Happy New Year friends and investors! What an amazing new year it is likely to be. Like a bolder dropped in a pond, the virus produced a huge implosion of corporate growth in 2020 and an unprecedented explosion of growth in 2021. Extending the ripple-in-a-pond metaphor we might expect that these waves will diminish in magnitude and then settle. But when and how bumpy will the waves be in 2022? And which sector(s) will possibly be causing it.

– Valuewalk

Q4 2021 hedge fund letters, conferences and more

Historically Negative Combination

Complicating things is a surge in inflation that is likely to persist through these waves as decades of easy money policy, of lower labor share of wealth/income and now the global disruptions associated with the virus will pressure prices up. That means that we will need to manage through a period of lower growth and higher inflation. Historically that is a very negative combination for asset prices.

The peak of the first wave was evident in the 3rd quarter financial statements database update that was just completed. The frequency of rising sales growth and rising gross profit margins was lower in the period and it is those frequency numbers that typically mark the growth peak.

Rising Inflation And Interest Rates

The only way to defend our assets from the negative affect of rising inflation and interest rates is to own accelerating companies. Only rising growth will provide defense against rising interest rates. The rebound from the virus depressed levels last year has most companies recording acceleration attributes.

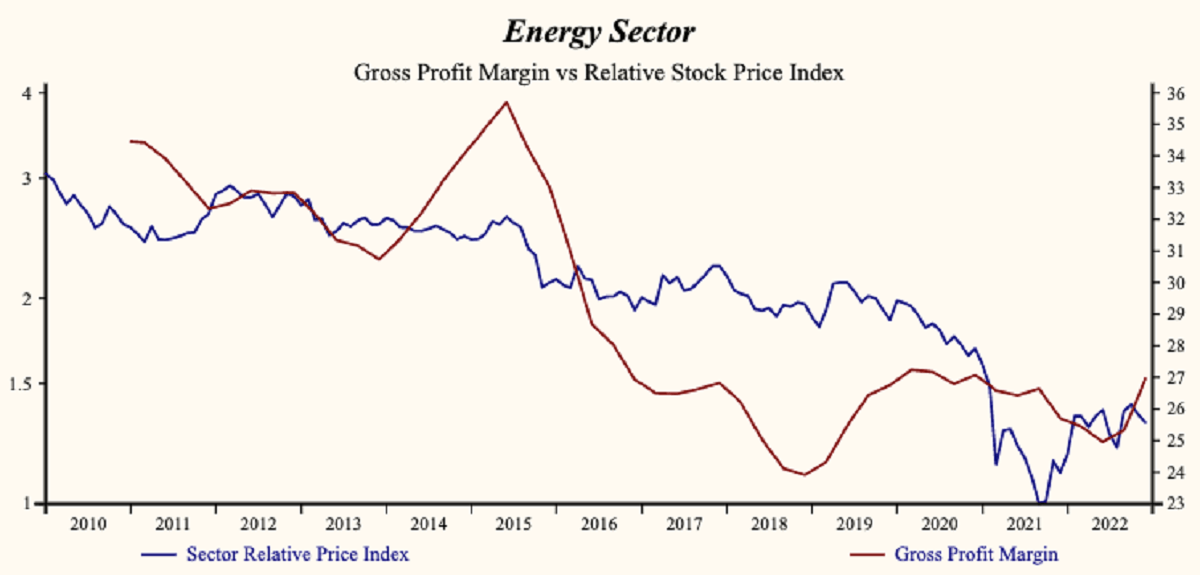

Recently, the biggest rebound was the energy group where sales growth dropped to -50% (at the most virus depressed period) but has since recovered to 44% in the recent update; with a whopping 88% of energy companies achieving an improvement.

Oil & Gas Cycles

There are several cycles in our data record but in a typical oil and gas cycle we would begin to see an acceleration in capital expenditures as companies react to higher oil prices with bigger exploration and development spending. Successfully implemented new projects would replace fading production elsewhere and contribute to supply growth.

Recent evidence suggests the opposite is happening in the oil and gas industry. Capital expenditures continue to fall relative to sales. Oil prices continue to advance, production is fading but not being replaced and supply growth is slowing.

Energy Demand Continues To Grow

The world is not willing to reduce energy use. There is tremendous resistance to higher oil prices and lower fuel-cost subsidies as we have seen in social unrest repeated in recent years. Most recent example in Kazakhstan.

Econ 101

From basic economic theory, we know that the only way to reduce fossil fuel use is through higher prices. Higher energy costs and carbon taxes will sustain high inflation. The recent increase has lifted measured inflation by the fastest rate (7%) and to the highest level since 1979. The current yield on long term bonds is 2% producing an after inflation (real) negative return of -5%!

Back In 1979

The last time (1979) inflation was behaving in this trend, long treasury bonds yielded 12% for a real return of 5%. If Bond yields were to rise to 12% now, the price of long treasury bonds would fall by over 80%. This is an impending retirement disaster.

Terribly important to retirees, please review your retirement accounts now and sell all fixed income securities. The only way to defend our assets from the negative affect of rising inflation and interest rates is to own accelerating companies. Only rising growth will provide defense against rising interest rates. The rebound from the virus depressed levels last year has most companies recording acceleration attributes.

Otos MoneyTree

Otos displays rising sales growth and rising profit margins as a MoneyTree with a green globe, a dark trunk, and a golden pot. As companies report their financial statements in coming weeks, be scrupulous around the growth attributes of your portfolio companies.

Whatever Quantitative Tools you choose to use, your portfolio of companies must have rising growth attributes (MoneyTree with a green globe, dark trunk and hourglass shaped golden pot).

The current Otos Total Market Index portfolio MoneyTree below has high and rising sales growth, rising profit margins and high operating/financial leverage.

Choose Active Portfolio Management and verify that your portfolio attributes are, simply put, growing!

SEC Filings Of Annual Reports

This is the last update of the 3rd quarter financial statement update with the Securities and Exchange Commission (SEC) but soon updates from the 4th quarter year-end period will begin. Most companies will soon to be reporting their annual period ended December. The reporting deadline for annual financial statements is later so it will be early March before we see a full macro picture (stay tuned).

All the best in 2022 and take care!