Leon Neal/Getty Images News

Founded in 2012 by Brian Armstrong and Fred Ehrsam, Coinbase (COIN) is a U.S.-based cryptocurrency exchange platform for investing, spending, saving, earning, and trading crypto. According to CoinMarketCap’s ratings, Coinbase is ranked as the best crypto exchange in the U.S. and second in the world behind the Chinese-based Binance. Coinbase serves around 73 million users, 10,000 institutions across 100 countries, and holds an 11% global market share. Its variety of products generated 5.92B in revenue and 2.31B in profit in the past year. The majority of Coinbase’s revenue comes from the transaction fees of individuals and institutions. Institutional custodial fees and sales of owned crypto assets serve as secondary revenue streams. Coinbase is the only publicly-listed and regulated exchange in the U.S., which is a major selling point for institutions. Having said that, exchanges such as Kraken and BlockFi have plans to go public in 2022.

Price Movements

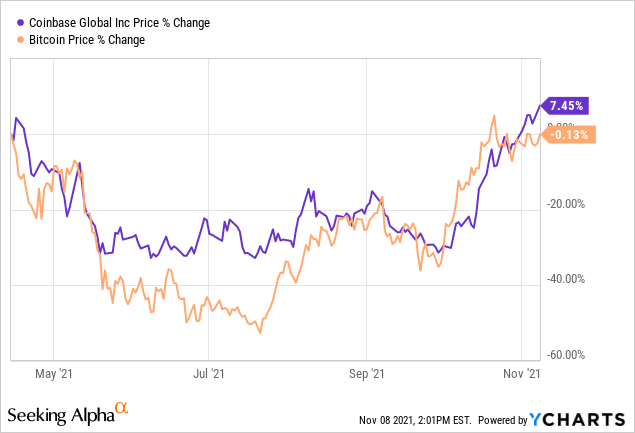

On April 14, 2021, Coinbase went public on the Nasdaq with the ticker COIN. At the time, Bitcoin’s price was rallying and Coinbase’s listing pushed Bitcoin to its all-time high of $65,000. Coinbase ended its IPO day with a closing price of $328.28, a whopping valuation of $85.7 billion. Over the next couple of months, the bubble seemingly popped and Bitcoin tumbled to $30,000, a near 50% loss. Along with it, Coinbase’s stock fell to $220. However, Bitcoin bounced back in November and so did Coinbase. The pair’s price changes are almost identical, demonstrating a strong positive correlation. This can be linked to transaction fees being Coinbase’s major revenue stream. As cryptos fall, so do transaction volumes and Coinbase’s revenue. As of January 4, 2022, Bitcoin sits at $46,000 and Coinbase fell to $250 from highs of $400.

Source: Seeking Alpha

Industry Overview

Market Share

CoinMarketCap’s rankings factor in trading volume, liquidity, traffic, and confidence in legitimacy. Although Coinbase is ranked very high due to liquidity and legitimacy, it does not fare as well in terms of trading volume. Binance sits comfortably at the top of the 24H trading volume list with around $16 billion. Coinbase is often 6th on the list at around $4 billion after OKEx, CoinFLEX, HitBTC, and Crypto.com. In recent months, many of these exchanges have become major competitors to Coinbase. Recently, the Singaporean company Crypto.com purchased the rights to the naming of the Staples Center, now Crypto.com Arena, in a 20-year $700 million deal starting this year. These exchanges have been gunning for Coinbase’s position, but without any new stock listings in the U.S., Coinbase will still reign supreme among domestic and global investors.

Industry Growth

According to an October Fortune Business Insights report, the cryptocurrency market is expected to grow at a CAGR of 11.1% from 2021 to 2028. The current total cryptocurrency market cap is around $2.2 trillion, and that number will likely reach $5 trillion or more by 2028 considering new developments and crypto acceptance.

Future Adoption

A Pew Research survey found that 16% of Americans have invested in, traded, or used cryptocurrency. This number is set to grow as global adoption increases. El Salvador recently adopted Bitcoin as legal tender, a major step for the crypto industry in 2021, indicating that a major area of growth would be the increased acceptance of crypto from governments. However, after China’s ban on crypto, many countries have grown weary. SEC Chairman Gary Gensler has promised to crack down on crypto and heavily regulate the industry. Despite that, it is clear that the crypto market is here to stay.

