An introduction to the world of Block chain, Cryptocurrency, and W3.

The Oxford Dictionary defines Blockchain as a system in which a record of transactions made in cryptocurrency is stored. As we have already established Blockchain, is a technology that enables digital currencies called Cryptocurrencies to become a medium of exchange. Blockchain consists of a network of blocks, and they form a blockchain. Blocks consist of:

- Unique block number

- Data- Salaries of employees in a corporation to store the details of transactions made using Bitcoin

- Hash is the digital fingerprint of each block. They are a combination of random integers and alphabets.

- Nonce or number only used once is a number that gets added to the encrypted hashed block.

- The hashing system helps encrypt the data.

Tampering with the data in each block could lead to the fingerprint or the hash changing. Subsequently, the hash of one block changing leads to a change in all other blocks. This interference could destroy the entire Blockchain. If someone hacks 51% of the computers on the network of a particular Blockchain. Then the technology is as such that the hack can happen. It stands difficult to hack 51% of any network’s computers without setting off any flags or alarms, and the network of computers is decentralised. The number of nodes also increase the difficulty of hacking.

Blockchains are present in a network of computers. A network of computers manages the various Blockchains. Hence, no one person or authority has control over it. It provides a decentralised system.

The public ledger is an account of all information stored in a particular blockchain. A copy of this ledger exists on all computers connected to this network. The people running these networks are called miners (nodes). Their job is to verify transactions and ensure that no one is hacking or tampering with the data present in a particular blockchain.

To understand how this verification process works look at the model below

- Suppose there is a person X on some Blockchain network, they have $50

- The $50 need to go from person X to person Y

- Under person X, a new block will get created — consisting of those random digits and alphabets.

- Under person Y, a new block will get created — consisting of random digits and alphabets.

- Now, all the other computers on this particular Blockchain network will get notified, and their computers will record this transaction, as it is on the public domain/ ledger.

- The other computers will verify the transaction (miners) by solving a complicated mathematical equation. Once the equation is solved, the other; computers confirm the claim or deny it.

- However, if one computer says this transaction is not going from person X to Y but from person X to A

- Other computers will verify by recording that the transaction was not from X to A but X to Y.

- Then, the computers will allow the transaction of $50 to resume from X to Y and disregard person A.

- Person A will get penalised for verifying it wrong, and so will any computer that supported the false verification. Penalties ensure that no one uses the system. People who computed the calculations correct receive some Bitcoin as a reward.

Uses of Blockchain

- Education system — India has two central education boards: the CBSE and ICSE; either of them can upload the grades of the country-wide exam and upload that data to a blockchain disabling any hacker from maliciously changing the marks of any student. Hence, helping preserve the grades.

- Elections — Sierra Leone was the first country to conduct elections using Blockchain supported technology. It did lead to controversy over the fairness of the results. Hacking into a network of blockchains is difficult but hacking into individual phones or switching off the network is relatively easier.

- Healthcare industry — Using blockchain in the healthcare industry to store medical data did prove to be advantageous. It improved patient privacy, and doctors could access the data only if they needed to.

- Some other uses: Trading, crowdfunding, property management, and the management of government data.

Blockchain and Privacy

Information uploaded on the Blockchain is not only secure but also privacy protected. Each computer in the public ledger has access to a private key and a public address. Similar to an email address and an email password. Email addresses can be shared while passwords are; private to you. The blockchain public key or address is a combination of random alphabets and numbers. It is high unguessable, and you’re personal details remain anonymous.

Cryptocurrency

Cryptocurrencies are digital assets over which central banks or financial institutions have no control or regulation. For example, the Fed regulates the USD but no one controls blockchain or crypto.

