- Bitcoin price is making a short-term run for the $60,000 psychological level in an attempt to move higher.

- Ethereum price inches closer to retesting the all-time high at $4,880 after rallying 22% over the past five days.

- Ripple price looks to collect liquidity resting above the $1.1 resistance barrier.

Bitcoin price is consolidating while it tries to move higher, but Ethereum price seems to be enjoying a full-fledged rally as it comes closer to setting up new highs. Ripple price, on the other hand, is struggling to find bullish momentum.

Bitcoin price chops around

Bitcoin price saw a massive spike in buying pressure on November 28 that led to an 11% upswing over the next two days, pushing BTC to $59,269. While this upswing came closer to sweeping last week’s highs at $59,608, it failed.

The sideways movement that Bitcoin is seeing now is likely a build-up for a move toward the $60,000 level. Beyond this, BTC will also make a run to produce a daily close above the demand zone, extending from $58,100 to $61,545.

Doing so will allow the pioneer crypto to retest the $63,000 level. If BTC manages to produce a higher high above $65,000, it will embark on a bull run to set new highs.

BTC/USD 1-day chart

While the narrative explained above is bullish, it assumes that Bitcoin price has enough momentum to produce a daily close above $65,000. Failing to do that could result in another downswing that retests the $53,000 level.

A daily close below this barrier will invalidate the bullish thesis and trigger a crash to $50,000 and even lower if selling pressure picks up.

Ethereum price makes a strong comeback

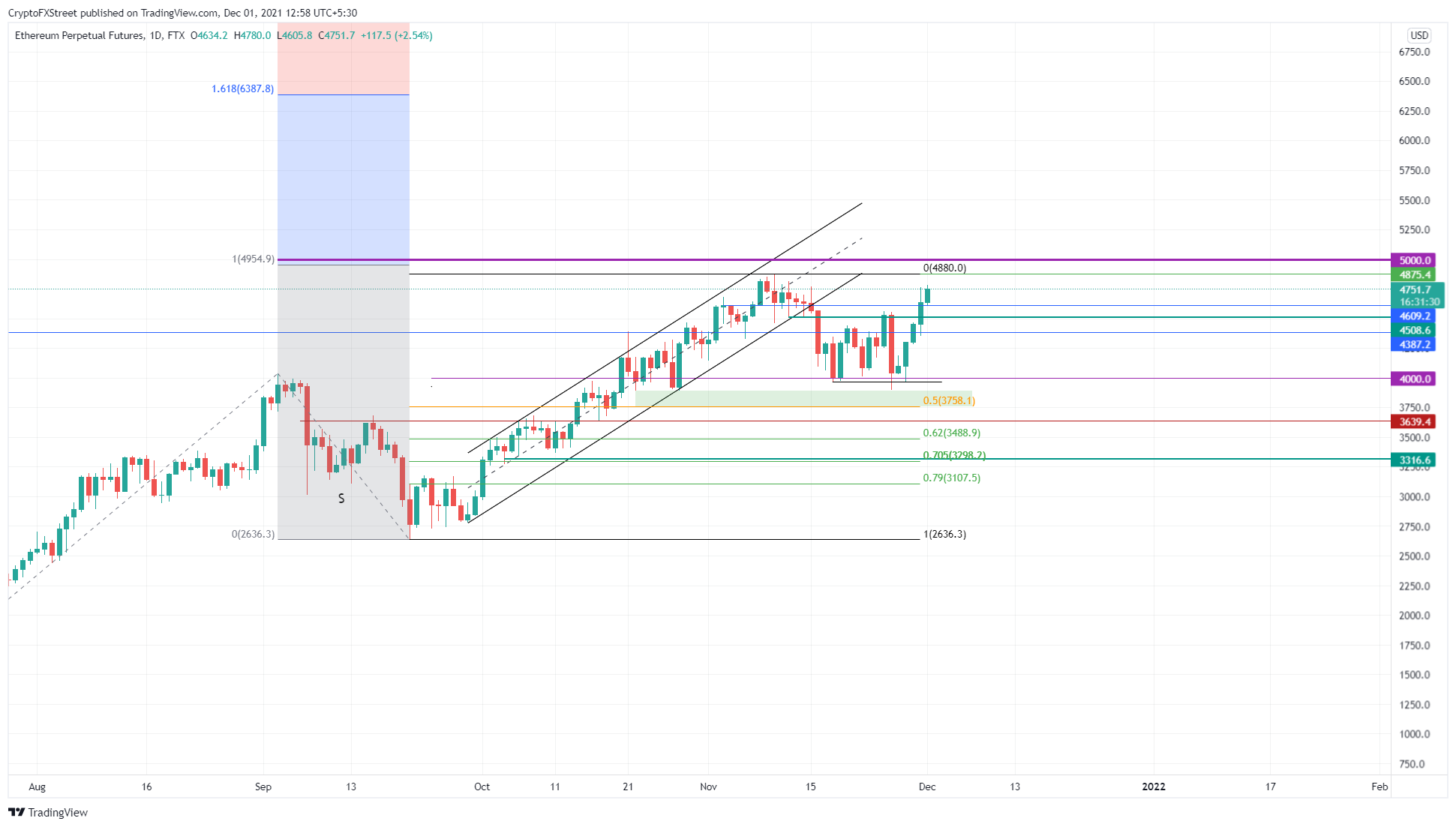

Ethereum price has seen a massive upswing over the last two days that has pushed it up by 22% and is trading at $4,751 at the time of writing. A continuation of this uptick will propel ETH to retest the all-time high at $4,880.

Moving past this area will take ETH to the $5,000 psychological level, where the smart-contract token can set a new high. Beyond this area, investors can expect ETH to continue its ascent to $5,500 and $6,000, especially if BTC does not crash.

ETH/USD 1-day chart

The bullish thesis for Ethereum price depends on Bitcoin price and how it reacts. A flash crash to $53,000 could easily undo the recent gains. However, consolidation or an uptrend will help ETH’s case.

If Ethereum price fails to hold above $4,000 and produces a daily close below it, there is a high chance ETH will invalidate the bullish thesis and lead to a correction that retests $3,600.

Ripple price barely recovers

Ripple price has been stuck on a downtrend since mid-April and shows no signs of volatility. Regardless, XRP price has managed to climb above the $1 psychological level and shows promise of a small upswing.

A 10% upswing from $1 will put the remittance token at $1.10 and allow market markers to collect liquidity above it. If the bullish momentum increases, this run-up could move a step higher and retest the 50% retracement level at $1.13.

In a highly bullish case, Ripple price could briefly swing above the 62% Fibonacci retracement level at $1.20, representing a 20% ascent from $1.

XRP/USD 6-hour chart

While things are looking fairly decent for Ripple, a breakdown of the $1 level will put its bullish perspective in jeopardy. This move could also drag XRP price down to the range low at $0.85, where the buyers have another chance at a comeback.

However, a daily close below this level will create a lower low, invalidating the optimistic narrative.