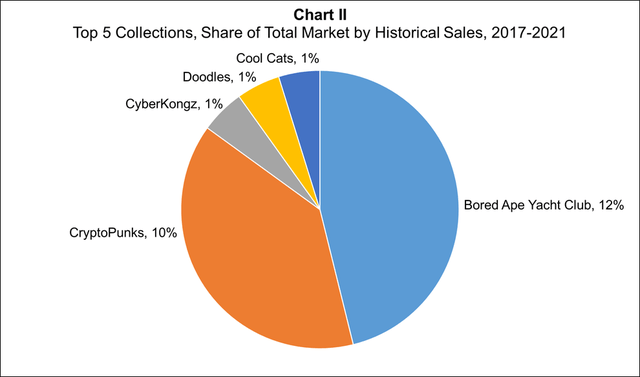

In Chart II below, I present the market shares out of the total NFT market by historical sales of the top five collections at the end of 2021. The most popular collection is the Bored Ape Yacht Club, with historical sales of $2.4 billion and an overall market share of 12%. The Bored Apes are a collection of 10,000 different disinterested apes. You can see what they look like on the OpenSea marketplace here. The second most popular collection is the CryptoPunks, with $2.0 billion in total sales and a 10% market share. CryptoPunks are 24×24 pixel images of oddballs that the creators randomly generated using algorithms, you can see them on OpenSea here.

nonfungible.com

A metaverse is a virtual world designed for humans to interact with each other, where they can mint, buy, and sell NFTs, play NFT games, and experience things as they would in the real world. As shown in Chart I, metaverse NFTs have a small market share, only 5%. The Sandbox (SAND-USD) is by far the largest NFT metaverse, with more than $400 million in historical sales. The Sandbox’s NFT elements, such as avatars, land, and other pieces, can bought and sold inside or outside of The Sandbox.

NFT games are play-to-earn computer games, where it is possible to buy and sell in-game NFTs with other players and earn NFTs as awards. The structure of NFT games allows players to have the freedom to create their own games, using various themes. The game sector has total historical sales of $4.5 billion and a 23% share of the total market. Axie Infinity (AXS-USD) is the largest NFT game, dominating the sector with $3.6 billion in historical sales and a 17% share of the overall market (74% of the game sector), and is the bestselling set of all NFTs. The Axies are NFT pets, fantasy creatures that can be collected, raised, and trained. Players must buy them before they can play the game and can collect and trade them during the game; in addition, anyone can collect these NFT pets outside the game.

As art, NFTs are deeds of ownership for digital art pieces. The art sector has all-time sales of $2.3 billion and a 12% market share (see Chart I). Art Blocks are the most popular NFT art pieces sold, with total historical sales of $1.4 billion and a 7% share of the overall market. Art Blocks are on-demand artworks created in the Art Blocks marketplace, randomly produced by an algorithm defined by an artist.

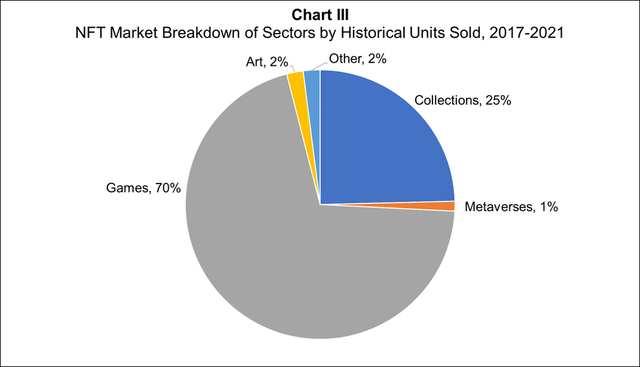

To put the above segments into further perspective, Chart III breaks down the market by the historical number of units sold. In this market decomposition, games have a 70% market share, collections 25%, and art only 2%. What we learn by comparing Charts I and III is that gaming-for the most part not really an investable sector-is the most active. In contrast, the art sector, which is much hyped, is actually not that active. Collections, the most important sector for investing, is the largest in terms of the total value of trades, but due to the high prices of collection NFTs, it is much smaller when it comes to activity.

nonfungible.com

The five major groups of NFTs I discussed above – the Bored Apes, CryptoPunks, Axies, The Sandbox’s avatars, and Art Blocks – are all collections. This shows how the concept of a collection category is becoming blurred. (I will explain the economics behind why this is the case in the next section.) These five collections together accounted for 50% of the overall NFT marketplace at the end of 2021; the next five highest selling NFTs account for another 15%.

