Fritz Jorgensen/iStock Editorial via Getty Images

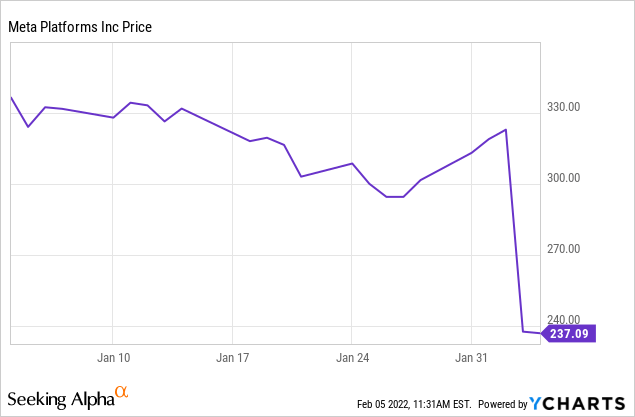

By now, you have surely heard about Meta’s (FB) recent debacle. They reported disappointing earnings results that failed to please investor’s expectations. So much so that the company lost over a quarter of its value overnight:

That’s over $200 billion of value vanished in a day. To put this into perspective, Meta just lost the equivalent of ~8x Twitters (TWTR) in its valuation, which is the biggest wipe out of equity value ever.

Is this a historic opportunity to buy Meta at a bargain valuation… or is it just a value trap?

There are strong arguments on both sides:

On one hand, it is undeniable that Meta has a strong business and it is now available at a reasonable price. It has a strong moat on social medical, high profitability, and good long-term prospects.

Moreover, it has historically always been a good idea to buy the dips in Meta. As a reminder, Meta dropped by nearly 20% in July 2018 when its results disappointed investors, but shortly after, it was again hitting new highs.

Therefore, many were quick to buy the dip and point out that this is just another opportunity.

But on the flip side of things, it is also undeniable that Meta is facing increasingly large headwinds.

For the first time ever, it is now dealing with a competing platform (TikTok, owned by BDNCE) with over a billion users that’s significantly ahead of it in engaging in new format. Historically, Meta has always been leading the pack, but for the time, it is still clearly the follower, trying to copy TikTok with its new “Reel” format. Meanwhile, its legacy formats like Facebook are losing their appeal. I don’t know anyone in my close circle that uses it consistently and many already call it the “new MySpace”.

On top of that, they are dealing with the growing Apple (AAPL) privacy changes that hurts their advertising business. From the earnings call:

“We believe the impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion, so it’s a pretty significant headwind for our business.” – David Wehner, Chief Financial Officer.

The regulatory environment is also increasingly hostile towards them. Perhaps that’s well deserved, considering that the impact of social media on society is quite controversial.

And finally, something that’s rarely mentioned is that Meta now has nearly 2 billion users, which is massive. Size is the enemy of growth and for the first time in history, Meta recorded a drop in active daily users in the last quarter. Can they keep growing from here? Sure, they can, but growing from a 2 billion starting point is far more complicated than growing from just a few million.

As a result, Meta guided for “just” 7% mid-point revenue growth in 2022, which is a big slowdown from its growth over the last few years.

What’s Meta’s response to these growing challenges? It is attempting to reinvent itself as the leading Metaverse platform. It is very heavily investing in this future, hurting today’s profitability, and it even changed its company name.

Ultimately, it appears increasingly likely that Meta’s future success as an investment opportunity relies on the future of the Metaverse.

But business transitions are never simple and the future success of the Metaverse is still highly unpredictable. As we explain in a recent report:

The problem with describing it as “the metaverse” is that there isn’t just one MV or potential MV. There are many.

Moreover, there’s another problem with these fanciful visions of “the” metaverse: they are all based on virtual reality or augmented reality, technologies that have existed for a number of years now but have failed to catch on.

As much as crypto enthusiasts and proud NFT (non-fungible token) owners would like to think that their vision of the metaverse is the inevitable evolution of the Internet, it seems unlikely to take off as they envision it anytime soon.

My takeaway is that Meta is a far more complex story than most investors are willing to admit. If the Metaverse investments pay off, then it could be massively successful, but if it doesn’t, then Meta could be a value-trap from now on.

The arguments are compelling on both sides, but ultimately one thing is clear here: the uncertainty is significant and in my opinion, nobody really knows.

For this reason, the risk-to-reward still isn’t compelling enough for me to initiate a position. While I am not bearish, I have a hard time justifying an investment when there are so many better opportunities out there.

