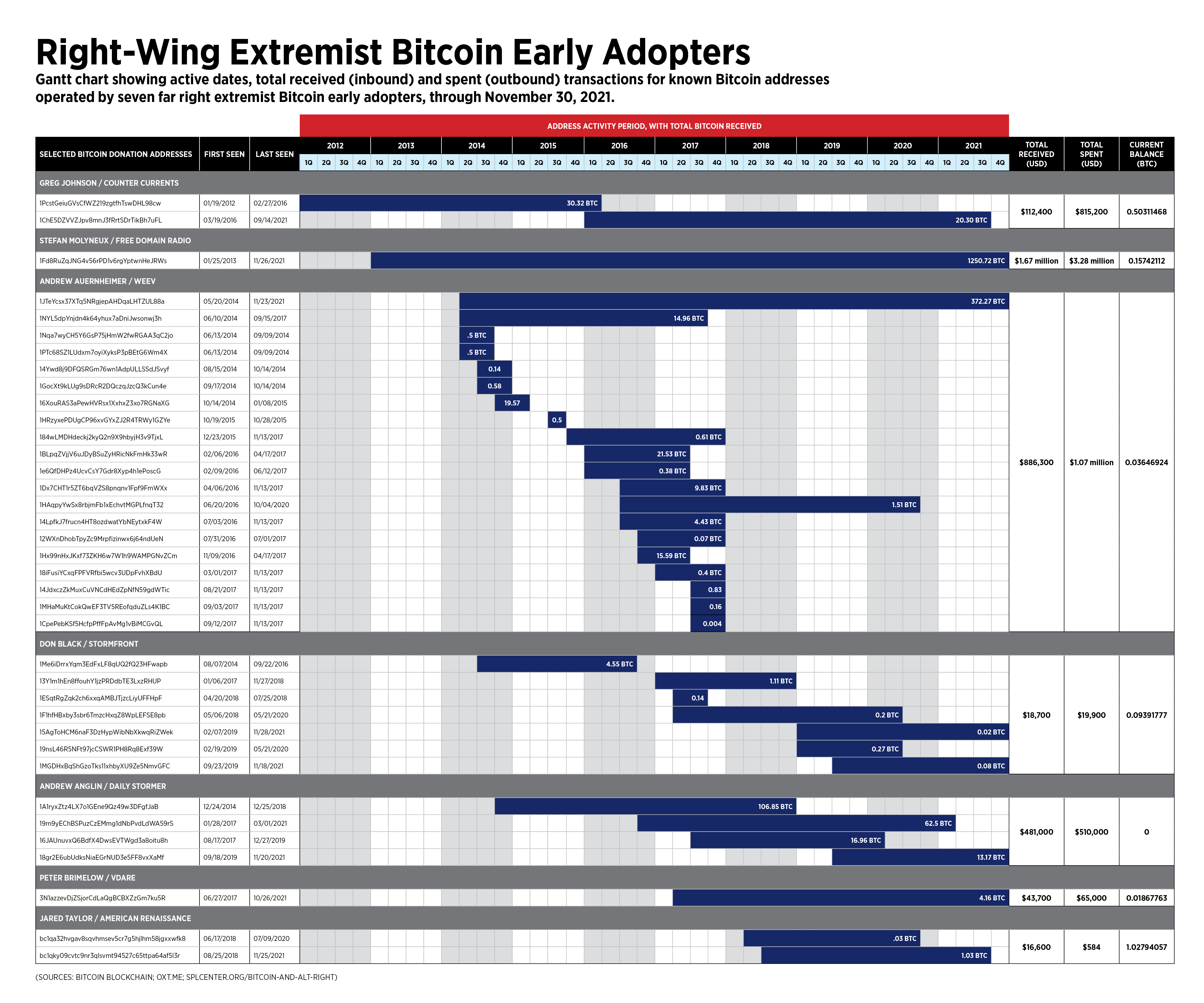

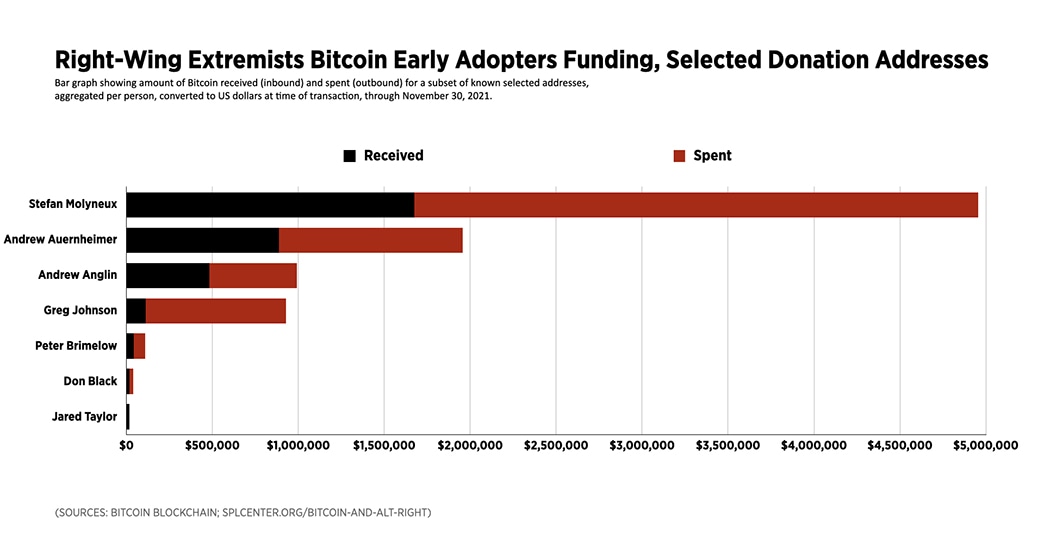

Hatewatch identified and compiled over 600 cryptocurrency addresses associated with white supremacists and other prominent far-right extremists for this essay and then probed their transaction histories through blockchain analysis software. What we found is striking: White supremacists such as Greg Johnson of Counter-Currents, race pseudoscience pundit Stefan Molyneux, Andrew “Weev” Auernheimer and Andrew Anglin of the Daily Stormer, and Don Black of the racist forum Stormfront, all bought into Bitcoin early in its history and turned a substantial profit from it. The estimated tens of millions of dollars’ worth of value extreme far-right figures generated represents a sum that would almost certainly be unavailable to them without cryptocurrency, and it gave them a chance to live comfortable lives while promoting hate and authoritarianism.

Less than a quarter of Americans presently own some form of cryptocurrency as of May 2021. But those numbers increase substantially within fringe right-wing spaces, according to Hatewatch’s findings, approaching something much closer to universal adoption. Hatewatch struggled to find any prominent player in the global far right who hasn’t yet embraced cryptocurrency to at least some degree. The average age of a cryptocurrency investor is 38, but even senior citizens in the white supremacist movement, such as Jared Taylor of American Renaissance, 69, and Peter Brimelow of VDARE, 73, have moved tens of thousands of dollars of the asset in recent years.

