Cryptocurrency buy signals for Tezos (XTZ), Monero (XMR) and Orion Protocol (ORN)

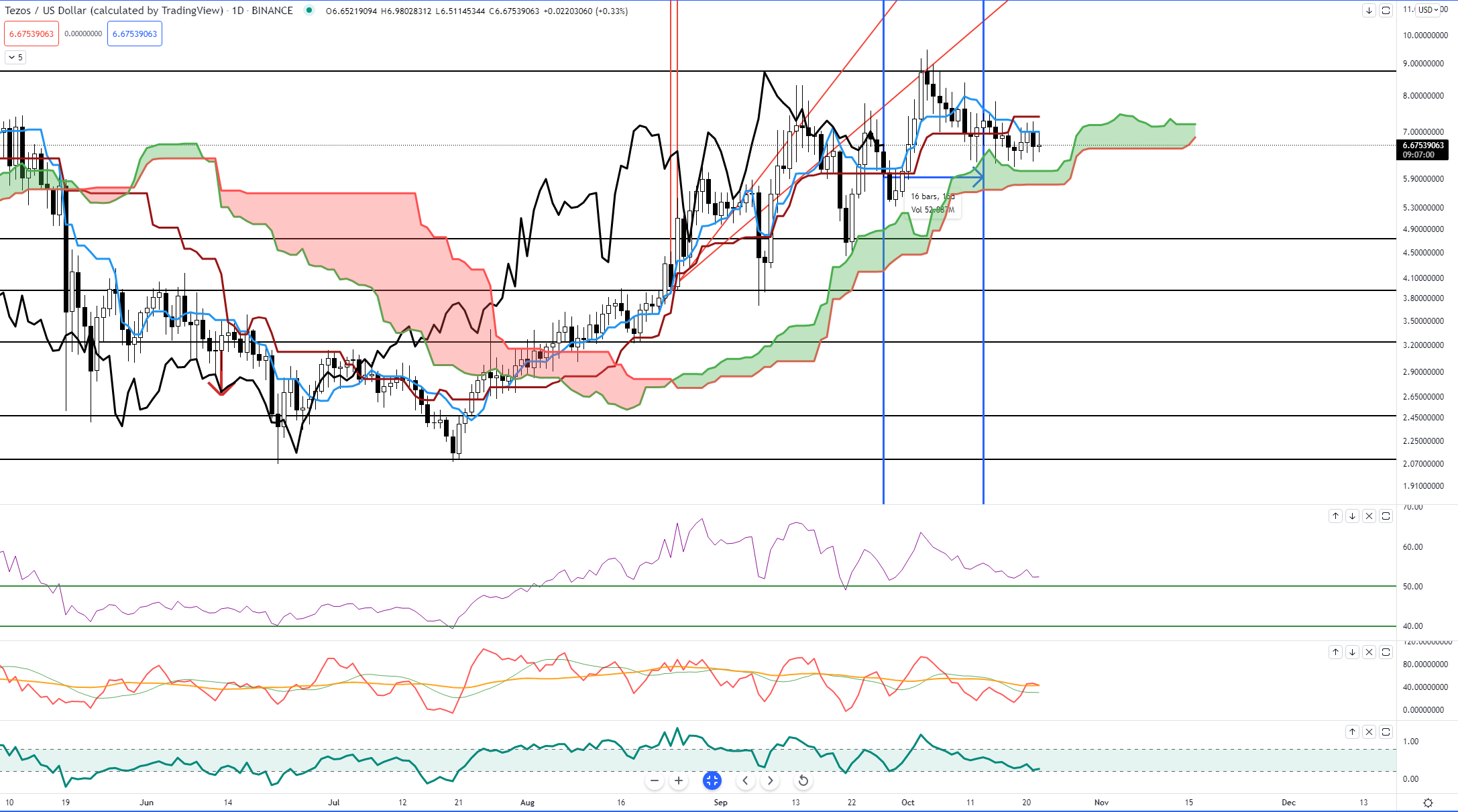

Tezos (XTZ)

Above: Tezos (XTZUSD)

Tezos (XTZ) has made some impressive gains over the past few months, easy becoming one of the best outperformers of 2021. It’s experience some weakness, profit taking and an overall slump since hitting its most recent all-time high on October 4th. In fact, it’s currently trading -30% lower from its all-time high. Some consolidation has come in, but there still needs to be some clear conditions before creating a strong uptrend. Ultimately, the Lagging Span needs to remain above the candlesticks and in open space. For this to occur, bulls will need to push Tezos to new all-time highs. Or, buyers will have to wait roughly sixteen days where the threshold to put the Lagging Span above the candlesticks drops from $9.47 to $7.31.

