- Bitcoin price dips below the R2 for October, with bulls awaiting a good discount for launching BTC price to $70,000.

- Ethereum price sees bulls offering a very tight window for profit-taking, with momentum already prepped for all-time highs.

- XRP price traps sellers in a bear trap and sees bulls booking 35% gains.

Bitcoin price came off the new all-time highs the most, whilst Ethereum and XRP kept their price corrections a bit more controlled. The way things are looking, global market sentiment will dictate if Ethereum is the next cryptocurrency to make new all-time highs as Bitcoin price has faded a bit too much by now. XRP price keeps lagging but sees more buy-side volume added to the momentum, so the catchup has begun.

Bitcoin price is blowing off some steam as bulls book some profits

Bitcoin (BTC) price has been fading since the cryptocurrency hit all-time highs on October 20. In the first phase, the monthly R2 resistance level held throughout the weekend but then gave way on Wednesday, as global markets came off their highs as well. With markets on the back foot a little bit, expect volume and volatility to die down somewhat.

BTC price bulls will want to wait before picking up more Bitcoins. Expect more room for the correction to unfold towards $55,619, a historical level from April 7. Around that level, fresh buyers should eagerly start to repurchase Bitcoin and ramp the price back up above the monthly R2. Once above that, new all-time highs are not far away, especially if global markets are back on the front foot and provide favorable tailwinds.

BTC/USD daily chart

If earnings start to depress market sentiment further, expect more and more bulls to take profit and see Bitcoin price fade further. BTC price will start to test the overall $50,000 psychological barrier and might hit $48,760 in a nosedive move. But at the same time, this should attract plenty of buyers and keep the BTC price from correcting further, as quite a lot of support levels, moving averages, and pivots are present in this area.

