In recent years, cryptocurrency trading has emerged as an expeditious way to turn into a millionaire. Consequently, companies such as Coinbase have secured their spot in the crypto industry by providing traders with an exchange platform that enables them to sell and buy digital tokens.

Founded in 2012, Coinbase is an exchange platform and mobile app that enables investors to trade cryptocurrencies such as Bitcoin, Ether, Litecoin, and over 50 other altcoins. The American company is the first major crypto business to go public in the United States.

#1 Broker to Invest in Coinbase – eToro

How to Invest in Coinbase – Step by Step Guide 2021

If you’re considering investing in the stock, we’d recommend going for eToro. This is because the platform has the lowest fees; it supports different payment methods and is suitable for beginners. Also, you can start investing right away following our guide:

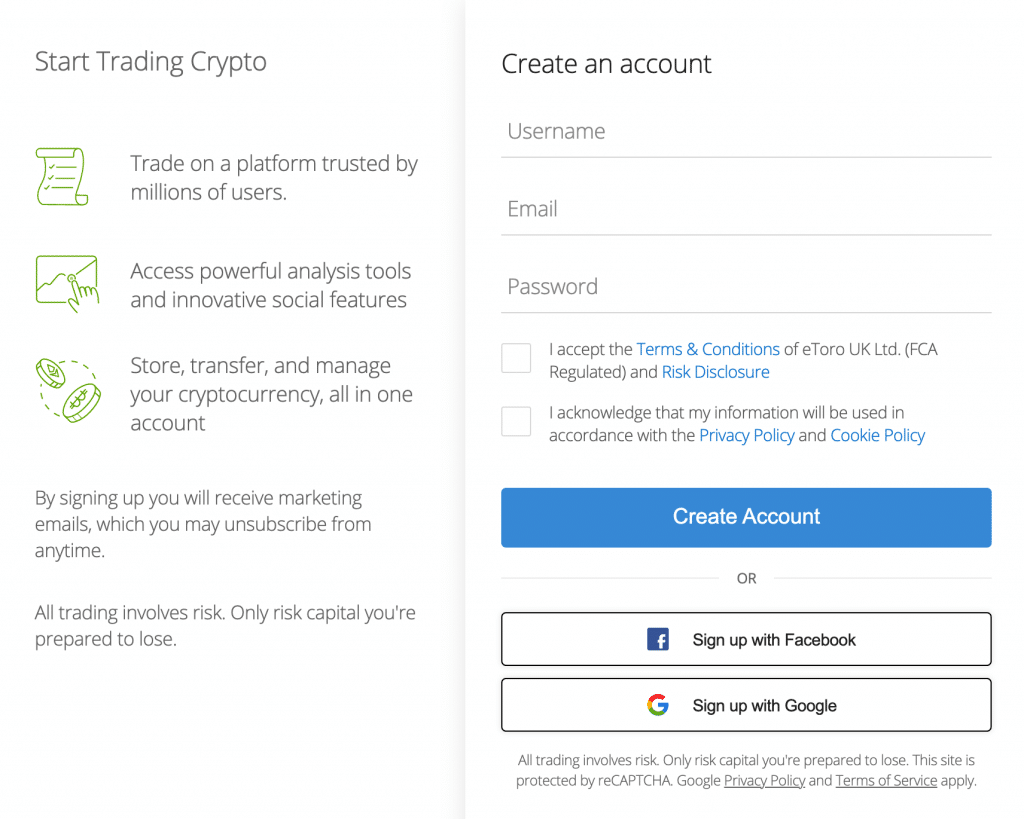

- Step 1: Setup an eToro account – To open a trading account, start by heading over to Etoro’s website and click on the “Join Now” button. Enter your email address and set up a username and password for your account.

