DNY59/E+ via Getty Images

Most of my wealth is today invested in defensive real asset investments like farmland, apartment communities, and grocery stores.

I follow this portfolio strategy because I think it offers the best ratio of risk-to-reward in today’s world of low rates, high inflation, and extreme uncertainty.

In an article posted one year ago, I explained that real asset stocks like REITs (VNQ) and MLPs (AMLP) looked particularly opportunistic relative to tech stocks because:

-

Valuation spreads had grown to an extreme level.

-

The end of the pandemic would favor real assets but hurt tech stocks.

-

The surging inflation would benefit real assets but hurt tech stocks.

-

The raising of rates would likely cause the tech stock valuations to deflate

-

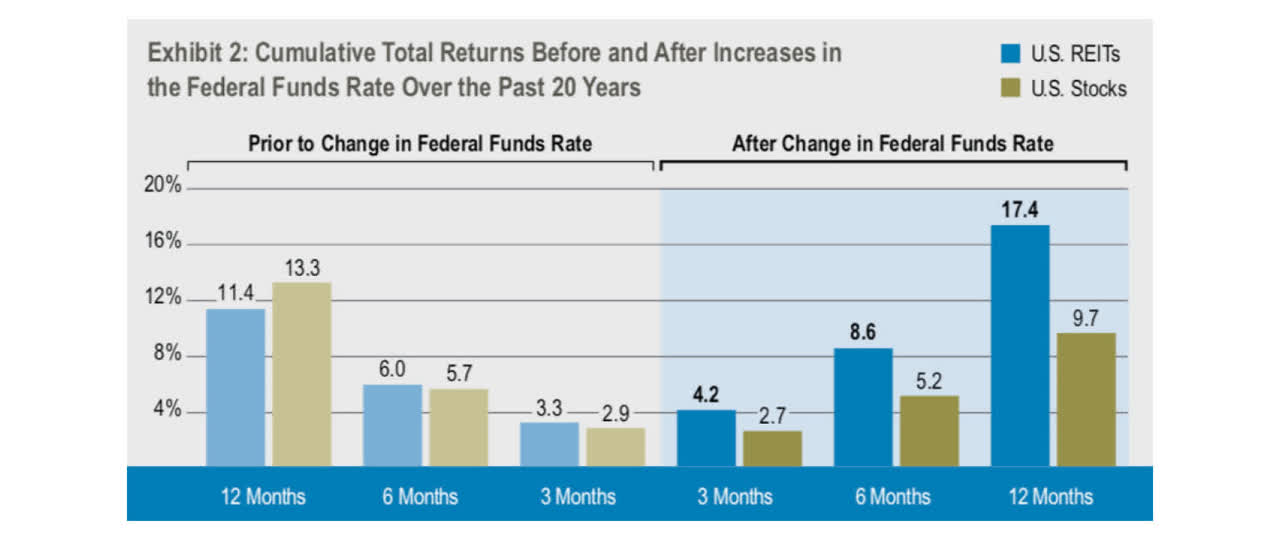

Real asset investors are able to lock in today’s cheap rates for much longer periods, serving as a hedge against rising rates and inflation. It is one of the reasons why REITs outperform tech stocks during times of rising rates:

REITs outperform when interest rates rise (Cohen & Steers)

But since posting that article, things have changed quite drastically and I have also started to make adjustments to my portfolio strategy.

I continue to think that today’s environment favors real assets and have about 50% of my wealth invested in the recommendations highlighted at High Yield Investor.

However, I have also begun to accumulate beaten-down tech stocks, many of which are now down by more than 50% in just one year.

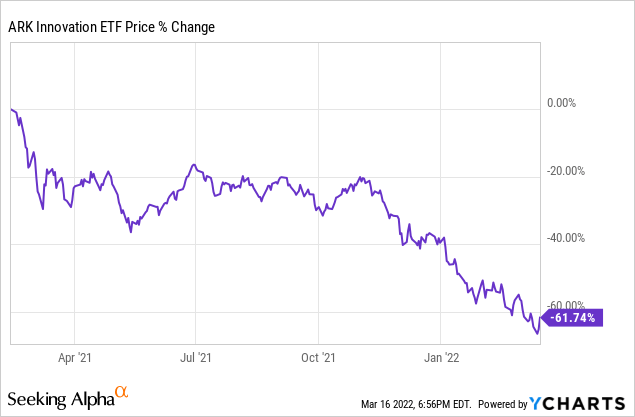

The ARK Innovation ETF (ARKK), which owns a collection of popular tech stocks like Zoom (ZM), Tesla (TSLA), Teladoc (TDOC), and Block (SQ), is down a staggering 62%:

It’s crazy to think how quickly market sentiment can change.