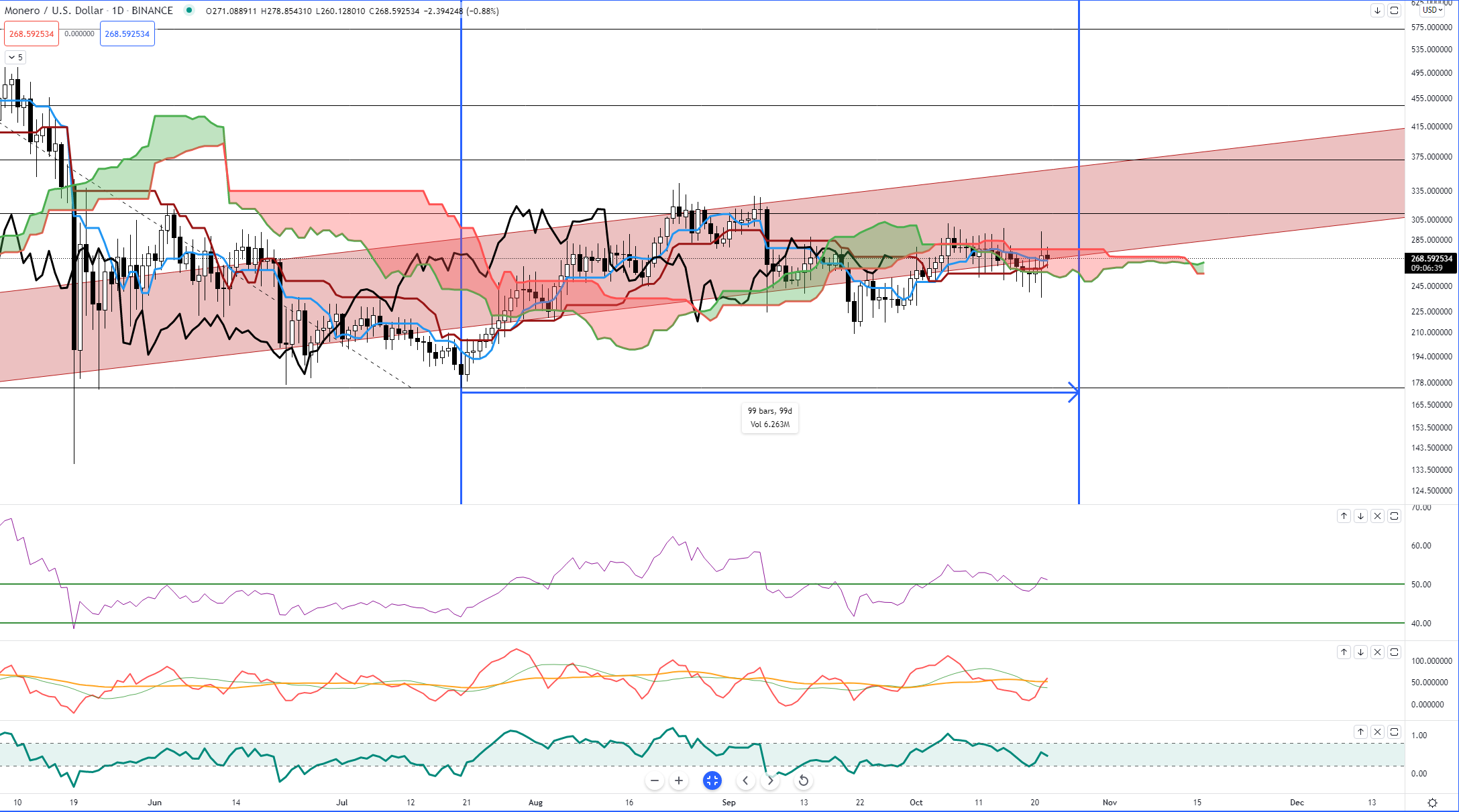

Monero (XMR)

Above: Monero (XMRUSD)

Monero (XMR) has nearly all conditions fulfilled to initiate an Ideal Bullish Ichimoku Breakout – save one. The close must be above the candlesticks. If you want a good chart image that is a perfect example of why the Cloud is horrible, just look at Monero’s daily chart. Look at the wicks above and below their respective daily candles. It’s a little messy. No, it’s horribly messy. In order for Monero to return to clear and decisive bull market, Monero needs to close not only above the Cloud, but ideally above most of the highs of the past few weeks. A close at or above $292 would fullfill that bullish outlook.