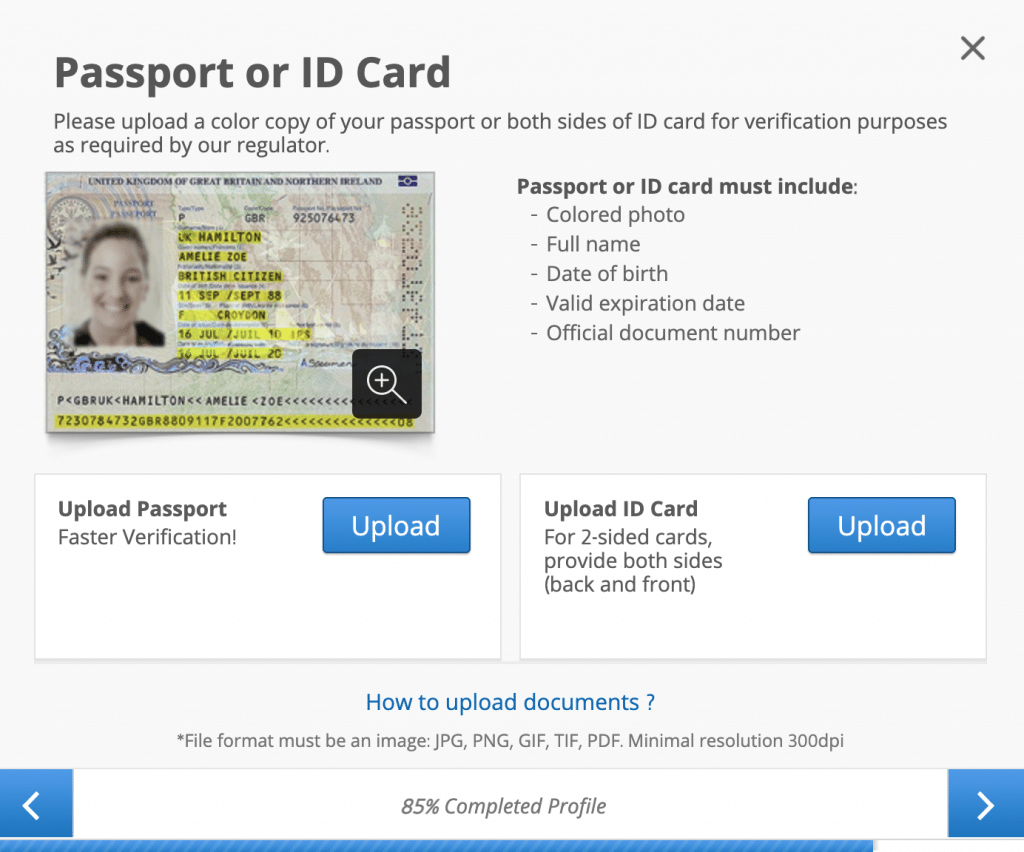

- Step 2: Upload verification documents – Since Etoro is obliged to comply with the KYC process, you should verify your account by sending proof of identity and address. You can do that by uploading a scanned version of your passport as well as your most recent utility bill.

- Step 3: Account activation – To activate your account, you need to deposit a minimum amount of $50. You can deposit using a bank transfer, credit/debit card, or an e-wallet. Click on “Deposit Funds” and add the amount you want to invest then tap on “Deposit”.

- Step 4: Invest – You’re all set. Choose the “Coinbase” stock in the search bar, indicate the stake amount, and click on “Open Trade” then “Buy”.

Where to Invest in Coinbase – Choosing a broker

There are several options to choose from when it comes to choosing a broker. However, not all brokers are created equal. That said, we’ve picked a hand-vetted list of the best brokers available for you to choose from. In this list, you’ll find our detailed information about the best platforms to invest in Coinbase.

1. eToro — The best option for investing in Coinbase

A leader in the industry, eToro was founded in 2007 and has amassed over 20 million users since then. The platform is a suitable option for both beginners and professional traders. It also has a variety of stocks to choose from – making it the go-to solution for investors seeking portfolio diversification.

