Leon Neal/Getty Images News

In this analysis of Coinbase Global Inc. (COIN), we analysed its cryptocurrency exchange business and believe that it stands to benefit as interest by people to invest in cryptocurrency grows. Furthermore, we believe that besides retail customers, its institutional business which represented 56% of its assets on platform in Q3 2021, could benefit as more institutional investors invest in cryptocurrency. Additionally, we analysed its financial position and determined that it has a solid net cash position excluding customer custodial funds liabilities with positive free cash flow, which we believe bodes well for its goal to pursue M&A activity.

Stands To Benefit as More People Invest in Cryptocurrency

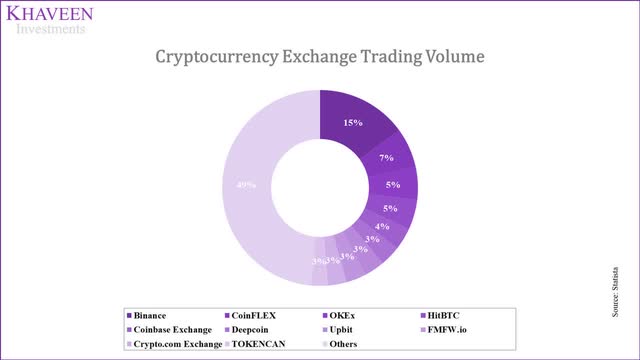

Coinbase is one of the largest cryptocurrency exchanges in the world. It is ranked 5th in terms of trading volume in 2022 with a share of 4% of total cryptocurrency exchange trading volume according to Statista. What sets it apart is that it is the only public-listed crypto exchange in the world.

Statista

Source: Statista

| Coinbase | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021F |

| Users (‘mln’) | 2 | 5 | 13 | 22 | 30 | 35 | 73 |

| Users Growth % | 100% | 150% | 160% | 69% | 36% | 17% | 109% |

| Transaction Volume (‘$ bln’) | 135 | 105 | 79.9 | 193 | 1,499 | ||

| Transaction Growth % | -22.2% | -23.9% | 141.6% | 676.5% | |||

| Bitcoin Price | $ 425 | $ 952 | $ 13,062 | $ 3,690 | $7,251 | $28,769 | $47,128 |

| Bitcoin Price Growth % | 37.1% | 124.1% | 1271.4% | -71.8% | 96.5% | 296.7% | 63.8% |

| Revenue (‘$ bln’) | 0.016 | 0.927 | 0.520 | 0.534 | 1.277 | 7.441 | |

| Revenue Growth % | 5693.8% | -43.9% | 2.6% | 139.3% | 482.7% |

Source: Coinbase, Coindesk, BusinessofApps, Reuters, Khaveen Investments

Coinbase’s revenue is expected to increase from just $16 mln in 2016 to a full-year 2021 revenue of $7.44 bln (based on analyst revenue consensus). Intuitively, we would have expected Coinbase’s revenue to be dependent on its transaction volume. However, we find its revenue more correlated to the price of BTC. We believe the huge revenue increase (5694%) in 2017 was due to the 1271% jump in Bitcoin (BTC-USD) price. In 2018, revenue actually dropped, which was also in line with the decline in BTC price. Coinbase revenue displayed a similar pattern for the following 3 years.

In 2021F however, Coinbase’s huge revenue increase of 482.7% is much higher than BTC price increase of 63.8%. It is in fact more in line with the transaction volume growth of 676.5%. The huge jump in its transaction volume meanwhile, we believe was due to the company’s IPO. Going forward, while we still expect its revenue to be dependent on BTC price, we see transaction volume playing a much more crucial role, given it has now reached a significant size ($1.499 tln based on annualized Q1 to Q3 2021 trading volume).