Cryptocurrency, or a group of digital moneys maintained through decentralized systems, has grown into a billion-dollar industry. A growing swath of Americans embrace the technology. Nothing is inherently criminal or extreme about it, and most of its users have no connections to the extreme far right. (One of the authors of this essay owns cryptocurrency, as disclosed in an author’s note at the end.) However, the far right’s early embrace of cryptocurrency merits deeper analysis, due to the way they used it to expand their movement and to obscure funding sources. It is not uncommon for far-right extremists to seek to hide their dealings from the public. The relative secrecy blockchain technology offers has become a profitable, but still extraordinarily risky, gamble against traditional banking.

“There are a lot of Bitcoin whales from pretty early [on in its history],” futurist and computer scientist Jaron Lanier told the Lex Fridman podcast in September. (People use “whales” to describe those who hold large sums of cryptocurrency.) “And they’re huge, and if you ask, ‘Who are these people?’ there’s evidence that a lot of them are not the people you would want to support.”

‘A huge tolerance for unreality’

Johnson of Counter-Currents, an influential figure in the white nationalist movement due to his outspoken support for the creation of an “ethnostate” serving only white, non-Jewish people, first picked up Bitcoin on Jan. 19, 2012, Hatewatch found, making him the first known figure in the movement to invest. Hatewatch could not determine how Johnson generated just shy of 30 Bitcoin on that Thursday in January 2012 – whether he mined it or purchased it, or someone merely sent it to him – but the date falls just a year-and-a-half after the first known commercial cryptocurrency transaction took place.

