Despite recent crypto market turbulence, 2021 was a successful year for the crypto industry, with Bitcoin and Ether reaching new all-time highs, growing adoption, and the birth of new industries such as GameFi, NFTs, and metaverse.

Even though we at ChangeNOW.io aren’t seeing the explosive growth predicted by some analysts by the end of this year and some are upset with BTC retracing more than 30% from its all-time high of $69,044.77 hit in November, things are not all that bad.

Bitcoin performs much better than traditional assets

BTC’s price is currently up about 50% from around $29,000, where it started the year.

For comparison, the S&P 500 index, which is considered the benchmark measure for annual stock market returns and consists of about 500 of the largest publicly-traded companies in the US, has gained only 23% since the beginning of the year. Gold’s value has declined 5% since January 2021.

Brushing aside corrections, you can clearly see that Bitcoin’s year-to-date performance is good:

ROI Chart – Year to date. Source: CaseBitcoin.com

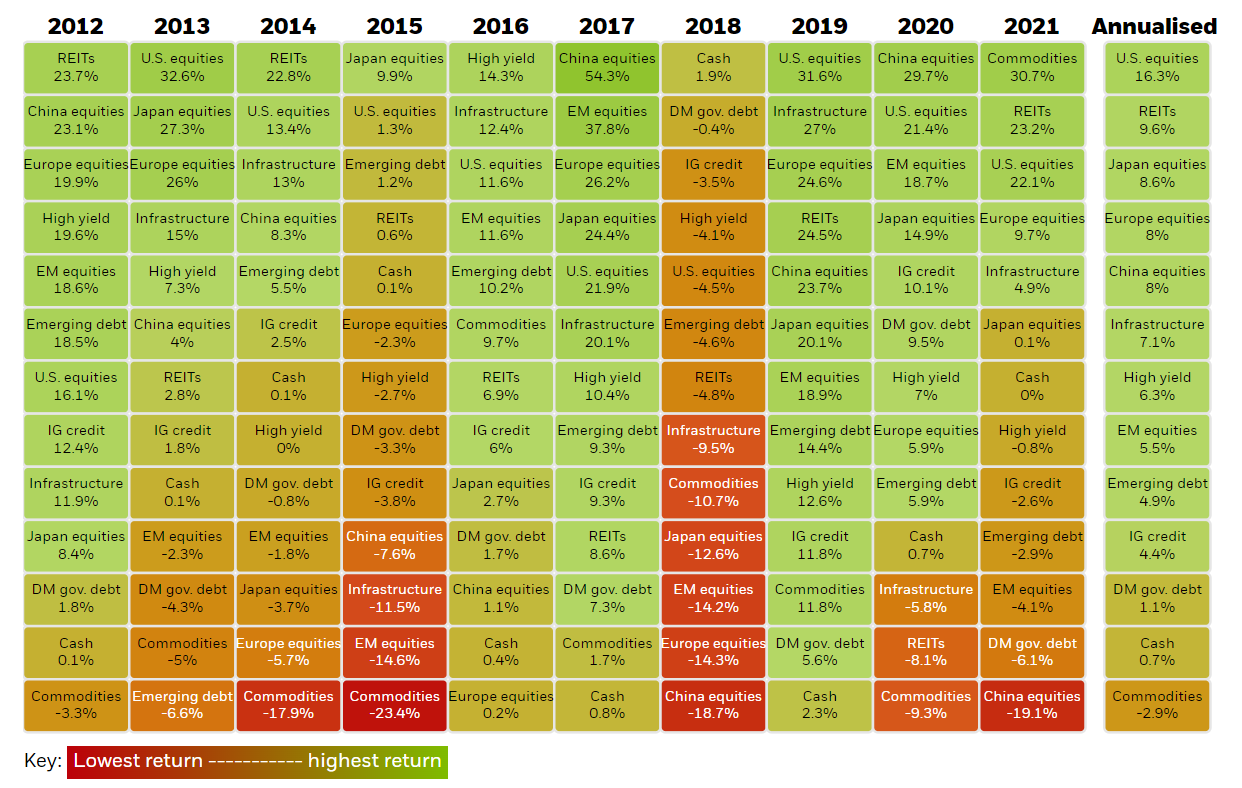

Here’s how all traditional asset classes performed over the very long term:

Source: BlackRock

And below is a table that illustrates Bitcoin’s extreme outperformance over the past decade compared to other assets that can be used as inflation hedges. All traditional assets pale in comparison to it.