Trading fees and features

Etoro is a commission-free platform. In other words, if you invest a sum of money, you’ll be able to invest every dime of it on your chosen stock. There are no account or deposit fees on the Etoro platform; however, there is a $5 withdrawal fee and a $10 inactivity fee after 12 months of no login activity on the account.

Traders on eToro can follow the strategies of expert investors by “Copytrading”. This will allow you to copy traders of your choice and automate your investments accordingly. eToro also enables traders to invest in different assets such as cryptocurrencies, stocks, and forex.

Security and Privacy

eToro is regulated by regulatory bodies including the FCA (UK), SEC (US), CYSEC (Cyprus), and ASIC (Australia). This means that your investment funds are secure and protected by regulators. Additionally, eToro is SSL encrypted and all your sensitive data on the platform are safe. To increase the security level even higher, users can set up a 2FA (Two-factor-authentification) to eliminate the risk of compromising your account.

eToro Fees

| Fee Type | Fee Amount |

| Deposit Fee | $0 |

| Withdrawal Fee | $5 |

| Commission Fee | $0 |

| Inactivity Fee (charged monthly) | $10 |

Pros

- Commission-free

- Regulated

- Supports demo account

- Beginner-friendly

- Supports fractional investing

- Supports Copytrading experts

- Easy to use platform

- SSL encrypted

- Supports 2FA

Cons

- No support for Metatrader4 or Metatrader5

67% of retail investor accounts lose money when trading CFDs with this provider.

2. Capital.com — Invest in Coinbase CFDs

Capital.com joined the stock exchanges industry in 2016. Despite being a newcomer to the stock exchanges—Capital.com was able to position itself as a successful CFD broker. The company is regulated by large financial institutions including UK’s Financial Conduct Authority. Additionally, the platform is user-friendly and provides traders with a variety of trading guides. This allows investors to develop their trading skills and consequently invest more in the platform.

Trading fees and features

Capital.com might be a bit limited when it comes to investing in stocks. However, the exchange provides users with precise price movements of over 4,000 stocks. That being said, you’ll be able to trade contracts for differences (CFDs) while speculating on the market movements of the supported stocks. The platform has a variety of guides for beginners and established traders. Furthermore, Capital.com doesn’t have any fees or commissions.

Security and Privacy

Sharing data online is a great concern for internet users. It gets more complicated when it’s sharing personal and sensitive information on an exchange platform. Nonetheless, Capital.com is adapted to the PCI data security standards and your personal information is safe and protected. Furthermore, the exchange is regulated by major regulatory bodies including CySEC and the FCA. And to make things better, Capital.com covers up to £85,000 to its UK-based users since it has FDIC insurance.

Capital.com Fees

| Fee Type | Fee Amount |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Commission Fee | $0 |

| Inactivity Fee | $0 |

Pros

- Commission-free

- Supports TradingView integration

- Trading guides

- Regulated

- Practice account

- Federal Deposit Insurance Corporation insurance

- Supports different payment methods including Apple Pay

Cons

- Doesn’t support price alerts on the web platform

- Limited to trading CFDs and real stocks

- Smaller account currencies not available

67% of retail investor accounts lose money when trading CFDs with this provider.

3. AvaTrade — A flexible way to invest in Coinbase

For more than 15 years, AvaTrade has been providing traders with the opportunity to invest in CFDs, stocks, bonds, ETFs, commodities, and forex. The company was founded in 2006 in Dublin, Ireland, and has a clean reputation when it comes to investment experience.

Fees & Features

Apart from inactivity fees and bid-ask spreads, investing on the AvaTrade platform is commission-free. The exchange also provides you with a 24/7 phone line and email support. To broaden its reach to more traders with different cultures and backgrounds—AvaTrade enables users to open an Islamic account. And that’s not the only difference since you can also set up a professional trading account if you meet their specific criteria. This will allow you to access advanced financial instruments and other features.