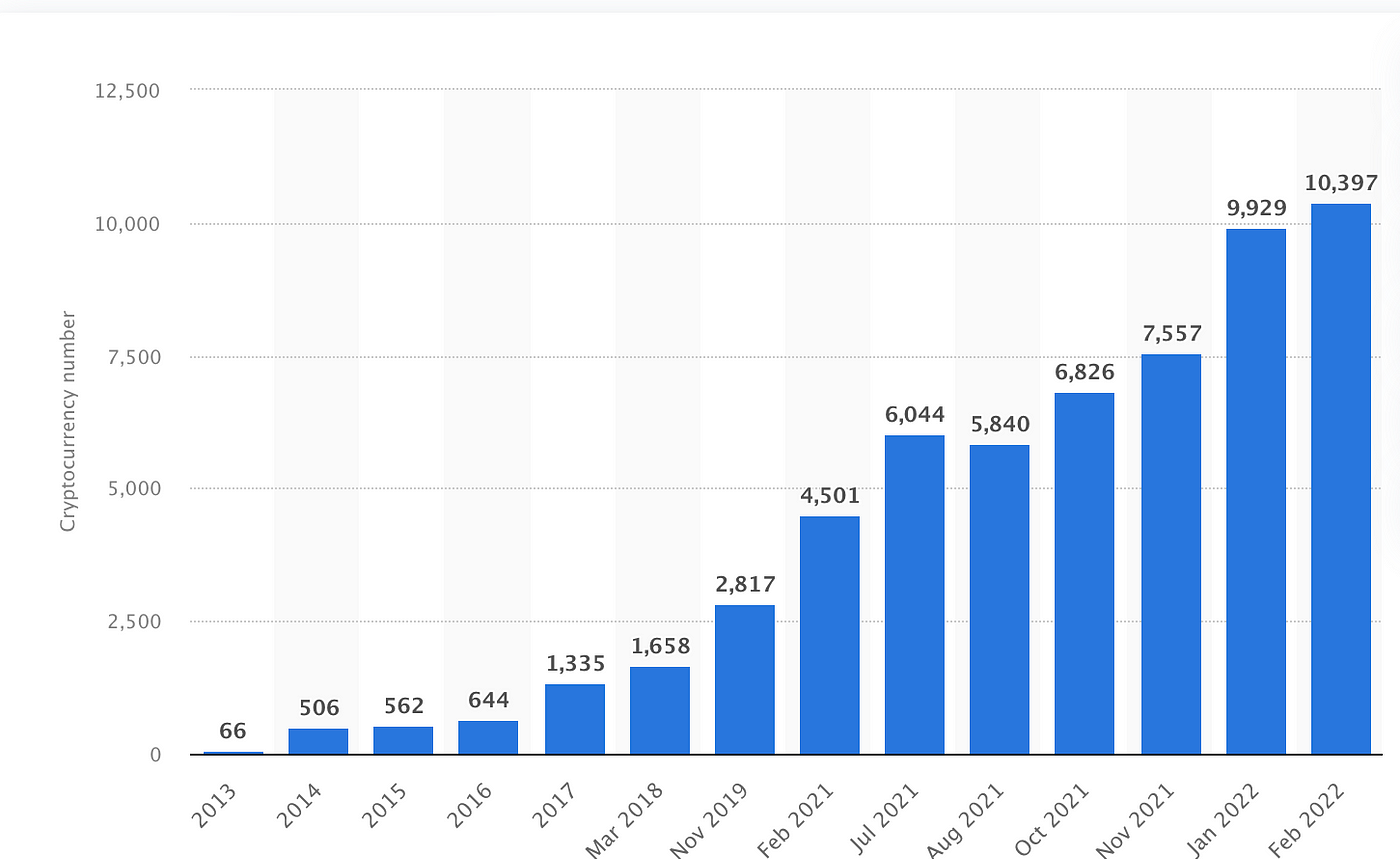

Financial systems run on trust. We trust the banks to safely store our money and assets. Banks trust that we can borrow and pay back the money on loans. The currency notes and coins have value in our society because they are, guaranteed by a government body and central bank. Bitcoin and other cryptocurrencies allow people to have control over their money by cancelling out the depositing money into a bank bit. Satoshi imagined Bitcoin as an alternative financial banking system that would be, based on software technology and would be outside the control of third parties. The rise of cryptocurrencies slowly started after the 2008 financial crisis and the downfall of the Lehman Brothers. Bitcoin arrived first on the scene- followed by Ethereal, Litecoin, Ripple, Dogecoin. At the beginning of 2020, there were more than 2000 cryptocurrencies. There are nearly over 10,000 cryptocurrencies as of 2022. Due to how open the creation process of a cryptocurrency is, it is relatively easy to make one. It is believed that the top 20 cryptocurrencies make up nearly 90 per cent of the total market. This also means that the other 80% are not that significant in the market.

Bitcoin

The date was 31st October 2008 Satoshi Nakamoto published a paper on the net. His motive was to create a version of electronic cash that would allow payments to be sent directly from one party to another party without going through a financial institution.

Bitcoin as an alternate currency?

Some people use it as an investment. Some others use it as an alternate currency. A few people wish to replace the old dollar with cryptocurrencies. However, the main use in 2022 remains to be as an investment. We invest money in cryptocurrency and hope for a higher return in the future. Similar to how we use stocks or lower-risk bonds. In this case, Bitcoin has become similar to gold as a store of value. This is how Bitcoin famously was called Digital Gold. Like all investments, there are certain risks in this as well. People who criticise cryptocurrency as a form of investment say that Bitcoin is a digital currency and inherently has no value. You can not physically hold it or touch it with your hands. For example, a house you can live in and gold you can hold. Bitcoin is still considered a very niche product and does not have widespread acceptance in society. Cryptocurrency is not yet a medium of exchange and although certain stores have started accepting crypto payments, most have not. The Western world has a positive trend towards using Crypto as a medium of exchange with more than 700 thousand hotels that accept Bitcoin. There is a technical problem that holds back Bitcoin transactions from becoming a widespread medium of exchange. The problem is that it takes time to process and verify the transactions.