I rarely invest in tech stocks, but when I do, I focus on businesses that are highly predictable and that certainly isn’t the case of Meta these days.

In what follows, I highlight two tech stocks that I am buying instead of Meta:

PAR Technology (PAR)

PAR Technology is today one of my larger tech investments.

I think that it is a hidden gem among SaaS companies that still hasn’t been discovered by most investors due to the complexity of its business and its past troubles.

PAR was founded in 1968 and it was initially a government service-provider that designed computer-based systems and provided technical services to the department of defense and various other federal agencies.

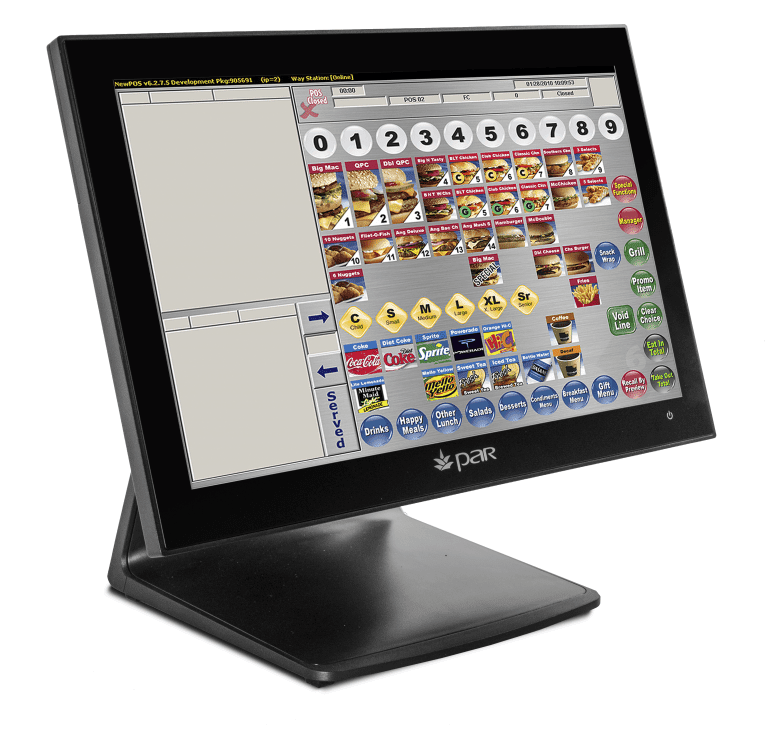

That’s how they got started, but then a decade later, they invented what we call the “Point-of-Sale” terminal that you see at most fast food restaurants like McDonald’s (MCD):

PAR Technology McDonalds (PAR Technology)

Then for most of their history, they focused on selling this hardware and servicing their government clients. It was a good business, but nothing exceptional. Importantly, this was a family-run business that mostly rested on its laurels, failed to innovate, and was slow to adapt to the growing tech needs of restaurants.

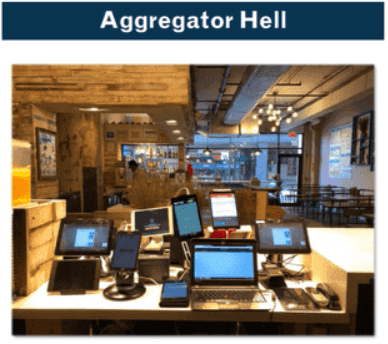

Since restaurants didn’t have a good single solution for all their tech needs, they had to resort to what we call the “tablet hell.” This is obviously very inefficient because you don’t have a central system with all the data:

PAR Technology tablet hell (PAR Technology)

PAR finally recognized this problem in 2014 and began its transition into a one-stop-shop for all restaurant tech needs.

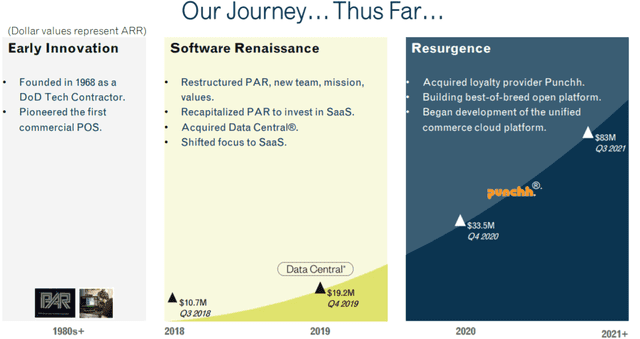

Some years later, PAR even changed its CEO and hired Savneet Singh, who is a software investor. They made several acquisitions to implement this transition and here are the results so far:

PAR Technology history (PAR Technology)

In just 3 years, PAR grew its ARR (annual recurring revenue) by 8x, reaching $83 million in Q3 of last year. By the end of 2022, we expect that number to reach $100+ million and it will only grow from here because PAR’s addressable market is massive and it is just getting started.