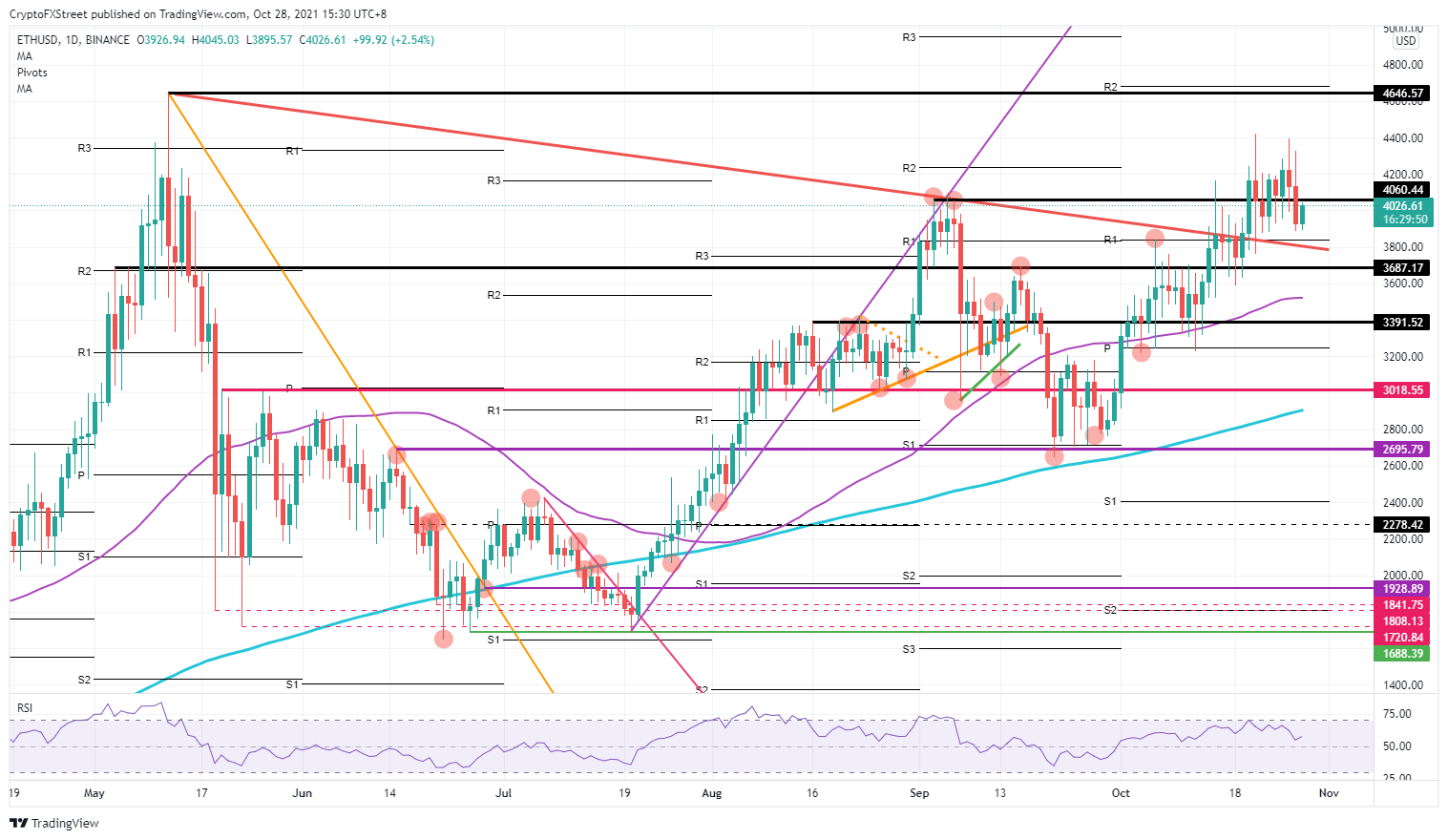

Ethereum price takes a pause before the final push towards new all-time highs

Ethereum (ETH) price started to fade a little bit on Tuesday after hitting $4,400. It remains contained, however, and the monthly R1 resistance level has yet to be tested. Bulls look to keep the uptrend and momentum going, allowing a small correction window but keeping ETH price action under pressure.

ETH price enjoys quite some support from the monthly R1 and the descending red top line, which should provide enough support for a bounce-off. If that does not do the trick, a few dollars lower, historical support from May 5 near $3,667 has been exceptionally well respected. With this summary, it is clear that bulls have three support levels in just a 200$ range, offering plenty of occasions for new buyers to add volume to the uptrend.

ETH/USD daily chart

ETH price could come under more fire if global markets start to correct even further and the VIX volatility gauge starts to make higher peaks. Expect cryptocurrencies like Ethereum to be the first on the chopping block in portfolio reshuffles. After a break below $3,687, expect $3,391 and $3,039 to be the following lines in the sand that should be able to slow down any dips or corrections. Should more headwinds start to emerge, certainly $3,018 should be able to withstand quite a lot of sell-side volume and be able to provide solid support.

