This article is an on-site version of our The Road to Recovery newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Good evening

Today’s news that US consumer prices rose in October at the fastest rate since 1990 is the latest sign of the inflationary pressures facing the world’s major economies as they attempt to bounce back from the pandemic.

The consumer price index rose 6.2 per cent from a year ago, a sharp increase from September’s 5.4 per cent, reinforcing the view that inflation is proving more persistent than originally expected.

Shorter term US government bonds sold off on the news on expectations that the US Federal Reserve might need to act more quickly to contain the threat. The Fed has already announced that it will begin tapering its pandemic emergency measures this month although chair Jay Powell said last week that it was too early to begin raising interest rates.

US president Joe Biden highlighted rising energy costs as one of the main drivers of inflation and said it was a “top priority” to reverse the trend. He urged Congress to pass his spending bill which he said would ease the pressures.

Inflation is also a serious problem for global business. New data published today showed Chinese factory gate prices — the cost at which wholesalers buy materials from producers — rose at their fastest pace in 26 years in October, up 13.5 per cent compared with last year.

Chinese consumer prices are also increasing at a quicker rate: CPI was 1.5 per cent higher than the same time last year and up 0.7 per cent on September. The costs of fresh vegetables jumped 16.6 per cent, adding to concerns that soaring production costs were feeding through to essential goods.

The potential of rising inflation — which hit a 28-year high of 4.6 per cent in October — to dent economic recovery in Germany was highlighted by the country’s Council of Economic Experts today, which raised its inflation forecasts for this year and next.

Katharina Utermöhl, economist at Allianz, said increasing inflation would also reduce disposable income for households. “Consumption remains our last hope for growth in the winter months, but the downside risks to that are growing,” she said.

Latest news

-

The World Health Organization said coronavirus deaths rose by 10 per cent in Europe in the past week, making it the only world region where both Covid-19 cases and deaths are steadily increasing (AP)

-

US consumers faced the biggest jump in their energy bills in more than a decade last month, with costs soaring for electricity, natural gas and fuel oil (Bloomberg)

-

Unemployment claims in the US dropped to a new pandemic-era low for the fifth consecutive week

For up-to-the-minute news updates, visit our live blog

Need to know: the economy

Russia’s Gazprom opened the taps to start refilling European gas storage facilities but not enough to ward off supply fears. Moscow has rejected claims that Gazprom was exacerbating the gas crisis by limiting export volumes to speed regulatory approval of the controversial Nord Stream 2 pipeline.

The FT Editorial Board argues Fed chair Jay Powell should get a second term to give business and investors at least one source of stability at a time of great economic uncertainty.

Latest for the UK and Europe

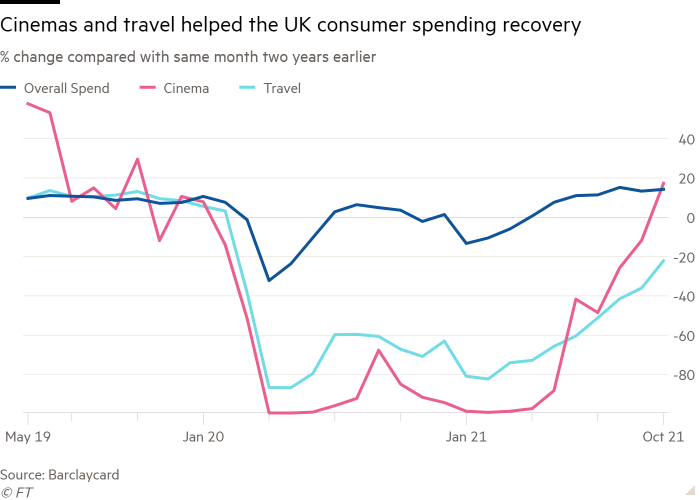

Early Christmas shopping, more cinema trips and increased overseas travel boosted UK retail sales and consumer spending in October, according to the British Retail Consortium. Sales were up 1.3 per cent compared with the same month last year — and 6.3 per cent above retail spending in October 2019, before the pandemic hit.

New survey data offer mixed signals on the rate of recovery in Germany, the eurozone’s biggest economy. Ifo said the country’s retailers will still be facing supply chain problems well into next summer, but Zew’s monthly survey found investors in more confident mood.

Global latest

The global supply chain squeeze is being brought home to shoppers in the form of record numbers of “out of stock” messages, according to data from Adobe Analytics. But although delivery times for the world’s manufacturers may have dropped to new lows, this tends to obscure the fact there has also been a dramatic surge in demand for consumer durables, says our Trade Secrets newsletter.