Johnson obtained the 29.82 Bitcoin on a date when prices for the asset sat between five and 10 dollars. Hatewatch found that Johnson flipped the Bitcoin from that first transaction and additional ones into over $800,000 worth of value. He has turned his website Counter-Currents into a hub for cryptocurrency discussion in the movement and solicits donations in digital tokens, or cryptocurrency “coins,” such as Bitcoin, Ethereum, Litecoin, Monero, Bitcoin Cash, Tether, Cardano, Ripple, Dash, Neo, Stellar Lumens and Basic Attention Token. Hatewatch reached out to him for a comment on this essay, but he did not respond.

“If any of you haters out there have any Bitcoin and you just want to get rid of it, send it to Counter-Currents, we have a Bitcoin address,” Johnson said on a Jan. 5 edition of his livestream, referring to those who perceive cryptocurrency as lacking in real world value. “I’ll hold it, I’ll stack it, I’ll keep it … I have a huge tolerance for unreality.”

Johnson often platforms on his site an antisemitic white nationalist personality who goes by the pseudonym Karl Thorburn. As Thorburn, the author advises people in the movement to purchase and hold Bitcoin as an investment. He wrote through his Telegram account that he advertises for Bitcoin so white nationalists can have money they “can travel with, that bad people can’t seize/inflate, and that will allow [them] to live in a safer, White neighborhood and start a family.”

Thorburn also advises people in the movement on how to donate cryptocurrency to white nationalist causes without exposing their identities, highlighting one of key reasons that the assets appeal to them.

“Just transfer the [Bitcoin] from your exchange account to another wallet you control, and later move the [Bitcoin] from that wallet to the donor’s address. This creates plausible deniability because you aren’t sending the [Bitcoin] directly from your exchange account to a publically [sic] known nationalist,” he wrote for Johnson’s site in a post published on Nov. 26, 2020.

Matt Gebert, a State Department official Hatewatch identified as a white nationalist organizer in 2019 (the government suspended him after we published the story), also has contributed material to Johnson’s Counter-Currents. In April, Gebert brought the person behind the Thorburn pseudonym onto a podcast. Explaining how he got interested in white nationalism, Thorburn said that he “went into the Stefan Molyneux thing, where it was hardcore atheism, and hardcore anarcho-capitalism” before becoming a white nationalist. A significant number of people who started in libertarian online spaces adapted to the pro-fascist ideology of the “alt-right” movement during the rise of Trump.

“And in fact that’s what really led me into Bitcoin,” he said of Molyneux’s influence.

David Gerard, a cryptocurrency analyst and author of Attack of the 50 Foot Blockchain, told Hatewatch that the cryptocurrency community denies that extremists have immersed themselves in their subculture.

“Bitcoin started in right-wing libertarianism,” Gerard said in an email. “This is not at all the same as being a neo-Nazi subculture. That said, there’s a greater proportion of Nazis there than you’d expect just by chance, and the Bitcoin subculture really doesn’t bother kicking its Nazis out. … Bitcoiners will simultaneously deny they have Nazis (which they observably do), and also claim it’s an anti-bitcoin lie, and also claim it’s good that anyone can use Bitcoin.”

‘At the expense of the parasites’

Molyneux, a self-described moral philosopher who started his career as a libertarian pundit, denies being a white supremacist despite repeatedly and falsely claiming that non-white people are predisposed to be of lower intelligence. He started to embrace white nationalism around 2018 during a trip to Poland. (Hatewatch obtained leaked video of Molyneux calling a monologue he filmed at that time his “white nationalism speech.”) He never responded to a request for comment about that incident.

YouTube, and even typically more lenient Twitter, suspended Molyneux’s access to their websites in 2020 after years of his using the platforms to denigrate women and non-white people. Molyneux, relegated to fringe websites, saw his website traffic and his ability to raise funds plummet. One of his associates implied that Molyneux could survive the change because of Bitcoin.