Competitive Analysis

Porter’s Five Forces

Competitive Rivalry – Moderate (3 out of 5):

The global competitive rivalry of crypto exchanges is intense, however, Coinbase’s position in the U.S. gives it a major leg up domestically. It holds far more recognition and trust among investors and large institutions.

Threat of New Entrants – Moderate (3 out of 5):

The decentralized and digital aspects of crypto make starting ventures less time-consuming. There is less upfront cost of capital because it requires no physical assets. Consequently, many companies have changed to remote-first with no formal headquarters, like Coinbase. This increases the number of new entrants, but not necessarily the threat of these entrants because legitimacy plays a larger factor.

Threat of Substitutes – Moderate (3 out of 5):

Individuals are likely to look towards substitutes in a market of near-identical products, nonetheless, institutions will likely stick to Coinbase due to its regulation as a publicly-traded company.

Bargaining Power of Customers – Insignificant (1 out of 5):

Competitors almost have no bargaining power in the crypto arena. Transaction fees from exchanges are layered on top of the existing blockchain transaction fees. For companies to profit, fees have to stay where there are.

Bargaining Power of Suppliers – Significant (5 out of 5):

The suppliers for a crypto exchange are the native coins and their transaction fees. The transaction fee from the blockchain of cryptos increases as the network size increases. These fees are necessary to reward miners and keep the network operational. As fees increase, companies face a decision whether or not to decrease margins to keep prices low for consumers.

SWOT Analysis

Strengths

Coinbase’s strength comes from its ecosystem. It has been able to build up an array of products that allow it to have roots in the banking system. Besides the well-known Coinbase.com, Coinbase Pro, and Coinbase Wallet, the company offers Coinbase Custody, Coinbase Commerce, Coinbase Prime, and Coinbase Card. In addition, crypto’s new popularity has given Coinbase a large user base and audience opportunity.

Weaknesses

Coinbase generates large amounts of cash, and cash flows have been positive for the past few years. Though, what seems like a strength could end up as a weakness. Coinbase has been unable to demonstrate a strong ability to launch and grow new segments with the large amount of cash it has on hand.

Opportunities

Coinbase has major opportunities in the NFT space and should look to bring NFTs to investors just like how they brought crypto mainstream. The company recently announced Coinbase NFT, a marketplace for NFTs. There have been predictions that the NFT market could take over Bitcoin in terms of market capitalization as the demand for NFT widens.

Threats

A major threat is Coinbase stock’s correlation to the prices of major cryptos. Coinbase is overly reliant on the daily prices of cryptos like Bitcoin to move to its stock. Other large threats are government regulation, climate change policy, and the acceptance of crypto in countries around the world, including the U.S.

Revenue Drivers

Transaction Revenue

Coinbase’s major revenue drivers are its transaction fees, which made up 85% of its revenue from Q1 to Q3 2021, as reported in the company Q3 10-Q. This number has decreased from 90% in the same period in 2020 because of the company’s expansion towards different products. However, Institutional transaction fees still only make up 5% of total revenues in 2021, compared to 81% from retail traders. This shows that Coinbase charges much fewer fees on institutions to attract them to their platform, providing liquidity for the exchange.

Subscription and Services Revenue

Key revenue drivers for Coinbase’s future come from subscriptions and services. The largest section of this segment is in the form of blockchain rewards at 43% of subscription and service revenue or 2.4% of total revenue. This high percentage is a result of Coinbase’s large crypto holdings that allow it to generate staking revenue. The company participates in validating blocks on networks using its holdings and the blockchains reward the company for serving as a node. The second-largest category is custodial fees at 28% of subscription and service revenue and 1.6% of total revenue. This is revenue from holding custody of crypto assets of individuals and retailers. Coinbase Custody is specifically geared towards institutions, who are not well equipped to hold billions of crypto on their own. The last service in this category is Coinbase Earn at 14% and 0.8% of total revenue. Coinbase Earn pays you to learn about cryptos such as Compound, Stellar, or Polygon. These crypto companies pay Coinbase for advertising their product to users, essentially making the platform a promotion platform.

