(Edited by Greg Ahlstrand)

Good morning. Here’s what’s happening:

Market moves:

Bitcoin opened lower on the first trading day of U.S. equities market, while the stock market gained with Apple briefly hitting a $3 trillion market capitalization.

Technician’s take: Price indicators suggest limited downside for BTC over the short-term as selling pressure slows.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $46,343 -2.29%

Ether (ETH): $3,755 -1.84$

Markets

S&P 500: 4,796 +0.64$

DJIA: 36,5856 +0.68%

Nasdaq: 15,832 +1.2%

Gold: $$1,803 -1.38%

Market moves

Bitcoin, the oldest cryptocurrency, was trading below $46,000 at the time of writing. Its price was also down by nearly 3% in the past 24 hours.

“It’s pretty much been choppy since that big drop in the beginning of December,” Andrew Tu, business development manager at crypto quant trading firm Efficient Frontier, told CoinDesk in a Telegram message. Bitcoin has “been ranging $46,000-$51,000 for a month or so now… most of major [tokens] have been following the trend.”

Bitcoin’s spot trading volume across major centralized exchanges remained low on Monday, nowhere near its pre-holiday level, based on data compiled by CoinDesk.

An “absence of trading activity is likely to be one of the reasons for the overall crypto market’s “bearish pullback” over the past week, according to crypto trading data firm Kaiko.

While bitcoin is viewed by some market participants as “a risk-on asset” similar to stocks, S&P 500 opened its first trading day higher, with electric car maker Tesla’s stock skyrocketing. Apple’s market value briefly touched $3 trillion because of the stock rally.

Risk-on refers to a situation where investors are willing to invest in assets with higher risks like equity markets, commodity currencies. That typically happens when the economy is expected to fare well. But according to Wall Street Journal, Monday’s stock rally is also associated with the new year: stocks tend to rally at the start of new calendar periods due to “new money” like pension funds that invest when a new period starts.

Efficient Frontier’s Tu said “macro uncertainty” remains the main factor of bitcoin’s choppy move. The Federal Reserve in the U.S. in December signaled three interest rate hikes in 2022, and would move faster to wind down its bond purchases in response to elevated inflation pressures.

As CoinDesk reported, a tightened monetary policy is typically considered as bearish for assets, bitcoin included.