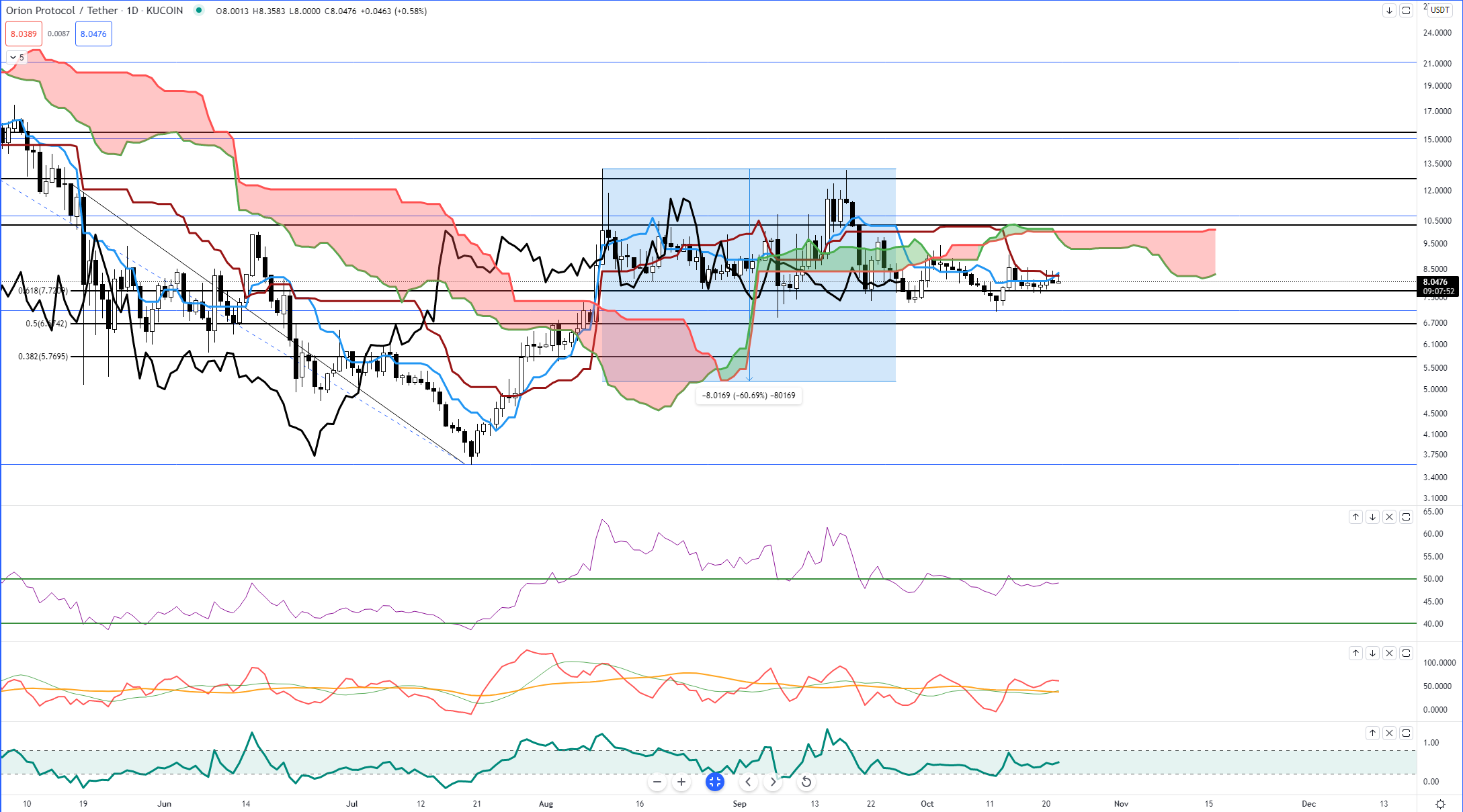

Orion Protocol (ORN)

Above: Orion Protocol (ORNUSD)

Orion Protocol did have some great participation and momentum in mid July – August, but it has dropped off a considerable amount since then. ORN has been in tight consolidation range for over a month and there are few signs that a breakout above or below is going to occur anytime soon. At the present, its overwhelmingly bearish as its below the Tenkan-Sen, Kijun-Sen, and the Cloud. The Lagging Span is not far away from closing below the candlesticks, thereby triggering further downside moves. To convert to the bullish side of the market, Orion Protocol needs a close at or above $10.50.

However, do note that ORN’s Lagging Span doesn’t have far to move to trigger a very strong sell-off. A close at or below $7.27 could trigger a flash crash-like move to test the $3.50 value area, testing the most recent major swing low of $3.60 found on July 20th, 2021.

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016 – 2020. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

Find out more here.