Crypto Asset Sales Revenue

An often overlooked category is Coinbase’s revenue from crypto asset sales. The company sells its crypto asset holdings to customers, including institutions. This generated the company $475 million in the period of Q1 to Q3 2021. This makes up 8% of Coinbase’s total revenue, more than its entire subscription and service revenue. According to the company’s 10-Q, “Periodically, as an accommodation to customers, the Company may fulfill customer transactions using the Company’s crypto assets held for operating purposes.”

Financial Analysis

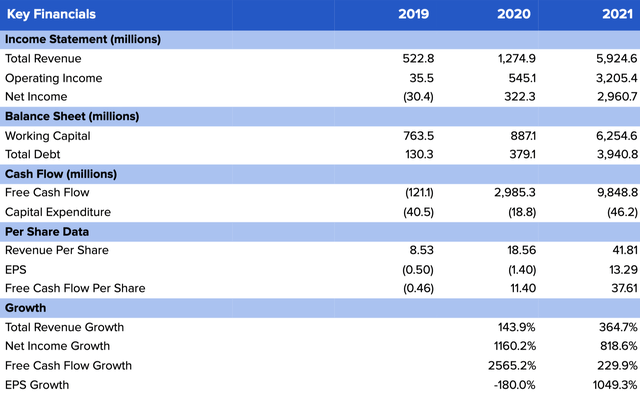

Source: Yahoo Finance, Seeking Alpha, Nasdaq

Coinbase’s financials are very healthy with strong gains over the past 3 years. The company has seen three to even four-digit growth rates of its revenue, net income, free cash flow, and EPS each year. These numbers are mainly due to the growing popularity of crypto and its market capitalization, which Coinbase has taken advantage of. In the past year, Coinbase has been able to increase its EPS by a tremendous 1049.3%. The company’s revenue CAGR has been 236.6% from the period of 2019-2021. Although these numbers may seem inflated, they are strong signs that the company is substantially undervalued.

Major Shareholders

Coinbase stock is held by multiple large institutions, Nikko Asset Management, ARK Investment Management, The Vanguard Group, Tiger Global Management, JPMorgan Investment Management, and Fidelity Management & Research, who all have at least a 1% stake. Nikko Asset Management owns a 6.14% total stake split equally between itself and its subsidiary Nikko Asset Management Americas. Ark Investment Management owns 4.51%, The Vanguard Group owns 3.52%, Tiger Global Management owns 1.72%, JPMorgan Investment Management owns 1.56%, and Fidelity Management & Research owns 1.29%.

ESG Considerations

A major setback for crypto’s adoption is its climate impact. It is common knowledge that Bitcoin uses massive amounts of energy to solve Proof of Work (POW) puzzles and validate blocks. If Bitcoin were a country, it would rank among the top 30 in energy consumption. It consumes 0.5% of all electricity produced in the world and uses 7x as much energy as Google. However, an argument could be made that the entire global banking system uses double the amount of energy as Bitcoin and that Bitcoin is the replacement for such a system. Despite that, the energy used in mining is inherently wasteful and generates an estimated 57 million tons of CO2 each year. Putting Bitcoin aside, let’s take a look at Coinbase’s climate impact.

Environmental

Exchange

Coinbase operates its exchange off-chain, as stated in the H1 2021 In Review Report from Coinbase. However, this does not mean that Coinbase’s environmental impact is completely nonexistent since Coinbase has not disclosed its source of energy. It only means that the Coinbase exchange is not built on top of a cryptocurrency’s blockchain but rather on data servers. In 2015, Coinbase was using AWS data centers to run its exchange. Now, Coinbase is building its cloud service with Coinbase Cloud and is looking to be the AWS of the crypto world.

Transactions

The more important question is if transactions on Coinbase affect energy consumption. The answer is no if the transaction is in between Coinbase users with off-chain Instant Sends on, resulting in zero miner and transaction fees. The answer is yes for all other transactions because they go on the blockchain and are validated by a PoW miner. Thus, Coinbase as an operation does not have much environmental impact, but it encourages crypto transactions, indirectly producing an environmental cost.