|

Bitcoin |

Gold |

S&P 500 |

|

|

1 year: |

+103% |

-4% |

+26% |

|

2 year: |

+555% |

+22% |

+43% |

|

3 year: |

+1,100% |

+44% |

+94% |

|

4 year: |

+215% |

+42% |

+72% |

|

5 year: |

+5,654% |

+59% |

+103% |

|

6 year: |

+10,586% |

+68% |

+124% |

|

7 year: |

+13,918% |

+53% |

+122% |

|

8 year: |

+7,671% |

+49% |

+154% |

|

9 year: |

+350,257% |

+9% |

+223% |

|

10 year: |

+1,195,941% |

+12% |

+264% |

Data Source: Messari.io, bitcoincharts.com

Although past performance is not a 100% predictor of future results, we can use it to get an idea of what to expect.

Bear market before late 2022 seems unlikely

We also should consider a wide range of fundamental factors, such as crypto regulation news, stock market performance, global economic growth, and others.

The Federal Reserve’s monetary policy decisions are among those significant factors we need to pay attention to.

In its latest FOMC statement, the Fed indicated that its ultra-easy policy is coming to an end, and aggressive policy moves are on the way. The US central bank said it would speed up its tapering of bond purchases and there would be as many as three rate hikes in 2022 starting in late winter or early spring.

Risk assets like stocks and cryptocurrencies historically have been negatively impacted by the Fed’s aggressive monetary policy.

However, analysts at Deutsche Bank examined the performance of the S&P 500 over hiking cycles since 1955 and concluded that the negative impact may be delayed, meaning that negative returns could begin 9-10 months after the hiking cycle starts.

Due to rising inflation, Bitcoin’s correlation with traditional stocks continues to rise, which means the same may be true for the crypto market, and a full-blown bear market may not arrive until November 2022.

Altcoins that outshine BTC and ETH and are likely to remain competitive

At this point, we can see that other cryptocurrencies are closely correlated with Bitcoin, but are more volatile.

As I mentioned in previous articles for CoinTelegraph, it is highly probable that Ethereum will decouple from Bitcoin, with each asset taking its own path. I think this may happen sooner than we might expect. Ethereum is poised to gain market share in the near future because of the wider range of use cases for its blockchain, such as DeFi, NFTs, and metaverse.

So far this year, Ether rose by 421% and posted a 205% gain versus Bitcoin year-on-year.

Due to its low throughput, high latency, and unpopular programming language, it is a difficult ecosystem to develop within, leading to developers looking for newer blockchain-based platforms.

Tokens that power these new platforms are therefore thriving and are likely to do well in the future.

Below is the overview of this year’s top-performing altcoins with a market cap of at least $10 billion:

Polygon (MATIC)

Since the start of the year, MATIC has galloped by 11,556%. On a yearly basis, it outperformed BTC and ETH by 5,419% and 1,707%, respectively. Interestingly, it led to such curious incidents as this one.

MATIC is used to power Polygon, the gateway to a multi-chain Ethereum ecosystem. The crypto is used to pay fees for transactions taking place on over 400 Polygon DApps as well as for staking to secure the network.

Solving some of the most pressing problems that Ethereum is facing today, like high transaction fees and low transaction throughput, Polygon offers various tools to build ultra-scalable and high-performance blockchains and decentralized applications.

Its unique qualities and bright prospects suggest that its value will keep increasing in the coming year.

Source: TradingView

Solana (SOL)

A highly functional open source project, Solana uses the permissionless nature of blockchain technology to provide DeFi and smart contracts solutions. It is a hybrid blockchain that combines proof-of-history (PoH) for consensus and proof-of-stake (PoS) for transaction confirmations, enabling the network to process 50,000 transactions per second.

SOL has a total supply of nearly 500 million tokens, but its current circulating supply is just over half that number. Only 38% of these tokens are reserved for the community, with roughly 60% controlled by the project’s founders.

Solana advanced by 9,249% so far this year. On a yearly basis, it outperformed BTC and ETH by 5,547% and 1,749%, respectively.

Source: TradingView

Terra (LUNA)

Terra is a blockchain protocol that enables price-stable global payments systems with fiat-pegged stablecoins. Currently, it offers stablecoins tied to the IMF’s basket of currencies, as well as some other options. LUNA is Terra’s native token, which stabilizes the price of its stablecoins. The LUNA token also functions as a governance token, allowing users to submit and vote on proposals.

