The US Federal Reserve (Fed) aims to get inflation down with its interest rate hikes this year. Longer-term, however, inflation might still remain as the winner, with bets on bitcoin (BTC), ethereum (ETH), and gold expected to pay off. But until then, volatility could flush out even the most dedicated crypto holders, crypto exchange BitMEX warned.

Unlike some other observers from the crypto space who don’t seem to believe the Fed will raise rates in any meaningful way, BitMEX said that it believes the Fed “will respond” to the rising inflation. It added that this shift in Fed policy will have “a significant impact” on both the inflation level and general conditions in the financial markets.

“The Fed is now required to respond and will do so,” BitMEX’s research team said, while adding that this “is not necessarily a consensus view, at least not among Bitcoiners, gold bugs and those who anticipated inflation in 2020.”

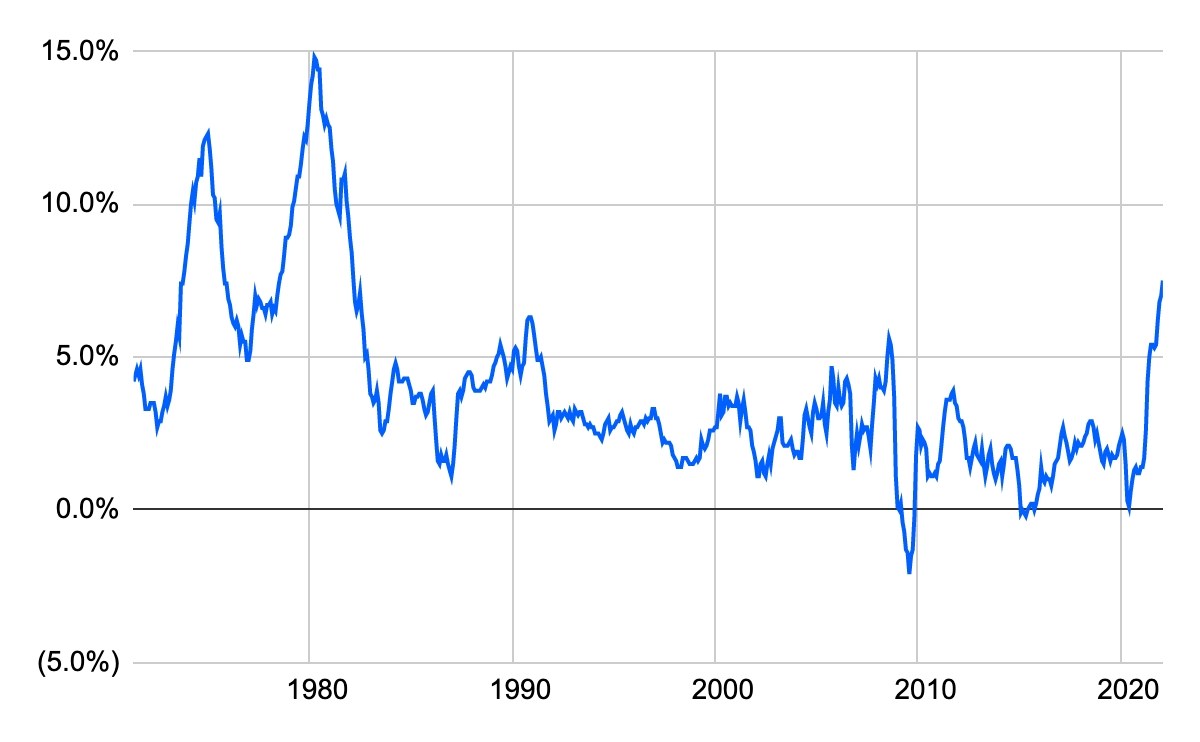

The exchange went on to share a chart that showed how inflation, as measured by the US Consumer Price Index (CPI), has reached its highest point since 1982.

US Consumer Price Index:

Further, analysts at BitMEX wrote that rising rates are expected to have a “significant impact on investor demand for financial assets,” and that this includes both stocks and crypto.

“Artificially low rates have taken the economic fuel away from real, sustainable, profitable and humble companies. Instead, we are left with loss making tech startups, master of the universe VC funds, meme stocks, CryptoPunks and a Metaverse real estate bonanza.”

It added that this represents “an extreme level of financialisation in the economy,” and that financial assets in general are more sensitive to liquidity conditions and financial flows than any fundamental value.

“Of course, the authorities will react to the economic downturn and we will eventually correct course back to the inflationary regime.” However, responding may not be as simple this time around, BitMEX predicted, saying that loose monetary policies could become “less politically palatable.”

“Instead the response could be a more targeted and coordinated monetary and fiscal stimulus. The result here could be that the next wave of inflation is experienced first in consumer prices, rather than financial assets,” the team said.

On the question of how investors should position themselves for such a scenario, the exchange reiterated that inflation will be the only winner in the end. In that event, inflation hedges such as gold, gold miners, BTC, ETH, and index-linked bonds are expected to pay off, BitMEX said.

Still, it warned that the scenario “could take five or ten years to play out.” In the meantime, things will be volatile, inflation is likely to fall, and very few investors will have the patience and resilience to stick with their plan through all of this, the exchange said.

Lastly, BitMEX noted that “trying to be tactical and time markets is widely regarded as a fool’s errand.” Instead, the exchange suggested investors should “turn off the machines and sell the index trackers, you will have no choice.”

“Buy Bitcoin at USD 20,000. Play the game,” BitMEX concluded by saying.

____

Learn more:

– Supply Disruptions Add to Inflation, Undermine Recovery in Europe

– Demand for High-Yield Crypto Savings Products to Surge, BitMEX Predicts

– Inflation Is ‘Huge Danger’ as the US Government ‘Overdid It a Little’ – Charlie Munger

– How Raising Interest Rates Curbs Inflation – and What Could Possibly Go Wrong

– Fiat Fears Intensify as Turkey’s Inflation Runs Wild; Citizens Turn to Bitcoin, Tether

– IMF Warns of Dangers of Fed’s Rate Rise, Brazil Says Inflation ‘Won’t Be Temporary in West’