Matt Winkelmeyer/Getty Images Entertainment

Investment Thesis

Coinbase Global, Inc. (COIN) is one of the leading cryptocurrency exchanges in the world, based on daily volume. Based on 8 February’s data from CoinMarketCap, Coinbase occupied the #7 position, accounting for over $4.3B worth of daily volume. But, it’s still far behind the leader Binance, which accounted for about $21.4B in daily volume.

Coinbase stock has also undergone a highly volatile rollercoaster ride. Therefore, investors who want to gain exposure to COIN stock should consider its inherent volatility. Notably, the recent volatility in Bitcoin (BTC-USD) and Ethereum (ETH-USD) have also affected COIN stock. It also sent COIN stock to its all-time lows recently.

Nevertheless, while we hold Bitcoin and Ethereum ourselves as long-term holdings, we don’t prefer to hold COIN stock as an investment. So instead, we have executed swing trades/short-term trades on COIN stock to benefit from its volatility and mean reversion tendencies.

Despite hitting its all-time lows lately, we discuss why we rate COIN stock as Hold (Neither Buy nor Sell).

Coinbase Has Diversified Beyond Bitcoin and Ethereum

Even though Bitcoin and Ethereum are its primary revenue drivers, the company relies on other crypto assets for most of its revenue. For example, Bitcoin and Ethereum accounted for 43% of its FQ3’21 revenue, down from 50% in the previous year. Furthermore, on a nine-month basis, Bitcoin and Ethereum accounted for 53% of its total revenue, down from 59% in the last year. We think it’s consistent with the general trend that crypto investors have broadened their transactions to other crypto assets.

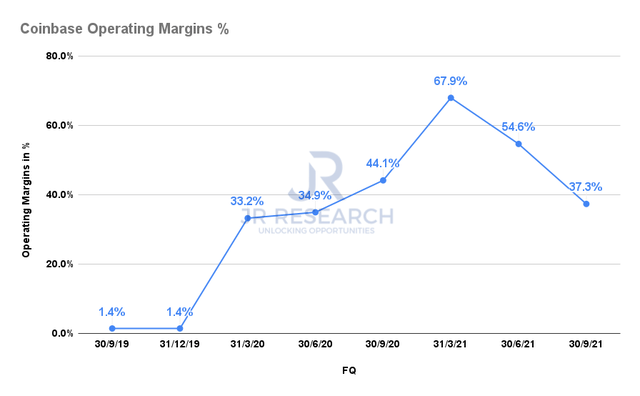

Coinbase operating margins % (S&P Capital IQ)

Furthermore, Coinbase’s business model is profitable, even though its consistency has also been affected by its volatility in its trading volume. The company has also cautioned investors that it’s not meaningful to focus on its near-term earnings report. Furthermore, it emphasized that Coinbase’s journey in creating its cryptoeconomy is still in the early innings. Therefore, investors should continue to expect volatility between its near-term performance. Coinbase added (edited):

We are in the early stages of the development of the cryptoeconomy and are focused on investing for long-term growth. We have consistently indicated that volatility is a key factor influencing our transaction revenue. As our year-to-date results have clearly demonstrated, our business is volatile. Coinbase is not a quarter-to-quarter investment, but rather a long-term investment in the growth of the cryptoeconomy and our ability to serve users through our products and services. We encourage our investors to take this point of view. (Coinbase’s 10-Q)

We have also seen such volatility in Block Inc.’s (SQ) and Robinhood’s (HOOD) earnings. These companies also have substantial crypto exposure, except that Block is focused on Bitcoin. In Robinhood’s case, we explained in a recent article that its forays into crypto had introduced a significant amount of revenue and earnings volatility in its quarterly reports. Therefore, we believe it’s pretty challenging to model Coinbase’s estimates moving forward.

Crypto Volatility Affects the Reliability of Coinbase’s Revenue Estimates

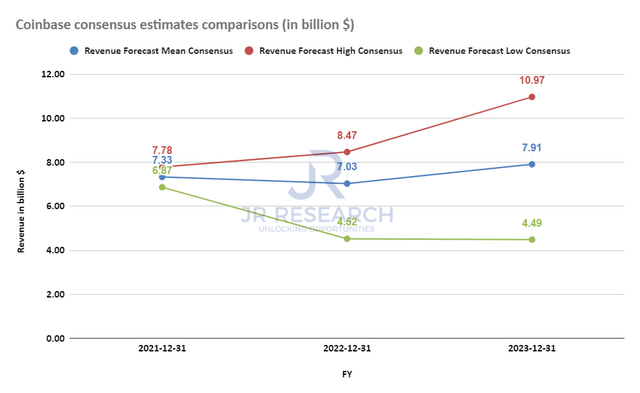

Coinbase revenue consensus estimates (S&P Capital IQ)

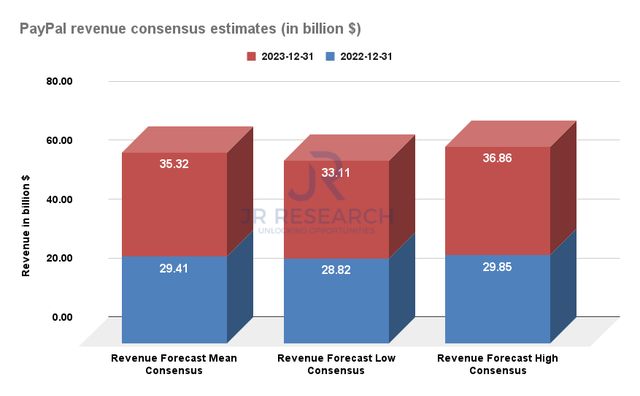

PayPal revenue consensus estimates (S&P Capital IQ)

Readers can glean from the above charts and observe that Coinbase’s revenue estimates differ significantly between the most optimistic and pessimistic analysts. For instance, the lowest estimates put Coinbase’s FY23 revenue at $4.49B, while the highest estimates suggest Coinbase’s FY23 revenue comes in at $10.97B. Even the Street couldn’t be closer in their forecasts on what Coinbase could potentially deliver. The estimates for FY21 are more comparable because there’s much more visibility with the company’s guidance, and with Coinbase reporting its FQ4’21 card on 24 February.