“Stefan Molyneux was in Bitcoin at $1. He is more than ok,” Mike Cernovich, known primarily for pushing the #Pizzagate conspiracy theory in 2016, posted to Twitter in June after Molyneux was removed.

Molyneux may have obtained Bitcoin prior to 2013, but the earliest existing wallet of his identified by Hatewatch pulled in Bitcoin for the first time on Jan. 25, 2013, roughly a year after Johnson received his donation in January 2012. Molyneux’s experience with Bitcoin stands out alongside the other extremists Hatewatch studied. Not only did he invest long-term in Bitcoin, holding the asset through periods of volatility rather than cashing out, but his donors bestowed him with 1250 Bitcoin tokens, far more than anyone else Hatewatch studied. (The price of one Bitcoin has ranged between roughly $30,000 and $68,500 U.S. dollars in value during 2021.)

Hatewatch found that an anonymous “mega-whale,” someone who controls thousands of Bitcoin tokens, gave large donations from that sum to multiple wallets in 2020, including one operated by Molyneux. On Oct. 11, this anonymous individual doled out 50 Bitcoin in total to such causes as the Ron Paul Institute, the Free Software Foundation and the American Institute for Economic Research. They gave Molyneux 10 Bitcoin, which is today worth nearly half a million U.S. dollars. Whoever operated the account held onto their Bitcoin since 2010, underscoring Molyneux’s importance to Bitcoin’s community of early adopters and libertarian devotees.

Molyneux generated million-dollar profits in less than a decade through his donations, flipping $1.67 million worth of value into at least $3.28 million. In February 2021, he described the value of cryptocurrency using tropes commonly associated with antisemitism.

“Bitcoin is a currency that serves the people at the expense of the parasites, rather than the currency which serves the parasites at the expense of the people,” Molyneux said of the cryptocurrency on his independent radio show. “Bitcoin is rescuing your precious labor from being hoovered up endlessly by the invisible vampire mosquitoes of central banking.”

Molyneux responded to a request for comment by telling Hatewatch that by “parasites,” he was likely referring to his “deep moral opposition to imperialistic governments and wars of aggression” and his belief that “Bitcoin can put an end to such wars.” (Hatewatch has elected to publish the full comment of Molyneux, who disputes that he is “far right,” here.)

‘The dollar is going to collapse’

Neo-Nazis promote propaganda claiming that Jewish people control the banking industry for the purpose of deliberately harming or undermining the ambitions of non-Jewish white men. They also often openly cheer for the destruction of the U.S. as we know it – portraying the collapse of the government and financial system as an inevitability. This dystopian worldview primed neo-Nazis to embrace cryptocurrency’s promise early. The Daily Stormer lays out these beliefs in explicit terms.

“Bitcoin is going to become the new gold. Because of that, if you don’t buy any now you’re doing yourself a disservice. So buy some when the price goes down again, and when you do consider donating to us here at Stormer so we can continue to fight the Jew-owned banking empire,” a Daily Stormer post from Oct. 24, 2017 claims.

Daily Stormer editor Andrew Anglin, who in recent posts to his site advocated for the legalization of gang rape and called the COVID-19 pandemic a hoax, and Andrew “weev” Auernheimer, a man known for hacking, praising far-right terrorists and providing technical support to Anglin, started promoting cryptocurrency to their audience as early as 2015. Auernheimer’s first known Bitcoin address issued transfers in May 2014, roughly a month after he celebrated his release from federal prison and demanded 28,000 Bitcoin from the U.S. federal government as restitution. As of Dec. 1, 20 of the largest and oldest Bitcoin addresses known to belong to Auernheimer pulled in payments totalling $886,345 and transferred out roughly $1,069,395. Anglin, who appears to have adopted cryptocurrency soon after Aurnheimer in December 2014, has moved around at least 1 million U.S. dollars in Bitcoin, as Hatewatch previously reported .

“We know as an absolute matter of fact that the dollar is going to collapse, and presumably every other fiat currency on the planet is going to get dragged down with it. Maybe property or metals are better than crypto. Maybe even the stock market is better than crypto – I am not a financial advisor and I have no idea. But what we know as a matter of fact is that you want your money somewhere,” Anglin wrote in 2020 of cryptocurrency.