The impact of last week’s surprise decision by the Bank of England to keep interest rates on hold reverberated far beyond the UK, highlighting how a group of smaller central banks have found themselves dictating moves across the world’s bond markets

Argentina’s clash with the IMF over a $57bn bailout deal is a test of the fund’s ability to help key emerging market economies out of pandemic crisis, as today’s Big Read explains. The country’s leftwing government desperately needs the money but is insisting on big concessions as it gears up for midterm elections on Sunday.

Asian countries such as Singapore, Japan, South Korea and Thailand are taking a third way approach to reopening their economies, rejecting the “freedom day” tone of the US and Europe as well as the isolationist approach of China and Hong Kong. “These countries are now pivoting away from the zero-Covid approach to a preventative approach that emphasises vaccinations and other measures, like mask wearing and handwashing,” said a director at advisory group Bower Group Asia. “The approach may slow the recovery initially, but it’s certainly better than lockdowns, and the pace should quicken if high vaccination levels keep hospitalisation and death rates low.”

Need to know: business

Marks and Spencer shares leapt this morning after the UK retail bellwether upped its profit forecasts. Half-year profits beat expectations, hitting £187m, up 18 per cent on the same period in 2019/20. Last year the group made an £87m loss. Online sales are now 34 per cent of the total, reflecting the shift to ecommerce during the pandemic.

The global travel rebound drove up revenues at Emirates by 86 per cent helping the Dubai-based airline cut its half-year losses to $1.6bn. UK airports have urged the government to bring back rules, waived during the pandemic, that force airlines to use or lose their valuable take-off and landing slots.

Quarterly profits almost doubled at Infineon, Europe’s biggest chipmaker, thanks to the global surge in demand for semiconductors. Earnings at the Munich-based company, which relies on the auto industry for more than 40 per cent of its revenues, came in at a record €464m, up from €245m in the previous quarter.

Shares in BioNTech shot up yesterday after the German company, which launched the first Covid-19 vaccine with US pharma giant Pfizer, lifted its revenue forecasts for the jab to €17bn this year, €1bn higher than previously estimated. AstraZeneca, which has suffered setbacks with its Covid jab — yet to be approved by US regulators — announced it was setting up a division dedicated to vaccines and antibody therapies.

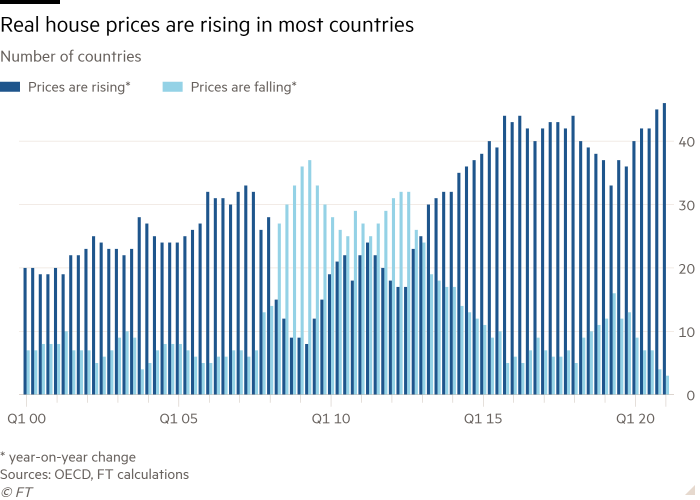

Estate agents such as Savills and housebuilders such as Persimmon recorded strong sales figures amid a buoyant UK housing market, where the average property price passed £270,000 for the first time last month. Demand is also strong in many other countries where low interest rates have pushed down the cost of mortgages, but could house prices start to dive once interest rates inch upwards?

The World of Work

Trusting your staff to take as much time off as they need to rest after the trauma of the pandemic is a worthy goal, but what would it be like in reality? The new edition of our Working It podcast discusses a radical unlimited vacation experiment.

Columnist Sarah O’Connor examines why more older people have started leaving the workforce since the pandemic struck, bucking the trend of the past two decades which has seen the proportion of older people still participating in the labour market steadily rising.

Covid cases and vaccinations

Total global cases: 250.3m

Get the latest worldwide picture with our vaccine tracker

And finally…

. . . Or rather, not just yet. From the search for immortality to treating age-related illnesses, our new collection showcases the latest developments in the quest for a longer (and healthier) life.

Thanks very much for reading The Road to Recovery. We’d love it if you shared this newsletter with friends and colleagues who might find it valuable, so please do forward it. And if this was forwarded to you, you are very welcome to sign up and enjoy it — and access to all of the FT — free for 30 days. Please sign up here.

Please also share your feedback with us at roadtorecovery@ft.com. Thank you