Just because something is digital, that doesn’t mean that the rules of physics go out the window. With multi-terabyte hard drives becoming standard, it is easy to forget that managing dataflows will always be a costly problem.

The same is true for blockchain networks. When they are congested, it manifests as higher transaction fees. High transaction fees have plagued Ethereum since it gained popularity, especially in the last two years with the launch of hundreds of DApps and the rise of DeFi.

This is the blockchain scalability problem: keeping transaction fees low while the intake of users increases. As Ethereum layer 2 blockchain solutions, Arbitrum and Optimism are specifically designed to address this problem. So, how do Arbitrum and Optimism help solve the blockchain scalability issue?

What Are Rollups?

A blockchain’s main network or main chain—the default network—is often called layer 1. These are Bitcoin, Litecoin, Ethereum, Solana, Cardano, Avalanche, Terra, Binance Smart Chain, etc. Some of them, such as Solana or Binance Smart Chain, were created with a higher network capacity from the get-go. The downside of this approach is that large memory blocks are more difficult to verify, resulting in the blockchain’s centralization.

Ethereum is one of the most decentralized blockchains. Hence, it needs help with layer 2 (L2) networks. Interestingly, even below layer 1, there are layer 0 blockchains like Polkadot. This is a network of networks in which layer 1 (L1) blockchains become parachains.

However, above layer 1, layer 2 networks serve as auxiliary protocols. Their sole purpose is to offload traffic from the main chain, layer 1.

If you were to picture layer 1 as a congested highway, then layer 2 protocols/networks are additional highways plugged into them. Of course, in the digital space, we deal with data bits instead of cars, so they are much easier to handle.

Handling network congestion is exactly what rollups do. Layer 2 networks roll up hundreds of transactions into one, transfer them to themselves, and then return them back to layer 1 in their compact form. To push the previous analogy further, it would be like fusing hundreds of cars into one vehicle.

Except, none of the passengers—important data bits—would get lost in the transit. Instead, the empty seats, chassis, and wheels would be removed as redundant. At that point, the analogy ends because rolled-up contract data can be recomputed from the Merkle tree. Both Arbitrum and Optimism are such rollups, helping Ethereum’s congestion.

How Are Arbitrum and Optimism Similar?

If both Arbitrum and Optimism are layer 2 rollups for Ethereum, why have different ones? The core purpose of rollups is to perform two actions:

- Remove the bulk of the main chain’s traffic to off-chain layer 2.

- Interact with the main chain’s smart contract that processes withdrawals/deposits and verifies off-chain transactions.

The verification part is critical because off-chain data needs to be proven to be authentic. Arbitrum and Optimism are similar in that they use:

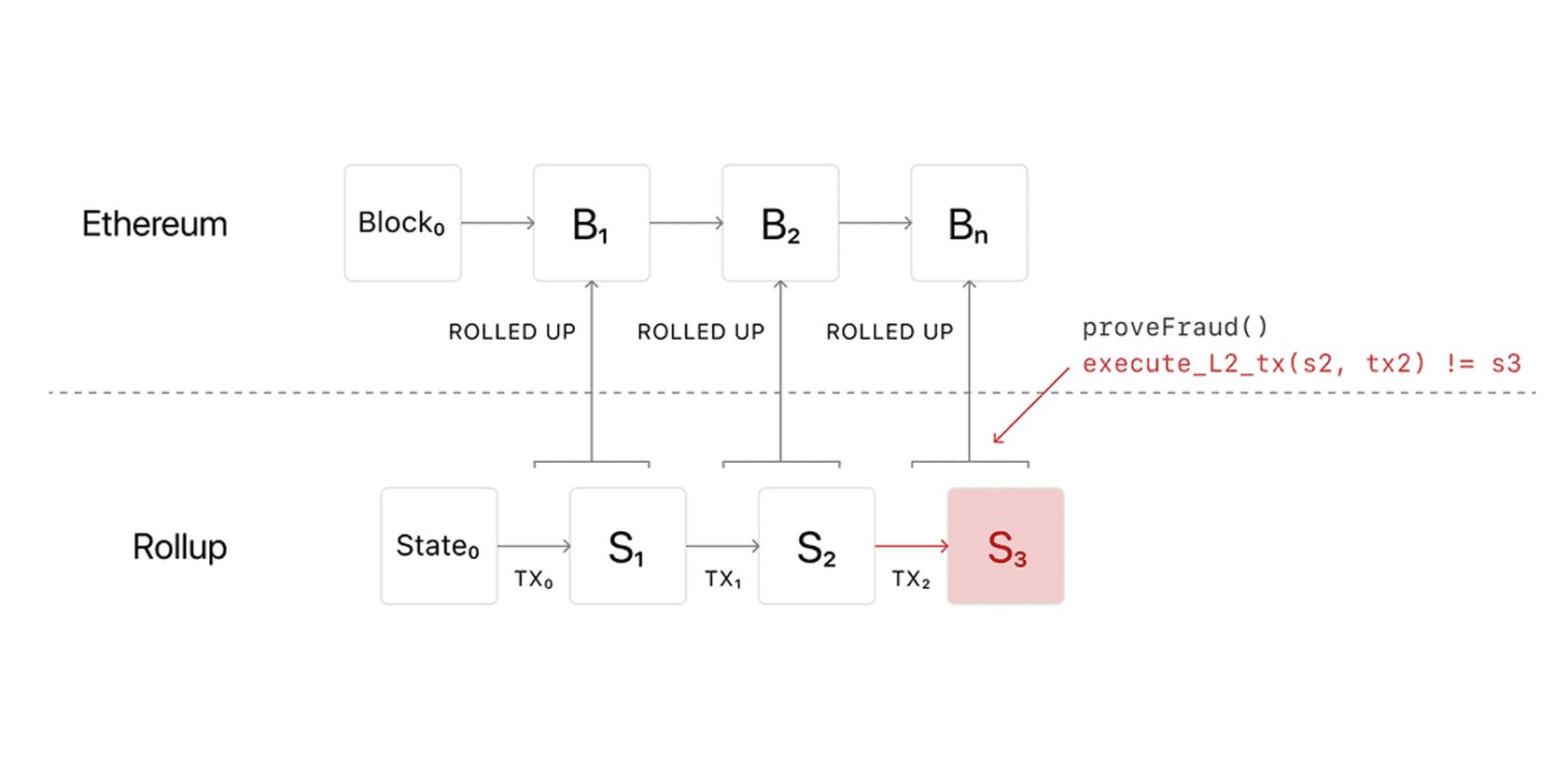

- Fraud proofs: Ideal for scaling solutions because they are deployed only when invalid blocks are detected, instead of with every transaction. In turn, this saves the computational resources of the network.

- Instant finality: The transactions are finalized the moment the block is created, instead of undergoing a series of confirmations. Once again, this makes for a low-latency, high-throughput network.

- Cross-chain bridges: Allowing tokens to move between layer 1 and layer 2.

Although both Optimistic Rollups (ORs) and Arbitrum drastically lower ETH gas fees, there are key differences in how they verify proofs and how they handle future compatibility issues.

What Are the Differences Between Arbitrum and Optimism?

To begin with, it is important to understand that the Optimism team first created Rollups. As often happens in the software field, Arbitrum team then tweaked its source code, which led to two different layer 2 scalability solutions.

Fraud Proof Verification

The most important difference is that Optimism rollup uses single-round fraud proofs, while Arbitrum uses multi-round fraud proofs. Why is that important?

Optimism’s single-round fraud-proof (FP) relies on L1 to execute the entire L2 transaction. This way, the FP verification is instant. However, this exerts greater costs because on-chain L1 execution costs more gas, and the L2 fee is itself limited by the L1 gas block.

In contrast, Arbitrum uses a fine-combing approach to FP verification. By using multi-round FP, Arbitrum focuses on a singular point of transaction disagreement. In turn, this translates to higher network performance. Likewise, because L2 transactions are not entirely executed on L1, its gas block limit is rendered irrelevant.

Optimism’s Ethereum Dependency

Both Arbitrum and Optimism are optimistic rollup protocols because they rely on the majority of Ethereum validators to process transactions honestly. However, if Ethereum receives a major consensus overhaul, re-executing L1 transactions would lead to divergent final states. That’s because Optimism uses EVM (Ethereum Virtual Machine). It is a virtual sandbox with a set of network consensus rules present in every Ethereum node in charge of executing smart contracts.

Arbitrum doesn’t have such worries because it has its own AVM (Arbitrum Virtual Machine). Although this requires DApps from EVM to be translated to AVM, the process is automatic. The benefit is too big to ignore because Arbitrum has total control.

Furthermore, Optimism is limited to a Solidity compiler for OVM bytecode. Without going into the weeds, a bytecode is a compiled code derived from source code to run in a virtual machine. In contrast, Arbitrum supports all EVM programming languages, such as Vyper, Solidity, Flint, YUL+, LLLL, and others.

Bridging and Tokens

As previously noted, both Arbitrum and Optimism use bridges to interact with other blockchains and make the flow of tokens happen. However, where Arbitrum employs a universal and permissionless bridge for all tokens, Optimism deploys dedicated bridges when the market demands are ripe.

Lastly, although both rollups don’t have their own tokens, Optimism uses Wrapped ETH (WETH). This is akin to a stablecoin, pegged to ETH in a 1:1 ratio, allowing for cross-chain ERC20 token compatibility. Arbitrum has native ETH support without needing such extra steps.