At the top, the NFT universe is very concentrated, and it is within this concentration where speculators make money. The rest of the market is very fragmented because of the influx of new collections and individual NFTs by those who perceive a new gold rush. The top part of the market is competitive, with NFTs fighting for attention. Those that get sufficient social media awareness will pop, drawing traders and pushing their prices up. Traders can monitor the hottest NFT trends on websites that track and rank NFT trading, see for example OpenSea’s list here.

Not All NFT Prices Go Up and Up

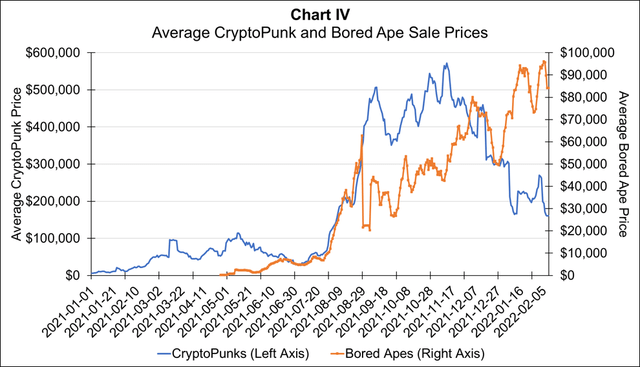

The time series plot below, Chart IV, shows the historical average sale prices for the CryptoPunk and Bored Ape NFTs. Looking at these price plots, we can see periods when prices trend upwards and traders could have earned positive profits, and, of course, the opposite. If you purchased an average CryptoPunk on July 1, 2021, and sold it today, you would have earned over 400%; for an Ape, over 1,500%. CryptoPunk prices have been declining since last November, in line with declining Ethereum (ETH-USD) prices. If you bought an average CryptoPunk at its peak on November 9 and sold it today, you would have lost 71% of your investment; Ethereum fell 37%.

nonfungible.com

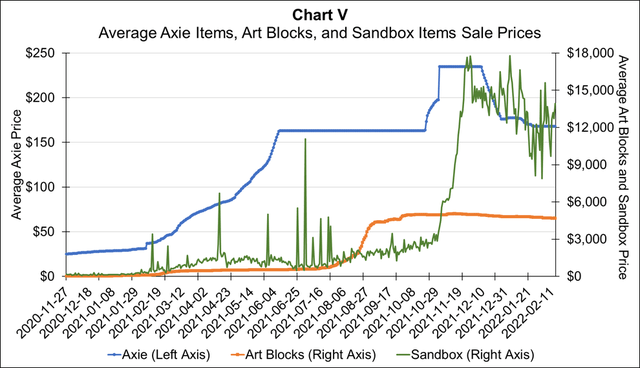

Chart V presents the average historical prices for Axie items, Sandbox items, and Art Blocks NFTs. As we can observe in this chart, not all prices follow a simple climb up, and maybe down. Rather, some prices just stay flat for extended periods, such as those for Axies and Art Blocks. Also, we see a lot of daily volatility in the prices for Sandbox pieces.

nonfungible.com

These are important takeaways, as not all NFT prices keep climbing up and some prices can be very volatile. Although, the Apes’ prices have trended sharply higher, and it might seem straightforward to earn a positive return trading in these, you need to be careful, as I discuss in the next section. In my view, there might be a bubble in the Ape prices, and they could crumble down.

Another thing to notice from Chart IV is that the average sale prices for the CryptoPunks and the Apes are both high today, currently $160,000 and $85,000, respectively. From Chart V, the price for Axie game pieces are the cheapest of the five presented, currently at $168. But the prices for both Art Blocks and Sandbox pieces, while cheaper than the Punks and Apes, are still high at $4,700 for the Art Blocks and $14,000 for the Sandbox pieces. When I examined all the top 20 collections, all but three had average sales prices above $3,000. The high prices for NFTs indicate that the returns mentioned earlier are not available to a large swath of investors because the minimum investments are so large.

There Might Be Price Bubbles in Some NFT Collections

Regardless of how investors trade, whether it is based on fundamentals, technical analysis, or arbitrage, market forces usually push asset prices to align themselves, so they are correctly priced relative to each other. This is both a good and bad aspect of how financial security pricing works. It is good because, across time, it helps eliminate pricing discrepancies between securities. It is bad because the mispricing of one security can cause mispricing in others.