Security and Privacy

AvaTrade is regulated by well-respected financial institutions including Japan’s Financial Services Agency and the Financial Futures Association of Japan, the Australian Securities and Investments Commission, the Abu Dhabi Global Markets, CySEC, the British Virgin Islands Financial Services Commission, the Israel Securities Authority, and the Central Bank of Ireland. Additionally, the exchange platform uses 256-bit SSL encryption which minimizes cyberattacks. AvaTrade also supports McAfee Secure integration allowing you to secure your card information and identity documents.

AvaTrade Fees

| Fee Type | Fee Amount |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Commission Fee | $0 |

| Inactivity Fee | $50 after the first three months of inactivity, and $100 after one year of inactivity. |

Pros

- Widely regulated by regulatory bodies

- Commission-free CFD trading

- Access to MetaTrader4 and MetaTrader5

- Islamic account

- 24/7 customer support

- Supports professional trading account

- Minimum $100 deposit on a live trading account

- Supports demo account

Cons

- Exorbitant inactivity fees

- Doesn’t support all countries

- Doesn’t offer fractional share trading

67% of retail investor accounts lose money when trading CFDs with this provider.

Investing in Coinbase – Exchanges Price Comparison

If you’re still unsure about what platform is suitable for you to invest in the Coinbase stock, then we’ll help you decide in this section what might work best for you.

| Broker | Commission | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| eToro | 0% | $0 | $5 | $10/month after one year |

| Capital.com | 0% | $0 | $0 | $0 |

| AvaTrade | 0% | $0 | $0 | $50 after 3 months/$100 after one year |

How to choose which platform is best for your investment

It can be daunting to choose the platform you want to use for your investment. Things get more complicated when you’re a new trader. This is due to a large number of technical words and the different investments method. For instance, there are stocks, ETFs (exchange-traded funds), and CFDs. And as a trader, you should decide the best way you want to invest in Coinbase according to your experience and preferences. That being said, we’ll simplify these technical aspects of investing in Coinbase in plain language. Furthermore, we’ll choose which broker is best for investing in that particular method that you’ve picked.

Stocks

Stocks — or shares as it is also called —are one popular way to invest in Coinbase. Investing in the Coinbase stock means that you’ve bought a portion of the company. Once you buy the Coinbase stock, the shares will represent how much you own of the company. This is what brings one of the major benefits of investing in stocks — dividends. For instance, if you own 1000 shares of Coinbase, and the exchange platform decides to issue a 10% dividend, then your holdings will surge to 1100 shares. Dividends are also considered a bonus and companies issue them as means of sharing profits with traders on a quarterly or an annual basis. Now the price of any stock is directly influenced by the release of new products or features from the company you’re investing in as well as the company’s performance. In other words, the decisions of the company decide its future and contribute to the surge or the plummet of the stock price. Nonetheless, since you’re an investor with the company and you’re a part-owner of it thanks to the shares you bought; you’ll have the right to influence Coinbase’s future moves by attending shareholders’ meetings. This is where you’ll have the voting right in the Coinbase shareholder meeting if you have the minimum amount of shares that the company defined. The more shares you have, the more votes you’ll gain access to and the bigger your influence will be.

CFDs (Contracts For Differences)

As a trader, you can invest in a company without buying its shares. This is called a CFD and it’s a short-term leveraged derivative contract. Typically, by investing in CFDs you’re speculating on the potential market fluctuation and gaining profit accordingly. Investing in CFDs allows you to earn a profit if your direction of the share price is correct. For example, if you speculate that the share price of Coinbase would increase, you’ll gain profit once that happens, and lose if it goes the other direction. However, investing in CFDs comes with major risks including The potential to lose your investment if a trade is liquidated. Still, with major risks comes to a major profit since investing in CFDs can be more profitable and faster than investing in stocks.