Daily Stormer published a post in December 2017 under the byline “Tim Hort” that links their interest in cryptocurrency directly to their genocidal ideology. The post embeds a clip from Russia Today host Max Keiser asking his viewers to “imagine [JP Morgan Chase CEO] Jamie Dimon being sucked through a straw … imagine [Goldman Sachs Banker] Lloyd Blankfein being sucked through a garden hose … imagine Jamie Dimon and Lloyd Blankfein being spaghettified as they are sucked into the Bitcoin black hole.” Keiser is a self-described “Bitcoin maximalist,” meaning he believes the token is destined to become the dominant form of future money, even among other cryptocurrencies. Daily Stormer interpreted his words as a call to first destroy the financial system and then kill Jewish people.

“Max Keiser is explaining how Bitcoin will finally allow us to break free of the Jewish control of our finances,” the post claims. “When we can finally control our own finances without needing to rely on the central k*** banks, we can start repairing. And start up the ovens of course.”

Hatewatch reached out to Keiser through Russia Today’s press email, but no one replied.

In Hatewatch’s analysis of Daily Stormer’s Bitcoin transaction history, we found transactions that resemble the types of payments employers give to employees. Cryptocurrency wallets known to be controlled by Anglin regularly transferred Bitcoin, worth a market rate of between $2,000 to $3,000 U.S., into Auernheimer’s most active wallet on the first or second day of every month. Between Aug. 1, 2018, and Dec. 1, 2021, Anglin transferred a total of $91,920.56 to Auernheimer across 38 separate monthly transactions.

The Associated Press and PBS Frontline collaborated on a report in September showing that Anglin supporters have sent him at least $4.8 million in Bitcoin, based upon data pulled from Chainalysis, a cryptocurrency analytics firm.

‘It’s really good for anonymous transactions’

Anglin and Auernheimer likely have more money than Hatewatch can report. Both men pushed their audience toward the privacy-focused token Monero in the years following its release in 2014. Researchers cannot yet trace Monero due to its relative anonymity, as Hatewatch previously reported. Monero’s website describes their product as “a private, decentralized cryptocurrency that keeps your finances confidential and secure.” Critics note the degree to which law enforcement and other government officials so far struggle to see what people are doing with it.

The criminal underworld has reportedly employed Monero at a growing rate. The Financial Times noted in June that Monero has become “an increasingly sought-after-tool for criminals such as ransomware gangs.” In August, when comedian John Oliver ran a segment on his show depicting Monero’s advertising as subtly winking at criminals, an outreach organizer for the token defended their technology on grounds that it fights back against “a society of ever-growing mass surveillance.” Monero has elsewhere argued that it enables commerce and does not promote secrecy, or crime, any more than cash.

The cryptocurrency-focused website The Block reported in August 2020 that 45% of illegal darknet markets, which traffic in things like stolen credit card information, ransomware, drugs and hacked passwords, support Monero. The number has likely only risen, due to Monero’s increasing name recognition and availability. Anglin appears to have transacted with Russian darknet markets that traffic in illegal wares, according to analysis previously conducted by Hatewatch based on his Bitcoin usage. (Anglin later denied the existence of the payments by writing on his forum: “This is totally fake. I don’t even know what any of this is about. I never bought any Russian darknet drugs lol.”) Due to Monero’s current untraceable nature, Hatewatch cannot yet see if he’s also used that token in a similar manner.

Auernheimer publicly described his enthusiasm for Monero on a podcast with embattled white supremacist Christopher Cantwell in December 2017. Auernheimer, who is believed to be living in Eastern Europe, has involved himself in the promotion of at least one hack-and-leak effort launched by Russian military intelligence, among other stunts. A judge sentenced Cantwell to 41 months of prison in February on charges related to extortion and threats made against a fellow extremist.

“They’re trying to shut me out of the financial system,” Cantwell said of why he wants to get his audience involved in cryptocurrency on that December 2017 podcast. “People want to throw money at me and I’m like, ‘I’d love to take it, but I have no way to take it from you right now.’”

Auernheimer responded to Cantwell by saying that he recently sold off some of his own Bitcoin, taking profit from it. Hatewatch identified Auernheimer as having sold off large amounts of Bitcoin roughly a month before the podcast aired – on Nov. 13, 2017.