We included PayPay’s estimates to illustrate our point better here. Since PayPal’s revenue model is much better diversified across multiple revenue streams, it offers clearer visibility moving ahead. Therefore, the estimates between the most optimistic and pessimistic forecasts are much closer to the mean than Coinbase’s disparate estimates.

Consequently, we think it suggests that until Coinbase’s revenue streams are better diversified from focusing on crypto transaction volume, investors should discount the consensus estimates as a reliable indicator of potential future revenue. Notably, Coinbase’s transaction revenue accounted for 83.1% of FQ3’21 revenue, down from 87.5% in the previous year. It has also improved from the 85.4% average observed for the first nine months of FY21. Accordingly, the share was noticeably higher at 89.5% over the same period in FY20.

Nevertheless, we think that Coinbase’s institutional-focused business model insulates it better than a retail-focused model. Coinbase’s institutional volume accounted for 71.6% of its FQ3’21 revenue. For example, Coinbase’s institutional trading volume reached $234B in FQ3’21. The average institutional volume in its first nine months was about $255.4B. In contrast, Coinbase registered a retail volume of $93B. But, the retail average over the first nine months was $119.3B. Therefore, the volatility over crypto assets in FQ3 has caused a more considerable slowdown in retail trading volume than its institutional average. Therefore, it’s critical for Coinbase to focus more on its institutional clients. We think they provide more consistent volume visibility than retail clients.

Nonetheless, the company has also expanded its efforts to broaden its revenue streams beyond spot trading. Coinbase’s recent acquisition of the CFTC-regulated derivatives exchange, FairX, would help expand the company’s forays into the derivatives market. Notably, Needham also highlighted it “was an important step in diversifying transaction revenues and moving closer to a one-stop-shop for crypto-financial services.” Furthermore, “the trading volume of crypto derivatives reached $2.9T in December, surpassing that of spot trading.” We also believe that it can help Coinbase deepen its relationships with its institutional clients, as Head of Coinbase Institutional Brett Tejpaul emphasized: “This is the most important stepping stone for us to help a derivatives market come to form. We think the US-listed derivative market presents a very substantial commercial opportunity.”

But, Coinbase Stock is a Hold

We believe that Coinbase’s business model has proven itself, given its robust profitability. However, due to the volatility experienced in its underlying trading instruments, we think its revenue estimates are challenging to model. That adds increased complexity for us to derive how we should value Coinbase stock accurately. Furthermore, Mizuho accentuated (edited):

Coinbase’s business model is a complete 180-degree turn from Robinhood, and it is in “big trouble”. Coinbase is charging too much money, and it is “overly-profitable.” And the outlook for commissions in crypto trading will move towards zero. They are overcharging the retail investors, as compared to Robinhood, which is not charging anything for the retail investors. So that trajectory is coming down. Near-term, they are going to miss consensus estimates by 25-27% in FQ1’22. And, if this continues, that downturn in consensus estimates is going to come under more pressure over the next few years. (Bloomberg)

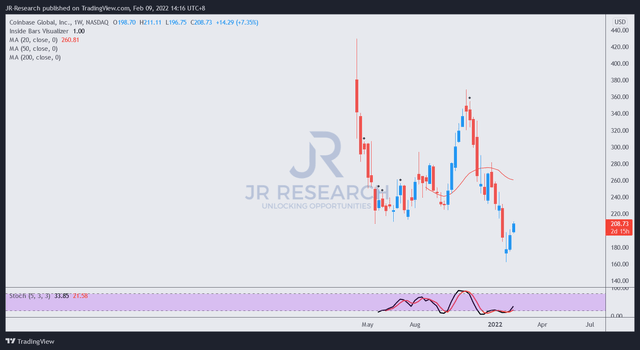

Coinbase stock price action (TradingView)

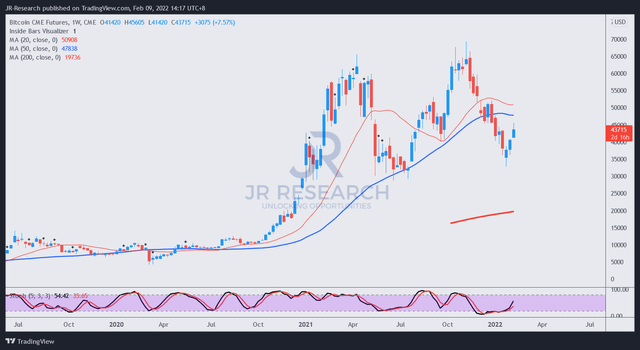

Bitcoin futures price action (TradingView)

Therefore, we believe that investors need to understand the critical difference between trading Coinbase stock or investing in it. We have been trading Coinbase stock and not investing in it. As you see from the above, Coinbase stock is still moving in a mean-reversion pattern, making it suitable for long/short trading opportunities.

In contrast, the underlying Bitcoin has a more robust long-term uptrend that we think makes it more suitable for an investment opportunity from this perspective. Furthermore, Coinbase as a long-term investment holding should continue to be impacted by the underlying crypto volatility, thus affecting its business model. In addition, we also need to factor in the potential threat to its commission-based revenue model moving ahead.

As a result, we rate Coinbase stock as a Hold for investment, even if it’s near its all-time lows. We encourage you to consider it a swing-trading / short-term trading opportunity instead.