As we explain in a previous article:

Since everything begins with the Point-of-Sale terminal, and PAR has relationships with most major enterprise restaurants, we think that it is in a fantastic position to grow this SaaS business over the coming decade into something substantial and the market valuation of the company today doesn’t reflect that.

Today, the market is pricing PAR at ~10x the ARR of its SaaS business. But if you take out the profitable hardware and government businesses, which will be sold, the shares trade at just around ~6x the 2022 ARR according to one of the company’s biggest shareholders, Greenhaven Road Capital.

We think that this is too cheap for a company with such a predictable path to rapid growth prospects. As they sell their other divisions, and simplify the business, we think that the market will reward the company with a materially higher multiple on rapidly growing cash flow.

But don’t just take it from me. Ron Shaich, founder and former CEO of Panera Bread, recently bought a major stake in the company at a share price that’s nearly 2x higher than where it trades at the moment:

“This company has the potential to really dominate in enterprise-class restaurants offering what is the holy grail of technology in this industry, which is essentially unified commerce,” Panera Bread founder Ron Shaich said. Source: CNBC

Coinbase (COIN)

I am not big into crypto.

In fact, I don’t hold any Bitcoin (BTC-USD), Etherium (ETH-USD) or anything else.

That’s not necessarily because I am bearish, but simply because I recognize that it is out of my circle of competence and I don’t have the time to learn about all the individual currencies and follow their prospects.

Fortunately, I don’t need to thanks to Coinbase (COIN). I follow crypto enough to recognize its potential need and given the world we live in, I think that its adoption will only continue to grow in the years ahead, and as a leading cryptocurrency company, Coinbase is set to profit from it.

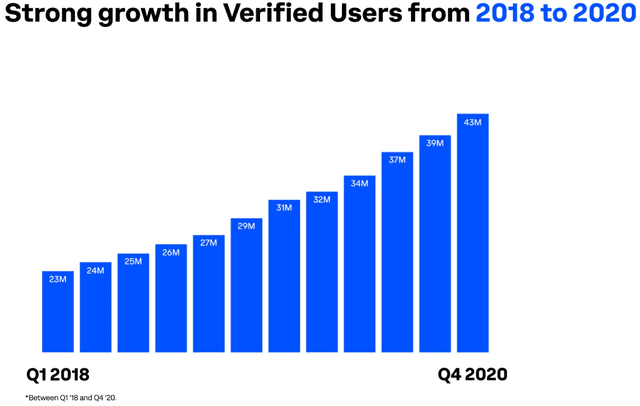

Coinbase User Growth (Coinbase)

Today, Coinbase is still perceived to be just another “exchange” and as a result, it trades at a very reasonable valuation, but in reality, we think that Coinbase is becoming much more than that.

The CEO’s goal is to become the “Amazon (AMZN) of crypto” and I like their chances. They have a strong first mover advantage, trusted reputation, and innovative tech that will allow them to grow many additional crypto-related businesses that are highly synergetic to their exchange. Here is a short list that we had shared in a previous article:

Coinbase NFT coming soon (Coinbase )

Best of all, Coinbase does not rely on the success of a single currency to succeed. As long as people are engaging with crypto in a way or another, Coinbase can profit from it with its various products.

Therefore, we think that the recent dip, which was caused by the broader decline in cryptocurrencies, is unwarranted and presents an attractive buying opportunity for investors who want to have some crypto exposure in their portfolio, while still owning a productive asset that generates profits and without making a bet on a single currency.

Priced at 17x normalized EPS, we think that Coinbase is undervalued and that’s probably why COIN is now one of ARK Invest’s (ARKK) largest holdings.

Bottom Line

As a REIT analyst, I rarely invest in tech companies because of exactly what happened to Meta. Most tech companies are too unpredictable in my opinion, and for this reason, I stay away from most of them.

Today, most comments that I see from bullish Meta investors emphasize the fact that it is cheap and that it has historically performed very well. But that’s exactly how people tend to describe value traps. Instead, we should look at the future and the valuation relative to that.

With that in mind, I believe that there are better opportunities in the tech space, and even more so in the REIT sector (VNQ), which is where I continue to allocate over 50% of my net worth.