“I hold a lot of Monero though. That’s my big thing now. I’m way into Monero. I hold a significant amount,” Auernheimer said. He went on after describing the difficulty to obtain Monero: “It’s really riding on the virtues of its technology. It’s really good for anonymous transactions. … It seems like a good idea.”

Anglin has described Monero as a tool to work around “spies from the various ‘woke’ anti-freedom organizations.” Other far-right extremists have followed Daily Stormer’s lead. The white supremacist group National Justice Party, which is linked to a pro-Kremlin propagandist who relocated to Moscow after attending the Jan. 6 U.S. Capitol insurrection, accepts donations on their website in only two cryptocurrencies today – Bitcoin and Monero.

‘Do you know how much I fucking hate the government’

National Justice Party founder Michael Peinovich is among a group of extreme, far-right fringe activists who now install a system called BitPay that automates the creation of new Bitcoin wallets to coincide with each new transaction. Izz ad-Din al-Qassam Brigades, the military wing of Hamas, embraces a similar technique. So does Nick Fuentes, the pundit whose vocal support for the Stop the Steal movement generated large crowds of young white nationalists and neofascists at events in the runup to the violence on Jan. 6. In each case, the BitPay system makes donations difficult to track.

Fuentes accepts payments on his site through Litecoin, a so-called fork of Bitcoin that trades at a fraction of its value per token. French computer programmer Laurent Bachelier, who also donated to Anglin of the Daily Stormer and the white nationalist non-profit VDARE, gave 13.5 Bitcoin to Fuentes before killing himself through an intentional drug overdose on Dec. 8, 2020. Fuentes has claimed that the government has seized some of the money he received in donations.

“I don’t like to brag or anything, but if you knew how much money they took – do you know how much I fucking hate the government because I woke up and one of my checking accounts – one of my checking accounts, which has lots and lots and lots of money in it, had zero dollars,” Fuentes said on one of his livestreams in April.

Fuentes has not received or spent any Bitcoin at that address since Dec. 16, 2020, when he withdrew all 13.73371697 Bitcoin in his account, worth $266,392.40. Customers at his website are directed to pay for merchandise emblazoned with slogans like “Radical Extremist,” “White Boy Summer” and “Hate Speech Enjoyer” using dynamically generated Litecoin addresses or by making regular credit card payments through Visa and Mastercard.

Similarly, Peinovich’s main donation address had received 37.65076951 Bitcoin over its lifetime, for a total of $28,668.10 in donations, but went quiet once he switched to dynamically generating addresses in BitPay. The balance in the account is currently 0.06546048 Bitcoin, currently worth about $3,307.06. Hatewatch reported on Peinovich’s collaboration with the extremist Glen Allen, who acted as a shadow lawyer in his defense during the Sines v. Kessler trial, which focused on violence stoked by white supremacists at the August 2017 “Unite the Right” rally in Charlottesville, Virginia. Leaked emails show Peinovich offering to compensate Allen through Bitcoin, demonstrating how white supremacists use the currency to organize in secret.

“Let me know how I can send you some cash or some more bitcoin,” Peinovich writes in an email to Allen.

Allen did not respond to a request for comment about his emails with Peinovich.

‘A place that doesn’t hate us’

In the aftermath of the violence on Jan. 6, a gaming video livestreaming site called DLive banned Fuentes. Their decision further isolated the 23-year-old extremist, who had up to that date used nightly live video appearances on the site to influence crowds of young men to attend Stop the Steal rallies. People donated to white supremacists and neofascist livestreamers in substantial amounts on DLive, as Hatewatch has previously reported. The company permanently removed a number of extremists beyond Fuentes after Hatewatch reported on them, including the antisemitic performer Owen Benjamin and Jan. 6 participant Tim “Baked Alaska” Gionet.

“We feel better being in a place that doesn’t hate us,” Benjamin said affectionately of DLive in the months before they suspended his account.

DLive uses a blockchain-based system to distribute donations to its livestreamers, meaning it functions like an under-regulated cryptocurrency market. Sites like these, particularly those operated by ideologically driven libertarians, have become easy ways for extreme far-right figures to promote their propaganda and earn a living. Another blockchain-themed video site that traffics in an in-house currency is Odysee, which has in recent months given platforms to hateful propagandists banned from conventional sites, such as Fuentes, Peinovich and David Duke, among hundreds of others. Odysee’s situation may portend trouble for websites built on this model.