Many call this the dot-com crash 2.0 and I understand why.

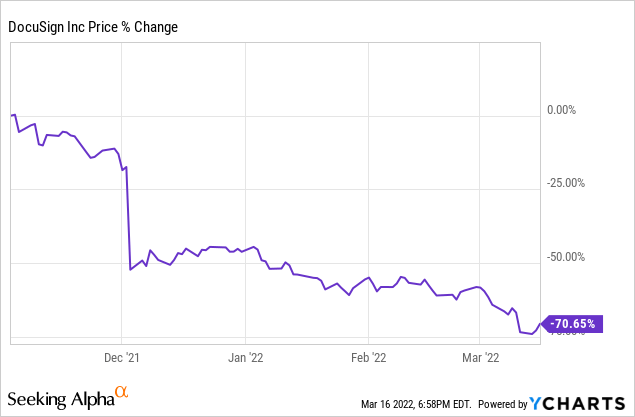

DocuSign (DOCU) lost 75% in less than six months, despite beating expectations and guiding for growth to continue, albeit a bit slower:

Anytime there’s such a rapid change in market sentiment, opportunities become abundant, and I don’t want to miss this chance to build the tech component of my portfolio.

In what follows, I highlight two tech stocks that I have been accumulating in 2022. As you read this, please keep in mind that I’m a REIT analyst and this is out of my main circle of competence. I would be happy to hear your thoughts in the comment section if you have differing views on these companies and/or know better alternatives.

Coinbase (COIN)

I’m not a crypto investor.

In fact, I don’t own any Bitcoin (BTC-USD), Ethereum (ETH-USD), or any other currency.

Perhaps I should, but I’m simply too incompetent in this domain to feel comfortable picking individual currencies.

However, I know enough about the pros and cons of crypto to recognize that it’s likely here to stay, and owning a piece of a major exchange can be a good way to indirectly participate in the growth of the crypto economy, without having to bet on a single currency.

Even better, by owning shares of Coinbase, I actually own a productive asset that’s generating profits, whether Bitcoin or any other crypto is rising, stagnating, or declining. Sure, the profits may rise faster in a crypto bull market, but because Coinbase is the “pick and shovel” play, it can do well as an investment even if crypto does relatively poorly over time.

This is especially true because it’s exceptionally cheaply valued for a company with such huge long-term potential. At the current price, it trades at just around 15x normalized EPS.

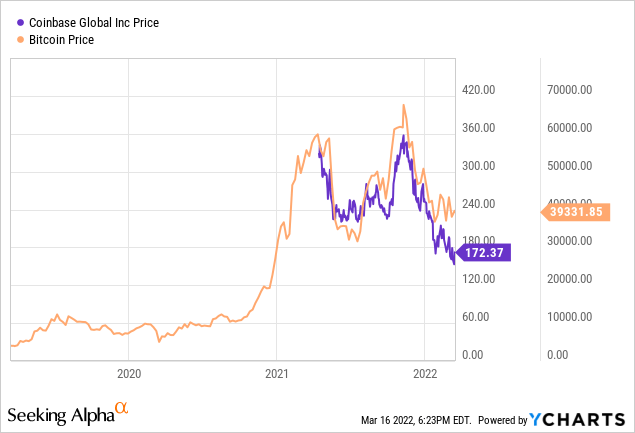

We believe that it’s cheap because of one main misconception: The market thinks that Coinbase is just an exchange and that its fate is heavily tied to the success or failure of Bitcoin. As a result, Coinbase has shown a high correlation to Bitcoin since its inception, and declined significantly in the past many months:

But in reality, Coinbase is much more than an exchange and while Bitcoin is an important crypto, its platform has plenty of others that are rapidly growing in popularity.

The CEO of the company has said that their goal is to become the Amazon (AMZN) of crypto. They want to be a one-stop-shop with a lot of different products in addition to their exchange. This includes:

-

Card

-

Wallet

-

Borrow

-

Asset Management

-

Custody

-

Commerce

-

VC Investments

-

NFTs

Coinbase’s different products (Coinbase)

If you just visit their site, you’ll see that Coinbase is far more than an exchange, and given how well the company is managed, I’m confident that they will keep profiting from the growth of the crypto economy.

Recently, they had one of the most successful Super Bowl ads of all time, and I think what’s happening elsewhere in the world right now is very favorable to the continued global growth of crypto.

If you can buy into that, then Coinbase is quite opportunistic right now. If crypto ends up losing steam, Coinbase will likely underperform. That’s why you diversify.