As the company is a leading player in the cryptocurrency exchange market, we expect the company to stand to benefit as more people become interested and begin trading in cryptocurrency as indicated by several studies. Based on a survey by Pew Research Centre, 86% of Americans are aware of cryptocurrency but only 16% indicated that they have invested in cryptocurrency. It further compares to a previous survey it did in 2015 which states that 48% have heard of cryptocurrency and only 1% either trade or used it. Thus, we believe this highlights that while people are generally well aware of cryptocurrency, many people still do not trade or invest in cryptocurrency which we believe may present growth opportunities for the company.

Additionally, another survey by the NORC at the University of Chicago found that 11% indicated that they were interested to start investing in cryptocurrency in the next 12 months. Though, it found that 62% of respondents to the survey lack enough knowledge of cryptocurrency to begin which we believe could be a barrier for people to begin trading cryptocurrency.

According to the company’s latest quarterly report, Coinbase has a verified user base of 73 mln in Q3 2021 which has increased by 109% since the end of 2020. What is even more impressive is its Monthly Active User Growth which has grown by 164% in the same period. This is possible as the MAU % of total users keeps increasing as a % of Total Users.

|

Coinbase Users (‘mln’) |

2018 |

2019 |

2020 |

2021F |

2022F |

2023F |

2024F |

2025F |

|

Users (‘a’) |

22 |

30 |

35 |

73 |

79.4 |

83.0 |

84.9 |

86.0 |

|

User Growth% |

69% |

36% |

17% |

109% |

9% |

5% |

2% |

1% |

|

Monthly Active Users as % of Total Users (‘b’) |

3.2% |

3.3% |

8.0% |

10.1% |

12.8% |

16.3% |

20.6% |

26.1% |

|

Monthly Active Users as % of Total Users Growth |

4.8% |

140.0% |

26.7% |

26.7% |

26.7% |

26.7% |

26.7% |

|

|

Monthly Active Users (‘c’) |

0.7 |

1 |

2.8 |

7.4 |

10.2 |

13.5 |

17.5 |

22.5 |

|

Monthly Active Users Growth % |

43% |

180% |

164% |

38% |

32% |

30% |

28% |

* c = a x b

Source: Coinbase, Khaveen Investments

We expect its user base to continue growing as more people trade cryptocurrency. However, we believe the 109% increase in its user growth in 2021 is due to its IPO. From 2018 to 2020, its user growth actually decelerated. From 2022 onwards, we resumed this trend from the 2020 growth figure and continued to forecast a decelerating user growth as seen above. Despite this, we see the Monthly Active Users % of Total Users continuing to grow steadily at its 3-yr average of 26.7%, which results in its total monthly active users growing at above 28% over the next 4 years, which would contribute to Coinbase’s transaction volume.

Growing Interest from Institutional Investors in Crypto

Besides the retail crowd, the company also serves institutional customers. According to its prospectus, its institutional customers include “hedge funds, family offices, principal trading firms, and financial institutions”. For example, its clients include PIMCO and Marex Solutions. Also, the company is a custodian of the Grayscale Bitcoin Trust (OTC:GBTC), one of the few bitcoin funds that hold bitcoin directly. The company highlighted in its prospectus that the value of crypto assets represented around 11.1% of total market capitalization in 2020.

For its assets on platform, institutional customers represent around $139 bln which is around 54.5% of its total assets on platform of $255 bln in Q3 2021. However, its institutional transactional revenues only account for 6.2% of its total transactional revenues in Q3 2021.

According to a study by Goldman Sachs (GS) of over 150 family offices, only 15% of respondents are invested in cryptocurrency and 45% are interested in cryptocurrencies as a hedge for “higher inflation, prolonged low rates, and other macroeconomic developments following a year of unprecedented global monetary and fiscal stimulus.” Furthermore, Coalition Greenwich found that 7 in 10 institutional investors expect to invest in digital assets in the future. However, it cited price volatility as one of the main barriers by institutional investors.