It is not all bad, certain things work get complemented with bitcoin rather than our traditional modes of payment. Foreign funds transfer from one country to another cancels out the usual lump sum that one would have to pay a bank in the name of foreign transfer fees and reduce the time that banks would take. In this scenario, bitcoin is more economical. No transfer fees are being charged, and ten minutes is much more time-efficient than 1–to 2 days that a bank would take. Similarly, cryptocurrencies are more efficient than credit card fees. This is one of the reasons why banks are against crypto-currencies. Cryptocurrencies rival their business model. As of 2020, Paypal introduced a pay with bitcoin option, J P Morgan one of the biggest enemies of Bitcoin was suddenly all for it. Ever since the pandemic, the consensus of crypto has changed and people who were initially against it are now for it.

The World Wide Web

W1:

Refers to the original version of the internet. The early internet was composed of web pages joined by hyperlinks, like this. It consisted of these things without the additional visuals, controls, user-friendliness we know today. It was a “read-only” version of W2. Individual webpages were hosted on web servers run by an internet service provider (ISP) or on free web hosting sites.

Web 1.0 site include: Static pages, content served from the server’s file system.

W2:

World Wide Web 2.0 is also known as the participative social web. Web 2 also has more distinctive features than the initial Web1.

Uses of Web 2.0:

- Blogging

- Podcasting

- Tagging

- Social media

- Web content voting

Five major features of Web 2.0:

- Free sorting of information

- Dynamic and more responsive content

- Information flows between site admin and users. Such as commenting and feedback.

- Developed APIs to allow self-usage, such as by a software application.

- Web access leads to concern different, from the traditional Internet user base to a wider variety of users.

After a while, the general public became cognisant about the way their data was being harvested by tech giants and used to create tailored advertisements and marketing campaigns. Facebook, in particular, has had the spotlight shone on it innumerable times for breaching data privacy laws and was hit with a $5 billion fine in 2019 — the largest penalty ever issued by the Federal Trade Commission (FTC.)

W3:

People have been talking about the future of the net, Web 3.0, or Web3. It is simply the next generation of the internet that wishes to promote decentralisation and reduce our dependency on Big Tech companies like Amazon, Netflix, or Youtube.

If Web1 is considered the read-only version of the internet, Web2 is the read/write version with the control in tech companies’ hands. Web3 is the read/write/own version of the internet. It wishes to

- Shift the power from Big Tech companies to individuals.

- Preserve our data from being exposed and shared from one data leak to the other.

A cool feature of Web3 is that rather than using free tech platforms in exchange for our data. Users like you and I can participate in the governance of protocols ourselves. In Web3, people are not just consumers but also shareholders of the internet.

In Web 3, these shares are called tokens or cryptocurrencies, and they represent ownership of decentralized networks known as blockchains. If you hold enough of these tokens, you have a say over the network. Holders of governance tokens can spend their assets to vote on the future of, say, a decentralized lending protocol.

Right now, what we see and click on is governed by companies like Twitter, Facebook, Alphabet (Google).

In Web3 anything can be tokenized a meme, piece of art, concert ticket. Large Web 2 companies, like Meta and Ubisoft, are creating virtual worlds powered in part by Web 3. Non-fungible tokens (NFT) will also play a huge role in reshaping the gaming industry by allowing players to become the immutable owners of the items they accrue. NFTs are also another thing enabled by the blockchain platform and the sales for NFTs are very hot right now.

The main criticism of Web 3 technology is that it falls short of its ideals. Ownership over blockchain networks is not equally distributed but concentrated in the hands of early adopters and venture capitalists. Some consider it too idealistic and think that the entire talk about decentralisation will fail and will end up in the hands of a few people like most things do in this world. However, Web3 does have potential.

In conclusion, it is exciting to know the future of our internet. We are witnessing history in real-time. The future of our lives are changing with more innovative technologies coming up and older one’s adapting to the volatile world- we live in. With the onset of Blockchain, cryptocurrency, and now Web3 it is clear that the world has an adapt or become irrelevant model. Therefore, now is the best time to increase our knowledge base, and skill set. Only the upcoming decade will display whether Web3, Crypto and blockchain was good or bad.