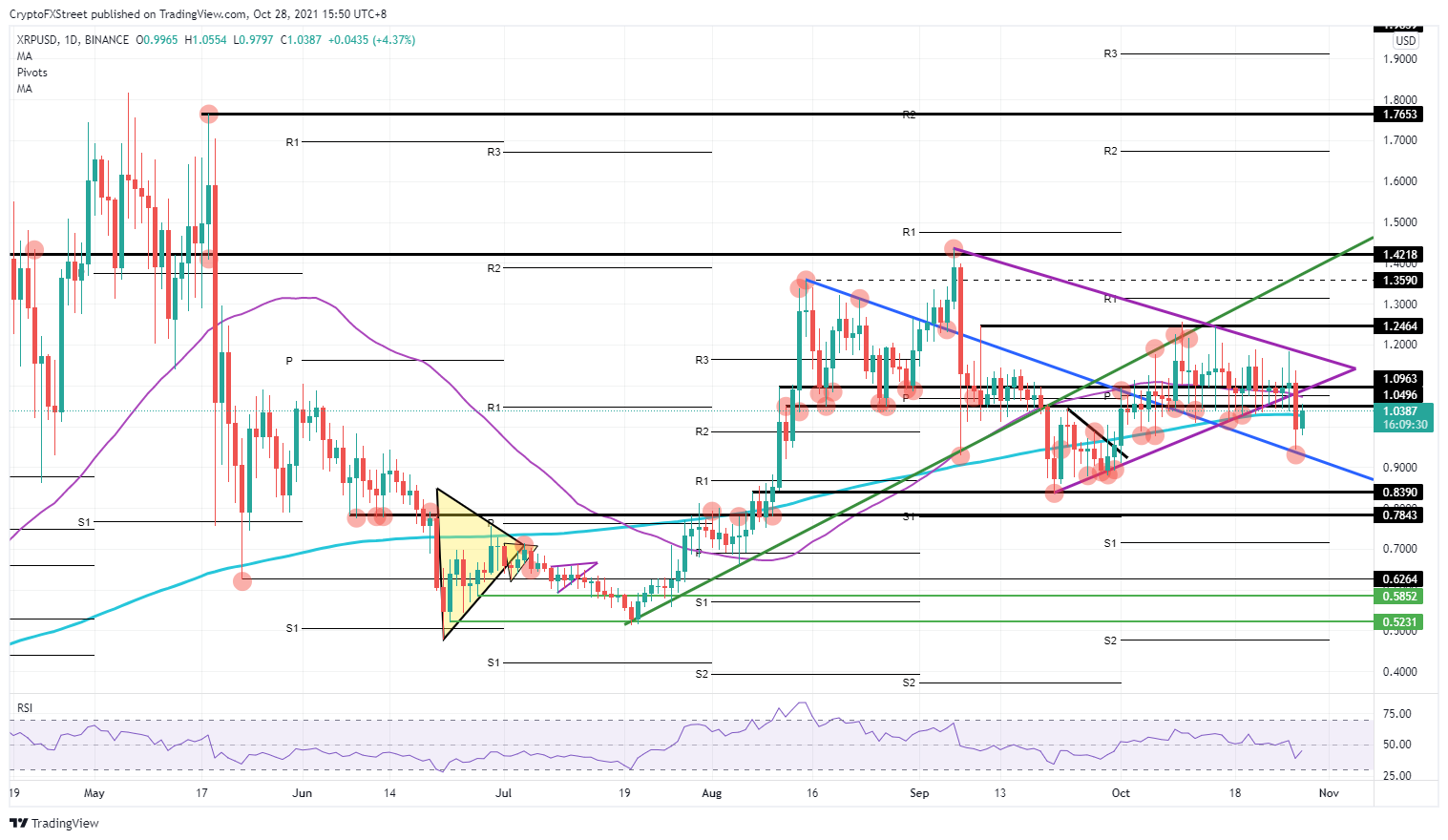

XRP price formed a bear trap, and it’s up to bulls to squeeze XRP prices higher

Ripple (XRP) price saw a pennant formation complete on Wednesday with a bearish outbreak. With global markets on the back foot yesterday, bears had the support of global sentiment. In that bearish outbreak, bears got quickly rejected on the blue descending trend line that has been exceptionally well respected since August 15.

XRP price quickly came off that blue descending trend line around $0.93 and today sees XRP bulls retesting $1.05. With this move, bears are getting hurt quite severely and look to have stepped into a bear trap. Bulls now need to squeeze the bears out of their short positions, enabling the price to quickly pop towards $1.25.

XRP/USD daily chart

With market sentiment in doubt as to whether it will go risk-on or risk-off, expect markets to quickly steamroll buyers out of their positions in the event of a return to risk-off, and see XRP price to fall back on that blue descending trend line again. A break would push XRP price towards $0.83 – $0.78. Should global markets get more worried about stagflation and the speedup of the hiking cycles from several central banks, expect a quick correction to $0.582.