As more institutional investors invest in cryptocurrency, we expect the company’s institutional assets to grow and project its institutional assets on platform to grow in 2021 by 717.6% (based on prorated Q1 to Q3 growth) tapering down by 100% beyond 2021.

|

Assets on Platform ($ mln) |

2020 |

2021F |

2022F |

2023F |

|

Institutional Assets on Platform |

45 |

368 |

2,641 |

16,309 |

|

Growth % |

717.6% |

617.6% |

517.6% |

Source: Coinbase, Khaveen Investments

Hence, as interest from institutional investors in cryptocurrency grows as indicated by the studies, we believe that the company’s institutional business which represents a major portion of its total assets at 54.5% could continue to grow as more institutional customers join its platform and invest in cryptocurrency.

Company’s Healthy Financial Position Factoring in Custodial Liabilities

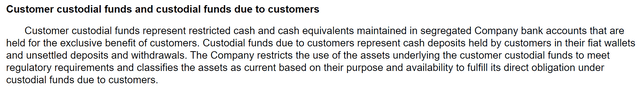

In Q3 2021, the company had cash of $6.35 bln and debt of $12.8 bln. However, its debt also includes custodial funds liabilities for its clients of $8.8bln in Q3 2021. The company described its customer custodial funds in the following excerpt.

Coinbase

Source: Coinbase

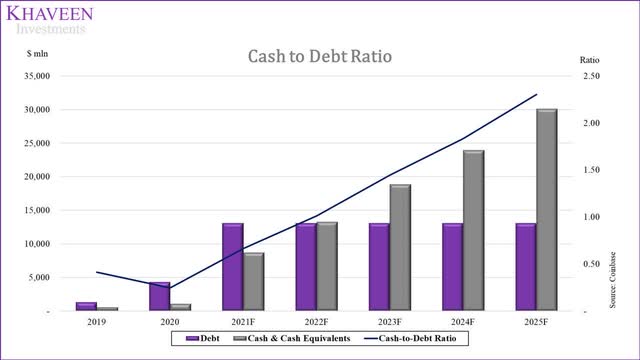

Excluding the custodial fund liabilities of $8.8 bln, the company would have a net cash position of $2.3 bln which is around 16.8% of its market capitalization. Thus, we believe this highlights its healthy financial position with a net cash position excluding its client fund liabilities. Further, the chart below shows our forecast of the company’s cash to debt ratio increasing through 2025.

Coinbase, Khaveen Investments

Source: Coinbase, Khaveen Investments

Furthermore, the company announced in September 2021 that it was issuing $1.5 bln in debt for “general corporate purposes, including investment in product development and acquisitions”. Based on the following quote, the company’s management has highlighted its intent to pursue M&A activity.

A secondary goal for us is about M&A pipeline and or partnerships. – Emilie Choi, President and COO of Coinbase Global

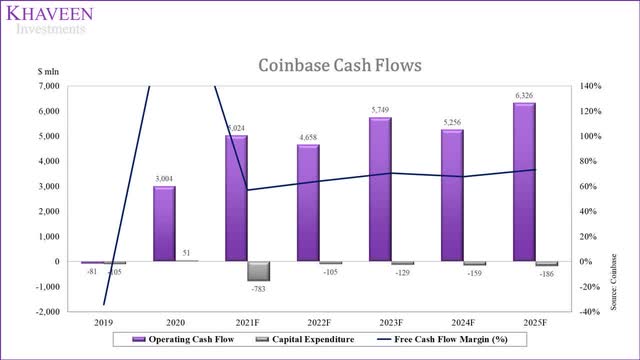

Therefore, while the company may appear to have high debt, this is mainly due to the inclusion of its customer fund obligations under its liabilities. Excluding its client fund liabilities, we believe that the company’s financial position is strong with a net cash position. Moreover, we believe that its financial position strength underpins its capability to pursue acquisitions supported by its positive FCFs.