Critics of blockchain-based sites note the degree to which they operate outside of the rules of banks, despite in some cases issuing money for people and storing it. The Securities and Exchange Commission sued Odysee’s parent company LBRY, not for issues related to the hateful content promoted on their site, but for offering unlicensed securities. The SEC claims that LBRY promoted their cryptocurrency as a security without being licensed to do so. LBRY denies the government’s allegations. That case, filed in March 2021, is pending in federal court.

‘The music will eventually stop’

When the Australian bank Westpac cut ties with Hitlerite, anti-Muslim extremist Blair Cottrell, his supporters, and many libertarians who may feel ambivalent about his hateful beliefs and simply love cryptocurrency, hyped his situation as an ideal reason for Bitcoin’s existence. These advocates suggested that if banks agree to cut ties with far-right extremists, those who are affected should respond by converting their fiat money (money issued by a government) entirely into cryptocurrency. This way of seeing the world, layered with dreams of big payoffs in passive income and understandable fears of government intrusion, has taken hold on the far-right fringe. But converting your money entirely into cryptocurrency carries undeniable risks.

“Regulators want to crack down on fraud,” financial analyst Jacob King told Hatewatch of the cryptocurrency space. “While this is great news in the long run, it will have a disastrous impact on the price of Bitcoin and many altcoins as they are dependent on price manipulators like Tether and Binance.

By “altcoins,” King refers in a general sense to cryptocurrencies that are not Bitcoin, running the gamut from more universal tokens such as Ethereum, Bitcoin Cash and Litecoin, to much more obscure offerings. His point of view runs contrary to the propaganda churned out on a regular basis by the cryptocurrency industry, which has become notorious for publishing quixotic assessments of their space. He mentions two potential looming dangers for cryptocurrency prices in Tether and Binance.

Tether, a so-called “stable coin,” which is in theory ‘tethered’ to the price of the U.S. dollar, plays a critical role in cryptocurrency, enabling investors to shift funds between tokens on exchanges, or pull them out temporarily, without completely exiting and putting money back into fiat currency. As Bloomberg noted in July, “Tethers in circulation are worth about $62 billion and they underpin more than half of all Bitcoin trades.” The thesis of that article helps underscore King’s concerns about what Tether could in theory do to tank the value of other cryptocurrencies. It notes that the DOJ is investigating whether Tether hid from banks the fact that transactions were tied to cryptocurrency. The Tether investigation also deals with possible market manipulation:

In the course of its years-long investigation, the Justice Department has examined whether traders used Tether tokens to illegally drive up Bitcoin during an epic rally for cryptocurrencies in 2017. While it’s unclear whether Tether the company was a target of that earlier review, the current focus on bank fraud suggests prosecutors may have moved on from pursuing a case tied to market manipulation.

The feds are also allegedly probing Binance, cryptocurrency’s most trafficked exchange, in an investigation led by government officials who investigate money laundering and tax evasion, according to a Bloomberg report published in May. Bloomberg reported that “the specifics of what the agencies are examining couldn’t be determined” but noted that U.S. investigators have long expressed concern that such exchanges could be used for illicit finance. Binance indicated to Bloomberg that it does not comment on specific matters but touted its “robust compliance program” and asserted it takes its “legal obligations very seriously.”

In addition to investigations such as these, so-called exit scams, which prey on trusting investors, incidents of hacking and hoaxes intended to pump up prices, all point to the possibility that the profitability such early investors as Greg Johnson saw last decade may not be as easy to find in the future. This scenario would prove even more risky if extremists choose to eschew traditional banking altogether or if traditional banks choose to cut them off.

“Neo-Nazis have mainly used cryptocurrencies to escape the traditional financial system,” King added. “While that may have worked for the last few years, we’re seeing a huge pushback from regulators. The crypto markets are like a giant game of musical chairs. The music will eventually stop, and millions will be subjected to major losses as the prices tank back to their true values.”

