The crypto exchange giant Coinbase says that altcoin transaction volume keeps increasing its share on the platform at the expense of bitcoin (BTC) and ethereum (ETH).

The firm released details in its financial year quarter three (FY2021 Q3) report and letter to shareholders, where it remarked that total retail trading volume tumbled to USD 93bn, for a decrease of 36% on Q2 figures. Institutional trading volume, which makes for the lion’s share of its business activity, also fell by 24% to USD 234bn. However, compared to the third quarter of 2020, retail trading volume jumped by 417%, while institutional trading volume increased by 767%.

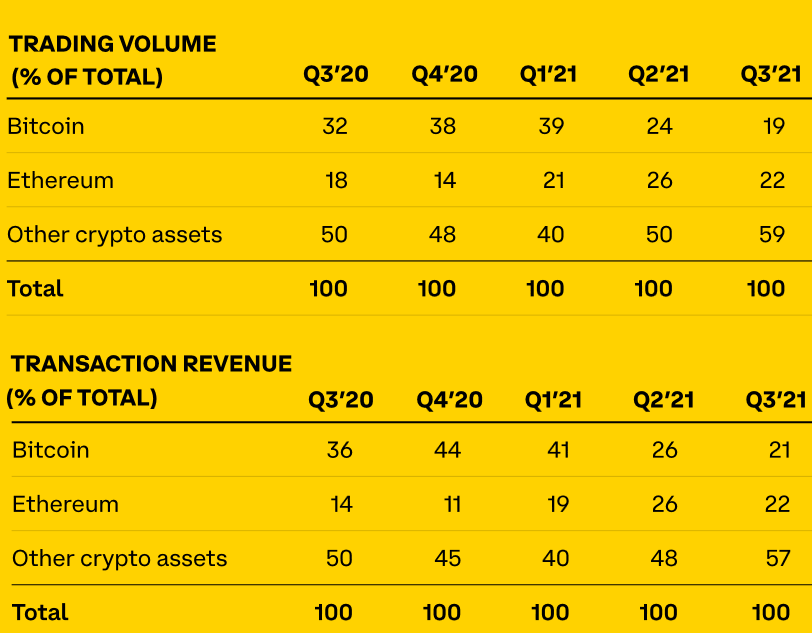

But non-BTC/ETH coins had a strong quarter – at the expense of the world’s two biggest-cap coins. While this time last year, almost a third of all the transactions made on the platform were in BTC, that figure has now shrunk to just 19%. And while ETH accounted for over a quarter of total volume in Q2 2021, in Q3, the figure was a more modest 22%.

Altcoins, meanwhile, have never before represented more than half of total trading volume in Coinbase reporting history – but in Q3 broke through to 59%, also making up for 57% of total transaction revenue on this exchange.

In its report, Coinbase explained:

“The continued expansion of cryptoassets supported for trading provides greater choice for our users. […] Bitcoin and ethereum constitute a larger share of institutional trading volume compared to retail although we are starting to see institutions increasingly diversify into other cryptosssets as well.”

The firm made forecasts about its retail Monthly Transacting Users (MTUs), of which it says it currently has 7.4m, noting that it expected a rise in both retail MTUs and total trading volume “in Q4 as compared to Q3.” The current figure is down from 8m reported at the end of summer this year.

The firm said it was “tightening” its full-year forecast “scenarios,” for a “high average 2021 retail MTU figure of 8.5 million,” which “assumes moderate-to-high cryptoasset price volatility as we have seen in the month of October.”

It also provided a low-“scenario” figure for MTUs of 8m, assuming lower crypto volatility. Both figures are a marked improvement on the 5.5m-8m figures it projected in August.

Bloomberg reported that one key listing, in particular, may have sparked altcoin growth, writing:

“Coinbase benefited from listing [the] shiba inu (SHIB) meme token, popular with investors, in September. That, combined with a bull market in crypto that’s pushing more investors to step in, has led to a surge in downloads of Coinbase’s main mobile app.”

Nasdaq data shows that Coinbase share prices initially fell in after-hours trading after the report went public, with drops of around 13%.

Coinbase explained that its falling trading volumes over the quarter were “roughly in line with the overall crypto spot market volume,” with a “sequential decline in retail trading volume driven primarily by lower levels of volatility” – and a decline in institutional trading volumes “also driven by lower volatility.”

The exchange also reaffirmed its commitment to buying more crypto, noting that it had already “announced a new crypto investment policy” and that it “expect[s] to be growing [its] crypto investments over time.”

____

Learn more:

– Ethereum’s EIP-1559 Helped Coinbase Save ETH 27 on Daily Fees

– 1.5% of Coinbase Users Join NFT Waitlist in a Day

– At Least 6,000 Coinbase Clients Robbed This Spring, Exchange Reimburses Losses

– Coinbase’s Junk Bonds Success an ‘Endorsement’ by Institutions

– DYDX Soars as Protocol Sees Trading Volume Double That of Coinbase

– Coinbase vs. ‘Sketchy’ SEC Case Reminds of Crypto Regulation Challenges