ETF (Exchange-Traded Fund)

Exchange-traded funds or ETFs for short are a type of security that can be sold on an exchange platform. Similar to mutual funds, ETFs enables traders to diversify their portfolios without going through the same daunting process that stocks follow. Instead of trading a particular stock, trading ETFs allows you to gain profit from the total value of ETF shares. However, the differences between an ETF and mutual funds are that ETFs are traded on open markets like stocks and you’re not entitled to redeem shares with the fund in a direct way. Furthermore, you can invest in ETFs at any time — allowing for more flexibility with your trading strategy.

Which investment type to invest in Coinbase

By understanding the different ways you can invest in Coinbase, it’s now time to choose which one is most suitable for you. In the upcoming paragraphs, we’ll understand together how to match the type of investment with your strategy, preferences, and investment timeline.

Invest in Coinbase stock

Companies’ prices are influenced by their performance and the new releases of products or services to mention a few. Nonetheless, Coinbase stock price has another important factor. The stock price of Coinbase is heavily related to the surge of price and adoption of cryptocurrencies. Now both investments have potential on a long-term basis. That said, if you believe that Coinbase’s stock price will soar in the long term, then investing in its stock might be suitable for you. Additionally, if the company will be successful during the upcoming months or years, you can benefit from the dividends instead of liquidating a fraction of your investment.

Invest in Coinbase CFDs

If you aren’t comfortable with long-term investments and want to claim profit quickly, then investing in a CFD is the best option. But as we mentioned earlier, investing in CFDs can be a bit tricky, and risky. Contrary to stocks, investing in CFDs can result in losses that you can’t afford since you can lose more than your initial investment. As a side note, if you have an Islamic investment account, you won’t be able to invest in CFDs since it doesn’t comply with the religion’s Sharia laws.

Invest in Coinbase ETF

Investing in stocks or CFDs doesn’t seem like a great deal to you? If so, then you’ll have one final option that you can consider to invest in Coinbase. By investing in ETFs, you’ll minimize the risks compared to CFDs or investing in stocks. This is because ETFs give you more flexibility and diversification when it comes to investment. Mechanically, if a stock is plummeting, other stocks involved in your ETF investment might cover up the losses. However, Coinbase is included in several ETFs and if you’re basing your investment on an exchange platform then you should take into account the percentage that Coinbase’s stock represents in the total value of the ETF.

How profitable is investing in Coinbase

Coinbase is the first major crypto company to go public. The exchange platform stock price started trading at $381 on its IPO before it plummeted by 30% since then — as of this writing. Now despite the Coinbase stock being volatile, the fact the company is involved in a major disruptive innovation and gives it a huge advantage. Additionally, the platform has built a reputation of being secure, transparent, and flexible. Also, Coinbase has had stronger than expected results in the 2nd quarter of 2021 and its revenues have surged by 27% to $2.2 billion with 8.8 million monthly transacting users. It’s important to mention however that with the major crackdown of China on cryptocurrencies as well as the planned regulations by the U.S., you should take into account that this might negatively impact the price of the stock.

Cryptocurrency adoption is growing

Coinbase has positioned itself as a leader in the cryptocurrency market. In fact, the exchange platform is mainly associated with cryptocurrencies. It’s a no-brainer that the crypto market is growing exponentially and its adoption by major financial institutions is remarkable. Also, 6 countries have adopted Bitcoin and El Salvador has officially considered Bitcoin as a legal tender and started mining it using power generated from volcanoes. Therefore, Coinbase among several other crypto exchange platforms has more room to prosper.

The cryptocurrency market is volatile

The cryptocurrency market is highly volatile and the price of cryptocurrencies is unstable. This means that both long and short-term traders are always buying and selling cryptos. The more transactions happen in the market on Coinbase, the more profit the company makes. Consequently, with more earnings and profits for Coinbase, investors in the Coinbase stock will benefit. For instance, Coinbase’s average trading volume has surged by %142 to $193 billion in 2020, before it rose to $335 billion and $462 billion in the 1st and the 2nd quarters of 2021, respectively. 50% of the trading volume in the 2nd quarter was coming from Bitcoin and Ethereum, the two largest cryptos in the market.