This is the reason why we see most trading and, presumably, speculation, as well as some soaring prices, occurring within NFT collections. Investors can compare NFTs from the same collection to each other because they typically share some similarities. Because they share similarities, I call these NFTs within the same collection semi-fungible tokens because you theoretically can trade one for another at a price differential.

Thinking this way is important because it makes the valuation of these semi-fungible tokens easier. For two semi-fungible tokens from the same collection, market forces should align their prices relative to each other, with one’s price approximately a multiple of the other depending on their differing characteristics. This is the same valuation technique that we apply to stocks when we conduct a multiples valuation. This technique, however, will not work for truly unique NFTs because they do not have common characteristics upon which to build a relative relationship. Because this relative pricing method works well within an NFT collection, we are seeing many collections sprouting up (even inside the non-collection sectors, such as art). Investors prefer some basis to understand how much they should pay for an NFT.

Multiples valuation is not the greatest technique to value stocks; however, at least with stocks we have fundamentals and discounted cash flow analysis to fall back on. Unfortunately, this is not the case with semi-fungible tokens. Because there are no fundamentals for these tokens, this relative pricing approach is the best we can do, but it comes with a major problem. What if you value one semi-fungible token from a collection off another from the same collection via a multiple, and that one is overpriced? Then you will also overvalue the semi-fungible token you are interested in. Then other traders repeat this relative pricing throughout the collection, and the complete collection becomes overpriced, and a price bubble forms. In my opinion, this is what we are seeing today with some of the more expensive NFTs, such as the Bored Apes.

This is analogous to the dot-com bubble in the late 1990s. The dot-coms were all new start-ups that had little or no revenue, plus negative earnings-so really, no fundamentals to fall back on. Therefore, analysts priced dot-coms relative to other already listed dot-coms using non-financial metrics, such as clicks to a website. And what did we see? A bubble. The problem with bubbles, of course, is that they burst when enough investors decide to cash out. Of course, not all bubbles have to burst, they can slowly leak air, and, in my view, this might be happening today with the prices of the CryptoPunks.

Money Is Hard to Earn in NFT Investing

A recent study by Chainalysis examined if investors profited from their NFT investments. They found approximately 44% of the trades from buying to selling in NFTs resulted in profits for the buyer.

In more detail, the transaction data showed that of the NFTs that speculators purchased when they were minted, which they later sold, only 29% of the trades resulted in a profit for the trader. The research split this 29% into two types of traders. NFT creators typically build interest in their new NFTs before they first release them, finding followers who help promote them. Creators then reward these promoters by putting them on a whitelist, which indicates the creator will let them purchase their new NFTs at a reduced price. As you would expect, whitelisted investors. who constitute a small portion of the buyers of newly minted NFTs, have better investing results. Whitelisted buyers who later sell their newly minted NFTs gain a profit 76% of the time, and 51% earn a return of 200% or more. Of the remainder, almost 35% earn between a 100% and 200% return. Only 21% of users who were not whitelisted made a profit, another 60% lost at least 50% of their investment.

Buying NFTs on the secondary market and then flipping them leads to a profit 65% of the time, but only for a small percentage of select traders. During the sample period, over 2,000 NFT collections on OpenSea had a secondary sale, with just 250 collections accounting for 80% of those sales, and 95 collections for 50%. Only 20% of the traders accounted for 80% of the secondary NFT trades and most of the profits, while just 5% of all traders accounted for 80% of all profits.

These most successful top 20% NFT flippers earned almost a 300% return on average and had the following characteristics: They buy and sell significantly more NFTs than other investors, on average 105 NFTs over the sample period versus 26 for everyone else. They pay significantly more on average for their purchases, almost three times as much. They spend more money overall on their NFT trading, 11 times as much as everyone else. Finally, they invest in a diverse array of NFT collections, an average of 28 unique collections versus 12 for everyone else.

A minority make money from investing in NFTs, while the majority lose money-not a good prognosis for a typical investor. Connections and money matter. You need connections to get whitelisted and thereby earn high returns. You need money to hold a diversified portfolio of many NFTs to minimize your loses, and money to invest in the most expensive NFTs, to maximize your earnings.

Issues and Risks With NFT Investing

Investing is risky, so we cannot discuss the returns to NFT investing without also discussing its risks. Unfortunately, because of the unique structure of NFTs and NFT marketplaces, scammers have entered the scene to take advantage of the situation. NFT marketplaces have a lack of security protocols, and the government does not regulate them; therefore, they may not be able to or want to prevent scams.