Investments

According to Coinbase’s blog, “Coinbase Ventures recently invested in Crusoe Energy — a firm that harnesses natural gas producers’ excess “flare” energy for crypto mining and other productive uses.”

Social

Charitable Campaigns

In 2017, CEO Brian Armstrong cofounded GiveCrypto, a nonprofit that distributes cryptocurrency to people living in poverty. In May of 2021, Coinbase announced Coinbase Giving campaign was partnering with Pledge 1% to “commit 1% of Coinbase profits, equity, and employee time toward charitable activities that leverage the power of crypto to help people around the world.” Coinbase also announced that it would bring GiveCrypto.org under Coinbase as a private foundation to further expand the reach of the foundation.

Governance

Diversity

4 out of 8 on Coinbase’s management team are non-Caucasian and 1 out of 8 board members is non-Caucasian.

Valuation

Discounted Cash Flow Analysis

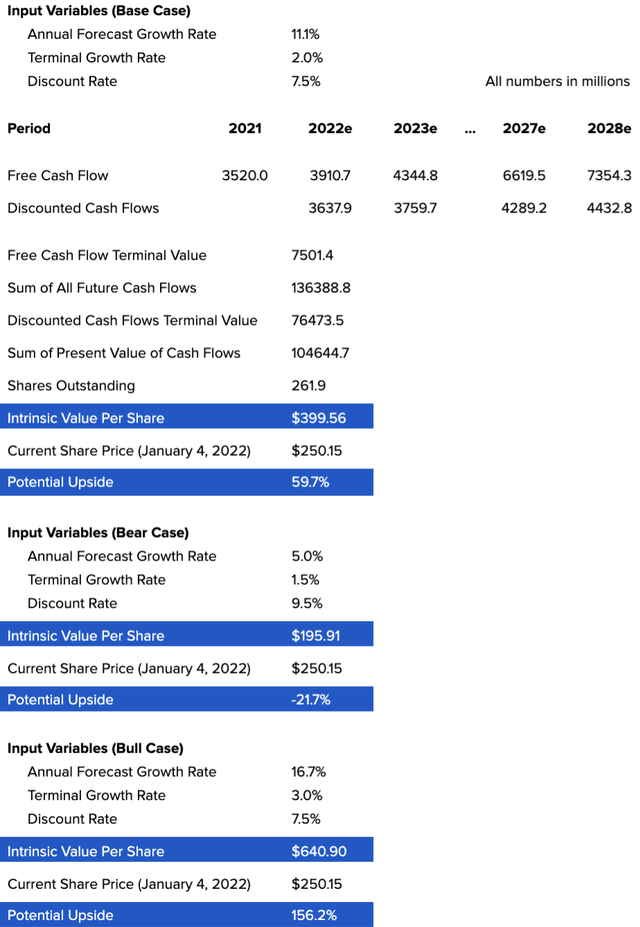

The assumptions made in this model are the annual forecast growth rate and the terminal growth rate. The discount rate is determined by Coinbase’s Weighted Cost of Capital (WACC).

Source: Author’s Calculations, with data from Nasdaq

Price Targets

Bear Case ($195.91)

To justify this bear valuation, we assume a 5% annual growth rate for the next 7 years in which Coinbase is unable to expand past transaction fee revenue. The terminal growth rate would be 1.5% if crypto adoption slows and regulations knock prices down.

Base Case ($399.56)

For the base case, we assume an 11.1% 7-year growth rate, taken from the estimated CAGR of the crypto market in the same period, which Coinbase has been following. The terminal growth rate would be 2% if the company maintains its continued expansion of products and into the institutional market with favorable regulations.

Bull Case ($640.90)

A bull case can be made if Coinbase grows as fast in the next 7 years as it did in the past year at a 16.7% CAGR. In this case, the terminal growth rate would rise to 3.0% as it outpaces other tech companies. The United States would be accepting of the crypto market and embrace it instead of taking a negative stance.

