Blockchain gaming crypto Axie Infinity (AXS), privacy coin Monero (XMR) and four more altcoins are conditioned for rallies, according to data from analytics firm Santiment.

Besides AXS and XMR, the firm highlights decentralized application (DApp) platform Quantum (QTUM), Web3-focused Ankr, Solana-based liquidity provider Raydium (RAY), and XRP competitor DigiByte (DGB).

“There are usually at least a few crypto assets that are being excessively shorted by bearish traders at any given moment. Our latest insight looks at the negative funding rates of XMR, AXS, QTUM, ANKR, RAY, and DGB for potential opportunities.”

A short squeeze occurs when an excessive amount of short sellers enter the market, and then get hit by an unexpected price spike that causes a chain reaction of liquidations and consequently a strong rally. According to the firm, traders bearish on Monero are making themselves vulnerable to such a scenario.

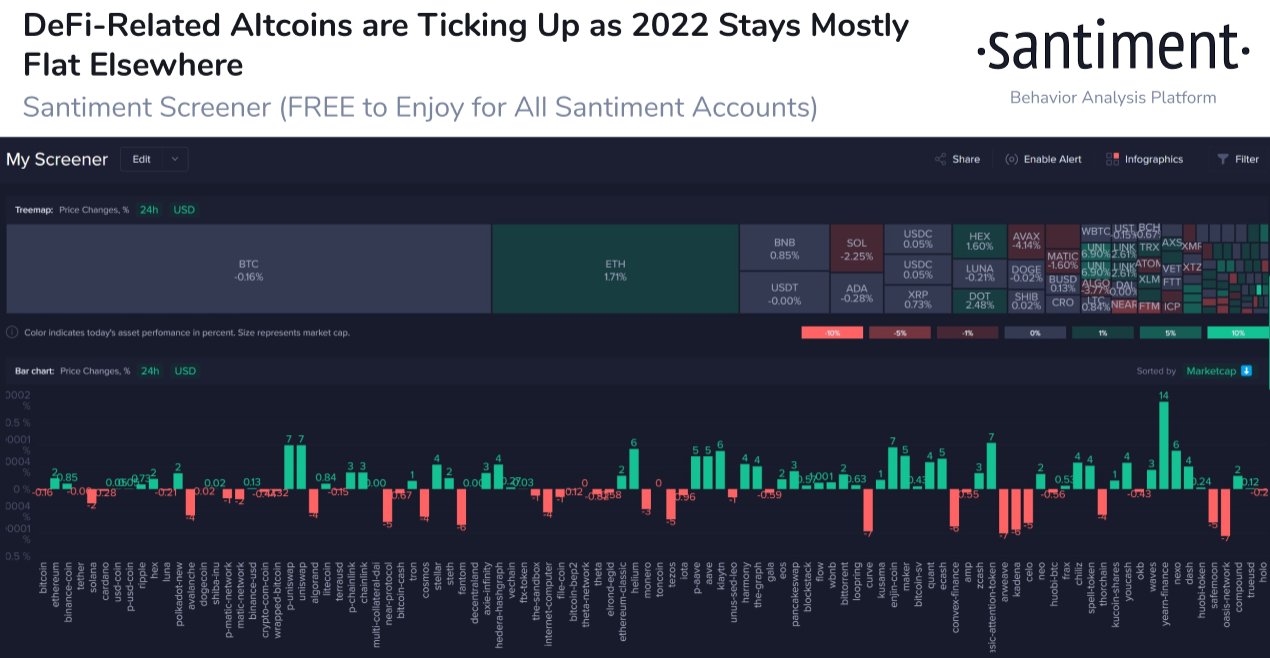

Santiment also says that the decentralized finance sector of crypto looks ready for healthy growth this new year. The firm identifies three of the most bullish-looking DeFi coins showing strength while much of the market trades sideways.

“DeFi assets are showing some nice signs of growth to kick off 2022. YFI [Yearn.Finance], UNI [Uniswap], and AAVE are all ticking up nicely thus far with the first Monday of the year looking bullish for several altcoins.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Foryoui3/Fotomay