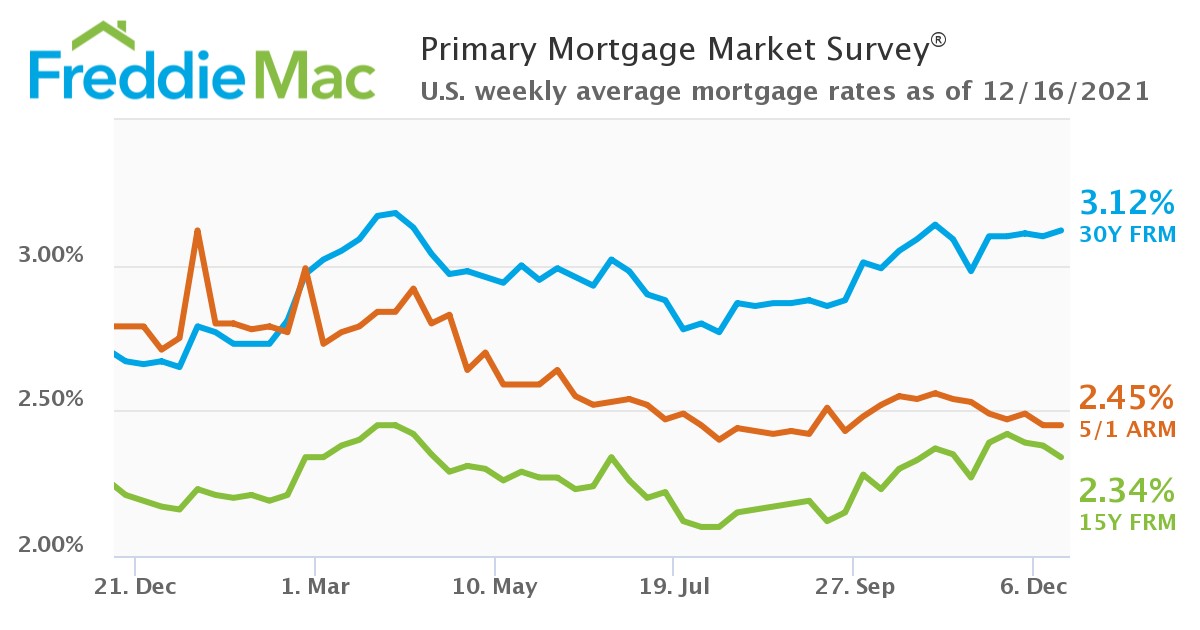

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows that the 30-year fixed-rate mortgage (FRM) averaged 3.12% for the week ending December 16, 2021, up from last week’s total of 3.10%. A year ago at this time, the 30-year FRM averaged 2.67%.

“Mortgage rates inched up as a result of economic improvement and a shift in monetary policy guidance,” said Sam Khater, Freddie Mac’s Chief Economist. “While house price growth is slowing, prices remain high due to solid housing demand and low supply. We expect rates to continue to increase into 2022 which may leave some potential homebuyers with less room in their budgets on the sideline.”

As rates rise at a slow, but steady pace, the number of those taking advantage of rates in the low-3% range is dwindling. The Mortgage Bankers Association (MBA) has reported that the refinance share of overall mortgage activity decreased to 63.3% of total applications, from 63.9% the previous week. Overall, the MBA reports that mortgage application volume dropped 4% week-over-week, as the Refinance Index decreased 6% from the previous week, and the seasonally adjusted Purchase Index increased 1% from one week earlier.

Trending in the opposite direction, the U.S. Department of Labor (DOL) reports that, for the week ending December 11, the advance figure for seasonally adjusted initial unemployment claims was 206,000, an increase of 18,000 from the previous week’s revised level. The four-week moving average was 203,750, a decrease of 16,000 from the previous week’s revised average, marking the lowest level for this average since November 15, 1969, when the metric read 202,750.

Earlier this week, the Fed announced that it will begin accelerating the tapering of its bond buying program, forecasting several rate hikes in 2022 which will pressure an uptick on mortgage rates over the next few months.

“The housing market remains competitive, with our data showing that asking prices jumped this week,” said Realtor.com Chief Economist Danielle Hale. “With rents also surging, up 19.7% in the last year, the rental market isn’t offering any relief from high housing costs. In response to these realities, first-time homebuyers are more determined than ever. Our recent survey data shows that aspiring first-time homebuyers are upping their home budgets and more willing to offer above asking-price to be successful in today’s housing market.”

Also this week, Freddie Mac reported that the 15-year FRM averaged 2.34%, with an average 0.7 point, down from last week when it averaged 2.38%. A year ago at this time, the 15-year FRM averaged 2.21 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.45% with an average 0.3 point, unchanged from last week. A year ago at this time, the five-year ARM averaged 2.79%.