LUNA rose by 11,676% so far this year and outperformed Bitcoin by 8,000% on a yearly basis. It also made a 2,552% gain versus Ether over the past 12 months. I believe it has the potential to expand gains further into 2022.

Source: TradingView

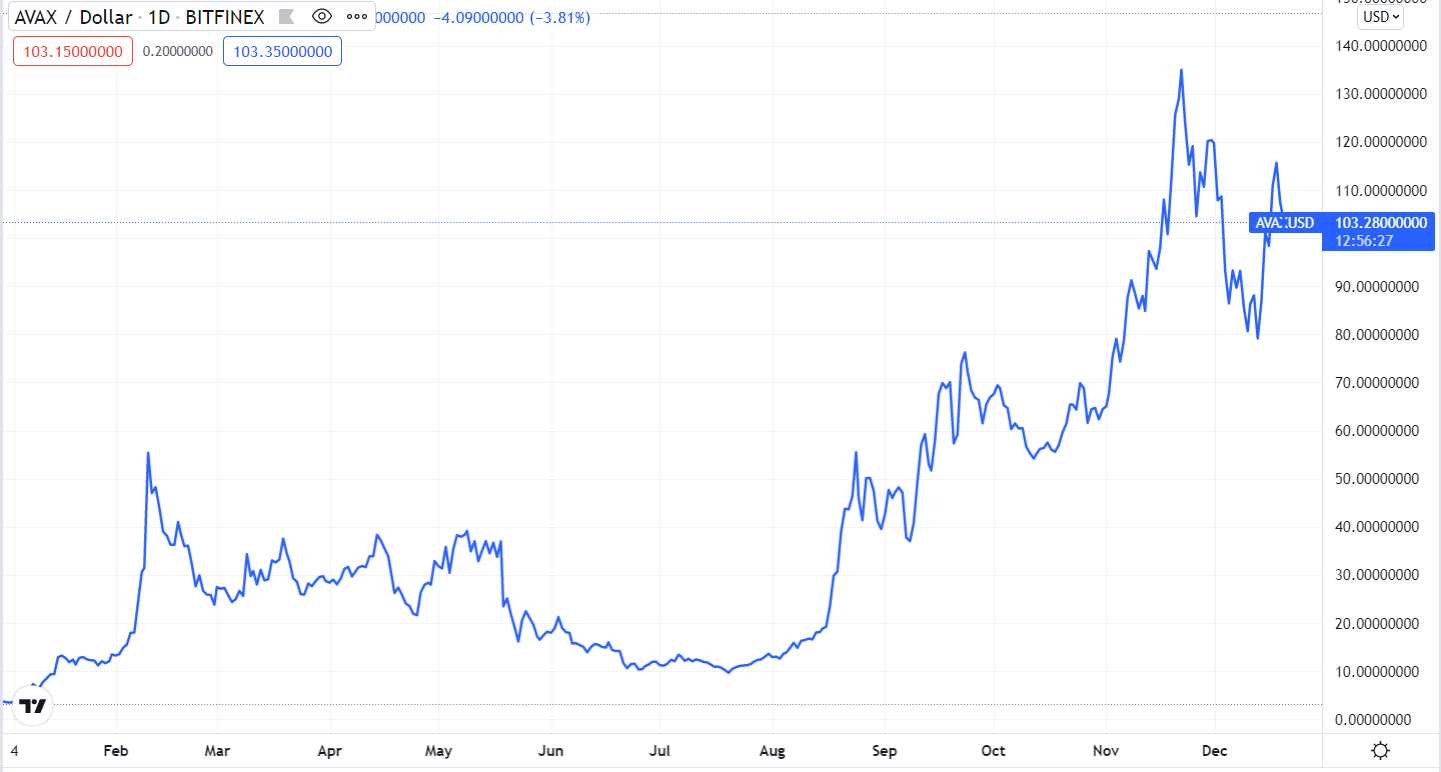

Avalanche (AVAX)

Avalanche is another open-source platform designed to launch Defi applications in an interoperable and scalable environment. Avalanche allows developers to create DApps and custom blockchain networks with complex rulesets, or to build on existing private and public subnetworks.

Its token AVAX also showed some fantastic year-to-date gains (+2,708%). Over the past year, it has increased by 1,495% compared to BTC and advanced by 422% against ETH.

Source: TradingView