For example, pump-and-dump schemes refer to when a group of people buy large quantities of NFTs and artificially drive demand and prices way up. Once demand and prices increase, the schemers cash out and leave everyone else behind, holding assets worth little or nothing. Counterfeiters can easily steal an artist’s work and open a fake marketplace account where they list the counterfeit artwork for auction. This means the counterfeit NFT is worthless, with no way for its owner to get their money back. Defrauders create plagiarized, imitator, clone, and parody NFTs.

For example, there are PolygonPunks and there are Phunky Ape Yacht Club apes. Wash trading is the act of buying and selling an NFT to one party (probably through separate accounts) to fool the market into thinking there is more value and liquidity for an NFT than there is. This has become rampant in some NFT marketplaces today, such as the recently opened marketplace LooksRare. Wash trading is a major issue because this practice misleads investors into thinking that a collection is more popular and expensive than it is, so be careful.

There are three key technical issues that investors need to consider. First, NFTs do not provide copyrights or intellectual property rights to the owner of the NFT. Second, the blockchain usually does not attach the digital asset to the NFT; only the proof of ownership, and that may be a web address pointing to the digital asset. This raises the risk of someone breaking this link and, if they do, there is no recourse. Third, creators build NFTs via smart contracts embedded into the blockchain, and the unscrupulous can break, manipulate, or exploit them. An example of this is the recent stealing of several valuable NFTs from OpenSea’s users.

The hazards of NFT markets are not just the fault of miscreant scammers. Some of the largest marketplaces have done a poor job at managing the situation, if not even exploiting it. Because there is so little oversight, when the market recognizes a deception, it could make an NFT investment worthless overnight.

Popularity Does Not Make NFTs Great Investments

Why have NFTs garnered so much interest? With their dramatic growth, they are where the action is. All types of media are hyping NFTs. No one wants to be the one left out. FOMO. These are dangerous rationales and indicate standard behavioral finance biases.

It appears clear to me that investing in NFTs is a losing proposition for all but a small group of wealthy, sophisticated investors-whales. There is an unequal distribution of traders in the NFT marketplaces, with these whales (probably cryptocurrency whales) controlling most of the value in the system and making most of the profit. Given the small probability that a typical investor will earn a positive return, the elevated prices of some NFTs, their meme nature, and the risks behind them, NFTs are not great investment assets.

Indeed, we best think of NFTs as the new meme stocks. What makes a Bored Ape worth $85,000? Its inherent value? No, not in the NFT market. A perusal of social media and an expectation of what another investor will pay determine its value. But what you read on Twitter can be purposefully misleading and what another investor is willing to pay can be fickle. Either way, you could soon be holding something that has no value.

It is possible the NFT market will change across time, making trading easier, but I suspect not. It is becoming more complicated rather than less, with creators minting increasingly more NFTs and collections. But on the positive side, there is also the development of more encompassing metaverses and sophisticated games.

How to Get Exposure to NFTs in Public Markets

Given all the above, I do not recommend the typical investor take a chance with NFT speculation; however, given the rapid growth of the NFT ecosystem, which I think will persist for the metaverses, gaming, and art sectors, as well as new sectors, I do think investing in NFT infrastructure plays is interesting. Unfortunately, there are no NFT pure plays traded in public markets; they are all still in private hands, receiving an increasing flow of venture capital funds. The public markets do, however, have companies with partial or indirect exposure to the NFT ecosystem. The possible areas of the NFT world to invest in include: blockchains and their related technologies, NFT marketplaces, payment processors, and companies investing or trading in NFTs.

It is difficult to recommend any stock or cryptocurrency to invest in today given that the markets are depressed and volatile. Depending on where you think we are in the market cycle, consider some of my recommendations as possibilities for the future. I will also discuss a few stocks and an ETF, which analysts often recommended for their NFT exposure, not because they are great investments, but rather because I think the analysts are misguided.

Let’s start with blockchain investments. By investing in one of the popular cryptocurrencies for NFTs, you will get exposure not just to the currency, but also that currency’s blockchain. After Ethereum, the most popular blockchains and currencies for NFTs are Solana (SOL-USD), Tezos (XTZ-USD), WAX (WAXP-USD), Terra (LUNA-USD), Avalanche (AVAX-USD), Flow (FLOW-USD), Polygon (MATIC-USD), and Cardano (ADA-USD). The effect of NFT trading volume on some of the above cryptocurrencies will be small; for example, Ethereum’s average daily trading volume since the beginning of 2021 has been 200 times that of NFTs. However, for others, such as SOL and FLOW, which are becoming increasingly trendy in the NFT sphere, the effect will be larger, with the average trading volume of these currencies only being 20 times and two times that of NFTs, respectively. Investing in Coinbase Global Inc. (COIN), the U.S.’s largest crypto exchange, will get you indirect exposure to five of the above currencies and their blockchains.