PAR Technology (PAR)

PAR Technology is my favorite restaurant tech investment.

The story is not as exciting as that of Coinbase, but I think that its potential is even greater given the much smaller size of the company, predictable path to rapid growth, discounted valuation, and immense opportunity to modernize the restaurant sector.

But you’ve probably never heard of PAR so let’s start with a bit of history. PAR is the company that invented the modern point-of-sale terminal for restaurants about 40 years ago. Its first major client was McDonald’s (MCD) which added it to its restaurants:

PAR point of sale terminal (PAR Technology)

For a long time, it was a great family business, but as is common with many such businesses, its management was resting on its laurels and slow to innovate.

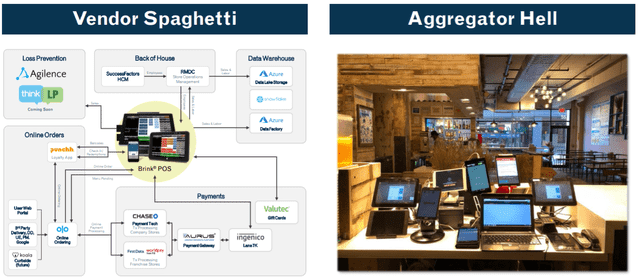

As restaurants’ tech needs evolved, they had to add more non-PAR equipment to complement PAR’s terminal, leading to what they now refer to as tablet hell:

Tablet hell (PAR Technology)

But the company finally recognized this issue, changed management, and began its transition to become more than just a point-of-sale terminal hardware business.

They brought in a new CEO with a SaaS background and his goal is to make PAR a one-stop-shop for all the tech needs of restaurants. This is badly needed for restaurants to work efficiently by consolidating all data under one system.

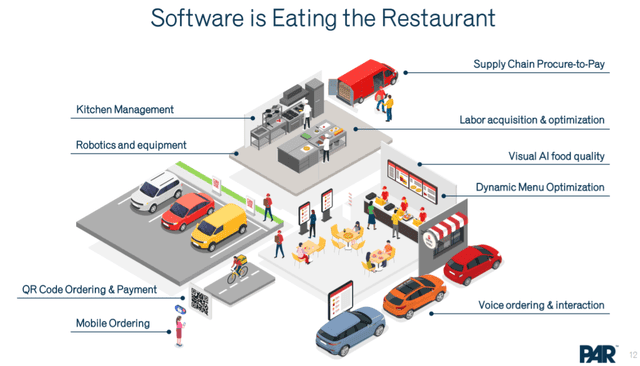

PAR has a major competitive advantage here because it’s the inventor of the point-of-sale terminal and has multi-decade long relationships with most major restaurant chains. Now PAR is adding new technologies to it to build a restaurant tech platform that handles everything:

Tech in restaurants (PAR Technology)

The total addressable market is massive, PAR has a clear competitive advantage, and the early results are very compelling.

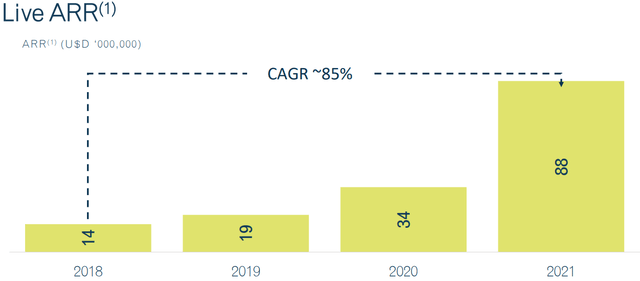

Aided by some successful acquisitions, they grew their SaaS annual recurring revenue from $14 million to $88 million in just a few years:

PAR’s growing ARR (PAR Technology)

Its normalized ARR per share is already around $4, pricing it at less than 10x ARR, and it is just getting started.

Panera Bread’s founder and CEO recently became a large shareholder of the company at $68 per share and commented that he likes to invest in situations where he has a competitive advantage and that PAR has a good shot at owning a large spot in this marketplace. He knows PAR better than 99.9% of investors as he has worked with them for a long time as a major client.

Today, you have the chance to invest in the company at a 50% lower share price, and a 64% lower price from its 2021 peak.

Bottom Line

“Be fearful when others are greedy, and greedy when others are fearful” is one of Warren Buffett’s most famous quotes.

It sounds simple but it really isn’t. People are emotional and going against the crowd isn’t a natural thing to do for most of us. But that’s what you have to do if you want to have a chance to earn outsized returns in the market.

Today, I continue to find the best bargains among REITs and MLPs and that’s where most of my wealth is going, but I have also begun to build positions in beaten-down tech companies that I expect to nicely recover in the coming years.