Investment Risks

Cryptocurrency Volatility

The largest foundational risk of Coinbase is the volatility of cryptocurrencies such as Bitcoin and Ethereum. These two cryptos made up 50% of trading volume in Q2 2021. As noted before, Coinbase’s stock is heavily dependent on the price and trading activity of top cryptos. A major drop in the crypto market can lead to a larger drop in Coinbase’s earnings. This happened in Q3 2021 when both Bitcoin and Ethereum took a tumble and affected Coinbase’s earnings. In the earnings report, the company stated that volatility is a major risk and this is indeed a risk to their revenue and earnings. They told investors to trust that investing in Coinbase is a long-term investment in crypto given the volatility. Cryptocurrency volatility also affects Coinbase’s revenue from the sale of crypto assets, which vary from time to time.

Cyberattacks

Cyberattacks are risks for Coinbase, since the exchange operates completely online. Although Coinbase is touted as one of the safest exchanges, the company disclosed in the spring of 2021 that 6,000 accounts were hacked in a suspected phishing scheme. Hackers exploited a flaw in the exchange’s two-factor authentication through messages and email. The hackers impersonated Coinbase emails to swipe the users’ username, password, phone number, and text message code. However, the hackers were not able to reach Coinbase’s internal infrastructure, but they created a threat to the exchange’s safety.

Financial Regulation

First, Coinbase is in the cryptocurrency industry, a nascent technology that many lawmakers have yet to understand. This leads to the possibility of harsh regulation that would hurt the image and reputation of crypto and Coinbase. Second, Coinbase is also in the financial services industry, subjecting it to countless other regulations. Lucky for Coinbase, major financial regulators have not stated that they are against crypto. However, SEC Chairman Gary Gensler and Treasury Secretary Janet Yellen have stated that they would like to see strict regulation of the market. The crypto space is largely unregulated, making scams such as rug-pulls more common. Rug pulls have yielded $2.8B in 2021 and accounted for 37% of scam revenue in 2021 compared to 1% in 2020. It is unlikely that the U.S. will take regulation as far as countries such as China, Egypt, and Qatar, which have all banned crypto. Many analysts predict that lawmakers will compromise and come up with a resolution that achieves the goals of crypto advocates as well.

Rising Blockchain Transaction Fees

In February of 2021, Bitcoin transactions were up twenty-fold in a year, an increase of 1,976%. Gas fees, the transaction fees on the Ethereum blockchain, have increased by 2,300% from June of 2021 to October. These fees have made it difficult to use the DApps built on top of blockchains and made transacting with the native blockchain incredibly difficult. This negatively affects Coinbase as well because it charges fees on top of existing mining fees. Thus, if the transaction fees off native cryptos skyrocket, Coinbase has to reduce margins to ensure that traders aren’t angered over additional fees. These would cost Coinbase profitability and hurt their operating margins.

Destabilization of Crypto Market

Destabilization of the crypto market was almost seen in the past year with Elon Musk’s erratic Twitter comments and China’s spontaneous ban. Another risk would come in the form of lost confidence in Bitcoin and Ethereum. With Coinbase earning half of its transaction revenue from these two cryptos, lost confidence would greatly damage Coinbase’s short-term earnings before traders readjust. Yet, an even larger risk persists. At the beginning of Bitcoin, anonymous creator Satoshi Nakamoto mined a huge cache of Bitcoins. As the price soared, these Bitcoins sat in a wallet hidden away. Although far-fetched, the unmasking of Nakamoto or the transfer of these Bitcoins could completely destabilize and cripple the market.

Key Risk Mitigants

While these risks seem to utterly outweigh any sort of mitigants, there are ways Coinbase can still mitigate these risks. The severity of cryptocurrency volatility can be lessened as adoption increases, and for Coinbase, the expansion into other crypto spaces would reduce the impact on earnings and share price. Cyberattacks can be dampened as Coinbase improves security and end-user safety protocols. Financial regulatory risk can be reduced as Coinbase improves reporting practices and as lawmakers learn more about the industry as a whole, leading to more calculated regulations. Rising blockchain transaction fees and the risk of crypto market destabilization are out of Coinbase’s control, however, the company can increase its liquidity to cover lost revenue.

Conclusion

Our recommendation is driven by Coinbase’s strong financials and product growth opportunities. While the stock has had its ups and downs in 2021, its cash flow and market position have made it a significantly undervalued stock for 2022. Amid regulatory risks, the crypto market is here to stay and Coinbase will benefit tremendously from the increased acceptance of crypto across major economies.