Coinbase, Khaveen Investments

Source: Coinbase, Khaveen Investments

While the company had negative free operating cash flow in 2019, operating cash flow in 2020 improved significantly, leading to a FCF margin of 239.3%. When examining its total capex, aside from PP&E, it also includes capitalized software costs, asset and business acquisitions, as well as investments. This leads to a much higher capex % of total assets (3-year average of 2.31%). Excluding these non-PP&E related cash flows, we arrived at the adjusted capex that is significantly lower than its total capex of 0.5%, which we believe is a more accurate assumption to use. To project its capex going forward, we used this capex as a % of total assets of 0.5%.

| Coinbase Cash Flows ($ mln) | 2019 | 2020 | 2021F | 2022F | 2023F | 2024F | 2025F |

| Operating Cash Flow | -81 | 3,004 | 5,024 | 4,658 | 5,749 | 5,244 | 6,312 |

| Total Capex | 105 | -51 | 624 | – | – | – | – |

| Total Capex as % of Assets | 4.41% | -0.87% | 3.38% | ||||

| Adjusted Capex | 33.51 | 9.90 | 4.00 | 104.77 | 128.90 | 158.93 | 186.15 |

| Adjusted Capex % of Assets | 1.40% | 0.17% | 0.02% | 0.5% | 0.5% | 0.5% | 0.5% |

| Free Cash Flow (Adjusted Capex) | -47 | 3,014 | 5,028 | 4,554 | 5,620 | 5,085 | 6,125 |

| FCF Margin % | -8.8% | 236.0% | 67.6% | 62.8% | 69.4% | 66.4% | 72.1% |

Source: Coinbase, Khaveen Investments

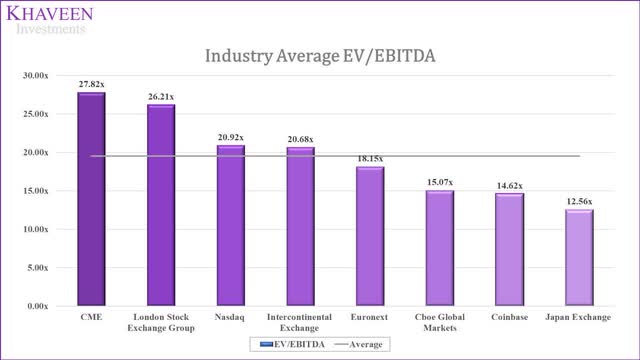

Risks: Volatile Business Model

According to the company, it highlights the high volatility associated with its business in the following excerpt from its Q3 2021 shareholder letter. It highlights that its users, trading volume and revenue could fluctuate with cryptocurrency asset prices.

Coinbase

Source: Coinbase

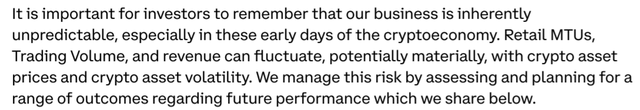

Furthermore, the following diagram below is the average analyst revenue consensus for the company which also shows very volatile growth for the company over the next 5 years.

SeekingAlpha

Source: Seeking Alpha

Based on estimated 5-yr revenue growth excluding 2017 due to its extreme growth for that year, we calculated its standard deviation to highlight its volatility.

|

Total Revenue ($ bln) |

2016 |

2017 |

2018 |

2019 |

2020 |

2021F |

Std Dev (4-yr) |

|

Revenue |

0.016 |

0.927 |

0.52 |

0.5337 |

1.277 |

7.121 |

|

|

Growth % |

5693.8% |

-43.9% |

2.6% |

139.3% |

457.7% |

226.3% |

Source: BusinessofApps, Reuters, Coinbase, Khaveen Investments

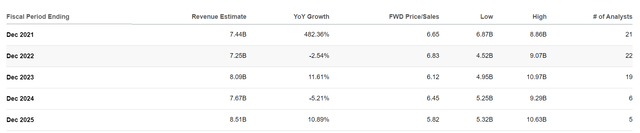

We obtained a standard deviation of 226.3%. We factored this deviation into the company’s analyst consensus revenue growth rate estimates to present the bear and bull case.