Technician’s take

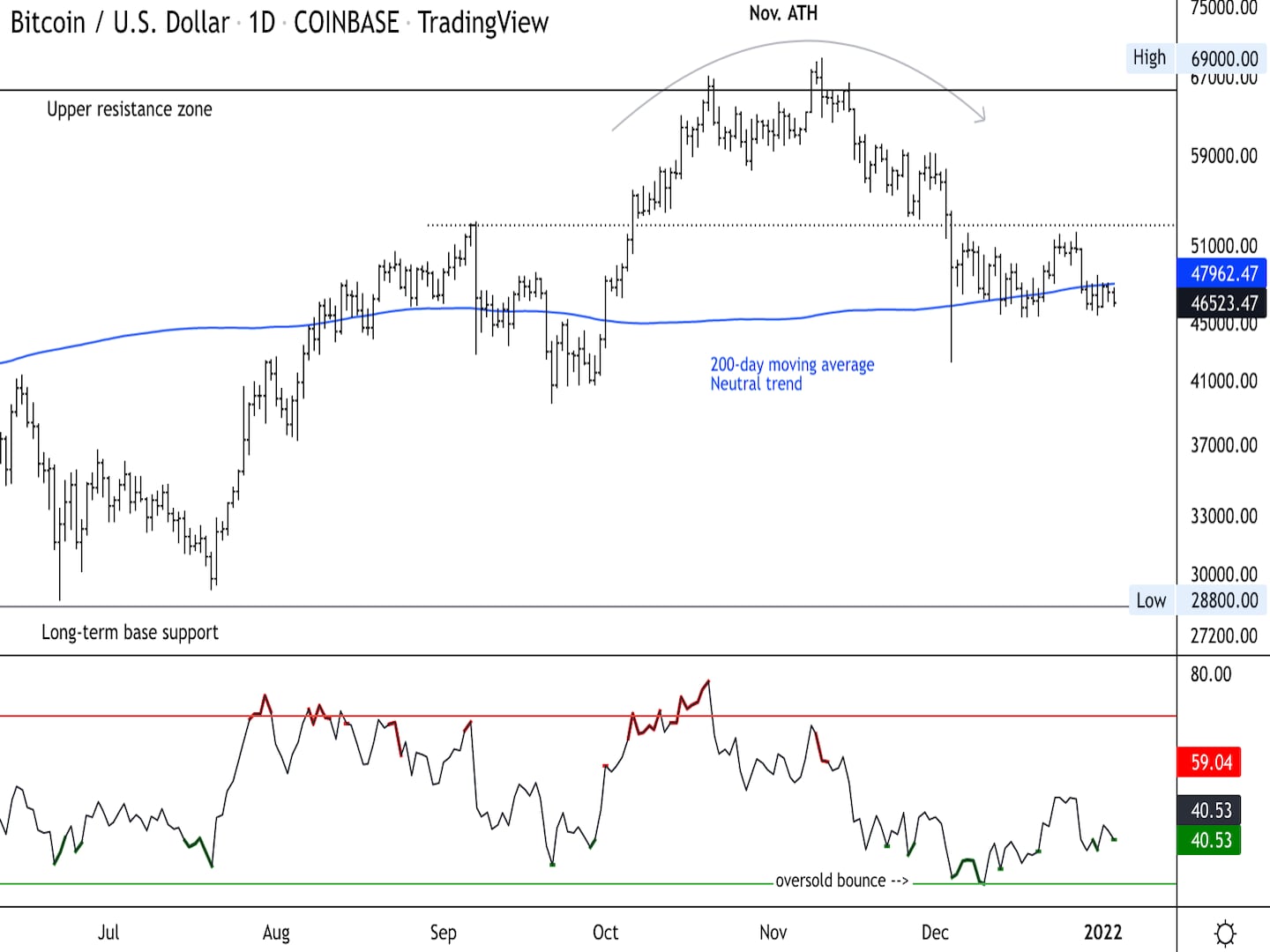

Bitcoin Stuck in Range Between $45K Support and $52K Resistance

Bitcoin is off to a slow start as traders ring in the new year. The cryptocurrency is down about 8% over the past week as demand from buyers slowed. The current price around $46,000 is near the bottom of a two-week long price range, which previously led to higher bids for BTC.

The relative strength index (RSI) on the daily chart is rising from an oversold level reached on Dec. 10. This suggests selling pressure is starting to wane, especially as downside exhaustion signals appeared on the daily chart for the first time since July.

BTC will need to return above its 200-day moving average, currently at $47,962, to yield further upside targets. The next level of resistance is seen around $52,000, which could limit short-term gains.

For now, price momentum is slowing ahead of the Asian trading day, as buyers and sellers appear to be in a stalemate.

Important events

10:00 a.m ET (2 p.m. HK/Sing) ISM manufacturing index 10 amISM manufacturing indexDec.

10 a.m. ET (2 p.m. HK.Sing) ISM manufacturing index

10 a.m. ET (2 p.m. HK/SING) Job openings November

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

Crypto Markets Update and Outlook, Layer 2 Solutions to Improve Ethereum Performance

“First Mover” dove into crypto markets on the first day stock markets opened in the new year. Joining us to discuss the general 2022 crypto outlook, questions about the inflation-hedge narrative, correlation to the stock market, volatility, DeFi and more was Greg Magadini, CEO of Genesis Volatility. Also, Jan Hartmann of Banxa Labs on the progress in deploying Layer 2 solutions to lower Ethereum gas fees and speed up transaction times.

Latest headlines

Should Western Union Worry About Stablecoins? For now, stablecoins are used mostly in the speculative crypto economy. Will that change?

Salvadoran President Bukele Expects Bitcoin to Reach $100K This Year El Salvador adopted bitcoin as an official currency last year.

LinksDAO NFT Sale Books First $10M Toward Buying an Actual Golf Course The project sold out a collection of over 9,000 NFTs with a token airdrop for members penciled in for 2022.

Longer reads

Today’s Crypto explainer: How Does Ethereum Work?