Coinbase has officially added Goldfinch Protocol (GFI) token to the supported assets on the exchange’s professional trading platform, Coinbase Pro, as part of its latest order book expansion.

It is the latest move in a series of rapid expansion plays that the popular US cryptocurrency exchange has made as of late in an attempt to further widen its offering and legitimize a variety of new digital assets.

Goldfinch Protocol is building a decentralized lending protocol that allows organizations to receive crypto loans without collateral or the need to own massive amounts of crypto assets. Instead, the Ethereum-based network is building up capital pools and allowing borrowers to get access to crypto loans while showing non-crypto collateral. Goldfinch is already serving thousands of borrowers across India, Mexico, Nigeria, Southeast Asia, and more.

A stunning price rally has caused the GFI token to explode from as low as $7.9 yesterday to around $13.08 as of writing. It was enjoying a daily surge of 72 percent, with a total market cap of $65 million and a 24-hour market volume of $85 million, which is shown in the data by CoinMarketCap.

The addition to Coinbase Pro means GFI is now accessible to millions of new users, while it will also spark speculation that the token could also end up on Coinbase’s retail trading platform. Coinbase apps typically tend to list tokens shortly after they are made available to professional customers.

FinanceFeeds webinar: Expert panel to discuss market data for multi-asset brokerages

The launch would take place in separate stages

“One of the most common requests we receive from customers is to be able to trade more assets on our platform. Per the terms of our listing process, we anticipate supporting more assets that meet our standards over time,” the listed exchange said.

In a blog post, Coinbase revealed the launch would take place in separate stages including auction mode, limit-only and the final phase full-trading mode. Coinbase will post tweets announcing the stages separately, but it may keep the book in one state for a longer period or suspend trading.

Starting immediately, Coinbase will begin accepting inbound transfers of GFI and will open trading later if liquidity conditions are met. The exchange points out that the new coin will be accessible for users in all supported jurisdictions, with certain exceptions as indicated in each asset page.

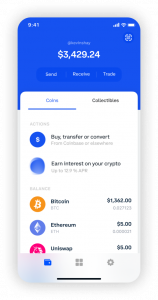

Strictly compliant with regulations, Coinbase is one of the world’s most popular consumer-facing cryptocurrency platforms.

The mega crypto venue re-launched its margin trading service last year on the exchange’s professional trading platform. Eligible traders can trade up to 3X leveraged orders on USD-quoted books, which allows users to amplify their trading results through borrowing money.