Khaveen Investments

Source: Khaveen Investments

| Coinbase Revenue Growth | 2022F | 2023F | 2024F | 2025F |

| Bear case | -6.05% | -4.42% | -12.40% | -4.15% |

| Base case | -2.54% | 11.61% | -5.21% | 10.89% |

| Bull case | 0.97% | 27.64% | 1.98% | 25.93% |

Source: Khaveen Investments

As seen in the chart above, the highly volatile nature of Coinbase’s revenue could mean negative revenue growth in each of the next 4 years in the bear case scenario.

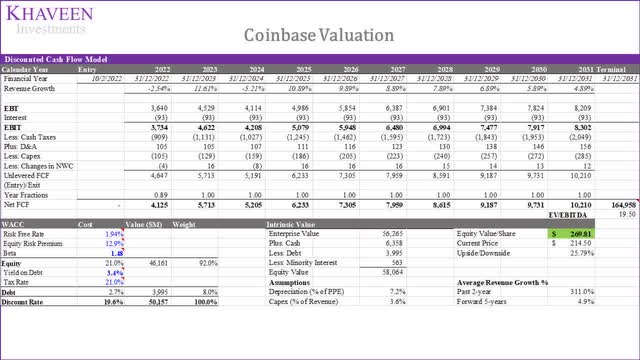

Valuation

To value the company, we used a DCF analysis as we expect the company to continue generating positive free cash flows. For its revenue growth, we used analyst consensus from 2021 to 2025.

| Revenue Projections ($ bln) | 2019 | 2020 | 2021F | 2022F | 2023F | 2024F | 2025F |

| Total Revenue | 0.53 | 1.28 | 7.44 | 7.25 | 8.09 | 7.66 | 8.50 |

| Revenue Growth % | 139.3% | 482.7% | -2.5% | 11.6% | -5.3% | 10.9% |

Source: Coinbase, SeekingAlpha, Khaveen Investments

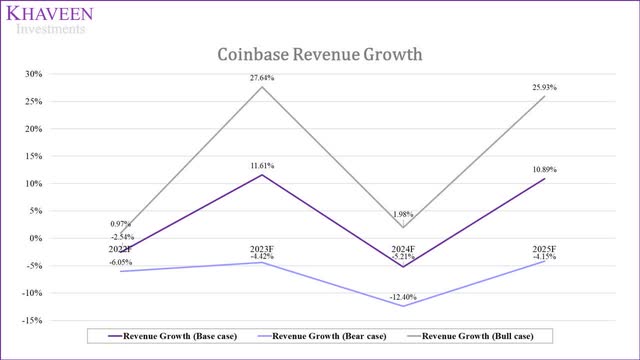

For its terminal value for the DCF, we obtained an average EV/EBITDA of financial data and exchange companies with an average of 19.5x.

SeekingAlpha, Khaveen Investments

Source: Seeking Alpha, Khaveen Investments

Based on a discount rate of 19.6% (company’s WACC), our DCF model shows an upside of 25.79%.

Khaveen Investments

Source: Khaveen Investments

Verdict

To conclude, we analyzed the company and expect it to benefit as one of the largest cryptocurrency exchanges and as more people begin investing in cryptocurrency. With the company’s transaction volume reaching a significant size ($1.5 tln) to drive revenue growth, we believe Coinbase’s increasing Monthly Active Users would contribute to higher trading volumes. Besides retail customers, we are also positive about its outlook with institutional investors with accounts for over half of its assets on platform, as they increase their cryptocurrency exposure.

Moreover, we analyzed its financial position with a healthy net cash position at 16.8% of its market capitalization excluding client fund liabilities. We also examined its capex and determined its adjusted capex focusing on PP&E related cash flows which had a 3-year average of only 0.5% of total assets and believe its free cash flows would remain positive.

However, we believe the risk to the company is its volatile business model with a 4-year revenue growth standard deviation of 226.3%. Based on our DCF valuation, we derived an upside of 25.7% as the company is trading at a low EV/EBITDA of 14.62x compared to other financial data and exchange companies with an average of 19.35x. Overall, we rate the company as a Buy with a target price of $269.81.