Which Rollup Is Better for Ethereum Scaling?

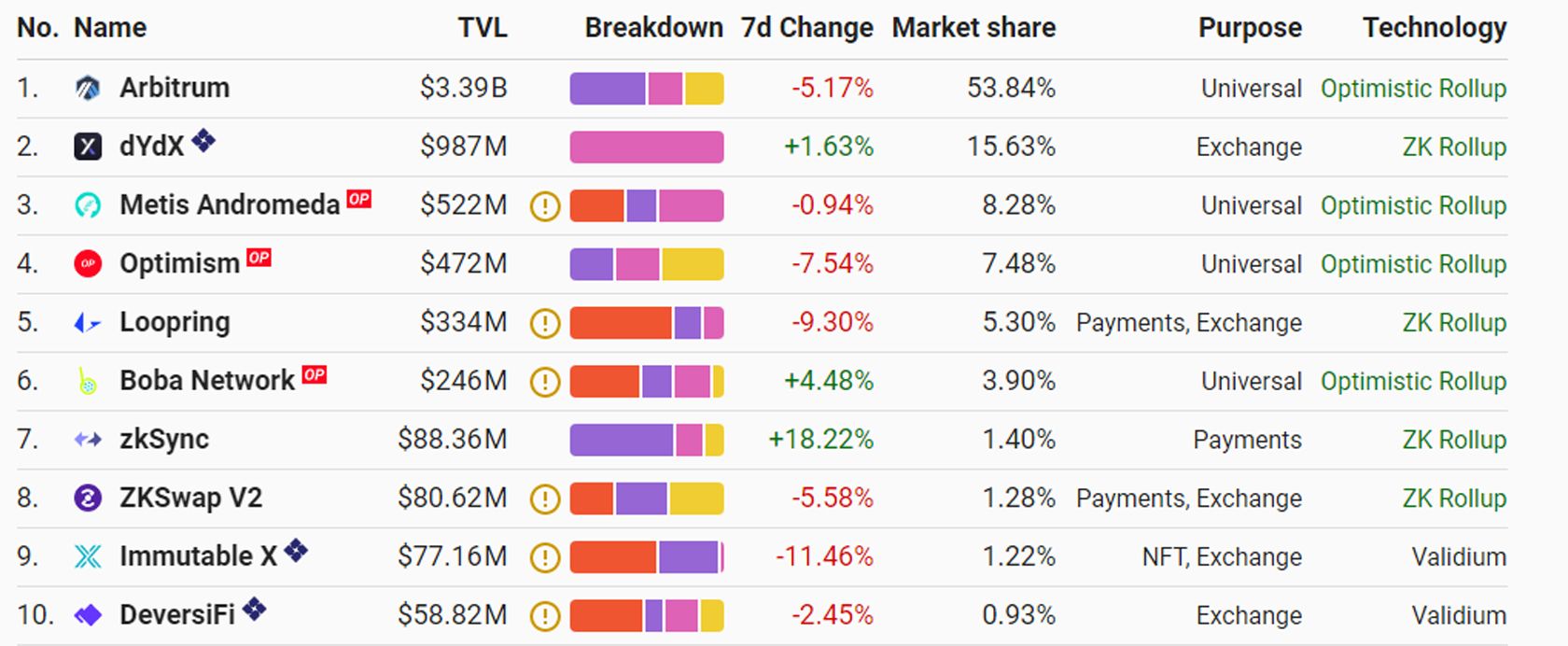

Although Optimism rollup was developed first, the market has already spoken in favor of Arbitrum. Of the top five L2 networks, Arbitrum is by far the most trafficked one. At press time, it has $3.39 billion total value locked (TVL) in smart contracts, with Optimism holding only 17% of that value.

Already, most of Ethereum’s major DApps are online within Arbitrum’s ecosystem. You can connect to each one with the MetaMask wallet. The transaction fee difference between Ethereum’s DApps and Arbitrum are enormous, so it would be foolhardy not to take advantage of layer 2 solutions.

Because of Arbitrum’s automatic AVM to EVM translation, more DApps are coming online every day. With that said, users still have to wait for a one-week withdrawal for their transactions to be deemed non-fraudulent. This applies to Optimism as well.

Another issue to keep in mind is that tokens between L2 networks first have to be onboarded to L1 and then on the other L2, exerting gas fees. However, the solution to this interoperability problem is on the way with projects such as cBridge, StarkEX, Connext, Hermez’ Massive Migrations, and Loopring.

In the meantime, transferring tokens between L1 and L2 is a simple process, only requiring the MetaMask wallet.

Read Next

About The Author