There are three ETFs that invest in companies involved in blockchain technologies, Amplify’s Transformational Data Sharing ETF (BLOK), with an expense ratio of 0.71%, Global X’s Blockchain ETF (BKCH), with an expense ratio of 0.5%, and VanEck’s Digital Transformation ETF (DAPP), with an expense ratio of 0.5%. All these funds invest in basically the same companies; for example, they all hold Coinbase as one of their largest holdings. Note that these companies invest in the blockchain and not directly in NFTs; therefore, it is not clear how much NFT exposure you will get by investing in these ETFs. BKCH and DAPP are new, launched just within the last 13 months.

In addition, there are two ETFs that invest in companies that utilize, develop, or have products positioned to benefit from blockchain technology: the First Trust Indxx Innovative Transaction & Process ETF (LEGR), with an expense ratio of 0.65%, and the Siren Nasdaq NexGen Economy ETF (BLCN), with an expense ratio of 0.68%. LEGR’s top two holdings are Micro Technology, Inc. (MU) and Engie SA (OTCPK:ENGIY), and BLCN’s top two holdings are IBM (IBM) and Baidu Inc ADR (BIDU).

Certain blockchains are incredibly slow and expensive in how they manage NFT transactions; therefore, a few blockchain scaling solutions companies have created new software to manage the trades in cheaper and faster ways. Two of the most popular scaling companies and the currencies you can invest in to capture their value are Polygon, mentioned above, and Immutable X (IMX-USD). OpenSea has already integrated Polygon into its Ethereum blockchain, and Coinbase makes both MATIC and IMX available for trading.

Many analysts recommend getting indirect exposure to blockchains by investing in some of the hardware behind them, specifically Advanced Micro Devices (AMD), IBM, Intel (INTC), and NVIDIA (NVDA). In a normal cycle all are great stocks, NVIDIA will have the largest exposure to NFTs; for the others, the actual exposure to NFTs will vary depending on their development of new product offerings. This investment path might be something for some to consider if investors just want a broader tech exposure; however, their share prices are currently depressed along with the rest of the tech market.

The next part of the NFT ecosystem to consider investing in is NFT marketplaces. There are five possible choices here: Coinbase, DraftKings (DKNG), eBay (EBAY), Shopify (SHOP), and GameStop (GME). DraftKings and eBay currently have NFT marketplaces. I examined both marketplaces and I found them very wanting. DraftKings only had 244 NFTs up for sale. eBay’s site was very disorganized, only sold low quality art NFTs, and included physical tie-in objects to the NFTs when listing the NFTs themselves, making it overall not a very impressive NFT marketplace. For both companies it felt like the marketplaces were afterthoughts, not important enough to spend money on; therefore, I do not consider these companies to be interesting NFT investments.

Coinbase, Shopify, and GameStop have all announced plans to open NFT marketplaces. Shopify’s NFT site is accepting applications from its current merchants to be able mint and trade NFTs (for extra costs) through their current storefronts. It is not clear if this process is up and running yet. It has been reported that GameStop is setting up a division and plans to launch an NFT gaming marketplace. No one knows the timeframe for GameStop’s NFT launch, but we know they are making progress because they very recently announced a partnership with Immutable X, the Ethereum blockchain scaling solution company previously mentioned.

Coinbase announced plans to open an NFT marketplace last October, Coinbase NFT, for which they are letting people join a waitlist. We know they are moving forward because they recently made a joint announcement with Mastercard (MA) that Coinbase NFT users will be able to use Mastercard credit and debit cards to make purchases on the marketplace, rather than having to use a cryptocurrency, which is good competitive advantage for Coinbase to have. (If you are interested in a payment processor as an NFT investment, I would recommend Mastercard based on this announcement.)

One caveat for Coinbase is that, based on their February 24, 2022, earnings call, the company was not clear how quickly it would roll out its NFT marketplace. This struck me as a caution flag, even though their fourth quarter results were excellent: revenue grew 90% over the third quarter and net income by 107%. With regards to their forthcoming NFT marketplace, Brian Armstrong, Coinbase’s CEO and co-founder, stated there was room in the fast-growing NFT space for new players, to compete with OceanSea.

