On Saturday, January 15, 2022, the market capitalization of all the stablecoins in existence is $173 billion, which represents 7.93% of the $2.18 trillion crypto-economy. The market valuations of stablecoins tether and usd coin represent 71.84% of the entire stablecoin economy’s value. This week, the current total supply of usd coin surpassed tether, in terms of tokens issued on the Ethereum blockchain, as usd coin has a 0.568% larger fully diluted market capitalization on the smart contract network.

USDC Issuance on Ethereum Surpasses Tether’s ERC20 Supply

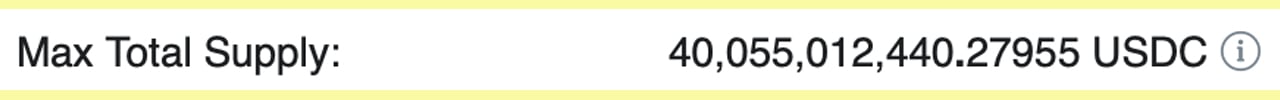

The current total supply of the stablecoin usd coin (USDC) on the Ethereum blockchain is over 40 billion units, which is higher than the number of tether (USDT) on the chain. At the time of writing, according to etherscan statistics, the current supply of USDT is 39.8 billion units. While there’s only 0.568% more USDC tokens than the number of tethers in circulation, it’s the first time USDC has overtaken USDT in terms of Ethereum issuance.

While tether has seen 136,448,792 transfers total on the ETH chain, USDC has only seen 33,104,877. Essentially, ERC20 tethers have been transacted with 312.17% more than USDC tokens have been transferred. Tether also has a lot more USDT tokens across multiple blockchain networks with a current total supply of 79 billion tethers.

USDC is also on a few different blockchains, but the majority of USDC resides on Ethereum. USDC has a current total supply of 45.3 billion, which means 5.3 billion USDCs are used on alternative blockchains.

Stablecoin Giants Eclipse Decentralized, Algorithmic Competitors Despite Double-Digit Monthly Growth

Both of these stablecoins are giants in comparison to the rest of the stablecoins in existence as they dominate 71.84% of today’s stablecoin economy. During the last 24 hours, across the entire crypto-economy, there’s been $78 billion in total trade volume. However, stablecoin trades represent $47.5 billion of today’s trade volume or more than 60% of the aggregate.

Statistics from coingecko.com’s top stablecoin by market capitalization indicate that tether has increased its supply by 1.8% during the last 30 days. USDC’s supply over the last month has increased by 8.9%. Decentralized and algorithmic stablecoin supplies have seen much larger increases during the last 30 days as UST, MIM, and FRAX increased by double-digit percentages. Terra’s UST increased 22%, MIM jumped 17%, and FRAX increased by 46.4% over the last month.

What do you think about the current total supply of USDC surpassing tether’s current supply on the Ethereum blockchain? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, etherscan.io,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.