Hatewatch reached out to Tether and Binance for a comment on this story and King’s depiction of them as “price manipulators.” Tether did not reply. Two different spokespersons for Binance responded to Hatewatch’s request for comment to push back on King’s depiction of the company, calling it “absolutely false” and “wildly inaccurate.” They also noted that any investigation of Binance may not lead to official actions against them.

Jay Cassano, the CEO of Cointelegraph, one of the biggest publications covering the cryptocurrency community industry and community, expressed a different point of view about the impact of regulation on cryptocurrency prices to Hatewatch.

“While there are certainly sections of the crypto community that are opposed to any form of regulation, the belief that crypto prices will fall in response to increased regulation is overly simplistic,” Cassano wrote in a text message. “On the contrary, there is widespread belief among cryptocurrency enthusiasts that a lack of regulatory clarity is slowing more widespread adoption. There are also those who actively want cryptocurrency to become part of the regulated economy, if only so that it will stop being viewed as criminal.”

The publicly traded cryptocurrency exchange Coinbase has already taken steps to remove some extreme far-right users from its service, which could become a larger trend if politicians pass regulations on the industry.

In addition to concerns about crashes, investors sometimes lose access to their cryptocurrency due to missing passwords or other blunders, rendering millions of dollars of value useless. Such may be the case of James Allsup, a white supremacist who associates with Peinovich. Known for his participation in the deadly 2017 “Unite the Right” march on Charlottesville, Virginia, Allsup may have abandoned a wallet with 1.00586899 Bitcoin sitting in it right now, Hatewatch found. Allsup has not interacted with the wallet since 2018 but he has opened up new ones, suggesting that his money may have been rendered inaccessible. Hatewatch attempted to call numbers believed to be associated with Allsup to ask about this dormant Bitcoin wallet but failed to connect.

‘More valuable than gold’ or ‘close to nothing’

The “true values” of cryptocurrencies, as King put it, depends on who you are asking, and opinions vary in the extreme. What happens to digital currencies from here is likely to have a profound impact on the far right due to the degree to which extremists have adopted the technology relative to the population as a whole.

“Bitcoin is not new. It’s been around for a while. I’ve been watching it closely. I’ve not seen one example of it creating economic growth,” the computer scientist and futurist Lanier said on a September episode of the Lex Fridman podcast.

Balaji Srinivasan, a former Chief Technology Officer for the cryptocurrency exchange Coinbase, who has developed a reputation for speaking in bullish, quixotic terms about the space, compares Bitcoin and Ethereum to a future version of gold and oil.

“Thesis: the crypto version of any product ends up being far more valuable than the original,” he tweeted in January. “Bitcoin is already more valuable than PayPal and will eventually be more valuable than gold.”

For the risk analyst and author Nassim Nicholas Taleb, the true value of Bitcoin may be zero. He opined about its value in a recent paper:

Few assets in financial history have been more fragile than bitcoin. The customary standard argument is that ‘bitcoin has its flaws but we are getting a great technology; we will do wonders with the blockchain’. No, there is no evidence that we are getting a great technology – unless ‘great technology’ doesn’t mean ‘useful’. And at the time of writing – in spite of all the fanfare – we have done still close to nothing with the blockchain. So we close with a Damascus joke. One vendor was selling the exact same variety of cucumbers at two different prices. ‘Why is this one twice the price?’, the merchant was asked. ‘They came on higher quality mules’ was the answer. We only judge a technology by how it solves problems, not by what technological attributes it has.

Either way, those who invest in cryptocurrency have already experienced price volatility in the extreme, demonstrating the degree to which funds can evaporate overnight. A neo-Nazi who purchased Monero at the time Auernheimer endorsed it on Cantwell’s podcast in November 2017 would have seen their money rise to five times its value as of May 2021, only to see it shed roughly 60% of that amount just two months later. Bitcoin has somewhat infamously lost nearly all value during different market crashes throughout the years, only to see it skyrocket back up.

“The current price pump is artificial, and bubbles always pop,” the author Gerard told Hatewatch.

Editor’s note: A co-author of this essay, Michael Edison Hayden, has at times owned cryptocurrencies including Bitcoin, Ethereum, Cardano and Algorand. He currently owns only one cryptocurrency, which is Ethereum.

Photo illustration by SPLC