There are companies that sell NFTs (and also give them away). Most of these companies are doing so to promote their brand. For example, some analysts recommend investing in companies such as Nike (NKE), Mattel (MAT), and Coke (KO) and many others because they give away and/or sell NFTs. I disagree with these recommendations because companies such as these are using NFTs as marketing gimmicks, not direct revenue generators.

If you have been watching NFTs, you may notice that there are three common names that analysts throw about with regards to NFT investing that I have left off my list of possible investments: Block (SQ), PayPal Holdings (PYPL), and the PLBY Group (PLBY). This is because none of these companies has made substantial progress in the NFT markets, and Block has indicated it will not do so.

I need to mention one final ETF that others have mischaracterized-an ETF that claims to be the first ETF that invests in the NFT sector, the Defiance Digital Revolution ETF (NFTZ), which listed last December. An examination of its holdings reveals that it holds the same stocks as the previous three blockchain ETFs I have mentioned. Its statements about lofty NFT exposure are pure hype. It only has $11.3 million in assets under management, has an expense ratio of 0.65%, and its value has been declining almost since its listing. I would not recommend this ETF over the three I already have mentioned.

It seems to me that Coinbase is the best listed company to invest in to get exposure to the NFT world because it engages in multiple aspects of the NFT lifecycle, from a digital wallet, to cryptocurrencies, blockchains, and then in the near future, Coinbase NFT. Coinbase has 73 million plus users, a global reach of 100 plus countries, and it trades more than 150 different cryptocurrencies. All these factors indicate that Coinbase would have a strong competitive advantage among NFT marketplaces.

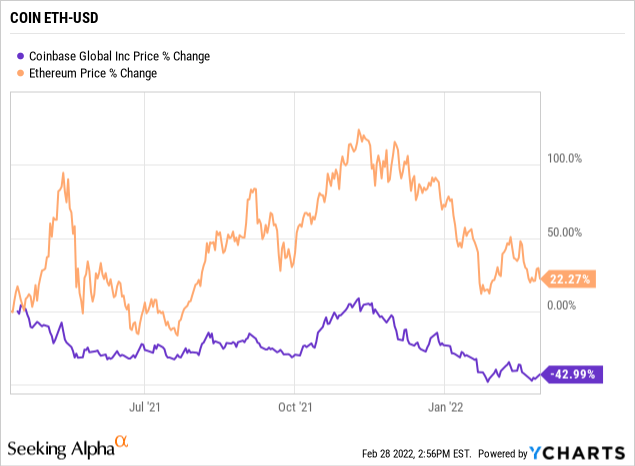

The chart below shows the time series of Coinbase’s share prices against Ethereum’s. Since last November, Coinbase’s stock price has been falling in lockstep with Ethereum’s price and its share price is currently close to its historical low. Without forecasting Ethereum’s price, which is exceedingly difficult, we cannot make a projection of when Coinbase’s stock price will come off its low and where it will go from there.

. (YCHARTS)

Initially Coinbase NFT will be a small share of Coinbase’s overall net revenue, but still large enough to have an impact that could grow across time. Before Coinbase NFT goes live, it has already partnered with some musicians, artists, and collections. Coinbase’s NFT waitlist currently exceeds 3.6 million potential NFT buyers and sellers, which is more than OpenSea’s current active user-base, which is around 1.3 million. Most analysts have a buy signal on Coinbase and are projecting improved financials for the company in 2022, although a Seeking Alpha contributor recommends a hold.

Investing in Public Securities Outweighs Investing in NFTs

As mentioned earlier, trading in NFTs is a losing proposition for most investors. Speculating and turning a profit in NFTs is more difficult than doing so in cryptocurrencies, which are, of course, more difficult than trading stocks and bonds. Most speculative NFTs are semi-fungible, making valuations difficult, but not impossible. We must rely on relative pricing to box in the prices of NFTs, and pricing in this manner creates circumstances in which price bubbles might form, with the potential for a dramatic downturn.

There is a strong future for NFTs, but investing is not its best path forward. The future is the commodification of metaverses and games, the trading of digitized art, as well as the recording, protection, and management of ownership of real assets, such as real estate and cars. I expect the speculation in individual NFTs and NFTs from collections will decline in time because their current popularity is just a fad.

Rather, the best way to invest in the NFT ecosystem is with companies that use and support the NFT ecosystem. After reviewing different investment possibilities to get exposure to NFTs, I have concluded that investing in Coinbase now or in the future is the best way. This does not mean that Coinbase is without its problems; it simply means that it is one the few ways to get public exposure to NFTs. More NFT-related companies will list in the future, so keep your eyes open.