The risks of investing in Coinbase

Investing in Coinbase — like investing in other stocks — can be risky. For instance, China is leading a major crackdown on cryptocurrencies and has closed the China-based second largest Ethereum mining pool in the world. Since then, the Coinbase stock was struggling to gain momentum. Additionally, regulatory bodies and watchdogs in both the U.S. and the U.K. have been sceptical about the cryptocurrency market and they might impose laws in the future that would cause both cryptocurrencies and Coinbase price to plummet.

Cryptocurrency regulations

Watchdogs across the world are regulating cryptocurrencies. One example is that the United States requires a surety bond or an equivalent amount in fiat currency for cryptocurrency exchanges within their jurisdictions. Additionally, then can provoke the scarcity of any asset by controlling it. Take for example gold which is restricted to import in many countries. These factors are a major influencer of the price of cryptocurrencies and since Coinbase is associated with digital tokens, it would contribute to a price plummet in the price of the stock.

China’s war on Bitcoin

China was the largest mining pool across the world. However, the Asian country has passed laws that restrict the use, mining, or trading of cryptocurrency. Additionally, China has also banned ICO (Initial Coin Offering). These actions have caused Bitcoin to instantly lose $500 of its value following the news. These kinds of actions have made investors skeptical about the future of cryptocurrencies and Coinbase is expecting to lose 1 million monthly transacting users on the 3rd quarter of 2021.

The SEC lawsuit against Coinbase

Coinbase was planning to release a new product called Coinbase Lend. The company was intending to launch the product this year to lend its users’ cryptocurrency deposits to borrowers. However, the U.S. Securities and Exchange Commission has shared a Wells notice (intent to sue) to Coinbase. The SEC argued that the product includes security and it needs to be registered first. The company’s stock price fell sharply following the news and it is unclear whether Coinbase is intending to launch it or not.

How to Invest in Coinbase with eToro

Even if you’re a new trader, investing in Coinbase on eToro can be the easiest process out there. The site hierarchy is simple and user-friendly, and the platform features are easy to understand. That being said, we’ve created a small guide for you to start investing in eToro in no time.

Step 1: Setup an eToro account

eToro is the go-to platform for both beginners and expert traders. This is because the platform is user-friendly and has advanced investment features. To register, you need to type eToro.com into your browser and click the “Join Now” before filling in the details.

Step 2: Account verification

After opening an account with eToro, you should upload a photo ID (driving license or passport) and a proof address (bank statement or utility bill). This is because the platform is regulated and should comply with data protection and money laundering laws.

Step 3: Fund your account

After the verification process, you need to deposit funds into the account by pressing “Deposit Funds”. Enter the sum you want to invest and click on “Deposit”. The exchange platform accepts different payment methods including credit/debit cards, bank transfers, and e-wallets (PayPal, Skrill, etc).

Step 4: Invest in Coinbase!

With the funds you deposited on your eToro account, you can start investing in Coinbase right away! Search for “Coinbase” on eToro’s search bar and press “Trade”. Define the amount you want to invest and click on “Buy”. Congratulations, you’re now a Coinbase investor.

Conclusion

It’s all done. By completing this detailed guide, you’ll have all the necessary tools and insights that would help you forge a path to become a successful Coinbase trader. Furthermore, by knowing some of the advantages and detriments of investing in Coinbase that we mentioned in this article, you’ll be able to know if investing in Coinbase is right for you and what type of investment suits you best. After detailed research about the best trading platforms, we’ve come to a conclusion that eToro is the easiest and the most secure platform to consider for investing in the Coinbase stock. However, if you’re not sure if you should go for Coinbase stock yet, you can take a look at our other articles about different stocks that might work best for you. Happy trading!